- Despite recent China woes, emerging markets are poised to enjoy a growth advantage over developed peers, creating opportunities for investors across all major asset classes.

- Countries in Latin America are paving the way for a bout of monetary policy easing in the second half of the year; the prospect of lower interest rates has helped lower local government borrowing costs.

- Emerging market bonds and currencies remain appealing this year. In equities, valuations are more attractive, but a selective approach is key.

Resilience and a growth advantage over developed markets make emerging countries an attractive destination for the second half of the year. The effects of monetary tightening are seeping through to the real economy, contributing to lacklustre growth, particularly in developed economies. The U.S. economy may suffer a mild recession towards the end of this year, while European growth should fall below potential as the continent grapples with the sticky core inflation that is constraining consumption.

By contrast, emerging countries enjoy a more favourable macroeconomic outlook. We are forecasting a 4% average growth rate for emerging markets in 2023, in contrast to 1.1% for advanced economies. Asia is driving a significant portion of growth, despite recent weaknesses observed in China. The size of the region’s market, labour prices, and government policies aimed at enhancing the business climate – tax incentives and streamlined regulation – continue to attract foreign investors, bolstering Asian economies’ prospects.

An overextended property sector, weak household consumption, indebted local governments, and shaky consumer and business confidence are warning signs that China’s economic slowdown may be more structural than cyclical. The country is rapidly approaching a new era of lower and more volatile growth. Following the release of its second quarter GDP data, we have downgraded our growth expectations from 5.7% to 5.1% in 2023.

At a key Communist Party meeting last week, Chinese leadership reaffirmed a relatively hands-off stance by holding off on any substantial stimulus to support key debt-fuelled growth engines, and forcing local governments to resolve their own implicit bad debt issues. The final total sum of all fiscal and semi-fiscal measures being unveiled is expected to reach 1 trillion renminbi, or 0.8% of GDP, reflecting a measured approach to enhancing policy support.

India's growth may also moderate, to 6%, although renewed investments in sectors like semiconductors, electric vehicles, and renewable energy should provide longer-term momentum.

The growth picture is more diverse across Latin America and Eastern Europe, but many countries are already far ahead in terms of monetary policy normalisation. Local central banks responded quickly and aggressively to impending inflation at the end of Covid-era restrictions, creating the scope for attractive carry trades, and paving the way for the best bond market performance in the year to date.

In view of decelerating prices, local policymakers should be preparing to lower rates in the second half of 2023. Chile was the first to cut its key interest rate by 100 basis points to 10.25% in its end of July meeting, and should be followed by Brazil in August. Colombia and Peru may begin easing in September, if not earlier, while the overheated Bank of Mexico is more likely to do so in the last quarter of the year. Central and Eastern European countries should follow suit, with the National Bank of Poland leading the way.

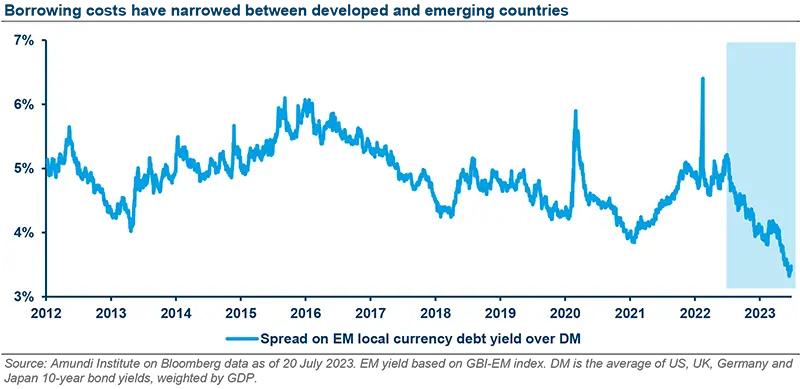

The Fed and European Central Bank, on the other hand, are still experiencing upward pressures on their terminal rates. The prospect of imminent interest rate cuts has helped narrow the gap between developed and emerging government borrowing costs, which is at its lowest level since 2007, and should provide an impetus for emerging local currency bonds, with a major upside expected in Latin America.

Emerging market bond yields fell in the first half of the year, but still offer appealing entry points for investors in terms of spreads and carry, supported by a weaker US dollar. Conditions in the corporate bond space are also improving thanks to lower levels of indebtedness, while corporate defaults have peaked in the high-yield segment, and should start to come down across Latin America, emerging Europe, the Middle East and Africa. On the other hand, risks linked to China’s real-estate sector should be closely monitored.

Low-volatility currencies – the Euro and Japanese Yen more so than the British Pound – are expected to benefit from a weaker greenback. Commodity exporter currencies and high carry currencies like those in Latin America are also appealing. The oncoming bout of monetary easing will be focused on removing emergency-era interest rate hikes and synchronising policy with growth and inflation prospects, so carry should remain high. However, a selective approach is still required, keeping an eye out for specific vulnerabilities and the inflation trajectory.

Cheaper valuations also favour emerging market equities, with regional differences. Countries that are more advanced in their monetary policy cycle may experience a faster rotation into equities. Margins have started to recover and earnings may rebound to positive year-on-year growth, especially in EMEA and emerging Asia. Investors should turn emerging markets’ growth advantage to their favour, as an invaluable contribution to a well-balanced and diversified global portfolio.

For more insights

To learn more about this topic, click on the article below: