Summary

Key takeaways

Q4 2022 was the first quarter of YoY profit declines for the United States, while Europe has held up better. In the United States, Big Tech-related sectors are suffering the most and we confirm a cautious view. In Europe, earnings resilience is keeping valuations at attractive levels despite the strong stock market rebound since late September. As long as the soft-landing scenario prevails, the European market could be considered as a wildcard for international equity portfolios.

The US earnings season is sufficiently advanced to draw some conclusions

The greater resilience of profits enabled the European market to remain cheaper than the US one.

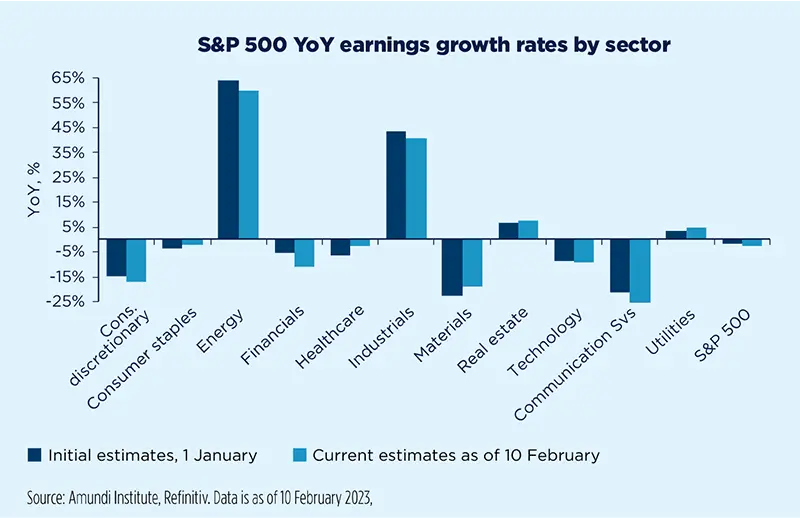

With almost 70% of S&P 500 companies’ results having been released, YoY earnings growth was negative for the first time in this cycle according to Ibes (-2.8% vs. +4.4% in Q3, +8.4% in Q2 and +11.4% in Q1 2022). This was slightly more negative than expected by analysts at the beginning of January (-1.6%) and combines a slowdown in sales and a fall in margins.

Those sectors rich in Big Tech recorded a more marked decline than the average. This was the case for technology (-9.2%), consumer discretionary (-17%) and communication services (-25.4), whose results were down more than expected at the beginning of January. These growth stocks – these three sectors represent over 70% of the MSCI USA Growth Index – have been shown to also have cyclical features and need to correct their over-profitability, which reached its peak with the Covid-19 crisis. This confirms our caution about these sectors and, given their weight in the indices, the US market in general.

The correction of the overvaluation of these few large stocks is thus combined with a cyclical correction. In this respect, the intra-year profile of US economic growth is not favourable; it is expected to slow gradually in YoY terms in the second half of the year and to be stable at best from one quarter to the next.

We can expect profits to continue to fall in 2023 despite the current resilience of the economy. Historically, it takes more than +2.0% real GDP growth to see positive earnings growth in the United States, but our macro forecast is just +1.0% for 2023 and +0.6% for 2024. Even with this soft-landing scenario, it is likely that profits, as forecast by Ibes (+0.6% in 2023), will be further revised downward to -3.0/-5.0% in the coming months.

Finally, the rebound of the US market means that it is paying above its historical median again in terms of P/E (18.7x 12 months forward earnings compared to a median over the last 12 years of 16.8x). It is therefore tempting to look at international markets.

In Europe, the earnings season is in full swing and is providing much information. With almost half of the Stoxx 600 companies expected to report having done so, Q4 earnings growth has so far come in at +11.3% according to Ibes. This is better than in the United States, as were the first three quarters of the year. However, as in the United States, this figure has also been revised downwards between 1 January and 14 February (+14.5% was expected at the beginning of January).

In Europe, the most striking fact is that cyclical sectors are doing better than defensive sectors. This is especially true of financials (+44.7% is even better than the +39.0% expected in January) – which are notably benefitting from the rise in central bank rates; consumer cyclicals (+19.5%) – notably luxury goods stocks with strong pricing power; and industrials (+18.8%) – a very broad sector that includes defence stocks, which are benefiting from geopolitical tensions. These were the only sectors to end the quarter with positive growth, alongside energy. More defensive sectors such as consumer discretionary, healthcare and utilities saw their earnings decline YoY and, in the case of utilities, was even more than expected. Certainly, profit growth, as forecast by Ibes (+1.2% in 2023), will also have to be adjusted further downward. Global GDP growth, forecast at +2.4% in 2023 and +2.8% in 2024 by our economists, is not expected to be enough for profits to end 2023 in positive territory. In the case of Europe, +3.0% global GDP growth is historically required for this. A decline of -8.0%/-10.0% is possible in 2023.

However, despite the tremendous rebound of the European market since its low point on 29 September 2022 – the Stoxx 600 has gained +20% up to mid-February – the greater resilience of profits on this side of the Atlantic has enabled the European market to remain cheaper than its American counterpart for the time being, even if we compare the markets sector by sector. The 12-month forward P/E is 13x in Europe, slightly below its 12-year average of 13.6x. After such a rebound, a consolidation is of course possible and even desirable. Nevertheless, with the disappearance of negative interest rates, valuation has become a more important selection criterion and, as long as the soft-landing scenario prevails, the European market should be considered as a wildcard for international equity portfolios.