Summary

Key takeaways

- India is currently experiencing an era of unparalleled growth, marked by significant shifts in various domains. As the most populous nation on Earth, the energy transition stands out as particularly noteworthy, due to its extensive scale and profound impact on India’s economy and environment.

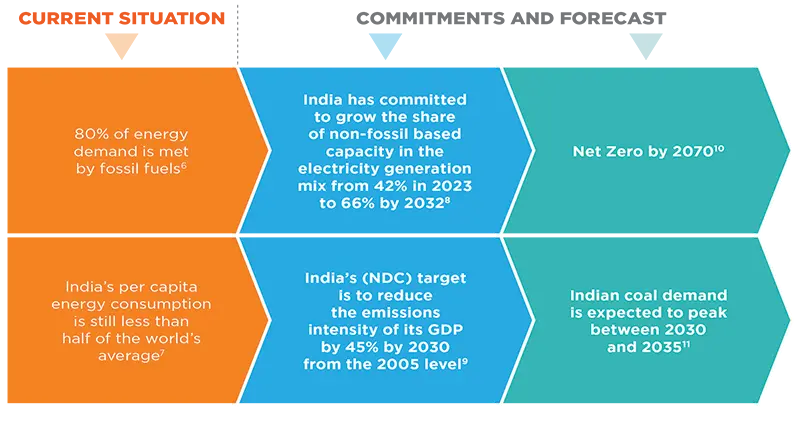

- As of today, India is the third largest CO2 emitter in the world, with an economy still heavily reliant on fossil fuels, especially coal, and a rapidly growing energy demand. Despite this, the Asian giant has committed to reach Net Zero emissions by 2070 and implemented plans to scale up renewable energy capacity and to direct investments towards the green sectors.

- To foster global investors’ support of the transition, the Securities and Exchange Board of India (SEBI) has updated the regulatory regime on ESG investing, imposing higher disclosure standards and more transparency on India’s largest companies. Moreover, the newly implemented green bond framework lays the foundation for a robust Indian green bond market, which stands today as the second largest among emerging markets.

- A key aspect of India’s transition to a sustainable economy is also the necessity to follow a just transition path. This means enabling the inclusion and participation of all social classes in the transition process through reskilling initiatives, women empowerment and social and workplace protection.

- Finally, we explore the challenges that India encounters on its paths towards Net Zero. Despite the country’s efforts in investing dually in the production and deployment of green technologies, coal is still a key component of its energy mix and won’t be phased out easily, especially considering the swift pace at which people are emerging out of poverty and the resulting rise in energy demand.

- To overcome these challenges, global asset owners should increasingly work alongside public actors – such as governmental agencies and development finance institutions – to scale the funding of Indian sustainable energy infrastructure, notably by providing access to cheaper sources of capital and thereby help India reach its ambitious environmental and social sustainability goals.

Introduction - India’s energy transition: progress, challenges and commitments

India is currently experiencing an era of unparalleled growth, marked by significant shifts in various domains. These include the transition from physical currency to digital payments, a move from traditional fuels to renewable energy sources, a shift from an

informal to a more formal economy, and a transition from underserved communities to ensuring inclusion even at the last mile. These landmark changes are shaping a new landscape of development. Among these transformations, the energy transition stands out as particularly noteworthy, due to its extensive scale and profound impact on India's economy and environment.

At this juncture, the world's most populous country faces a unique trilemma of energy security, affordability, and environmental sustainability. As the fifth-largest economy1 and third-largest emitter of CO22, the nation's energy decisions have global implications. In response to this challenge, India has implemented various policy measures and set ambitious targets for the future. India’s energy transition will be a factor of its robust economic growth, with a fast-expanding middle class and rapid urbanization. The nation is the third-largest country globally per primary energy consumption, standing behind the US and China as of 20223. Total primary energy demand more than doubled from 2000 to 2020, surging to 937 million tons of oil equivalent (Mtoe) from 417 Mtoe. Still, India’s energy consumption per capita is less than 1/10th of the United States’4. The nation's energy transition is a crucial factor in determining global energy market dynamics and achieving international targets in terms of greenhouse gas (GHG) emissions reduction.

Recognising this challenge, in 2016, India officially endorsed the Paris Agreement with the objective of containing global temperature increases to well below 2°C compared to pre-industrial levels. Subsequently, in 2021, the country significantly bolstered its commitments announcing the five targets to be achieved by the year 2030, including reaching 50% of its energy requirements from renewable energy and be net-zero by 20705. Despite these commitments, India’s path to net zero is still not in line with the objectives set out by international agencies and more efforts will be needed to reach targets necessary to limit global warming.

Still, in pursuit of Paris Agreement objectives, India has implemented targeted policies. These include initiatives to ensure widespread access to electricity, raise the proportion of natural gas in the overall energy mix to 15%, provide subsidies for the sale of electric vehicles, and promote the production of green hydrogen through the National Hydrogen Mission.

Key figures of India’s Energy Transition

Rising power demand and levers of the energy transition

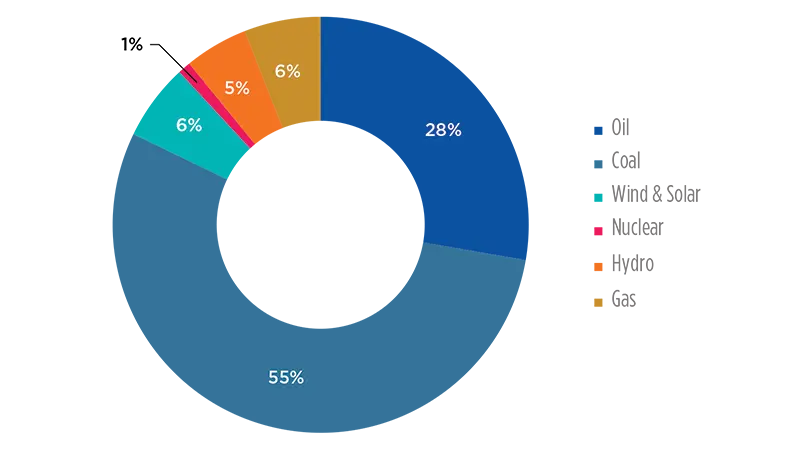

The primary energy mix is currently dominated by coal and oil, contributing ~55% and ~28% respectively in 2022. Modern renewables contribute only ~11% of overall primary energy demand in the present scenario12.

Additionally, the total primary energy demand has grown at ~4% (CAGR) in the last two decades. The industry, transport and building sectors witnessed the highest incremental primary energy demand in the last two decades. Coal is the mainstay for power generation and industrial energy use13.

Primary Energy Mix (2022)

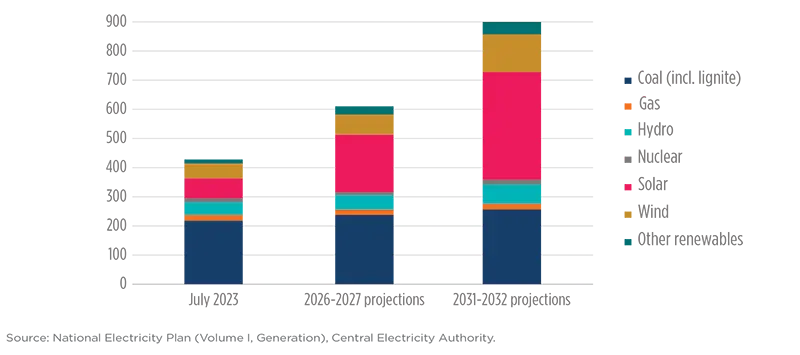

Nonetheless, the National Electricity Plan of India predicts that the share of non-fossil based capacity in the electricity generation14 mix is set to grow from 42% to 66% by 2031–32, with solar and wind energy leading the way15.

Electricity generation capacity by source

India had also achieved emissions intensity reduction of 28% over 2005 levels and is set to exceed its NDC commitments well before 2030. However, considering India aims to achieve its economic expansion by increasing its industrial output, such growth will be challenging without a massive increase in carbon emissions, especially considering its fossil-fuel dominated energy system. Hence, despite a positive start towards net zero, following the commitments will entail redesigning the economy as a whole, and directing large investments in green technologies and infrastructures16.

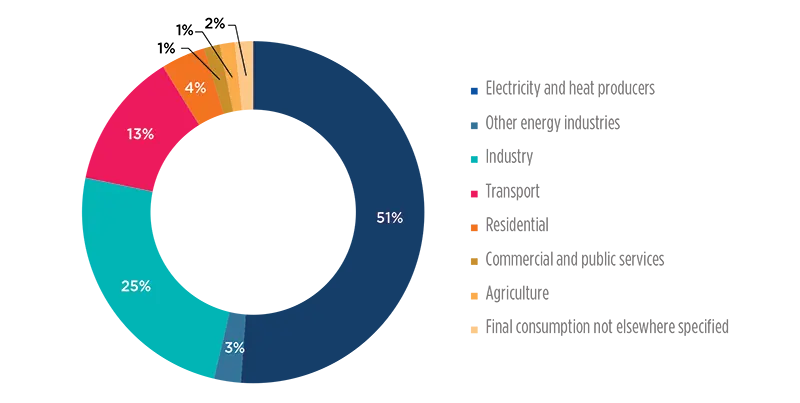

Considering the country’s rapid GDP per capita growth and electrification efforts, more than half of CO2 emissions derive from electricity and heat production and other energy industries, which often employ fossil fuels and especially coal. Industry and transport follow suit, representing respectively 25% and 13% of total carbon emissions17 (see Figure below).

CO2 emissions per sector

India has experienced the swiftest growth rate in the addition of renewable energy capacity among the world's major economies over the past seven years. Still, to meet its targets, the country must significantly scale up the addition of renewable capacity. As renewables' share in electricity generation is set to rapidly increase, new operational challenges will emerge due to the variable and intermittent nature of renewable sources, relying on factors such as sunlight and wind. Enhancing the flexibility of generation sources and implementing large-scale energy storage capacities are critical to ensuring grid stability, maximizing renewable energy capacity utilization, and meeting demand reliably. Along with these, efficient power system management, prioritizing the security and stability of the grid, integrated resource planning with a higher proportion of renewables are also crucial pursuits.

Securing energy independence

India’s economy will average 6.8% per annum GDP growth from 2024 to 203118, and its increasing energy demand will have a sustained global impact. However, limited domestic supplies mean that India is heavily dependent on imports for access to oil and gas. In this context, ensuring secure and affordable energy supply is of the highest priority for the government.

There are several opportunities to reduce import dependence which will also lead to reduce emissions and increase affordable access to energy. The best way would be to increase the efficiency of existing resources and continue adding non-conventional renewable sources to the energy mix19:

Solar photovoltaic (“PV”) installations have grown 12-fold in India since 201518, while wind power capacity has doubled. Further accelerating deployment of renewables will be critical in achieving the government’s target of increasing installed renewables capacity to 500 GW by 2030. This will help meet growing electricity demand while keeping prices affordable and cutting emissions. It will also reduce the impact of gas price volatility on power generation and support the retirement of old and inefficient coal power plants.

The government launched the National Green Hydrogen Mission in early 2023 with the goal of producing 5 million metric tons of hydrogen fuel annually by 2030. This will help reduce fossil-fuel imports and turn India into a leading producer and exporter of green hydrogen. The government plans to export 70% of output overseas. Domestically, hydrogen can be utilized for long-duration storage of renewable energy, as well as replacing fossil fuels in industry and heavy-duty transportation. It can also help to decarbonize India’s steel sector and make a significant impact in reducing emissions.

Near Term Challenges

Despite significant achievements in addressing energy poverty and increasing the share of clean energy in its economy, India faces formidable challenges in achieving its enhanced energy transition ambitions. Estimates suggest that annual investments ranging from US$160 billion to US$200 billion will be required, approximately 5% of the current GDP, to meet the set targets. Despite increased budgetary allocations and efforts to establish a green bonds market, substantial policy actions are needed to attract private, especially international, capital. Moreover, the complex geopolitical environment, stemming from the conflict between Russia and Ukraine and supply disruptions from China, necessitates India to bolster its domestic manufacturing capabilities for green infrastructure.

Although India is moving in this direction at a fast pace by investing dually in the renewable energy manufacturing industry and in the deployment on national territory of renewable technologies, coal is still a key component in the Indian energy mix, and it won’t be phased out easily. The significance of coal for the Indian subcontinent stems from the need to meet the rising energy demand of its burgeoning population, and from the importance that the coal value chain represents for the national economy, as it directly or indirectly employs an estimated 3.6 million people20. Therefore, the Indian government refusal to participate to a JETPs initiative – which would require a strong commitment to start the phase out of coalfired power plants – comes with little surprise. As a matter of fact, Indian coal demand is expected to peak between 2030 and 2035, a deadline which reduces hope for a prompt transition to Net Zero.

The need for a Just Transition

Moreover, the importance of a just transition cannot be understated in India. The Just Transition Declaration, established at the UN Climate Change Conference in Glasgow (COP26), underscores the imperative of ensuring that no one is left behind during the shift to Net Zero economies. This is particularly crucial for individuals employed in sectors, cities, and regions heavily reliant on carbon-intensive industries and production. It is forecasted that approximately 43 million people21 could find employment in the renewable energy sector globally by the year 2050, and India in no exception.

However, global studies also indicate potential job losses in certain sectors due to the adoption of renewable energy. Localized examples, such as the solar photovoltaic (PV) park in Rewa, Madhya Pradesh, illustrate this point. In comparison to large coal-fired power plants that typically support hundreds of employees, contractors, and businesses along the supply chain, a solar park like Rewa employs only a handful of full-time workers for its operation.

Additionally, the absence of property rights in some of these territories has resulted in many farmers losing their lands without any compensation from the state or the firms involved. Land acquisition, often motivated by the implementation of solar photovoltaic parks, intersects with already existing social and cultural inequalities, with women, socioeconomically disadvantaged groups, and unskilled workers facing greater challenges in securing new employment.

Moreover, the focus on job creation must not only be on quantity, but also on quality, in terms of living wage, inclusion, and decent working conditions, standards that have been often overlooked in the Sub-Asian region. To address these concerns, both the Indian government and private companies are working to turn this transition into an opportunity to combat energy poverty in those rural areas. The aim is to provide reliable electricity to communities that have long ben underserved, marking a significant step forward in addressing issues of energy access in India.

A key role in a fair transition is also played by public financial institutions such as the Asian Development Bank, the Asian Infrastructure Investment Bank and the New Development Bank. The European Union, the United Kingdom and the United States are also key partners and have already taken stance to provide funds and incentives, such as the EU-India Clean Energy and Climate Partnership which promotes access to and dissemination of clean energy and climate-friendly technologies and encourages research and the development of innovative solutions. The U.S.-India Strategic Clean Energy Partnership focuses on government, industry, and other stakeholder efforts to advance energy security, clean energy innovation, and decarbonization efforts to support the energy transition while ensuring clean energy access. Last but not least, a growing number of private financial institutions (more than 500 international commercial banks participating to the Glasgow Financial Alliance for Net-Zero) are also committing to ensure their net zero efforts are delivered through a just transition.

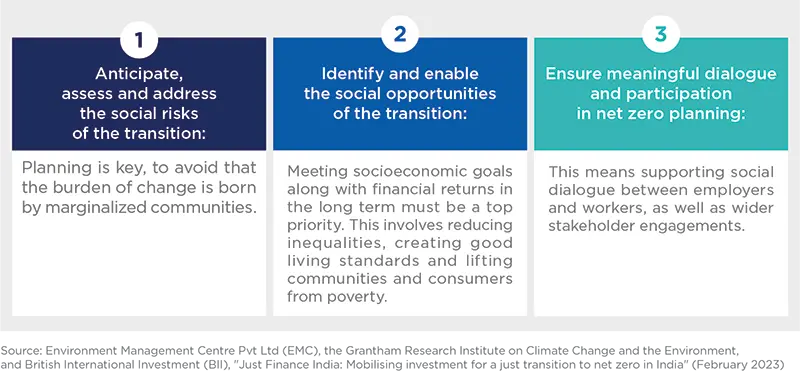

How can financial institutions operating in India turn the just transition principles into operational practice? There are 3 main priority actions that need to be achieved at every level of the value chain:

Workers, suppliers, communities and consumers should all be involved in the process, enabling a broad transformation that lifts everyone at the same time. A critical point will be represented by societal obstacles, like gender inequality, but it is imperative to ensure that each social class is not left behind, through reskilling initiatives, workforce planning and social and workplace protection.

Government support to finance the energy transition

The shift towards clean energy presents a substantial economic opportunity, and India is uniquely positioned to emerge as a global leader in the fields of batteries for energy storage and green hydrogen. The potential market for such low-carbon technologies in India is projected to reach up to US$80 billion by 2030. International support is crucial to assist India in steering its development towards a low-carbon trajectory. To achieve the goal of net-zero emissions by 2070, the International Energy Agency (IEA) estimates an annual investment requirement of US$160-200 billion, three times the current levels, across India's energy sector until 2030. Therefore, securing access to low-rate longterm capital is essential for realizing the Net Zero objective22.

India has implemented various economic measures to accelerate the pace of decarbonization. In an effort to address financing gaps, a green bond framework was introduced in November 2022, laying the foundation for a robust green bond market. Subsequently, India successfully issued its inaugural pair of sovereign green bonds (US$2 billion issuance) in January 2023. The decision to denominate these bonds in Indian rupees aims to minimize asset-liability currency mismatches and stimulate growth in the domestic sustainability-focused capital markets. The use of proceeds have been earmarked for expenditures in grid scale solar and wind, decentralized solar such as solar water pumps for agriculture, green hydrogen, metro lines and afforestation. This green bond issuance by the public sector is key, as it can serve as a model for corporate issuers to replicate.

Furthermore, the 2023-24 Union Budget reflects a heightened commitment to India's climate mitigation goals, with increased allocations towards green infrastructure. Compared to the previous year, the budget allocated nearly 50% more for renewable energy and saw a 42% rise in nuclear energy funding. The budget speech also signalled subsidies for electricity storage projects. This augmented financial commitment is particularly significant given the threefold increase in annual capacity additions required for non-fossil electricity sources. In line with the anticipated growth of India's electric vehicle (EV) market, projected at 49% per year between 2022 and 2030, the budgetary allocation for the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme was doubled to support this rapid expansion23.

In a pivotal move, the Ministry of Power issued a long-awaited notification on the Carbon Credit Trading Scheme (CCTS) in June 2023. Once operational, this formalized carbon credit trading market is expected to contribute to India's energy transition by providing incentives to reduce industrial emissions. The success of India's CCTS, however, depends on the establishment of clear targets for relevant carbon-emitting industries and on the pricing strategy for carbon certificates issued under this scheme.

The role of global investors in India’s energy transition

In 2020, a significant fall in interest rates coupled with government intervention to foster the development of certain key sectors resulted in a notable rise in investments in India, especially in the infrastructure, energy and technology sectors. Government initiatives like the National Green Hydrogen Mission and the Digital India Initiative present significant opportunities for international investors. The former aims to position India as a global leader in green hydrogen production and export, while the Digital India Initiative focuses on enhancing digital infrastructure and promoting electronic manufacturing.

In response to these policies and government commitment over the transition, Mergers and Acquisitions activity by multinational corporations has surged in recent years, demonstrating increasing interest both by international and domestic players. Moreover, regulatory innovations have allowed global private equity funds to invest in India through structures such as Alternative Investment Funds (AIFs), which have been growing rapidly and are expected to do so for the rest of the decade, and Infrastructure Investment Funds (InvITs). The latter are particularly attractive due to their predictable cash flows, and have received increased interest by sophisticated global infrastructure financial institutions including the Canada Pension Plan Investment Board and the Ontario Teachers' Pension Plan. Both structures have become popular thanks to the Securities and Exchange Board of India’s proactiveness in updating the regulatory regime, contributing to creating an investor-friendly regime that encourages foreign credit investments into India24.

Further evidence of the opening of the Indian economy to foreign capital is represented by the establishment of the Gujarat International Finance Tec-City (GIFT City), India’s first international financial services hub that benefits financial institutions and corporates that relocates in the jurisdiction by offering a favorable tax regime, a flexible regulatory framework, and a simplified registration regime for the setting up of new funds. GIFT City's attractiveness has been demonstrated by the Abu Dhabi Investment Authority's recent decision to establish a billion-dollar base there.

Considering both public and private sector issuances, India is today the second largest Asian emerging market for green bonds, with issuances representing the equivalent of US$25 billion as of December 202325. Additionally, the Indian rupee represents the second-largest slice of non-Chinese emerging market green bond issuance with a share of 13%, and second only to Brazil. The private sector is responsible for 84% of total issuance, with the utilities sector representing the largest destination of the proceeds raised from the green bonds.

Undoubtedly, change in India is foreseen in the near future as the country develops standardized and verified processes for their ESG investments in the next 5 years. This is likely to encourage asset managers to consider investing in India’s energy transition. However, this hinges on India’s capacity to overcome key challenges such as greenwashing concerns and the ability to attract and direct capital towards green technologies. Moreover, a critical challenge needs to be addressed: the still relatively low degree of commitment by the government to phase-out of coal, which accounts today for the highest portion of emissions.

An evolving ESG regulatory and policy landscape

In response to global investor demand, mainly by pension funds and insurance companies, India has set up a plan for ESG investments through its regulatory frameworks, such as the Business Responsibility and Sustainability Report (BRSR). The new regulation, which has come into effect in 2023, requires India’s top 1000 companies by market cap, to provide quantitative metrics on sustainability-related factors. It encompasses areas such as the disclosures of basic company information, evidence of adhering to policies and statements made by the company, and performance disclosures of operational impact on environmental and social metrics.

The Asian giant seeks, through BRSR and its capital allocations, to bring “sunrise” industries like semiconductors and renewable energies to India, and to increase investor confidence through transparency. Export of solar panels to the US have increased significantly in the past couple years due to the need of Western countries to diversify supply chains away from China, which currently dominates the solar panels market. The trend is expected to continue in the following years, as India reinforces its current role of mediator between the East and the West. In addition, India has allowed its public pension fund to make investments in sovereign green bonds, thus further incentivizing greater flows to green bonds amongst public investors.

Amongst other efforts to promote ESG investing, the Indian government launched a Production-Linked Incentive (PLI) Scheme that aims to build an ecosystem for manufacturing of high efficiency solar PV modules in India and thus reduce import dependence in the area of Renewable Energy. The scheme will provide incentives to selected manufacturers based on the production and sale of high efficiency solar PV modules, and will last 5 years post commissioning.

Nonetheless, there seems to be a long way to go for ESG to truly be integrated within organizations’ strategies and practices. According to a survey carried out by Deloitte on the ESG preparedness of Indian corporations and government-owned enterprises, only 7% of organizations indicate having a robust readiness for ESG requirements, while a mere 27% feel confident about their preparedness to meet ESG requirements26. This result comes from two main challenges: 65% of businesses are encountering obstacles with the constant evolution of ESG regulation and 62% are highlighting the complexity of the models. Nonetheless, India’s perspective on ESG is improving, as 68% of respondents have made significant progress by integrating ESG strategies into their operations.

Conclusion

The global energy transition cannot be achieved without a sustained effort to reach Net Zero from the world’s most populous country. The Indian government has proved commitment to fighting climate change, creating incentives to boost domestic production of renewable energy technologies and sustaining their deployment on Indian soil. Thankfully, India’s topography, geographical location, and weather conditions provide fertile ground for the utilization of renewable technologies. Moreover, India can leverage on its burgeoning and relatively young population to become a world leader in the energy sector, by enhancing at the same time domestic production and innovation to develop clean energy solutions on a larger scale.

However, the transition to a sustainable economy surely comes with its challenges: considering the swift pace at which the population is emerging out of poverty, energy demand is rapidly growing, at times encouraging the government to prioritize energy security and affordability over environmental sustainability. Coal mines and coal-fired power plants represent a crucial energy source, and coal remains a fundamental sector for India’s economy and society, providing employment opportunities and economic value. As a result, a key aspect of the transition must be the inclusion of all social classes in the transition process through reskilling initiatives, workforce planning and social and workplace protection. This would ensure that the transition leaves no one behind and promotes, among other objectives, gender equality and social mobility.

Nonetheless, India’s efforts and ambition to reach carbon neutrality have spurred international investors to take part in the country’s transition process. Global investors are notably contributing to the growth of India’s green bond market, which currently represents the second largest emerging market in Asia for green bond issuance. The Security and Exchange Board of India has also contributed to attracting more international investors by enacting more stringent laws regarding ESG disclosures standards.

Going forward, global asset owners should increasingly work alongside public actors – such as governmental agencies and development finance institutions – to scale the funding of Indian sustainable energy infrastructure, notably by providing access to cheaper sources of capital and thereby help India reach its ambitious environmental and social sustainability goals.

Sources

1. IMF, 2024: https://www.imf.org/external/datamapper/NGDPD@WEO/OEMDC/ADVEC/WEOWORLD

2. The World in Data, 2022: https://ourworldindata.org/co2-emissions

3. The World in Data, 2022: https://ourworldindata.org/energy-production-consumption

4. https://www.spglobal.com/en/research-insights/special-reports/look-forward/india-s-energy-transition-more-energy-fewer emissions

5. https://pib.gov.in/PressReleasePage.aspx?PRID=1795071

6. https://teriin.org/sites/default/files/2024-02/Power_Sector_2050_Report.pdf

7. https://www.iea.org/reports/india-energy-outlook-2021

8. https://pib.gov.in/PressReleasePage.aspx?PRID=1928750

9. https://climatepromise.undp.org/what-we-do/where-we-work/india

10. Government of India: https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1961797

11. Government of India: https://pib.gov.in/Pressreleaseshare.aspx?PRID=188538

12. The World in Data, 2022: https://ourworldindata.org/energy/country/india

13. https://assets.ey.com/content/dam/ey-sites/ey-com/en_in/news/2022/06/ey-accelerating-indias-clean-energy.pdf?download

14. It is important to note the difference between electricity generation and total energy mix: https://ourworldindata.org/electricity-mix

15. https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1928750

16. https://energy.economictimes.indiatimes.com/news/renewable/three-challenges-india-must-overcome-for-a-successful-energytransition/103231679?utm_source=copy&utm_medium=pshare

17. https://www.iea.org/countries/india/emissions

18. Business Standard, 2024: https://mybs.in/2dUFiWn

19. https://www.spglobal.com/en/research-insights/special-reports/look-forward/india-s-energy-transition-more-energy-fewer-emissions

20. https://www.germanwatch.org/en/89600

21. IRENA, 2021: https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2021/Oct/IRENA_RE_Jobs_2021.pdf?rev=98960349dbab4af78777bc49f155d094

22. https://www.iea.org/commentaries/india-s-clean-energy-transition-is-rapidly-underway-benefiting-the-entire-world

23. https://www.icicidirect.com/research/equity/finace/what-is-driving-the-ev-adoption-in-india#:~:text=In%20India%2C%20the%20EV%20registration,of%20annual%20sales%20by%202030.

24. https://www.whitecase.com/insight-our-thinking/investing-india-cross-border-investment

25. https://www.ifc.org/content/dam/ifc/doc/2024/emerging-market-green-bonds-2023.pdf

26. Less than a third of Indian businesses confident of ESG preparedness. https://www2.deloitte.com/in/en/pages/about-deloitte/articles/ESG-preparedness-survey-report-press-release.html#

A special thank you to:

- Nicole Jimenez Molina,

- Marco Davoli,

- and Charlotte Pace

for their contribution.