Summary

Slow disinflation and moderate softening in the US labour market support our view that the FED will cut in Q2 rather than in Q1.

- Amid a large consensus that the rate hike cycle has ended, markets are now trying to assess the timing of the next rate cuts.

- Together with inflation numbers, labour market developments will be key to the next Fed decisions

- Inflation figures this week surprised on the upside, signaling that the disinflation process is slower than expected by the market.

Like in 2023, inflation figures will remain, in 2024, an important driver of market’s expectations regarding Fed rates decisions. Inflation has come down by a lot, but it is still above 2% and the latest reading shows a slowdown in the disinflationary trend.

Also, given the Fed’s dual mandate (inflation+ unemployment), the pace at which the job market loses steam is also relevant. Recent data was mixed, despite a strong (216,000 new US jobs) headline figure. Weaker details included, among other, downward revisions of the previous months’ numbers (an almost continuous trend in recent months), weak job creation in cyclical sectors and a double decline in labour force and employment in the accompanying household survey. In our view, this is not enough to point to a rate cut as soon as Q1, but most likely in Q2. With markets reassessing the Fed future path, Treasury yields have reversed in the first weeks of 2024 their downward trend.

Actionable ideas

-

Money Markets

With the Fed expected to remain in pause until Q2, money markets in our opinion continue to offer appealing yields for investors. -

Flexible Fixed Income

Approaching the turning point in the Fed rate policy, longer term bonds are set to benefit. However, as January 2024 is proving, the path will not be linear and therefore a flexible approach is key.

This week at a glance

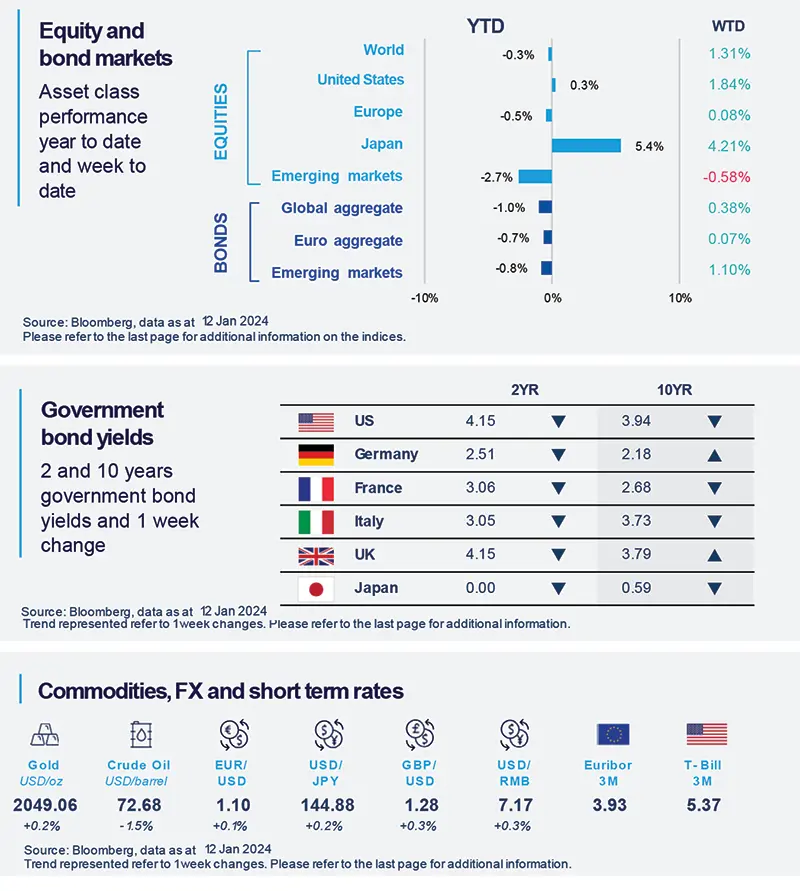

Markets moved mostly sideways this week after retreating during the first days of the year. Above-forecast US inflation figures only had little lasting effect on bond yields, with the US 10 year hovering around 4% and German 10 year slightly above 2%. Oil prices rose following increased tensions in the Red Sea.

Amundi Investment Institute Macro Focus

Americas

Inflation dynamics in the US are now much linked to core components.

Headline CPI in December rose 3.4%, up from 3.1% in November. Core Inflation went down to 3.9% YoY. Both monthly readings were on the firm side, at +0.3% MoM, reflecting slow disinflation in core services. Core goods disinflation which helped so far, did not help in December. Looking ahead, with foods and energy inflation expected to remain more contained in 2024, inflation dynamics will remain anchored to what happens to services inflation.

Europe

Unemployment rate in the Euro Area at 6.4% in November, at historical low.

The last print of the unemployment rate was a historical low, at 6.4%, with the number of people without jobs falling further and signaling some tightness in the labor market even if the economy most likely was stagnating in Q4 23. Even though it is possible that this tightness of the labor market reflects some inefficient allocation among sectors, visible in low productivity data, it does effectively put a floor to consumption in aggregate terms.

Asia

Another negative inflation print in China

China CPI print stands out globally, dropping 0.3% YoY in December, rounding 2023 full year at 0.2%. The low CPI print reflects an economic reality in which the average Chinese household is hit hard during the secular economic slowdown. We expect low inflation to continue and a 0.2% CPI for 2024.

Key Dates

|

17 Jan China Q4 GDP growth |

17 Jan |

19 Jan USA Univ. of Michigan Consumer Sentiment Index |