Summary

Trade war complicating the Fed’s job

Extreme policy uncertainty in the US is leading to sharp movements and increased volatility. Recent bond yield dynamics signal a shift from seeking safety in US assets to a reassessment of Treasuries and the USD as ultimate safe havens. While we think it is too early to question the trust in US assets, we also think any challenge to the Fed’s independence and so much policy uncertainty could undermine investor confidence. For instance, the perceived risks around capital outflows and some repositioning in the markets caused the recent divergence between US yields and dollar. Looking ahead, the main themes to watch are:

Trade war and protectionism will affect US growth, but a tariff-induced recession is still not our base case. GDP growth this year is projected at around 1%, down from nearly 3% last year. Tariffs and consumption pressures, labour markets and negative wealth effect are the main factors that will affect growth. While US tariffs will put pressure on European exports and growth, there are some bright spots for the region – fiscal spending in Germany, low oil prices and the muted EU response to US tariffs.

The Fed faces challenges on consumers’ inflation expectations but will likely tilt towards supporting growth. If consumers’ inflation expectations become unanchored, and if they start affecting wage negotiations, those expectations will reinforce actual inflation. The timing of the Fed’s move will be important. For now, we believe it will reduce rates three times this year.

We think a rotation out of the US will continue, benefiting other regions such as Europe, Emerging Markets, and Asia, and leading to a cautious view on the US dollar.

Less of a dilemma for the ECB because it is acknowledging a weaker growth outlook for the region. We have reduced our terminal rates expectations from 1.75% to 1.50%, implying three more cuts this year. In the UK, cooling labour markets, a stronger pound, and elimination of import tariffs should put downward pressure on inflation, allowing the Bank of England to reduce interest rates three times this year.

China will have to find a way to rely more on domestic consumption for growth. US tariffs on Chinese exports have exceeded our expectations and the country’s growth will of course be affected. Currently, Chinese policymakers are retaliating, but we believe they will also have to focus on domestic demand and consumers, using both monetary and fiscal tools.

From a medium-term perspective, we see a weaker economic outlook, strengthening the case for cautious allocation. However, we are not there yet, and for now, we remain mildly pro-risk.

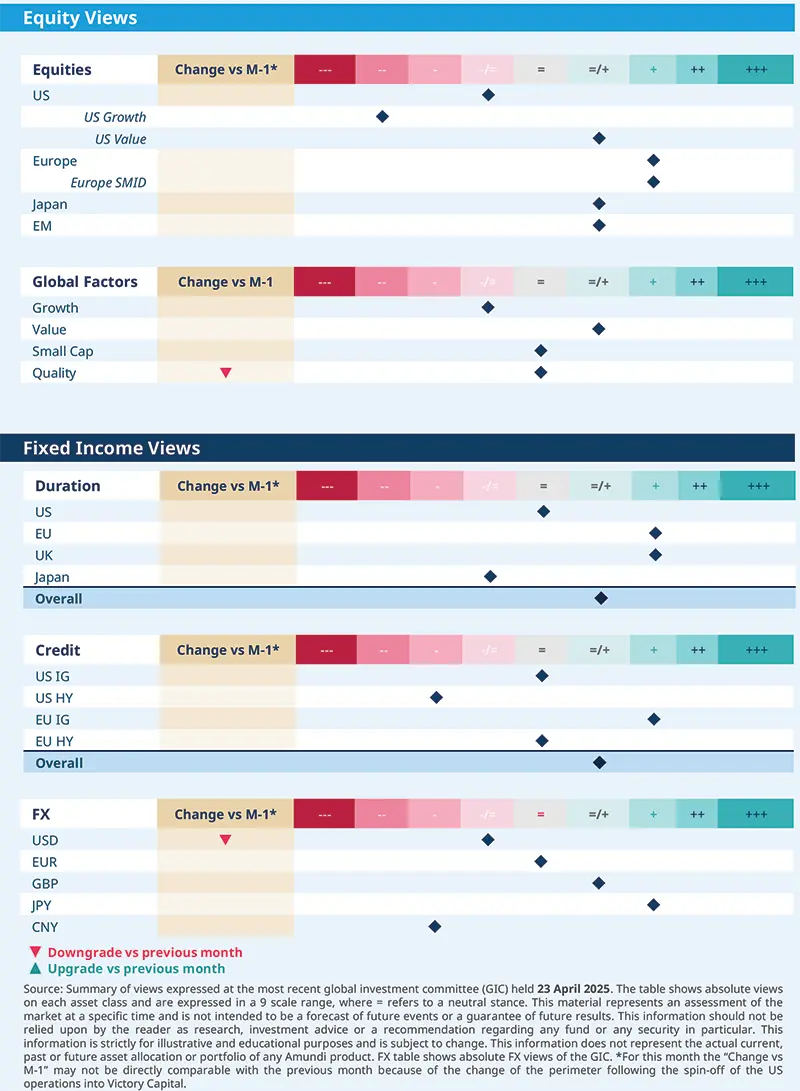

In fixed income, we are positive on duration mainly through the EU and the UK, but are cautious in Japan. On the US, we are neutral: while inflation is coming down, consumers’ expectations of inflation are high. Corporate credit valuations are pricing in a deterioration in growth, yet fundamentals remain healthy. Therefore, we are optimistic on the EU Investment Grade market given its valuation and we see good value in financials. However, we are cautious on US High Yield.

In equities, the US market sell-off is reaffirming the rotation towards regions such as Europe, the UK, Japan. With valuation multiples compressed, the main risk lies in earnings.

| Amundi Investment Institute: US tariffs likely to affect growth and earnings |

The IMF has downgraded its global and US growth forecasts in its latest World Economic Outlook released in April. While we are aligned with the IMF in terms of global growth for this year, our forecasts for the US are more conservative. We do not expect a US recession, but higher tariffs could affect consumers’ disposable income and eventually growth. This makes the Fed’s task difficult as it tries to balance inflation expectations with economic growth. We think the US businesses will face the heat on their earnings from tariffs and many large companies are already voicing their concerns on recession. With US exceptionalism under threat, we have downgraded our EPS expectations for the S&P 500 this year to around 5%. In this respect, the forward guidance from companies will be critical.With valuation multiples compressed, the main risk lies in earnings. |

We think the Fed will reduce policy rates three times this year, with risks of more cuts if unemployment weakens. Furthermore, pressures on US growth imply repercussions for Europe, but the impact on stock prices would depend on how expensive the valuation multiples are to begin with.

While remaining cautious on the US in general, we see selective opportunities among value, quality stocks and in equal weighted indices, on reasonable valuations and those that are relatively insulated from Trump's policies. In Europe, we favour defensive consumer staples and health care names, with strong pricing power and non-disrupted business models. In cyclicals, we also like quality European banks, and small/mid-cap companies due to their domestic exposure.

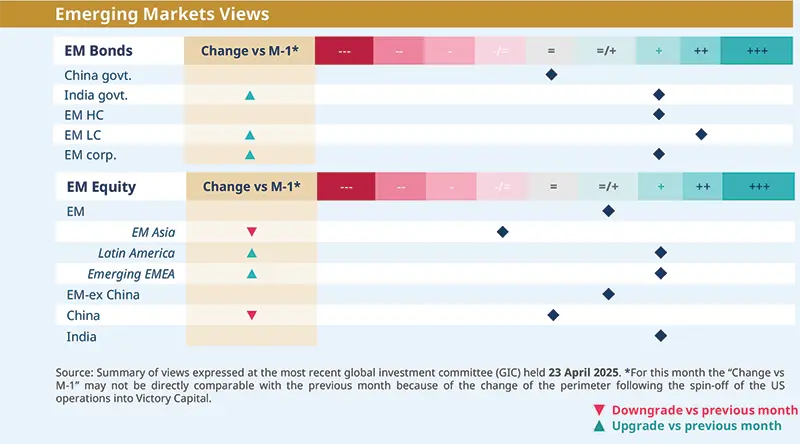

Emerging market assets are finding support in a weaker dollar, expectations of Fed rate cuts, attractive domestic yields and resilient growth so far. But uncertainty around Trump’s policies could weigh on the asset class. In particular, we are constructive on hard currency and corporate debt as absolute yields are attractive. In local currency, we find select opportunities in LatAm and frontier markets. In EM equities, China is vulnerable to tariffs and restrictions, but Latin America and the MENA region seem relatively insulated from US tariffs, leading us to keep a positive stance on Latin America and on India. We are also optimistic on emerging Europe.

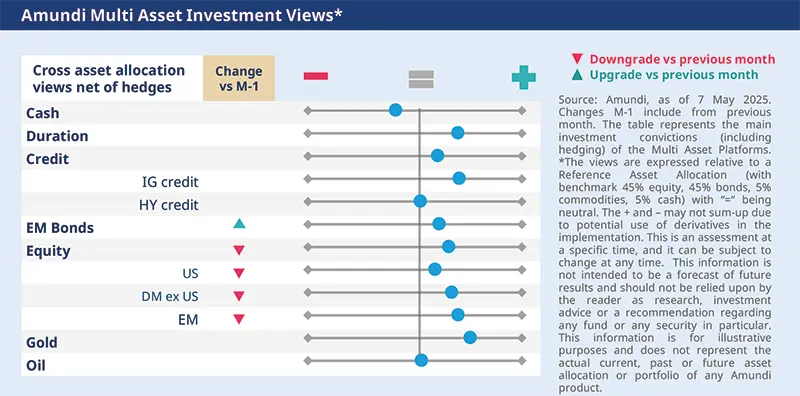

In multi-asset, we remain mildly risk-on despite a deteriorating outlook, as macro, credit and liquidity conditions are still reasonably supportive. We are tactically adjusting our stance, becoming less positive on developed market equities while more positive on EM bonds. Additionally, we are turning positive on EUR vs. USD, as US exceptionalism fades and lower interest rates from the Fed may reduce flows into US assets and increase capital repatriation to Europe and Asia. We stay positive on gold, given its appeal as a hedge against geopolitical tensions and inflation risks.

Growth hinges on the length of high tariffs and retaliation; despite policy uncertainty, supportive macro, credit, and liquidity conditions lead us to favour a mildly risk-on stance with gold and hedges.

FIXED INCOME

Tilt to Europe duration

Amaury D’ORSAY |

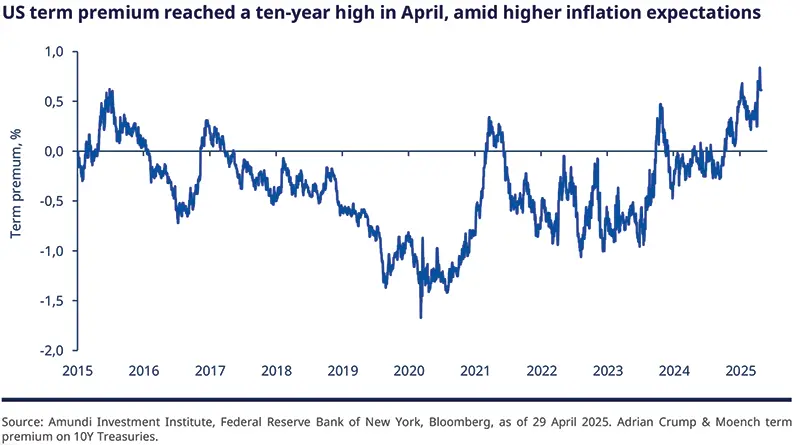

We are witnessing higher term premium in the US along with higher inflation expectations owing to uncertainty around import tariffs. While the Fed will be forced to deal with these inflationary pressures in the near term, inflation is less of a concern for the ECB. This could create some policy divergences between the two global central banks, leading us to downgrade our terminal rate expectations for the ECB.

In particular, lower energy prices, the muted EU response to tariffs so far and moderate wage growth in Europe all point to limited inflation risks. In addition, any deceleration in economic growth could affect corporate fundamentals, particularly in US. Hence, we maintain a global and a selective approach to credit and duration, and keep our bias towards quality.

Weakening growth and central banks in easing mode, particularly in Europe and the UK, support our constructive view on duration overall as we expect a negative impact on the economy from Trump’s tariff policies.

We are neutral on US duration, and we favour the EU over the US.

On Japanese duration, our cautious stance reflects our structural long-term view.

The sharp widening in credit spreads indicates markets are pricing in a darker economic outlook. US HY may be vulnerable. We prefer EU IG, with strong fundamentals and attractive valuations.

Overall, we expect some weakening of fundamentals and hence are selective.

At a sector level, we like financials given their robust capital buffers and high profitability.

We downgraded USD. The recent break in correlation between US yields and the dollar is rare and may be a result of capital reallocation in the markets. We may see a higher risk premium associated with US assets now.

The EUR may benefit from any potential ‘de-dollarisation.’ We expect EUR/USD at 1.16 by year-end (vs. 1.13 earlier). There could be scope for even further appreciation.

EQUITIES

Rotation opportunities amid a sell-off

Barry GLAVIN |

The rotation that started at the end of last year is still continuing and has been fastened by the trade war. As a result, US equities have been the most affected, leading to a derating in valuation multiples. Despite that, valuations remain expensive and other regions are relatively more appealing. In Europe, the key factor to monitor is the extent to which fiscal stimulus and infrastructure spending could offset the impact from tariffs.

The sustainability of this rotation depends on earnings and how confident companies are with respect to the impact from tariffs. While we expect guidance to be bleak, we think there are opportunities to be found in businesses with strong fundamentals and with a strong domestic focus in Europe, UK and Japan.

We see more opportunities outside the US, in Europe, UK and Japan. While volatility will continue in the US, opportunities remain in some value part of the market.

Valuations are appealing in Europe and the UK. In particular, the UK offers domestic opportunities that are relatively shielded from the international trade war.

In Japan, we stay positive and believe there is a potential to play interest rate normalisation through banks and insurers. We also see some high-quality international businesses.

We maintain an overall balanced approach, looking for businesses with strong balance sheets and non-disrupted business models.

Large caps are vulnerable to trade tariffs, at a time of their high valuations. We stay cautious on growth, and prefer small/mid caps due to their valuations and outsized domestic exposure in Europe. We are mindful of liquidity risks.

From a sector perspective, we favour defensive consumer staples and health care businesses over expensive technology names. In industrials, where we are cautious in general, we see select opportunities in quality cyclical companies, and in large cap financials.

Overall, we aim to maximise idiosyncratic ideas that offer long term returns to shareholders.

EMERGING MARKETS

EM Divergences in the tariff disruption

| Yerlan SYZDYKOV Global Head of Emerging Markets |

While emerging markets are sensitive to developments in global trade, policies of the US administration and geopolitical developments, some regions/countries seem to be more affected by US tariffs than others. At the same time, resilient domestic economic growth and less correlated economic cycle (from international trade) in select regions mean there are ample opportunities to diversify and generate income over the long term.

For instance, US tariffs are more likely to affect some supply chains in Asia, whereas Latin America could be the least hit. The important questions for us are where US tariffs will finally land, what will be the retaliation and who will be the likely winner of this US attempt to decouple from China. Another important point is which countries will be able to negotiate bilateral agreements. While the answer is complicated, we are careful to not take extreme views as the situation is fluid.

While we are constructive on hard currency and corporate debt, we keep a very active stance: country and sector selection remains key to long-term returns.

In local currency, we are positive on countries that offer high nominal and real yields and are less vulnerable to trade tariffs. We like Latin America, particularly in Brazil, as well as in frontier markets.

On EM currencies, we are cautious on some Asian FX and stay positive on high-yield FX (BRL, MXN, TRY).

In Asia, weakness in China could affect growth in countries with close trade ties with the country. We remain positive on India because of the domestic nature of its economy, and the advanced stage of its discussions with the US for a trade agreement.

We are constructive on emerging Europe. But in the MENA (Middle East and North Africa) region, we are monitoring oil prices and its impact on equities. We are slightly cautious on sectors that are sensitive to global growth.

Main convictions from Asia

Tariffs and trade are dominant themes. While we expect one-on-one trade deals to be eventually agreed, those will take time, keeping markets on the edge in the interim. The economic impacts of the 10% base levy, slower growth from the US and China, and elevated uncertainties will all weigh on the region’s growth outlook. Less trade dependent economies are better placed to weather the storm than the export-sensitive ones.

Asian rates offer good value. The combination of slowing growth and subdued inflation is offering Central banks the scope to step up policy easing. We like Indian bonds and are positive on Chinese and South Korean curves, with currencies hedged. The long end of the curve warrants some caution, however, due to fiscal expansion raising primary issuance. For corporate credit, we prefer income-generation themes and defensive issuers, particularly in Greater China and India. Diversification opportunities are also worth considering in subordinated financials and insurance companies in Japan and Australia.

Within equities, we are exploring defensive opportunities in domestic themes in India, China A-shares and the Philippines. Risk taking should be exercised with caution in a highly fluid market environment, and we recommend patience until there is better clarity on trade negotiations. Selectivity – based on export exposure and differentiating tariffs – is key for assessing the relative impact of the trade war on regional markets.

Multi-asset

US exceptionalism at risk: stay flexible

Francesco | John O’TOOLE Head of Multi-Asset Investment Solutions |

When markets are reassessing the role of traditional portfolio stabilisers, we remain flexible in search of attractive opportunities and maintain ample safeguards.

Liberation Day’ marked a massive US policy shift towards a more chaotic, transactional approach. US growth slowdown would depend on the duration of these tariffs and retaliation from trading partners. The damage to investor and consumer confidence has started already and markets are challenging US exceptionalism. But macro, credit and liquidity conditions are reasonable. In this environment, we explore all levers available, including EM bonds, and believe the supremacy of the dollar in FX is at risk. At the same time, we think investors should keep portfolio safeguards, such as gold, intact.

Without overreacting to stock market movements, we marginally reduced our stance on DM equities, but are still constructive overall through US, EZ and the UK. The EZ markets will benefit from their cheaper valuations and boost to earnings (in the medium term) from a fiscal push in Germany. UK is a way to diversify within Europe and its markets offer good defensive characteristics. In US, our views are well-hedged, and we maintain a small positive stance through segments which should benefit from a potential lowering of regulations and support to domestic-oriented companies. In EM, as a risk control measure, we turned neutral on India due to near term uncertainty. We are vigilant and believe structural growth story is intact.

In fixed income, we keep a global approach, with positive stances on duration in the US, core EU, the UK and on Italian BTPs – the recent rating upgrade for Italy is positive. We are also optimistic on EU IG. On Japanese bonds, we are cautious due to their excessive valuations and negative real yields. On EM bonds, we are now constructive after the sell-off seen in April beginning. A near term relief in this segment is expected amid dollar weakness. We are neutral on local rates.

In FX, we rebalanced our views, turning cautious on the dollar, and positive on the euro. We are negative on USD vs JPY and NOK. In EM, we became even more constructive on BRL and MXN vs. the CNH.

VIEWS

Amundi views by asset classes

Definitions & Abbreviations

Currency abbreviations: Currency abbreviations: USD – US dollar, BRL – Brazilian real, JPY – Japanese yen, GBP – British pound sterling, EUR – Euro, CAD – Canadian dollar, SEK – Swedish krona, NOK – Norwegian krone, CHF – Swiss Franc, NZD – New Zealand dollar, AUD – Australian dollar, CNY – Chinese Renminbi, CLP – Chilean Peso, MXN – Mexican Peso, IDR – Indonesian Rupiah, RUB – Russian Ruble, ZAR – South African Rand, TRY – Turkish lira, KRW – South Korean Won, THB – Thai Baht, HUF – Hungarian Forint.