Summary

Key Takeways

- The 26th Conference of the Parties, which took place in Glasgow, has been described as the last chance to avert the most serious negative impacts of climate change.

- The main goals of COP26 are the following: securing global net zero by 2050, adapting to protect communities and natural habitats, mobilizing finance in the fight against climate change, establishing collaboration to drive climate action.

- The “Glasgow Climate Pact” was signed with the aim of making the 2015 Paris Agreement fully operational, phasing down unabated coal and ending inefficient fossil fuel subsidies, aligning countries to a common timeframe and methodology for national commitments on emissions reductions, and supporting a just transition for developing countries.

- Investors should keep a close eye on the policy packages such as the EU’s Fit for 55 plan or the US Build-Back-Better package that will shape markets more than pledges, and materialize investment risks and opportunities.

- Even though none of the pledges made at COP26 have been implemented just yet, the IEA reported that if carried out, these policy packages will put the world on track for 1.8°C warming by the end of the century.

Introduction

The Conference of the Parties (COP) was established with the adoption of the United Nations Framework Convention on Climate Change (UNFCCC) at the Earth Summit in Rio de Janeiro in 1992.

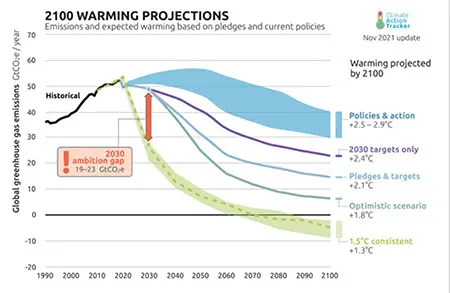

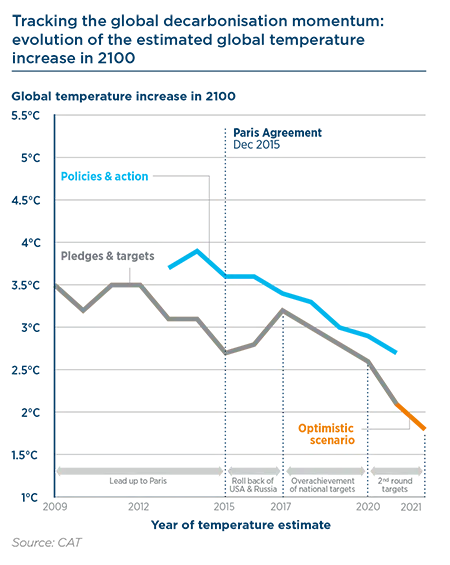

Since the first COP in 1995 headed by the environmental minister of Germany Angela Merkel, the way world leaders think about climate change has fundamentally changed. The arguably most groundbreaking contribution to this was the 2015 Paris Agreement, committing the world to limit global warming to well below 2° and to pursue effort towards a 1.5°C trajectory. The COP26 which took place between October 31st and November 12th in in Glasgow (Scotland, UK) has been described as the last chance to avert the most serious negative impacts of climate change. The current policies are likely to lead to global warming between 2.7 and 3.1°C by the end of the century, far off the 1.5°C trajectory.

The following sections present the main achievements of COP26 in getting the world on a Paris-aligned trajectory, structured along the four main goals.

Source: climateactiontracker.org/global/temperatures

1. Securing global net zero by 2050

- Countries must accelerate the phaseout of coal, curb deforestation and speed up the transition to greener economies.

- Countries’ carbon market mechanisms are part of the negotiations (Article 6 of the Paris Agreement)

2. Adapting to protect communities and natural habitats

- Countries already affected by climate change must protect and restore ecosystems, as well as build resilient defenses, warning systems, and infrastructure

3. Mobilizing finance

- International financial institutions are key to help secure funds with the help of international financial institutions.

4. Working together to deliver

- Opportunity to establish partnerships between governments, businesses and civil society and to finalise the Paris settlement to make the agreement fully operational.

- In addition to the formal negotiations, new initiatives and coalitions play a key role to drive climate action.

Source: United Nation

1. Securing Global Net Zero by 2050

The Glasgow Declaration on Zero Emission Cars and Vans

Over 100 public and private actors including the UK, Luxembourg, as well manufacturers Volvo, Daimler, GM, Ford, IKEA, Siemens and Uber have signed the Glasgow Declaration on Zero-Emissions Cars and Vans.

- Similar to the plan of the EU to phase out ICE vehicles by 2035 presented earlier this year, the Glasgow Declaration on Zero Emission Cars and Vans is promised to deliver more impact due to its global scope.

- A pledge to end the sale of internal combustion engine (ICE) vehicles in leading markets by 2035 in major markets and by 2040 worldwide.

- This has great potential for impact, as road transport is responsible for more than a quarter of all CO2 emissions in the EU and the US.

India sets net zero target for 2070

India, the world’s third largest emitter and where energy demand has doubled since 2000 (with 80% of demand still being met by oil, coal and solid biomass according to IEA) announced during the conference that it set net zero target for 2070.

- Interim target of providing 50% of the country’s energy needs from renewable means by 2030 an and to reduce total projected carbon emissions by one billion tonnes.

- This important commitment will require massive investment in green technologies for a country which will have to address major issues: conciliate economic growth, lift people of poverty and reach net zero commitments by 2070.

The Breakthrough Agenda: Acceleration and deployment of green technologies

More than 40 world leaders (including the UK, the US, India, China and the EU) have made a new commitment, the Breakthrough Agenda, aiming to accelerate the development and deployment of clean technologies needed in the fields of power, road transport, steel and hydrogen by 2030 to meet Paris agreement goals.

- It will stimulate investment in green technologies, to make them more affordable and accessible.

- According to the Agenda, these commitments could create 20 million new jobs globally while boosting the world’s economy by $16 trillion.

- The steel section of the breakthrough agenda brings together 30% of global steel producers, committing to make near-zero emission steel ‘the preferred choice in global markets’. This shift has the potential to open up new investment opportunities in a sector previously widely considered unsustainable.

- With official scenarios by the International Energy Association (IEA) relying on the use of technologies which are mostly existent but not yet fit for commercial use, accelerating the deployment of clean technologies is crucial to moving towards a Paris-aligned future. This especially holds true for industrial sectors such as steel, which are more difficult to transform.

The Global Methane Pledge

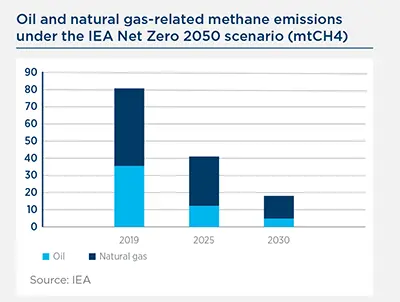

A major commitment announced by the US and the EU and followed by more 100 countries which agreed to cut methane emissions by 30% by 2030 (as compared with 2020 levels) as global methane emissions (coming from oil, gas, coal, agriculture and landfills) grow faster than any time in the past.

- The Global Methane Pledge covers countries which emit nearly half of all methane and make up 70% of global GDP.

- Roughly 30% of global warming since the industrial revolution is due to methane emissions, methane causing 80 times more global warming than CO2.

- A 30% cut in methane emissions could reduce projected warming by 0.2 degree Celsius according to European Union estimates.

|

|

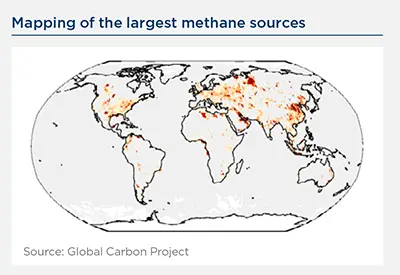

IMPLICATIONS FOR INVESTORS As the Pledge includes a commitment from signatory countries to take domestic actions “focusing on standards […] in the energy and waste sectors and seeking abatement of agricultural emissions through technology innovation as well as incentives and partnerships with farmers”, investors should expect a reinforcement of policies and regulations targeting methane abatement, generating both investment opportunities and risks. Restrictions to landfilling could create market opportunities for waste utilities able to offer advanced waste processing facilities as an alternative. Incentives to livestock farmers could also boost the market for feed additives which limit the amount methane released by cows for instance, creating further opportunities for chemicals companies already positioned on such solutions. This could also help food companies to find solutions to cut their scope 3 emissions related to such emissions in their supply chain. Of course, assessing such scope 3 emissions is a prerequisite. For the energy sector, momentum should build rapidly as the two founding countries are about to start passing some of the policies needed to deliver on this target: the EU is due to unveil a draft legislation of its Methane Strategy by the end of 2021, while a federal rule in the US could also impose tighter restrictions on controlling emissions from both new and old oil and gas wells. Although some methane mitigation measures have net negative abatement costs, stricter standards could nonetheless imply higher capital or operational expenditures for operators. In this context, investors should expect 1) a transparent reporting of methane emissions along with a view on the error margin due to the methodology employed, and 2) ambitious performance targets. We note that the methane footprint of the oil & gas sector should be cut by no less than 80% by 2030 according to the IEA Net Zero 2050 Roadmap, a figure much higher than the 30% headline cut of the Pledge. This is what should guide engagement with corporates to be consistent with global net zero efforts. Last but not least, we note that while shale oil & gas activities have been under the spotlight for their methane footprint, the issue is more general, with methane ‘hotspots’ spread across the globe (see chart below).

|

||||||

Transitioning from coal to clean power

More than 60 countries and companies made new commitments to phase out coal to clean power.

This is an important objective as fossil fuels dominate the global energy mix, adding up to around 80% of world energy consumption. After oil, coal is the second most consumed energy source, accounting for 27% of the global energy mix. Furthermore new coal development locks in future emissions, closing the window of opportunity to move onto a Paris-aligned transition pathway.

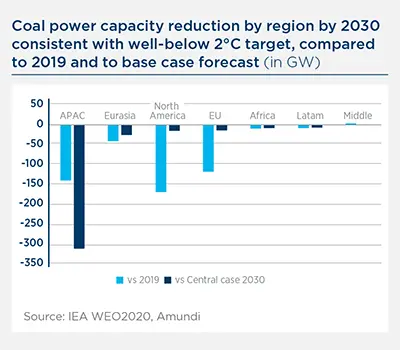

- Signatories agreed to ending all investments in new coal power generation domestically and internationally, as well as phasing out coal in the 2030s for developed and 2040s for emerging markets.

- This major commitment could shift $17.8bn annually out of fossil fuels and into the clean energy transition, as countries have agreed to phase out inefficient fossil fuel subsidies.

|

|

IMPLICATIONS FOR INVESTORS

1. Sustainable Development Scenario (SDS) |

||||

2. Adapting to Protect Communities and Natural Habitats

The Global Agenda on Transforming Agricultural Innovation

The Global Action Agenda on Transforming Agricultural Innovation has received the support from more than 160 actors including the World Bank, WWD, the World Food Program and the World Economic Forum.

- Aims at mobilizing finance for agricultural research and innovation to create more climate resilient practices and facilitate dialogue among food and climate actors worldwide.

The potential impact is significant, because agricultural pollution originates both from pesticides that contaminate the world’s air and water, and from fertilizers that in turn produce greenhouse gases. The agriculture, forestry, and land use sector is responsible for over 18% of the world’s greenhouse gas emissions.

Leading financial institutions commit to tackling deforestation

33 financial institutions with $8.7trn in assets under management agreed to phase out agricultural commodity-driven deforestation from their portfolios by 2025.

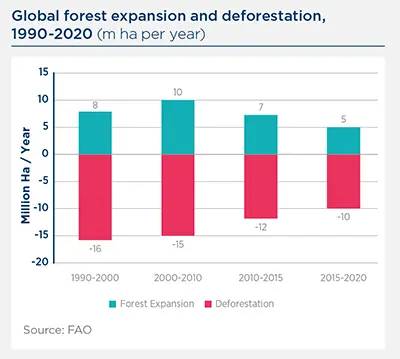

The Deforestation Pledge: Halt and reverse deforestation and land degradation by 2030

More than 100 world leaders accounting for more than 86% of the world’s forests have promised to end and reverse deforestation by 2030.

- Considered as a one of the major announcement of the COP26 as forests absorb nearly a third of CO2 emissions released from burning fossil fuels every year and that human activities have already cut down by half all earth’s forest

- More than a dozen countries and philanthropic donors pledged to provide $13.7bn of climate finance.

- Will support activities in developing countries including restoring degraded land, tackling wildfires and supporting the rights for indigenous communities.

- This pledge differs from the New York Declaration on Forests in 2014 as this time in Glasgow, Brazil and Russia which have the most extensive forest area have decided to join this commitment.

|

|

IMPLICATIONS FOR INVESTORS

2. Source: Global Carbon Budget - 3. Source: WRI |

||

3. Mobilizing finance

The Glasgow Financial Alliance for Net Zero

The Glasgow Financial Alliance for Net Zero (GFANZ) which amounts to $130 trillion in capital across 450 financial institutions in 45 countries announced that they committed to transforming the economy and achieving net zero (it was only $5trn at the beginning of the year according to Mark Carney, UN special envoy for climate action).

- The GFANZ announced that “these commitments, from over 450 firms across 45 countries, can deliver the estimated $100 trillion of finance needed for net zero over the next three decades”.

- GFANZ signatories commit to make TCFD disclosures which include climate stress-testing their own activities and to science-based transitions plans.

- In the GFANZ report, it has been mentioned that “ a key step in decarbonizing finance is to develop common industry standards and best practices on how to measure alignment with the Paris Objectives. At this stage, no consensus on which tools and metrics to use or how and when to apply them. However they are crucial for bringing a forward-looking view to a counterparty’s future emissions and its level of alignment to net zero”.

Mobilizing $7bn for climate related projects in Asia

The Asian Development Bank (ADB) launched the new ASEAN Green Recovery Platform.

- A catalytic $665 million fund pledged by the UK, Italy, EU and GCF that aims to mobilize $7 billion for low-carbon and climate-resilient infrastructure projects.

- ADB also launched an Energy Transition Mechanism which will use blended finance to retire existing coal plants.

Mobilizing climate finance for Asia is crucial, as the region remains one of the strongest proponents of coal, with just four Chinese regions accounting for nearly a quarter of all proposed coal mine capacity worldwide and almost three quarters of coal mining capacity currently under development.

Public climate finance for developing countries

After falling more than $20bn short of $100bn pledged during the COP25 in Copenhagen, this time at the COP26, developed countries committed to ambitious climate finance plans, further increasing their deployment of money to developing countries by 50% on average.

- Over the 2021-2027 period, the budget from European Commission to support climate action in developing countries will exceed EUR28 billion (around half of this amount will continue to serve climate adaptation objectives).

- The United States intends to further double by 2024 its annual public climate finance to developing countries to around USD 11.4 billion

4. Working together to deliver

The Clean Green Initiative: Infrastructure and technology for developing countries

The UK launched the ‘Clean Green Initiative’ to support the rollout of sustainable infrastructure and green technology in developing countries, in an effort to tackle climate change and accelerate economic growth.

Global disclosure standards for the financial markets.

The International Financial Reporting Standards Foundation, whose standards are used in 140 jurisdictions around the world (though not in the U.S. and China), announced the new International Sustainability Standards Board (ISSB) to develop globally consistent climate and broader sustainability disclosure standards for the financial markets.

Conclusion

“Mixed results”, “disappointing” and “failure” are some of the words used by by commentators to describe COP26. Climate COPs attract a lot of attention and generate lots of expectations. Maybe too much for a process that remains bottom-up - being the sum of individual country pledges - and where positive news are mostly front-loaded. Clearly, ambitions are not yet high enough and the clock is ticking to put the world on track with the 1.5°C temperature target. However, we still see a need to recognize the positive direction.

The glass half full: The ambition gap has further narrowed

The fact that the ambition gap has narrowed shows that the ratcheting up mechanism of the Paris Agreement works well. As shown in the chart below from the Climate Action Tracker, the period leading to COP26 shows a significant increase in countries’ decarbonisation pledges.

If achieved, these new targets could limit global warming to +1.8°C compared to +2.6°C back in 2020. Granted, the ambition gap remains high, but direction-wise the momentum is clearly positive. 140 countries have announced or consider a net zero target, covering 90% of global emissions compared to 70% six months ago.

This now notably includes India: the third largest emitting country representing 7% of global carbon emissions with a carbon neutrality target by 2070. Mexico and Vietnam are amongst the countries which have yet to set net zero targets.

The glass half empty: the policy gap has increased as the ambition gap narrowed

Countries now have to implement the actions and policies needed to achieve these targets and pledges, such as the EU Fit-for-55, or the US Build-back-Better package.

Investors should therefore keep a close eye on these policy packages that will shape markets more than pledges, and materialize investment risks and opportunities4.

A number of countries also have to clarify their net zero pledges (eg. scope, recourse to international carbon offsets and/or CO2 removals). This should provide investors with heightened visibility on the real level of ambition behind the headline reduction targets. A significant ambition gap remains as well and countries are requested by the Glasgow Climate Pact to revisit and strengthen their 2030 target by the end of 2022.

4. See our Thema publication dedicated to the EU Fit-for-55 legislative package