Summary

Executive summary

We believe that Artificial Intelligence (AI) could have over the long-term a positive impact on productivity and GDP growth. However, the impact will not be linear across sectors, especially in the early phases. Those companies that are already investing heavily in AI technologies are the most likely to see benefits to revenues and/or profitability, but disappointments will happen given increased and new competitive pressure as well as the emergence of questionable business cases in light of the involved costs.

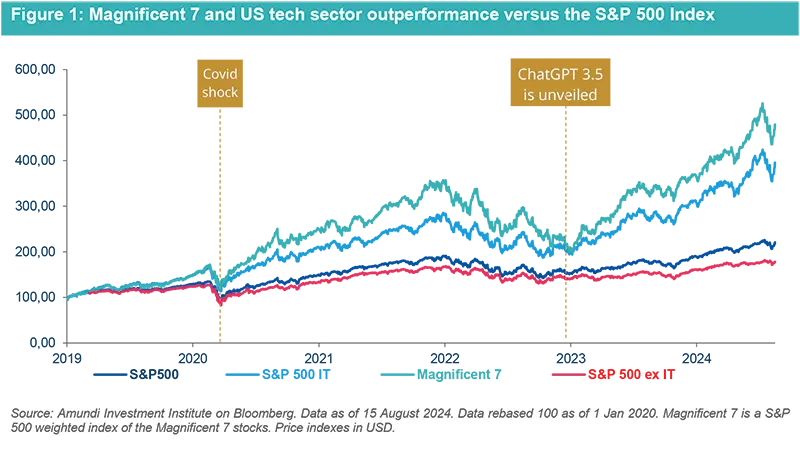

With rising expectations around AI, the tech sector and US mega caps have outperformed strongly in recent times, leading to higher market concentration. In particular, the US tech companies have risen by 300% since the start of 2019, whereas non-tech stocks gained just 80%.1 This poorly discriminated performance has been driven by robust earnings growth in the US Mega Cap, a supportive economic backdrop and the launch of ChatGPT 3.5 (2023) that led to a cycle of investment in AI technologies. Investors may need to consider a potential reset of the tech sector’s valuation levels, and determine the companies which are likely to be the future winners and losers across the market.

To help identify such companies, we use a framework which categorises them into four AI types: tech providers, tech enablers, deployers and disruptors. The AI tech providers (e.g. semiconductor companies) are the early winners that are well-positioned to exploit the robust AI demand, while the AI tech enablers (e.g. hyperscalers/cloud providers, data centres) are heavy investors in Al, purchasing the majority of the leading-edge AI graphics processing units (GPUs).2 The AI deployers are those businesses that are already leveraging AI to transform their businesses whereas the AI disruptors are new entrants that will disrupt business processes by using AI technologies to achieve greater scalability.

There will be winners and losers in most industries. However, to be a “winner” a company needs not only to be an early-mover in terms of investing in AI, but also possess a proprietary data advantage, an existing competitive edge based on market position and an ability to innovate successfully. Otherwise, any advantages from using AI technologies could be competed away. In our view, the future winners are most likely to be found among the existing competitively-advantaged companies.

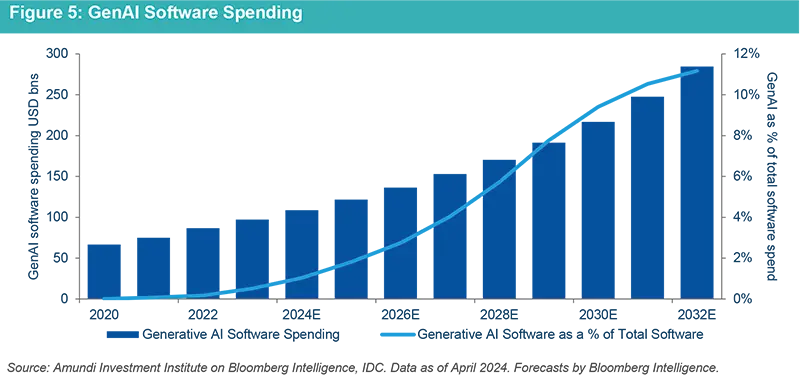

We highlight those industries which may see a meaningful impact from AI beyond the tech enablers and related suppliers, such as the software and services, media and entertainment, commercial and professional services and industrials sectors. Our attention is also focused on areas where AI will have a significant role, but the long-term outcome for growth and margins is uncertain. These include the financials, as this sector is an early-adopter, and health care, given it is already investing notable capital in AI.

To finish, we highlight findings from interviews conducted by Amundi Technology with senior financial services executives over the last six months. For example, GenAI was discussed in almost every conversation, unlike in the past when it was rarely mentioned. In addition, the rapid pace of change those businesses are now facing was emphasised. Any time frame for optimising business plans that stretches beyond six months is considered by these executives as being long-term. This pace has ensured that the best-in-class companies are seeking partners to help them navigate their challenges. In particular, attention was drawn to the importance of using AI to unlock the power of proprietary data, given that some of the AI technologies will become commoditised. AI can do general things very well, but may struggle when it comes to specifics.

While AI has the potential to drive productivity gains, its impact may vary across sectors and may not be immediate. With high concentration in the market, we favour opportunities outside the mega caps.

AI revolution: where are we and what comes next?

We have experienced three periods of elevated productivity growth driven by the adoption of new technologies going back to the mid-1950s: the mainframe, PC and web browser. We believe that AI represents a new technology paradigm that could lead to technology driven productivity gains in the coming decades (see the Macro Focus below). From an investor’s point of view, the main questions are to what extent will these productivity gains result in higher earnings growth and how much of this future growth prospect is already captured in valuations.

Sector earnings and revenue growth expectations

AI technologies will not be adopted by all businesses, or sectors simultaneously, and those that are expected to benefit will do so within different time frames. In our view, the companies that are making large AI investments in an attempt to further sustain their existing competitive positions, are likely to see earlier benefits to revenues and/or earnings than those with more limited resources. As regards sectors, it will be those that are labour and/or data intensive that are the likely to benefit the most from AI over the medium- to long-term. Overall, we believe that AI could have a long-term positive impact on global earnings, but with differences across sectors and companies.

Macro Focus: long-term productivity gains from AI

As a general-purpose technology, we expect AI to affect all production factors: labor, capital and productivity. The AI tech cycle is seen as significantly different from previous cycles, as it is affecting creative and cognitive jobs as well as physical ones. Jobs will be loss while others will be transformed or created that currently do not exist. As a result, the impact on real GDP growth might be more ambiguous than productivity gains. Focusing on its impact on growth, we anticipate that AI adoption will proceed in three phases: the first will be characterised by innovation and capital accumulation, but there will be limited visibility on the productivity effect; the second will involve a widespread AI implementation and increases in productivity being achieved; and a third will show diminishing marginal returns to further adoption. In our analysis, Will AI increase economic growth?, we conclude that it will take time for productivity gains to be realised due to hurdles, such as: infrastructure availability, readiness of enabling technologies, GenAI models’ huge energy usage, regulatory uncertainty and skilled labor availability. These may dampen the speed of deployment, but in the long-run, we expect AI to be widely adopted and have a positive impact on productivity and GDP growth.

We expect AI-led productivity gains in the global economy to follow a bell-shaped pattern, with positive changes evident in the near-term and larger benefits achieved later on.

Sector valuations in a historical perspective: will we see a reset in US valuation levels?

The US tech sector’s earnings trended in line with the rest of the market between 2010 and 2017, but then embarked upon a virtuous cycle from 2018 (except in 2022), growing 2 to 3 times faster than that of the non-tech companies. This robust growth ensured that the sector rose by 300% since the start of 20193, whereas overall S&P 500 Index Index excluding tech companies gained just 80%.

In January 2022, the sector’s performance declined, as consumer demand for tech products began to normalise post Covid-19 and earnings growth weakened. In addition, high inflation increased expectations for interest rate rises which placed downward pressure on the valuations of growth stocks across the market. However, the sector’s performance turned in 2023, as tech companies began to see: an earnings growth recovery (unlike the rest of the market), partly due to cost cutting; an easing in US interest rate expectations; and the launch of ChatGPT 3.5 that led to a cycle of corporate investment in AI technologies.

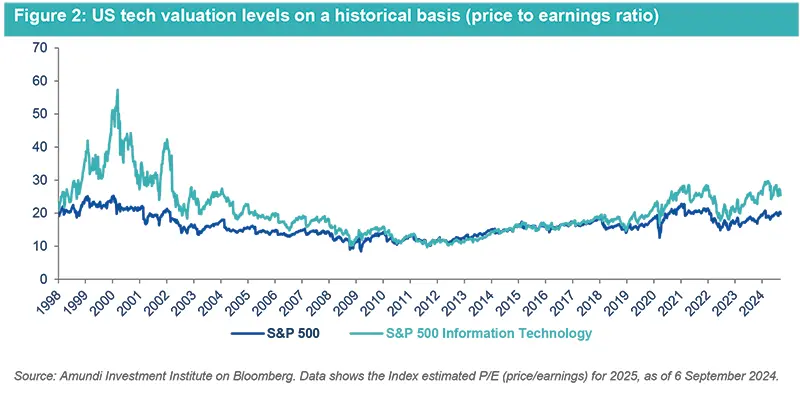

This resulted in the top US stocks, in particular, the Magnificent Seven4 experiencing a surge in earnings and valuations. These stocks have dominated equity returns over recent times, leading to extreme market concentration. However, with significant earnings growth expectations already priced into these stocks, we believe that the rest of the market could benefit from a broadening of the rally beyond the mega caps. This has started to materialise in recent days driven by rising expectations of upcoming rate cuts from the Federal Reserve after the recent inflation figures and concerns about the tech sector due to geopolitical developments.

Specifically, the sector’s strong relative profitability growth may slow, while that of the broader market could start to improve. In fact, the market’s earnings growth may cross that of the tech sector in the second half of this year. In addition, we are concerned about the sustainability of the US AI tech providers’ growth and profitability.

The vast majority of AI GPUs are being sold to a few leading cloud hyperscalers, which are producing their own chips in an attempt to reduce costs (a GPU costs approx. USD 30,000). Also, the end-customers across a variety of industries require an acceptable return on investment (ROI) on their AI-spend. If this is not achieved, these businesses may slow down their spending, thereby dampening the AI tech providers’ growth and profit outlooks. With that in mind, we may see a reset of some of the valuation levels of the US tech companies.

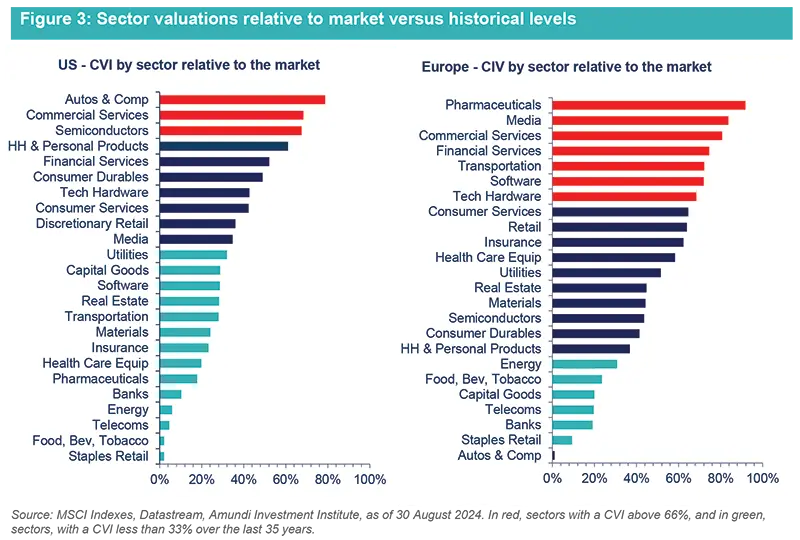

We use our composite valuation indicator (CVI) to assess sector valuations from a historical perspective and identify those most at risk of a valuation reset. This indicator is based on a basket of criteria relative to the market – price/book, dividend yield and price/free cash flow. We rank sectors in percentiles from 0 to 100%, according to the percentage of time a basket was the cheapest over the last 35 years (0% never been cheaper; 100% never been more expensive) (see Figure 3). Based on this data, the US semiconductor sector looks expensive (unlike the European semiconductors) while other tech areas are not at extreme valuation levels.

Assessing AI winners and losers

To help identify winners, we categorise companies according to the way AI is affecting their businesses.

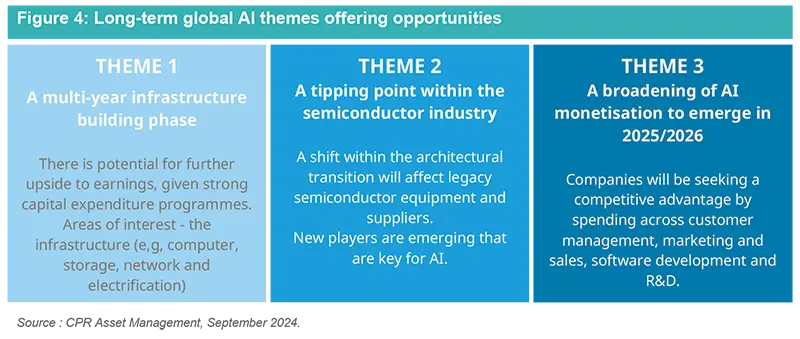

These are the early winners as their strong innovative skills ensure that they are well-positioned to successfully exploit the robust AI demand.

The top four hyperscalers (all US companies) will spend close to USD 200 billion on capital expenditure (capex) this year, a rise of 31% from 2023; the total figure comprises the entire increase in the forecasted capex of the companies in the S&P 500 Index. This investment is driven by a desire to achieve a first-mover advantage in AI, which may allow them to further sustain their competitive positions. Already, nearly two thirds of the purchases of the leading-edge AI GPUs are made by these businesses. Also, there is an ecosystem of companies that provide technology components/materials for the construction of data centres as well as services to deploy AI. This includes: semiconductor manufacturers with offerings in areas such as dynamic random-access memory (DRAM); networking equipment and storage; electronic components; manufacturers of cooling technologies and equipment; and IT consultants that help companies to implement AI strategies.

We are finding some attractive opportunities in this category: near-term deployers among the software and media/entertainment companies; and medium/long-term tech-centric leaders that will provide value as they leverage on AI. The current strong data growth combined with the AI technologies is creating an opportunity for those that are investing in tech expertise. Insights derived from this data may enhance businesses’ growth and margin profiles and be a performance differentiator when companies are facing cost pressures and difficulties in achieving pricing power. On a cautious note, management are reluctant to increase IT budgets, given the lack of visibility on how AI will be used and ROIs. Also, models can provide false outputs (“hallucinations”) and need training before being used for important decisions while concerns about competition, data privacy and AI misuses may result in new regulations.

New entrants will use AI to disrupt business processes by leveraging technologies to be more scalable. Our global thematic investment philosophy focuses on “disruption” which we define as any innovation or product that creates or transform markets. GenAI could be a notable disruptive technology, which is why its long-term impact is not clear. With this focus, we selected investment themes which may offer attractive opportunities, in our view.

Insights into AI and financial services companies

Interview with Benjamin Lucas, Chief Executive Officer, Amundi Technology by Swaha Pattanaik, Head of Publishing and Digital Strategy.

Ben, you interviewed a large number of very senior financial services executives over six months to get concrete insights into what clients want and how their needs are changing. How focused were they on AI?

Firstly, it is important to never assume client needs, or indeed, that they need the same things that they needed before. It is therefore incredibly important to stay connected and to listen. I have been leading conversations like this for much of the last decade and what was really striking this time was that GenAI came up in almost every conversation over the last six months. In previous conversations, CEOs had highlighted cloud, data and talent, but rarely mentioned AI.

Leading companies are looking at AI in terms of a broad restructuring of the way they do business.

Was there a unifying theme that really stood out?

The scale and pace of change. We are at the edge of a precipice with massive structural changes coming in ways that we haven’t seen before. Against a backdrop of change fatigue, there is a sense that what is happening now is truly different. Typically, leaders plan in terms of optimising their business for the next three, five or maybe ten years, and anything beyond that is the long-term. In speaking to the large tech companies, that optimisation timeframe has dramatically reduced, as one leader said to me anything beyond six months is now long-term. The speed at which the landscape is changing is phenomenal and each of us is going to have to deal with this dramatic shift in time frames.

How challenging will it be to adapt to such rapid change?

People often referenced regulation as a hurdle to innovation, whilst of course accepting the need for it. We are now seeing some regulators globally embrace the newer technologies and recruiting for the skillsets to allow them to effectively regulate the application of these technologies and support the growth of the sector. What may be more of an obstacle are the cultural challenges.

Leaders will have to overcome the normal human inertia when it comes to change. They may also face ‘change fatigue’, as leaders have been grappling with wave after wave of new ideas and technologies – blockchain, tokenisation, cloud – with wildly varying levels of success. There is such an immediate opportunity, that the incentive to get this right is large.

What are the best-in-class companies in financial services doing?

They are really looking at it in terms of a broad restructuring of the way they do business, and the leadership’s incentives are aligned with the long-term imperative to adapt to this fast-changing world.

The other distinguishing feature of the companies that are outperforming, is that they realise they can’t work in isolation from the big tech firms. Financial services companies won’t outcompete Big Tech when it comes to AI scientists or investment in AI. But there’s really no need to compete. The important thing is to choose partners that can see what’s coming next and that can help them to navigate their specific business challenges.

Another thing that will determine whether a company is successful in the future is the intellectual property that is specific to that business. This typically exists in a broad range of places – in the heads of their employees right through to their own proprietary data. How they use AI to unlock the power of it will determine their success.

Speaking of employees, what sort of work will people working in financial services do in the future?

When you move to a world of hyper-automation and mass-distributed AI bots, there will be much more machine-to-machine interactions and fewer human-to-machine interactions. And when you talk to academics or big tech firms, their perspective is that on aggregate, the machines will do things better than humans as the technology progresses.

But this is also exactly the sort of environment in which human capabilities will be massively leveraged. There will be some element of human oversight and interaction when it comes to AI, and every human decision will have a much greater impact than is currently the case. AI becomes a force multiplier for humans.

This won’t be a case of people doing well purely because they know how to write prompts for AI. The real edge that people will have over machines will be their domain expertise, whether it is agriculture, manufacturing or financial services. AI can do general things very well but may still struggle when it comes to specifics, especially when data isn’t a matter of public record. This is also where companies can differentiate themselves. Everything that sits in a company’s private database and that isn’t shared is a differentiator. This data becomes incredibly important, as is their employees’ knowledge of how to do things. Elements of the technology will become commoditised, and how boldly it has been applied to the business model will be the differentiator.

When it comes to AI, every human decision will have a much greater impact than is currently the case.

Given the importance of this data, how can privacy concerns be addressed?

Talking about regulating AI itself is going to be hard because the people who are working on the cutting edge of this technology are not, for the most part, working for regulators. The better bet in the interim, though this may not be perfect, is to try and regulate the end activity – helping companies explain exactly what they are doing and how it benefits the end client. The bigger question is what role should governments and policymakers play in protecting human activity.

Will developed economies, and in particular the US, always have an entrenched lead in AI?

India is a really interesting case in point when you’re thinking about this question. A company that is a leader in AI may have a legal entity in the US, but a lot of the actual work is done in India. There are literally millions of Indians focused on these technologies right now. A lot of the skills and capabilities already sit in India. On top of that, the country is aggressively expanding its public digital infrastructure, with a very clear goal of where it wants to be. In many ways, you could argue that India is already among the leaders of the pack.

Opportunities across sectors

As mentioned previously, to be a “winner” a company needs to have a proprietary data advantage, an existing competitive edge based on its market position and the skills to innovate successfully. Otherwise, any advantages from the deployment of AI could be competed away. Generally, other businesses may have to spend just to keep up with the winning company/ies in its sector, and yet over time, they may not be able to retain any AI advantages. In our view, the future winners will be the existing competitively-advantaged companies.

We highlight below some details on a few industries where AI is expected to have a meaningful impact and benefit the deployers, such as the software and services, media and entertainment, commercial and professional services and industrials sectors. We also focus on areas where AI is expected to have a role, but the long-term outcome for industry players’ growth and margins is very uncertain. These include financials, as this sector is an early adopter, and health care, as notable AI investments are being made by the large companies.

AI may bring productivity gains, but without a competitive advantage, it's unlikely to be a game changer.

In the US, AI tech providers and enablers are all spending heavily to further increase their technological and competitive advantages. We believe there are potential winners that stand out. Investors just need to understand their long-term competitive advantages to determine a fair value for the growth opportunities they offer. As mentioned previously, we do have concerns about the AI tech providers’ valuation levels, given our doubts surrounding the sustainability of their growth and profitability.

In Europe, we believe that most of the AI investment opportunities will be confined to the tech sector in the near-term. The semiconductor companies operate in different parts of the value chain as do some US peers, but it is important to note that they have dissimilar near- to medium-term growth drivers compared to the AI GPU-centric US peers. They have not fully participated in the recent AI rally. We remain constructive on some of these companies, given they may stand to benefit as the AI deployment broadens out into the real economy.

The sector includes both AI tech enablers and deployers. These companies are creating GenAI-related software, which will drive the next phase of the modern software as a service (SaaS) company.5

The cloud providers and other software and services companies will contribute to data modernisation which is vital for the deployment of GenAI technologies.6 Better quality data will help businesses leverage their proprietary data and modernise the data stack which should accelerate projects for cloud migration and digital transformation, benefiting cloud vendors.7 Before AI moves into production, however, CIOs will need to ensure that sensitive data is protected.

As GenAI becomes embedded into applications, we expect the software and services sector to be impacted from both a productivity (e.g. lower costs) and revenue perspective. There is already evidence that the productivity benefits around coding are material while we expect companies to deliver new applications and improvements rapidly with a lower level of human input.

On the revenue front, we expect software companies to improve the value delivered to customers through the use of AI (e.g. increase automation, assist in completing tasks and discover new elements within platforms). This should result in some additional pricing power as customers will be deriving greater value from the apps and achieving more efficiencies. This will only be the case, however, if the applications are not commoditised over time, and eventually provided for free.

Importantly, assessing the proper time horizon for each investment opportunity is key. In conversations with service companies, they highlight that despite their clients being enthusiastic about GenAI, company boards are hesitant to approve large AI budgets, given the uncertainty about the way AI will be used as well the costs and returns from AI investments.

Activities of the modern SaaS company

- Software development: coders could improve productivity by using GenAI co-pilots, automating repetitive coding tasks, analysing vast datasets, determining coding solutions and identifying bugs.

- Customer operations: provide software that could use GenAI to personalise responses, analyse customer issues and generate responses for customers.

- Product development: software to enable GenAI to improve product design.

- Data governance and security: increased need for cybersecurity, data clouds and observability.

Across this sector, content creation is already being impacted by text-to-image and video GenAI technologies. Agencies will use AI tools internally for productivity and cost reasons, while clients may bring some of these activities in-house. Businesses that are already investing heavily in AI technologies are expected to realise efficiency gains over the next 24 months, resulting in accelerating growth rates in the near-term. However, unless they are successful innovators who are furthering an existing competitive advantage, these companies may eventually see AI gains being competed away.

In the internet advertising segment, there are two perspectives to consider: the consumer-facing and advertiser-facing. On the advertiser side, companies use GenAI to improve creative content. For example, 15-second video ads can be produced via an AI engine using a text description, which are effective in different formats and geographies. These can be changed based on what aspects are driving engagement. AI-driven messaging platforms are also being developed that improve the ability for brands and companies to connect with customers. AI tools are making "chatbots" smarter, and eventually, companies may create "agents" where a consumer asks a computer or phone to "do something", and the agent does it in the background via a network of agents. Depending on company-specific factors, this can be seen as a threat or an opportunity.

On the consumer side, businesses use AI to improve customer experiences and increase conversion rates by providing a full AI system for recommending content across their family of apps. For content companies, the impact of AI growth is debatable. It benefits studios by enabling more efficient and cost-effective content creation. However, the barrier to entry for production may decline, allowing new entrants to take share from legacy film and TV studios. Distributors may see a decrease in the cost per hour of a film or TV show, although rising talent costs could offset this. Studios that own a distributor, or vice versa, are at lower risk compared to those with weak distribution.

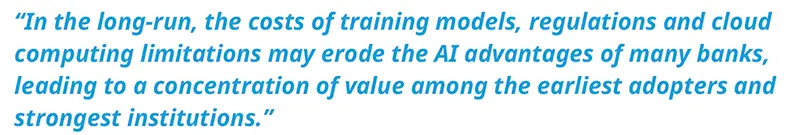

Similar to other sectors, we believe that only those banks that have an existing competitive edge and are early-movers in terms of AI investing, may be beneficiaries over the medium- to long-term. Being labour and data-intensive businesses, many aspects of a bank’s operations can be positively impacted by AI (see Appendix 1). In particular, GenAI offers opportunities to enhance customer service (e.g. automated chatbots) and product quality while productivity gains and improvements can be attained through process automation (e.g. risk reporting, credit risk controls). However, in our view, it is too soon to be confident about AI opportunities within banking. New regulations are expected while incorrect output will ensure that GenAI cannot be used for important decision-making, until the models used are trained sufficiently.

Turning to the insurance sector, staff costs as a proportion of sales are notable (approx. 25% of sales). We expect AI to have some impact on areas, such as: claim handling, underwriting processes (e.g. advanced risk models), customer interactions (e.g. greater personalisation) and agent productivity enhancement (e.g. content generation). Similar to other sectors, however, those companies that are laggards in terms of AI investment and/or less competitive will see their AI benefits eventually disappearing.

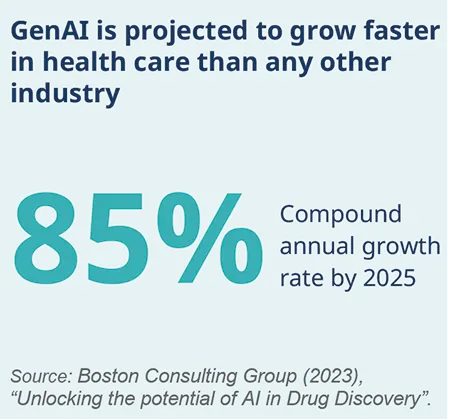

Within health care, AI is expected to have an impact on the drug discovery process as well as improve the effectiveness of medical devices and equipment (medtech). In particular, it has the power to reduce the costs, risks and time involve in discovering new drugs. It takes approximately eight to ten years and over USD 2.5 billion, on average, to develop a successful drug. Given that patent protection periods are largely fixed, a shortening of development timelines can have a material impact on the value of drugs. In the medtech sector, analysing medical scans for anomalies is one of the applications particularly well-suited to AI while hearing aids are also benefiting from AI being used to replicate natural hearing.

| Overall, it is not yet clear which companies will accrue the financial benefit from these innovations. Large pharmaceutical and biotech companies have been using machine learning for years to speed up innovation and approvals, while the ROICs for those businesses have not meaningfully improved. This leads us to question whether any benefit from AI will eventually just accrue to health care payors (i.e. governments, insurance companies, etc.). For the medtech companies, we have seen advances in the past decade. However, it may have been due to company-specific factors as to whether the benefits of the investments made by these companies in machine learning were retained. Generally, we believe it is important for leaders to establish internal AI capabilities to maximise returns for shareholders. |

|

In both the US and Europe, the growth in AI technologies will require a notable expansion in data centre capacity. This, combined with greater digitalisation, the energy transition and the requirement for greater efficiency, will accentuate the demand for electrical equipment. The leading-edge companies with the resources and skills to invest in AI technologies should benefit from this trend, although the sustainability of AI benefits is in question. Furthermore, the grid in both regions will need substantial investment. This is positive for medium voltage/distribution equipment companies and will feed through to the cable and utilities businesses.

A beneficiary of demand for electrical equipment: A European capital goods company provides electrical equipment to data centres for both power and buildings management equipment, as well as IT room electrical equipment. Examples of equipment sold would be uninterruptible power supply systems, power distribution units, cooling equipment and switchgear. In addition, since the power density required by AI applications is greater than ‘traditional’ data centres, there will be more need for equipment to manage that demand.

These services companies have large volumes of private data, business content and software-driven tools for their customers to use in their day-to-day operations. AI offers them the opportunity to better utilise their data, create new products/services and improve efficiency. It also enables customers to combine their own data with a company's proprietary data, providing valuable insights that can significantly improve outcomes. Additionally, AI allows these functions to operate with less human intervention than before. Overall, aside from the direct-to-consumer business models that possess a technological advantage, one should expect companies to see their AI benefits being competed away.

On the positive side, oil and gas exploration is highly data intensive. The identification of potential targets is somewhat of an artform which has been difficult to replicate using standard models.

An AI based approach may be better at identifying potential oil and gas fields which will help to reduce exploration costs.

Sources and References

1. Data to 15 August 18 July 2024 from 1 January 2019. Data refers to the S&P 500 Information Technology (IT) and ex IT Indexes.

2. A graphics processing unit (GPU) is a computer chip that renders graphics and images by performing rapid mathematical calculations.

3. Source Bloomberg, data as of 18 August 2024. Data refers to the indexes in Figure 1.

4. US Top tech/ tech-driven stocks - Nvidia, Meta Platforms, Tesla, Amazon, Alphabet, Microsoft and Apple.

5. Software as a service infers that the software lives on a SssS company’s server and the user accesses it remotely.

6. Data modernisation ensures that databases are transformed into a high-quality data which can provide valuable insights to businesses.

7. A data stack refers to the tools and technologies used to gather, store and process data in a scalable and cost-effective way.