Summary

Invest globally, look for potential opportunities in emerging markets, and balance equities with government bonds to navigate uncertainty from US elections and geopolitical hotspots.

- Geopolitics will be increasingly relevant for investors as we enter the hottest phase of US elections.

- After reaching new highs, equity markets may take a pause as uncertainty rises with US elections.

- The global geopolitical reordering may benefit some Emerging Markets, like India.

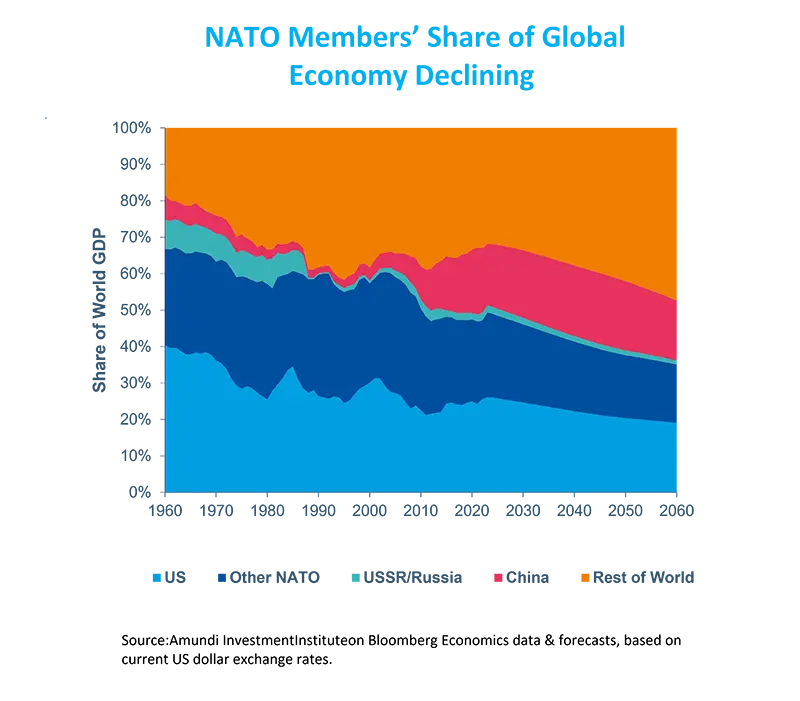

The recent NATO summit in Washington discussed key geopolitical issues, such as the war in Ukraine and China's increasing influence. However, we note that NATO's economic power is declining, with its members' share of global GDP now below 50% and projected to decrease further in the coming decades, while countries in the emerging markets are increasing their economic power.

As geopolitics takes centre stage and we enter the intense phase of the US elections, with scrutiny surrounding the Biden presidential race, we expect market uncertainty to rise.

A diversified* global stance, including investments in emerging markets, may help navigate this phase and capitalise on opportunities that may arise from the geopolitical reshuffling.

Actionable ideas

- Multi Asset investing to navigate uncertainty

Investing globally, across different asset classes including Emerging Markets and commodities like gold, may help navigate uncertainty amid geopolitical hotspots.

- Emerging Markets

The geopolitical realignment presents potential opportunities for Emerging Markets arising from supply chain reallocation, near shoring, investments in technology. India, for example, is among the countries that are benefitting from the global reordering.

This week at a glance

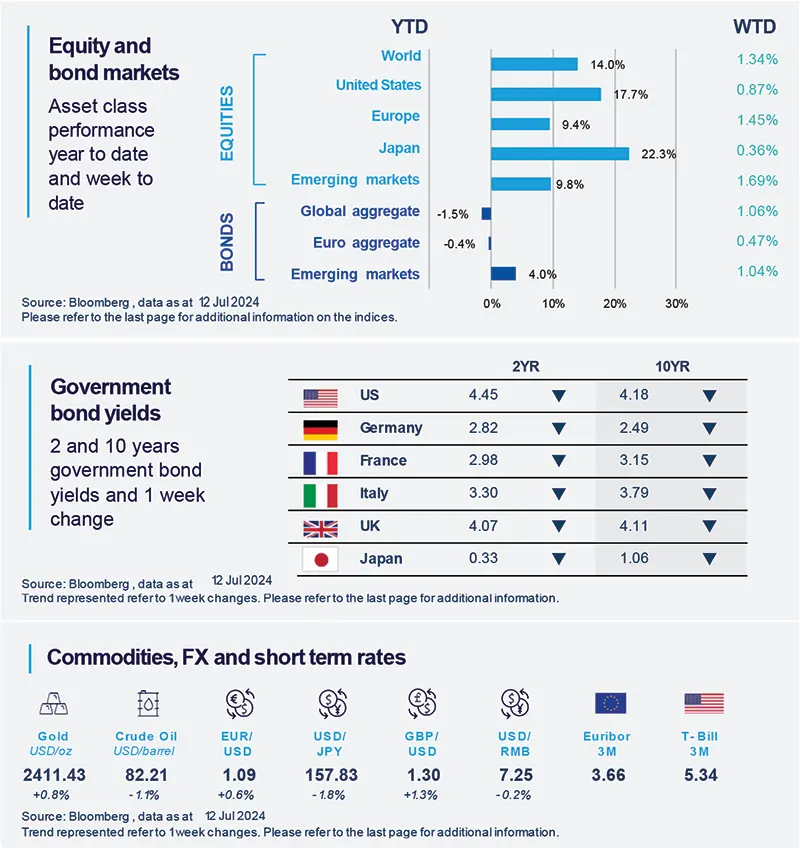

During the week, softer than expected US inflation data led US Treasury yields to move lower, as market expectations for the Fed to cut rates in September increased. The US equity market saw a rotation that favoured the rest of the market outside the mega caps following the inflation report.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short term rates.

Source: Bloomberg, data as 12 July 2024. The chart shows Global Bonds= Bloomberg Global Aggregate Bond Index, Global Equity = MSCI World. Both indexes are in local currency.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US inflation cooled down in June

In June, US inflation declined by 0.1% month-on-month to 3.0% year-on-year. This slowdown was mainly driven by lower energy prices. The US Core Inflation, which excludes food and energy, rose at the lowest pace since August 2021, with core goods experiencing deflation, while core services moderated. Shelter inflation also showed signs of softening. The data may support a September rate cut by the Federal Reserve.

Europe

The UK economy grew more quickly than expected and above market expectations.

Expansion in activity was supported by all three major sectors, with particular strength in services, the largest contributor to monthly GDP growth. Within the service sector, the strongest growth contributions came from the wholesale and retail industry, in line with reported retail sales. Additionally, production and construction output increased.

Asia

Asia central banks edge towards easing

The Bank of Korea kept its policy rate unchanged at 3.5%, but we expect it to deliver its first cut in October. Overall, with rising expectations of a Fed cut in September, central banks in the region are increasingly signalling easing. Among them, in the Philippines, the Bangko Sentral ng Pilipinasis one of the central banks that could potentially cut rates even before the Fed. We also expect the People's Bank of China to resume rate cuts in August.

Key Dates

|

15 Jul China GDP, EZ industrial production |

17 Jul UK CPI, Fed beige book |

18 Jul ECB policy rates, Japan trade balance |