Summary

Key takeaways

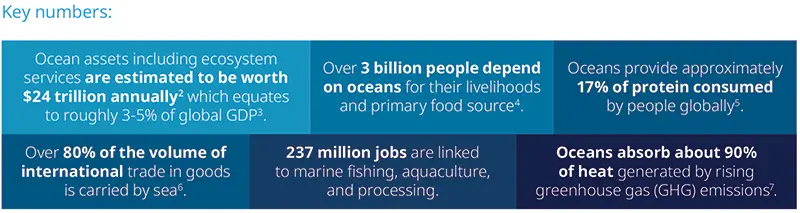

Despite the significant value that oceans provide to the global economy and society, the financial risks resulting from ocean degradation are overlooked.

A rising number of public and private actors are sounding the alarm over the need to act before irreversible consequences to economic stability and food security.

Actions from the private sector and investor community remain in their infancy. Out of the 67 companies engaged on material ocean risks by Amundi, only roughly half had some sort of acknowledgement of their links to oceans.

There are many actions that investors can already take to support ocean protection and foster ocean resilience towards ocean-linked nature risks.

Amundi ensures oceans are properly integrated into its investment processes notably through its inclusion in its biodiversity investment framework, Responsible Investment policy, controversy monitoring, and engagement strategy.

To better assess and incorporate ocean protection into corporate engagement and analysis, Amundi has developed a framework that maps ocean impacts per sector using internationally recognized frameworks and standards.

How can something so big be so forgotten?

It is hard to imagine that something covering 71% of the earth’s surface1 is often on the back burner of ESG materiality and management. However, this is the case when it comes to ocean protection.

Oceans are essential to our livelihood and economy

Oceans are in a rapid state of decline stemming from human activities

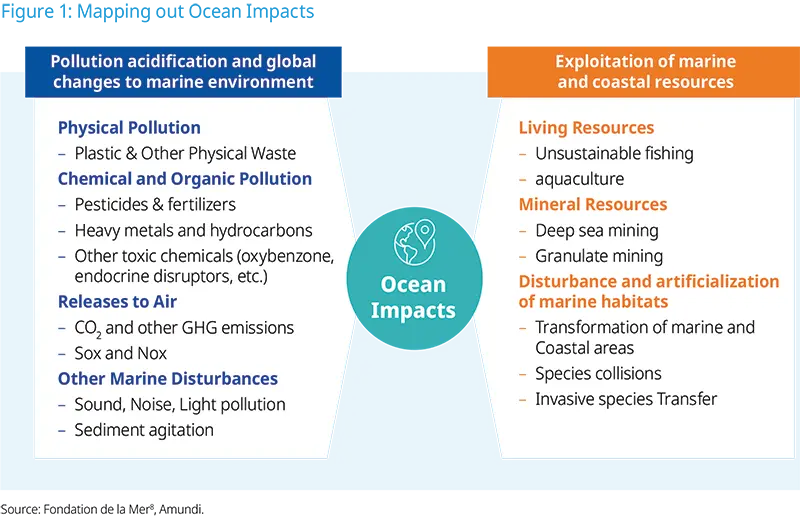

Ocean health is in a rapid state of decline because of human activities, and this will have a cost on the global economy (see Figure 1).

Declining ocean health is estimated to cost more than $4 billion annually and could reach $2 trillion annually by 2100.9 But conversely, ocean protection also presents real opportunities to address global challenges.

Solutions to mitigate Oceans are too few as of today

While international initiatives are taken, these do not seem to be sufficient. Thus, SDG 14 “Life Below Water” is shown to be the least funded10 SDG and is alarmingly off-track: there has been $10bn investment between 2015 and 2019 (vs. the $175bn expected per year) and 50% of its targets are showing regression11. Moreover, the aim to conserve 30% of coastal and marine areas by 2030 (30x30 target) will not be reached until 2107 based on the current rate,12 according to a report published ahead of COP 1613.

Most companies undervalue their impacts on oceans because they see them as indirect and prefer to focus on direct material issues. Amundi engaged with 67 companies on ocean protection in 2024, 20 of which were identified as Ocean100 Companies, the 100 transnational corporations extracting the majority of revenues from economic use of the world’s ocean. Of these companies under engagement, less than half demonstrated a strategy around oceans in their reporting. However, across all 67 companies evaluated, over half demonstrated some level of acknowledgement of their link to ocean impacts and over 80% already have actions in place to address key ocean impacts such as pollution.

At the investor level, the movement is slow and mostly at the guidelines development step, such as the Sustainable Blue Economy Finance Principles launched in 2019 by the UN Environmental Program14 and ICMA’s guidebooks for blue financing and blue bonds established in 2023.15-16 Investments also remain limited: blue bonds represent only 0.2% of overall sustainable bond issuance since 2019, the year that the first blue bond was issued17.

At Amundi, we consider that investing in oceans is an opportunity because:

A decline in ocean health will have a negative impact on economy;

All corporates have an impact on oceans through their products or processes and must mitigate their risks (for example, wastewater, fertilizers, plastics and other chemicals come from land-based activities via waterways and impact ocean’s health);

Oceans are key in fighting climate change as it is a carbon sink and ocean-based climate solutions could reduce the emissions gap by up to 35% in the 1.5°C pathway (estimated at 1-4 Gigatons per year in 2030).

As a result, Amundi has developed a dedicated approach to better consider oceans in its investment solutions and decisions.

Amundi Actions

Amundi’s approach aims to minimize oceans-related risks in portfolios by, on the one hand, reducing negative oceans impacts from companies and, on the other hand, investing in companies that are leaders on oceans-related matters.

Managing ocean impacts in our investment strategies through our responsible investment policy and bespoke investment framework

Oceans are part of Amundi’s bespoke biodiversity investment framework that consists in a 3-step approach: 1. Avoid, 2. Reduce and 3. Favor.

1. Avoid investing in companies with high negative impacts on biodiversity

Companies can be excluded from all Amundi actively managed funds if found to be in violation of the UN Global Compact18, and more specifically to the three environmental goals19 that include ocean impacts.

According to Amundi’s Biodiversity policy, companies linked with the following topics are under scrutiny and are reviewed regularly in order to ensure that biodiversity impacts – including oceans ones – are under control20:

Corporates involved in deep sea mining and/or exploration,

Corporates involved in controversial land and sea use,

Exposure to controversial pollutants including pesticide production, PFAS21, single use plastic production and single use plastic users,

Exposure to other controversial polluting activities such as severe spills or controversial disposal methods.

Last but not least, Amundi ESG analysts conduct a thorough controversies review multiples times a year, in order to analyze their severity and validity. Controversies with both direct and indirect impacts to oceans are considered, such as pollution or asset development. When considered very severe without any appropriate remediation, companies exposed to these controversies are excluded from portfolios.

2. Reducing Exposure to Ocean Harming Activities

Amundi’s ESG Analysts conduct assessments of companies’ most material topics and plan campaigns of engagement. This allows to confirm the ESG rating of the company and to influence companies in better taking into accounts topics that could impact their financial valuation.

Amundi began engaging on ocean protection in 2021 after identifying a distinct lack of consideration of ocean impacts in corporate ESG strategies despite the material risks. Starting with 9 companies in 2019, Amundi has grown the number of engagements on oceans to 67 companies in 2024. Amundi selects companies who are candidates for ocean engagement based on the following four factors:

Companies identified via the Ocean 100 as having the largest direct impact on oceans globally;

Companies in sectors with significant direct or indirect impacts on oceans and where the topic of oceans is material though often less prioritized than other ESG subjects22;

Companies with controversies that have either direct or indirect impacts on oceans;

Companies flagged in our Responsible Investment Policy due to ocean impacts such as exposure to deep sea mining exploration activities.

The specific aims of Amundi’s ocean engagements are as follows:

Increase company awareness on the financial materiality of ocean protection in terms of how they both impact oceans and depend on oceans;

Encourage ocean protection to be incorporated into nature-related polices and strategies;

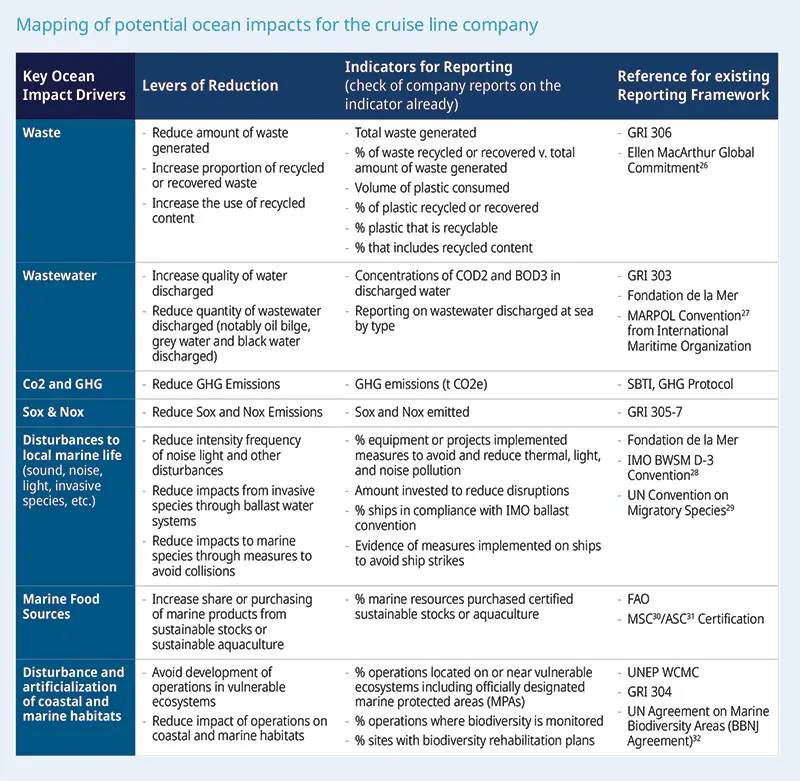

Identify key topics that drive ocean impacts23 and encourage increased reporting and action on these subjects (topics are identified via Amundi’s internal ocean framework);

Encourage improvements in performance on these activities that negatively impact ocean health through strong policies and practices;

Engage with blue bond issuers to ensure alignment to best market practices on ocean preservation and conservation.

Following the analysis and the engagement results, the ESG analyst can be led to override the ESG global score or relevant criteria if the ocean policy or the mitigation risks action plan are not considered serious enough. This will make investment more difficult, especially for funds with a high environmental perspective.

3. Favor: Driving Financial Flows Towards Ocean Protection

The Favor pillar in our investment framework helps to drive financial flows towards ocean protection by investing in issuers that are leaders on biodiversity- related matters. Eligible companies for the favor pillar are identified by screening for those that have more than 20% of their revenues linked to natural capital themes, or more than 80% of their revenues aligned to climate change solutions24.

On the credit side, green bonds that are financing biodiversity-positive projects are also considered under the Favor pillar. Several categories under the ICMA Green Bond Principles24 are considered eligible, having strong links to oceans including pollution prevention and control, and terrestrial and aquatic biodiversity conservation, among others.

The assessment and possible investment into blue bonds that come on the market are also included in Amundi’s overall GSSB26 strategy. In addition to blue bonds that come on the market, Amundi also engages on oceans with corporates who are considering issuing blue bonds to advise them on how to report on impact and ensure alignment with relevant principles such as ICMA.

In 2023, Amundi engaged with a European energy company that issued a blue bond targeting two main categories of projects: marine ecosystem restoration and sustainable shipping. Amundi encouraged this company to align with the ICMA’s Green Bond Principles and to develop a dedicated blue bond framework, in order to give more clarity to investors on the projects to be financed.

Engagement Case Study: Ocean100 Cruise Company with direct impacts on oceans flagged in the Amundi Biodiversity & Ecosystem Services Policy for Controversies |

This large US based cruise line company was flagged in our natural capital policy under controversial pollution because of serious controversies due to illegal dumping of contaminated wastewater on multiple cruise ships since the early 2000s. |

Based on the company’s impacts on oceans and its current performance, we came up with the following recommendations:

In addition to the above, the company demonstrated gaps in reporting on nature overall including assess and report on their impacts, dependencies, risks, and opportunities linked to nature for both land and ocean linked activities. Since 2022, the company has made some improvements, notably on waste and pollution by strengthening its policies and controls, investing in enhanced infrastructure, and reducing the quantity and increase quality of discharged water. If the company is now relatively strong on reporting emissions & waste, it remains hesitant to set quantitative reduction targets (notably on air pollution and plastic), preferring to reduce through project based goals such as investment into ship upgrades. We keep encouraging them to set up concrete targets as it is proof for stakeholders of their ambition and make it possible to compare them with peers. On oceans strategy and nature overall, the company reports very little but we have noticed a positive evolution in their efforts. The company has been working to identify environmentally sensitive regions in operations such as migration paths and nesting areas. This information is being consolidated into a single platform to support group efforts to mitigate potential impacts across operations and collaborate with external stakeholders such as conservation groups. We were impressed with these developments but encouraged the company to go further by developing a formal and public strategy/approach to nature that examines impacts, dependencies, risks and opportunities in line with internationally standards like TNFD. We cited the clear financial risks for investors and the need for this information. So far, we consider that we have had a good engagement with the company that allowed it to make progress. We will continue to follow up with the company on an annual basis to track improvements and reiterate our expectations. |

Conclusion

There is no doubt that oceans play a critical role in the stability of the earth’s ecosystem and that the current pace to manage these risks is far from sufficient. Their very unique nature adds an additional layer of complexity to manage ocean risks. The challenges to measure and manage land-based nature impacts are complex enough, making ocean protection seem like an even more distant goal.

However, this isn’t the only way to view it. Reporting standards and processes to manage ocean impacts, whether direct or indirect, already do exist. There is work that can be done now such as through the incorporation of ocean elements into nature strategies, Responsible Investment policies, and certainly through engagement. The expansion of financial instruments, such as blue bonds, as well as of guidelines around them will be a key driver of blue economy financing, and can provide investors with a diversity of investment opportunities to finance ocean preservation.

By starting these conversations now on the areas we can address, we are moving forward on ocean protection.

Sources and References

- https://education.nationalgeographic.org/resource/ocean/

- https://www.worldwildlife.org/pages/blue-finance#:~:text=The%20ocean%20or%20%22blue%22%20economy,US%242.5%20trillion%20a%20year.

- https://initiatives.weforum.org/ocean-action-agenda/home https://initiatives.weforum.org/ocean-action-agenda/home

- https://www.oceano.org/en/resources/1-a-healthy-ocean-for-a-healthy-die… https://initiatives.weforum.org/ocean-action-agenda/home

- https://www.un.org/en/climatechange/science/climate-issues/ocean-impacts

- https://www.fondationdelamer.org/wp-content/uploads/2023/12/Referentiel…

- https://oceanpanel.org/the-oceans-importance/ https://impact-investor.com/un-ocean-conference-sdg-14-still-most-underfunded/

- https://www.un.org/en/desa/world-oceans-day-call-action-save-our-ocean

- https://oceanpanel.org/the-oceans-importance/

- https://impact-investor.com/un-ocean-conference-sdg-14-still-most-underfunded/

- https://www.un.org/en/desa/world-oceans-day-call-action-save-our-ocean

- https://www.greenpeace.org/static/planet4-international-stateless/2024/10/b53a2f62-from-commitment-to-action-achieving- the-30x30-target-through-the-global-ocean-treaty.pdf?_gl=1*1ybktme*_up*MQ..*_ga*MjA5MDgyODk5OS4xNzM0OTY1ODk0*_ ga_94MRTN8HG4*MTczNDk2NTg5My4xLjAuMTczNDk2NTg5My4wLjAuMTgzNzA4MDcxNQ..*_ga_0CCB1GTVV6*MTczNDk2NTg5My4xLjAuMTczNDk2NTg5My4wLjAuMA..*_ga_99CSX66YC1*MTczNDk2NTg5My4xLjAuMTczNDk2NTg5My4wLjAuMA.https://for-the-ocean.org/wp-content/uploads/2024/10/Together-for-the-Ocean-Report-Exec-Summary.pdf

- Kunming Montreal Global Biodiversity Framework - https://www.cbd.int/gbf

- https://www.unepfi.org/publications/turning-the-tide/

- https://www.icmagroup.org/assets/documents/Sustainable-finance/Learning-resources/IFC-Blue-Finance-Guidance-Document_January-2022-270122. pdf

- https://www.icmagroup.org/assets/documents/Sustainable-finance/Bonds-to-Finance-the-Sustainable-Blue-Economy-a-Practitioners-Guide- September-2023.pdf

- https://www.spglobal.com/_assets/documents/ratings/research/101593071.pdf

- See our Global Responsible Investment Policy for more details: https://www.amundi.com/institutional/responsible-investment-policies-reports

- Principle 7: Businesses should support a precautionary approach to environmental challenges; Principle 8: undertake initiatives to promote greater environmental responsibility; and Principle 9: encourage the development and diffusion of environmentally friendly technologies.

- Please see our Global Responsible Investment Policy for the full list of categories in the Natural Capital and Ecosystem Conversion Policy.

- Per- and polyfluoroalkyl substances (PFAS) are a large class of thousands of synthetic chemicals that are used throughout society.

- Such as hotels, waste management, chemicals, fashion, and mining

- Including physical pollution, chemical pollution, atmospheric emissions, other ocean disturbances (such as light and sound), and over exploitation of marine resources

- According to MSCI Environmental Impact Revenues categories

- The Green Bond Principles (GBP) seek to support issuers in financing environmentally sound and sustainable projects that foster a net-zero emissions economy and protect the environment.

- Green, Social, Sustainability Bonds.

- https://www.ellenmacarthurfoundation.org/global-commitment-2024/overview

- https://www.imo.org/en/about/Conventions/Pages/International-Convention…

- https://www.imo.org/en/OurWork/Environment/Pages/BWMConventionandGuidel…

- https://www.un.org/depts/los//general_assembly/contributions_2020/CMS.p…

- https://www.msc.org/what-we-are-doing/our-approach/what-does-the-blue-msc-label-mean

- https://www.nsf.org/food-beverage/food-agriculture-aquaculture-fisherie…

- https://www.un.org/bbnjagreement/en