Summary

Key takeaways

The public finances of Eurozone countries began to improve in 2023 and fiscal consolidation will intensify in most Eurozone countries during 2024. Still, fiscal vulnerability – particularly for the most heavily-indebted countries – will rise over time, leading to a higher probability that public debt will not stabilise. The aim of the new fiscal rules is to ensure the longterm sustainability of public finances, but funding for the green transition could suffer.

It’s important to start reallocating resources to preserve priority spending now in preparation for tougher times ahead.

In an environment of weak growth, governments have less budgetary leeway. Indeed, for highly-indebted countries, the rise in effective interest rates paid on debt will increase debt-servicing costs and, all other things being equal, contribute to higher debt-to-GDP ratios. True, the public finances of Eurozone countries began to improve in 2023, with a recovery in tax revenues, helped by inflation, and the gradual removal of support measures. And fiscal consolidation will intensify in 2024. Based on a change in the cyclically-adjusted primary balance, the fiscal impulse is estimated to rise from -0.3% to -0.85% of GDP in 2024.

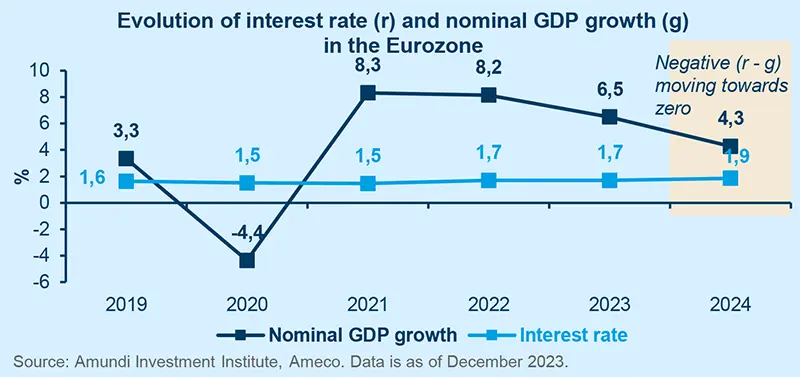

The growth-rate dynamic will not always remain so favourable

The difference between the interest rate and the GDP growth rate – known as (r - g) – is still negative in all countries, but is approaching zero. This simple measure sums up the severity of budget constraints. When (r - g) is equal to zero, the dynamics of the debt/GDP ratio are simple: if the government runs a primary deficit, the debt ratio rises / if it runs a surplus, the debt ratio falls.

Most Eurozone countries are currently running primary deficits. As they refinance their debt, the average interest rate on the debt (the effective rate) will reflect the higher long-term market rate. Budget constraints will inevitably tighten, with the r-g threatening to slip back into positive territory (because of weak growth, disinflation and higher bond yields).

Public finances are sustainable in Europe, however, fiscal vulnerability will increase over time, particularly for the most heavily-indebted countries. The probability that public debt will not stabilise is increasing. It is necessary to replenish resources for a rainy day now and to reallocate resources to preserve priority spending. This adjustment must be made very gradually to avoid overly pro-cyclical fiscal measures.

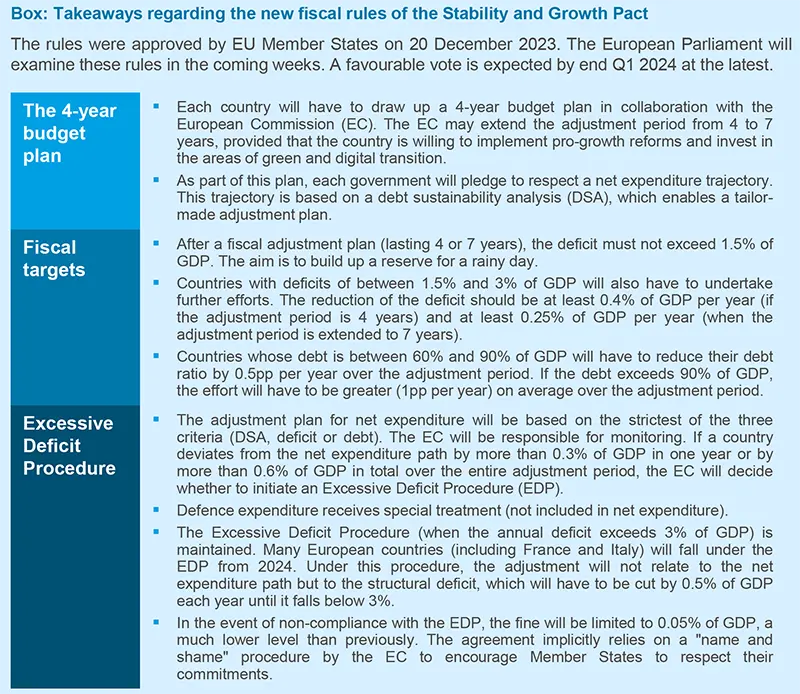

New fiscal rules: the sword of Damocles hangs over green transition financing

The newly agreed fiscal rules are particularly complex (see box) and far from the initial objective. This complexity is the result of a compromise between governments with initially conflicting positions. Nevertheless, they represent a step forward compared to the old rules. The main aim is to make governments more accountable and to encourage them to promote reforms and investment. Governments that play the game will benefit from greater flexibility. The rules will only apply from 2025.

In addition, to avoid a brutal adjustment for the countries that will fall into the Excessive Deficit Procedure (EDP) in 2024 (such as France and Italy), it has been agreed that the increase in interest charges on debt will not be taken into account in the measurement of the structural deficit over the period 2025-27. Budget cuts should thus remain contained over this period.

It is too early to judge the effectiveness of the new fiscal rules and their impact on growth. It is even more true that it will be quite difficult to reconcile these rules with the huge investments needed to finance the green and digital transition (€700bn per year according to the European Commission - EC). In the absence of a central fiscal capacity, this new institutional arrangement is unlikely to be more respected than the previous one. The EC will need to be pragmatic.