- India’s economic and demographic outlook points to strong growth over the next decade and suggest Indian equities could over-perform main equity markets.

- Investment is expected to drive the recovery, with government policies and initiatives playing a key role.

- In the equity market, investor sentiment is shifting to value stocks, cyclical industries, and mid- and small-caps. The outlook for fixed income is also favourable, with potential for positive real returns this years.

Investors’ attention should be turning to India, which has overtaken China as the world’s most populous country. The country has a lot more going for it than just demographics. We expect GDP growth will average 5.2% per year over the next decade, compared with 3.7% for emerging economies, and a modest 1% for developed markets. This year alone, India is projected to contribute up to 15% of global growth, second only to China and more than Europe or the United States. India has all the necessary components to become a key engine for global growth, but must overcome several obstacles before it can unlock its full potential.

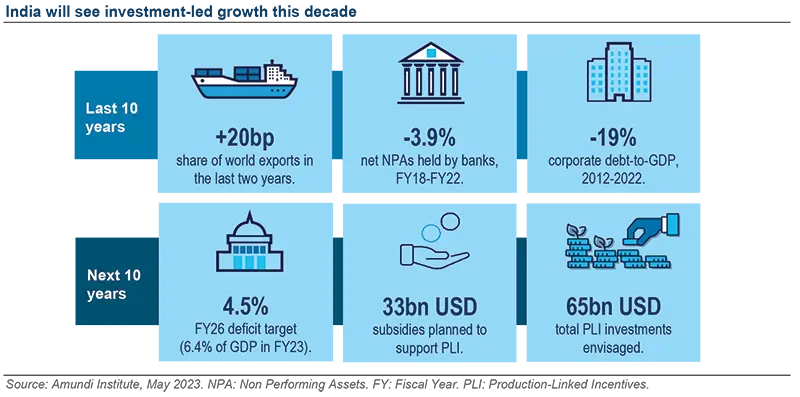

Companies’ capital expenditure has stagnated in the past decade, and we believe the need for new investments will drive growth in the next 10 years. There’s scope for this, given corporates have stronger balance sheets and corporate debt-to-GDP fell by 19% in the ten years to mid-2022. Also, banks have strong capital adequacy ratios of around 16%, which makes them better able to withstand risk and absorb losses, and consequently to lend. Indian banks also cleaned their balance sheets, with net non-performing assets accounting for 1.7% of total advances in March 2022 from a peak of 5.6% five years ago.

Additional support could come from the government, which is keen to stimulate investment activity in newer sectors. Initiatives like the Production-Linked Incentives (PLI) scheme can help boost manufacturing by wresting some supply chains away from China, propel exports, and attract rapidly-growing industries like semiconductors, electric vehicles, and renewables that are of strategic geopolitical importance. In fact, India benefits from maintaining relations with various powers, making it a potentially powerful broker between the East and the West. In some industries, like solar modules, entire value chains could be built domestically.

Fiscal policy should have capacity to support this push. The government is committed to reducing the budget deficit to 4.5% by the 2026 fiscal year, from 6.4% today. The tax authorities are working to ensure better compliance and close loopholes in the system. An anticipated 1-2 percentage point increase in the tax-to-GDP ratio over the next couple of years could be used to stimulate infrastructure investments through public and private partnerships.

Even if only half of the proposed initiatives are successful, that would create significant investment opportunities. Leaner cost structures, corporate tax reforms, and policy initiatives should support a strong investment cycle in the medium term.

Markets are starting to recognise the changing tide. In equities, investor preferences are turning to value stocks, cyclical industries, and mid- and small-capitalisation companies, which have been faring well in the post-Covid recovery. As inflation cools, consumption should also start to pick up. Corporate profits as a proportion of GDP rose 3.6 percentage points between 2018 and 2022, bucking the downward trend of the previous decade.

We therefore view 2023 as a year of transition for India, characterised by a modest slowdown in growth, but also a stabilisation that sets the stage for a sustainable recovery. India seems poised for a prolonged period of upward economic growth and improved earnings, primarily fuelled by a revival in manufacturing and investments.

The outlook for Indian fixed income is also favourable. Market yields offer positive real rates across most maturities, on both realised and forward inflation measures. And more good news may be ahead. Thanks to the medium-term growth and inflation outlook, the Reserve Bank of India (RBI)’s tightening cycle is likely over. Markets may soon begin to anticipate a turn in policy, although some stickiness in core inflation means that the central bank will not be able to ease quickly.

Finally, we anticipate the Indian rupee will perform better in 2023 than it did last year. Many emerging market currencies have strengthened since the beginning of the year due to the recent weakness of the US dollar. Lower inflation, relatively stronger domestic growth, and a pause in the interest rate hiking cycle are also expected to have a positive impact on the currency. Additionally, the potential for lower oil prices may decrease the country’s import expenses and improve its current account deficit, while active interventions by the RBI over the past eight years have helped reduce rupee volatility and hedging costs.

India’s demographics, urbanisation, and rising middle class will help sustain growth for many years. But the country will have to invest more to take full advantage of its demographics. Spending on education, the development of skills, and job creation to accommodate the growing numbers of young workers will open up rewarding investment opportunities.

For more insights

To learn more about this topic, click on the article below: