Summary

Key Findings

- The need to mobilize capital to fast track the transition to a more equitable, carbon neutral, economy has never been so acute, and the EU Sustainable Finance Action Plan (the “Action Plan”), launched as part of the European Green Deal, has never been more timely and relevant, notably in the light of the recently launched RePowerEU.

- The Action Plan will probably have long-lasting impact on EU capital market and play a critical role in supporting the development of more sustainable capital markets. But to fully apprehend the magnitude of the impact of the Action Plan, one cannot simply look at its different component as standalone legislation independent from one another. The key building blocks are all interconnected, and one needs to analyze each and every pillar to come to grasp with the ambition of the Action Plan.

- The implementation of the Action Plan raises numerous challenges for investors that are proportionate to the level of ambition set by the regulators:

- First, a structural and operational challenge, linked to the legislation’s complexity, granularity and level of prescriptiveness;

- Second, specific challenges linked to inconsistencies in regulations’ implementations timelines;

- Last, an interpretation challenge, which is today a source of great uncertainty in the market.

- Other challenges have been identified, notably basing the transition pathways of economic actors fully on the dominant interpretation and application of some key regulatory definitions (such as “Sustainable Investment”).

- Nevertheless, the implementation of the Action Plan has already had some positive impact on the development of sustainable finance, with financial market participants upgrading their policies and transparency standards to comply with the rules. At Amundi, we expect to see a positive impact in the medium and long run, even more so if the challenges mentioned above are addressed.

- Sustainable finance is evolving from a niche to a standardized and regulated environment. At a time of elevated scrutiny on ESG and sustainable finance practices, the EU Sustainable Finance Action Plan should act as a beacon, furthering increased transparency and upgraded standards.

Introduction

Countries and corporates’ carbon reduction plans are still falling short of the 1.5°C target in order to align with the Paris Agreement. According to the Climate Policy Initiative, an additional $1.6 to $3.8 trillion per year is required to finance the energy transition. The Covid-19 pandemic has exacerbated socioeconomic inequalities, particularly in emerging markets, dampening the development of a just transition. The war in Ukraine has generated a series of crises, the full scope of which cannot be fully apprehended as the conflict is still unravelling. It will continue to have a negative impact on the populations of Europe and the rest of the world, not only in terms of energy use but also in terms of the socioeconomic standards of households.

Sustainable finance has a key role to play in delivering on the international policy objectives such as the European Green Deal, the SDGs, and the 2015 Paris Agreement. This is accomplished by mobilizing private investment to support the transition to a climate-neutral, more equitable economy, as a complement to public investments. Financial actors are in a unique position to make a significant impact to close the energy transition-financing gap, on top of the influence they can have on closing the ambition gap.

Regulators around the world have a significant role to play in the energy transition and must accelerate the mobilisation of companies in this effort. The mobilisation of the financial sector is of particular salience in this regard. At COP26, for example, 450 financial institutions representing $130 trillion in capital joined an official collective engagement under the Glasgow Financial Alliance for Net Zero, pledged to transform the economy and achieve net zero by 2050. The development of a sustainable capital market has accelerated in recent years, and will continue to do so for the near future. New sustainable finance legislations are proliferating around the world to support, but also to provide stronger foundations, to sustainable finance growth.

The 2018 EU Sustainable Finance Action Plan was created as part of the European Green Deal, in line with the 2015 Paris Agreement and the UN 2030 Agenda for Sustainable Development. The plan has increased the EU’s climate ambitions and aims to see the EU become carbon neutral by 2050. It has since been complemented with the EU 2021 Strategy for financing the transition to a sustainable economy.

The EU Sustainable Finance Action Plan is divided into three main objectives:

- reorienting capital flows towards sustainable investments;

- managing financial risks stemming, for example, from climate change, resource depletion, and environmental degradation;

- fostering greater transparency and long-termism in financial and economic activity in order to achieve sustainable and inclusive growth. The regulations’ scope is very wide, and it covers a wide range of entities, including asset managers, insurers, banks and pension funds.

Despite the challenges in the short term, the EU’s Sustainable Finance Action Plan should accelerate the mobilisation of sustainable finance and strengthen EU leadership by serving as a model for regulators worldwide looking for a standardized approach to sustainable finance. Financial market participants should welcome this initiative as it provides investors, financial institutions, businesses, and issuers with clarity and transparency on a variety of sustainability measures, ultimately allowing savers to make informed decisions on sustainable investment.

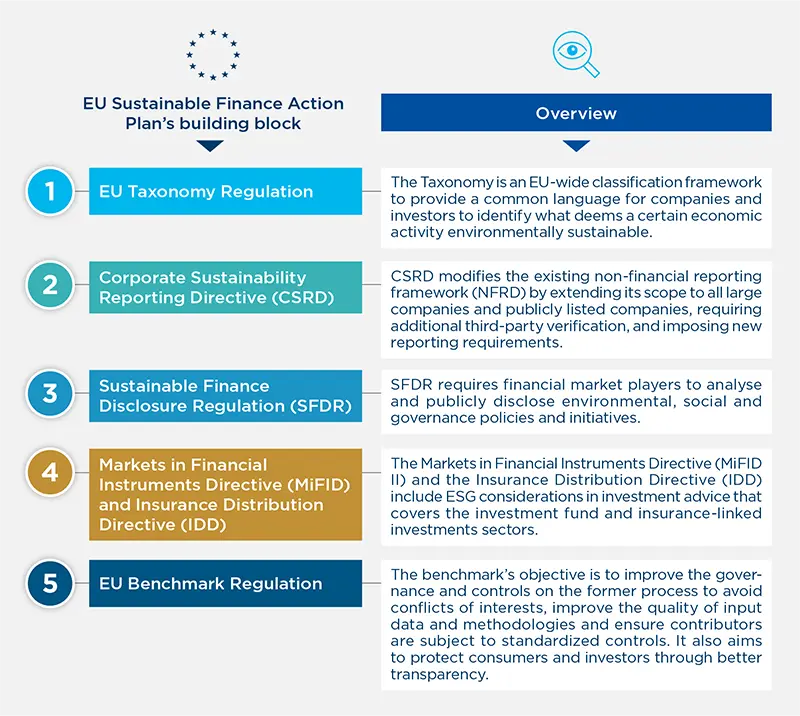

The building blocks

To fully understand the EU Sustainable Finance Action Plan and its recent revisions, one must consider it not as a single policy block but as a series of interconnected policy blocks that, when combined, create an environment that should not only be more transparent, with common references, but also able to effectively channel more capital flows towards the funding of sustainable activities. Only by understanding the different pieces of legislation in the EU can one comprehend the magnitude of the impact that this plan can have.

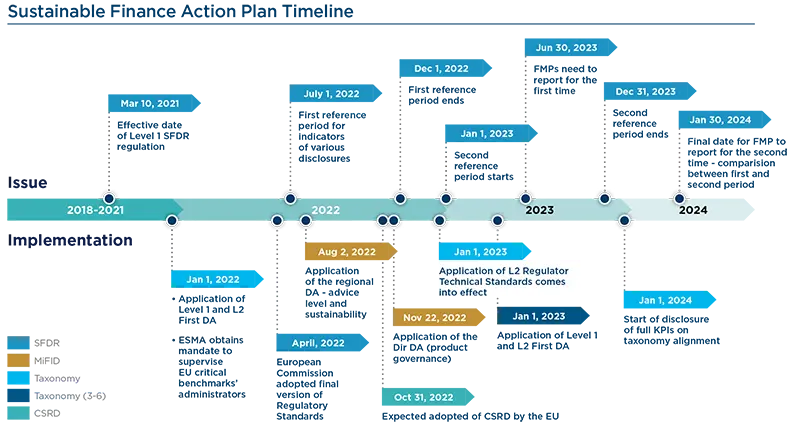

Within the EU Sustainable Finance Action Plan, there are five key building blocks each with different implementation deadlines: an EU taxonomy, corporate sustainability reporting requirements, disclosures to investors, new benchmarks and green bond standards, and the integration of clients’ sustainability preferences in the advisory process.

1 - EU Taxonomy Regulation

The EU Taxonomy Regulation determines which economic activities are environmentally sustainable. It assists investors, companies and policy makers in identifying activities that contribute significantly to environmental goals and, as a result, aid in financing the transition to a more sustainable economy. To this purpose, the EU Taxonomy has established a list of activities that contribute to six environmental objectives:

- climate mitigation;

- climate adaptation;

- sustainable use and protection of water;

- transition to a circular economy;

- pollution prevention;

- and biodiversity protection.

Furthermore, it has established three criteria for an activity to be considered aligned with the Taxonomy:

i) The respect of the technical criteria set by the Taxonomy;

ii) The “do no significant harm” criteria, and

iii) Minimum social safeguards.

At the same time, the EU Taxonomy currently only maps environmental activities.

https://www.esma.europa.eu/sites/default/files/library/jc_2021_50_-_final_report_on_taxonomyrelated_product_disclosure_rts.pdf

https://finance.ec.europa.eu/sustainable-finance/tools-and-standards/eu-taxonomy-sustainable-activities_en

2 - Corporate Sustainability Reporting Directive

The Corporate Sustainability Reporting Directive (CSRD) modifies the existing non-financial reporting framework (Non-Financial Reporting Directive) by extending its scope to all large companies and publicly listed companies, requiring additional third-party verification, and imposing new reporting requirements. This is based on the “double materiality” principle that states that a company must disclose environmental, social or governance factors that can materially affect its value, as well as how it affects the environment, social matters or human rights. The European Financial Reporting Advisory Group (EFRAG) is serving as the technical advisor for creating the draft EU Sustainability Reporting Standards (ESRS) and conducting analyses with the proper level of public scrutiny, due diligence, and participation from relevant stakeholders.

https://www.esma.europa.eu/sites/default/files/library/sustainable_finance_-_implementation_timeline.pdf

https://www2.deloitte.com/content/dam/Deloitte/nl/Documents/deloitte-nl-sustainability-eu-tax-csrd-timeline-june-2022.pdf

3 - Sustainable Finance Disclosure Regulation

The Sustainable Finance Disclosure Regulation (SFDR) supplements current rules governing the public disclosures of financial products. Managers now have to disclose the sustainability risks of their investment process, the metrics used to assess ESG factors, the objective in terms of sustainable environmental and social investments, and how investment decisions achieved these objectives, while accounting for the principal negative effects on sustainability factors.

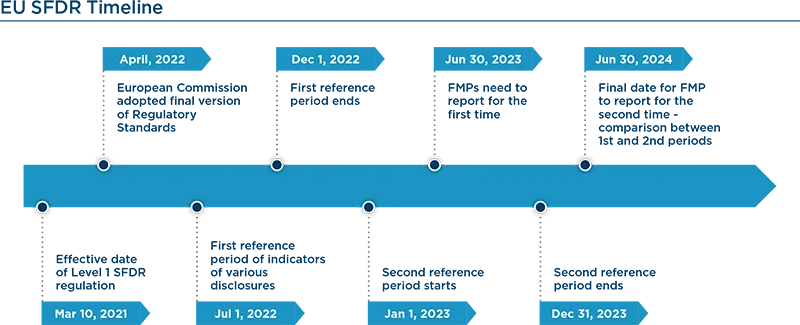

By establishing a framework for reporting standards, the SFDR has direct implications for financial market participants and raises the bar for investment products, particularly those seeking to promote ESG characteristics (Article 8 funds) and those with ESG objectives (Article 9 funds). Once these requirements were met by managers in the past months, this triggered a significant number of funds and strategies to upgrade to Article 8 or 9.

For example, in the last quarter, at Amundi, we have switched one of the largest passive funds from an Article 6 to an Article 9 classification. This is thus adding to the growing number of passive funds that have done so in the previous 18 months, shifting from a baseline or broad ESG index to a Climate Transition or Paris-Aligned Benchmark.

Early 2023 will be the implementation date of the SFDR Level 2 Regulatory Technical Standard (RTS). It will require Financial Market Participants to provide details on the negative impacts that their investments may have on the environment and society in general (Annex I) and it lays down sustainability disclosure obligations toward end investors through precontractual (Annex II et III) and periodic reporting obligation (Annex IV et V). The aim of the RTS is to facilitate sustainable investments by providing end investors with comparable and transparent information regarding the sustainability impact of underlying investments, while reducing the risk of greenwashing.

https://www.esma.europa.eu/sites/default/files/library/sustainable_finance_-_implementation_timeline.pdf

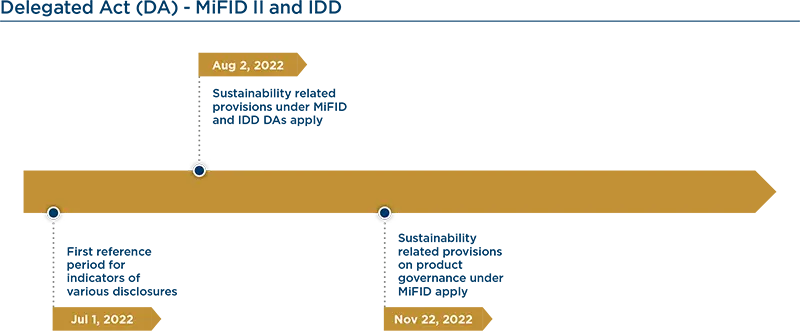

4 - Markets in Financial Instruments Directive, Delegated Act and Insurance Distribution Directive

The Markets in Financial Instruments Directive (MiFID II) and the Insurance Distribution Directive (IDD) have been amended to include ESG considerations in investment advice on investment funds and insurance-linked investments. While asset managers in the EU generally have a fiduciary duty to act in the interests of investors, the EU is now explicitly incorporating ESG considerations into these obligations.

According to MiFID II, Financial Market Participants will have to ask their clients about their sustainability preferences as part of the suitability assessment. The suitability assessment ensures that investors receive appropriate personal recommendations and that appropriate investment decisions are made on their behalf. Additionally, investment advisers and managers will now have to assess the client's sustainability preferences in addition to their financial expertise, investment objectives, financial situation, and risk tolerance.

The delegated act aids in defining the necessary information, methodology, and content that financial and non-financial undertakings must present and disclose regarding the percentage of environmentally sustainable economic activities in their operations, investments, or lending activities. Financial advisors can follow the guidelines in the MiFID II and IDD to incorporate this information and act in accordance with their clients' preferences for sustainability. In essence, the data comes from the corporates and is transmitted to the end investor through market participants and advisers.

https://www.esma.europa.eu/sites/default/files/library/sustainable_finance_-_implementation_timeline.pdf

https://www.efrag.org/en/projects/sustainability-reporting-standards-roadmap/concluded

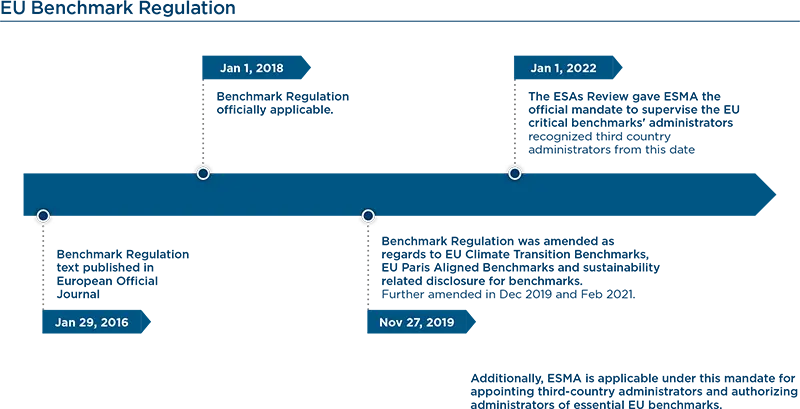

5 - EU Benchmark Regulation

The existing EU Benchmark Regulation has been amended in light of the EU Action Plan on two fronts. First, all investment benchmarks will have to disclose if – and how – they incorporate ESG criteria into their processes.

Second, new standards for carbon products have been developed, with two types of climate benchmarks aimed at assisting investors in understanding the carbon impact of their investments. New categories of low-carbon benchmarks include the Climate Transition Benchmarks (CTB) and the EU Paris-Aligned Benchmarks (PAB).

Both benchmarks were created to ensure a yearly decarbonization target of at least 7%, in line with the decarbonization trajectory of the Intergovernmental Panel on Climate Change's 1.5°C scenario, and to support the transition to a climate-resilient economy1.

https://www.esma.europa.eu/sites/default/files/library/sustainable_finance_-_implementation_timeline.pdf

Implications for investors: challenges and opportunities

The 2018 EU Sustainable Finance Action Plan has numerous implications for investors, representing both challenges and opportunities for the financial industry. Numerous challenges lie ahead, for policymakers, financial market participants and corporates that have to implement the new policies. Regarding regulators, there is still much work to be done on sustainable finance, for instance, advancements on the proposal for a standard for European green bonds or for an EU Ecolabel for retail investment. There are at least four challenges for financial market participants.

Structural Challenge

First, there is a structural challenge, as the legislative framework is complex, with many different building blocks to consider. The Action Plan’s composition of multiple building blocks makes it difficult for participants to grasp and identify which component applies to specific players. To keep its investment professionals and support functions up to date, a company must develop internal ESG data integration systems, ESG training tools and platforms, and share updated content across departments.

Implementation Challenge

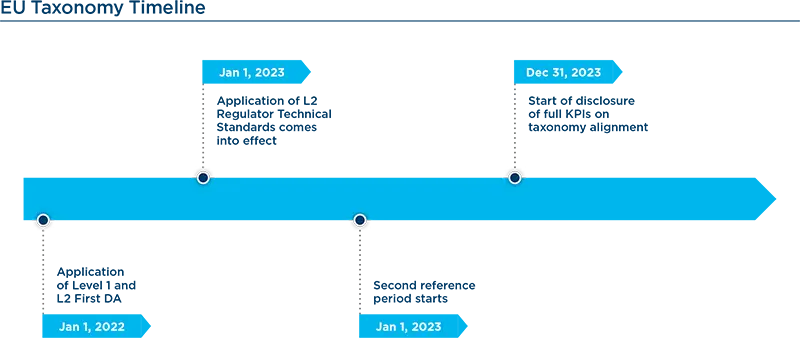

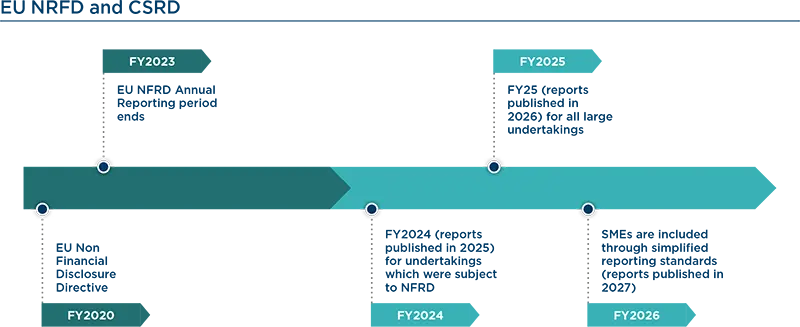

Second, there is an implementation challenge, as not all policies are implemented at the same time. Due to the misalignment of regulatory timelines, financial market participants are confronted with an implementation issue. While some regulations are immediately applicable, others require a longer timeframe for full implementation. For example, the Taxonomy Regulation will be phased in as the scope of economic activities and sustainable objectives are expanded to the end of 2022.

Reporting by companies under Taxonomy and CSRD shall reach full completion by 2024-2025. SFDR went into effect in March 2021, but additional disclosures followed in 2022, and others in 2023. See the figure below for a detailed timeline of the implementation calendar.

Moreover, the level of complexity of the regulation has raised significant operational challenges for all entities in scope. For example, the production of the European ESG Template, the official FinDatEx data exchange template for product-level ESG data, the extension of suitability assessment to sustainability preferences when providing financial advice, should not be underestimated.

https://www.esma.europa.eu/policy-rules/benchmarks

Data Availability Challenge

Financial market participants face a data availability challenge because they are required to report on topics for which data is not yet available. For instance, they need to disclose the level of sustainability of their products, even though CSRD has not yet made it mandatory for investee companies to do so themselves. To comply with the EU Taxonomy, financial market participants will need to collect reported data or estimate such data. At Amundi, we have decided to work with data providers to start gathering and providing the necessary information to investors and distributors. However, even collaborating with top-tier global providers, one cannot guarantee reliable numbers in line with expectations from the regulators in the ramp-up phase. In this first phase of implementing the EU Taxonomy, financial market participants essentially need to rely on estimated data.

Similarly, the ability to consider, monitor, and report on the Principle Adverse Impact on Sustainability Factors will require an easy access to the relevant information that only enhanced corporate disclosure can provide. In that regard, the sustainability reporting standards under development by the EFRAG are key. Excessively granular and prescriptive requirements may raise operational challenges, and be costly to issuers, but overly soft standards will prevent a smooth application of disclosure requirements by financial market participants.

Interpretation challenge

On 9 September 2022, the European Supervisory Authorities (ESAs) have submitted to the European Commission further queries relating to the interpretation of Union law with reference to SFDR. Different interpretations of key concepts, such as the concept of “Sustainable Investment” defined in the Article 2(17) of SFDR, may have significant impact on financial market participants, and notably on fund managers that need to take commitments to invest a minimum proportion in sustainable investments before 31 December 2022.

Moreover, the variety of approaches adopted by financial market participants (activity-based, issuer level or hybrid) and the dispersion in selectivity levels or thresholds, will lead to heterogeneous situations among fund manufacturers, and potential misalignment with assessments by third-parties.

Finally yet importantly, interpretation challenges remain acute when it comes to establishing links between the Sustainable Investment definition, sustainable investment as an objective and impact. “Additionality”, that is the net positive impact targeted by an impact strategy, may also come from transitioning assets, brown-to-green switches, and initiatives to support sustainable financial instruments issuances, which by construction may have difficulties to meet the stringent requirements attached to the regulation.

Despite the operational and implementation challenges that the financial industry faces in the short term, the EU Sustainable Finance Action Plan provides numerous opportunities for the financial sector in the medium to long term. This plan is made up of various building blocks that, when combined, create a favorable environment for sustainable and long-term investments.

With the emergence and now mainstreaming of ESG integration into investing analysis and decision-making, financial markets are undergoing a profound transformation, with enormous demand and expectations. The financial system, while also rapidly developing, is struggling to keep up.

SFDR is an example of a positive game changer for the financial market, allowing collective progress 1) by establishing the notion of "double materiality" and clarifying the value-proposition of ESG, not limited to financial materiality but also including the notions of "sustainability" and "principal adverse impacts"; and 2) by assisting the industry in shaping the investment offering around three types of approaches (Articles 6, 8, and 9) and setting the standards for disclosure.

Even though the EU Sustainable Finance Action Plan's regulations are by definition European, their impact is global, as our clients worldwide now understand what an SFDR Article 8 or 9 fund is, for example. Furthermore, these regulations will hasten the mobilization of sustainable finance, reinforce EU leadership in this area and serve as a model for regulators worldwide.

Conclusion

We are at a decisive and unique moment in the history of sustainable finance. Sustainable finance is transitioning from a niche sector to a standardized and regulated environment. Policymakers and regulators face new challenges, as do countries and financial market participants, as well as corporations that must implement new policies. Regulators must also better integrate the social dimension into the sustainable finance agenda, particularly by broadening the scope of the EU Taxonomy to include social objectives. During a time of elevated ESG questioning, the EU Sustainable Finance Plan, if well implemented with some shortcomings corrected, can assist in facilitating greater ESG integration amidst the scrutiny.

Despite the challenges, these regulations will accelerate the mobilization of sustainable finance and strengthen the leadership of the EU in this area: regulators around the world regard the EU Sustainable Finance Action Plan as a benchmark against which their local sustainable finance legislation is compared. Sustainable finance is evolving at a fast pace and we must not lose sight of the end goal: to build a greener, more sustainable future, with change ultimately taking place in the real economy.