Summary

- The long-term outlook for global growth is not promising, largely determined by declining working-age populations and weak investment.

- The secular decline in productivity growth, especially in advanced economies is unlikely to improve in the near term.

- Artificial Intelligence is promising, but its macroeconomic impact will take longer to move the productivity needle.

- Investment in AI-related companies will continue at a healthy pace, which should support AI-related equities as an expanding sector.

If these trends continue, global growth over the next decade would likely be sub-3%, compared to just under 4% in the two decades before the pandemic.

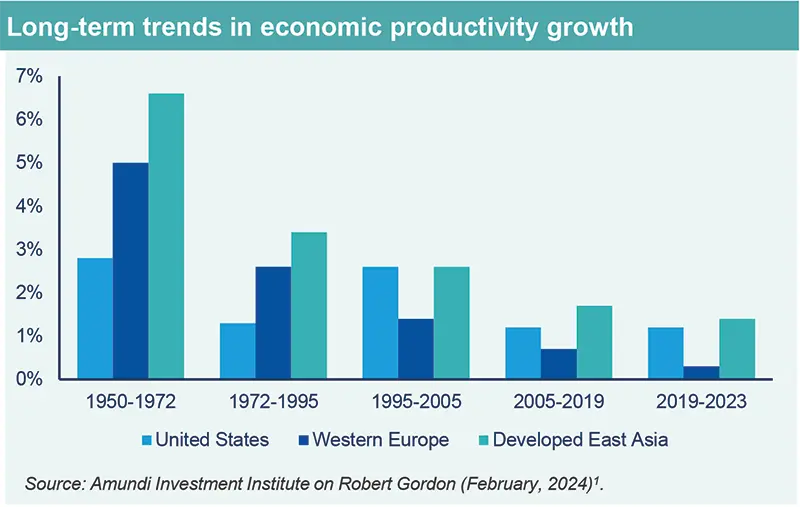

Global growth has been on a secular decline since around 2000, with a more pronounced decline following the Global Financial Crisis (GFC). Economists typically cite the sizeable and broad-based slowdown in Total Factor Productivity Growth (TFP) which measures how efficiently labour and capital inputs are used to produce output. Looking back over longer periods, there were strong advances in productivity after WW2 in the advanced economies and in some of the larger emerging market countries in the 1970s to the 90s, partly because they were starting from relatively low levels of per capita incomes. But since around 2000, the slowdown has been broad-based.

1 Robert Gordon, ‘The Future of U.S. Productivity Growth: A Skeptical View’, Sympsosium: U.S. Productivity Growth – Looking Ahead, NY Fed, February 2024.

If these trends continue, global growth over the next decade would likely be sub-3%, compared to just under 4% in the two decades before the pandemic. And that’s before we consider some of the more recent adverse developments, such as global economic fragmentation, increasing security concerns and the transition to net zero. Such a subdued growth environment would make it even more difficult to deal with high levels of public and private debt in many countries, increasing inequality and would exacerbate strains on already stretched public finances.

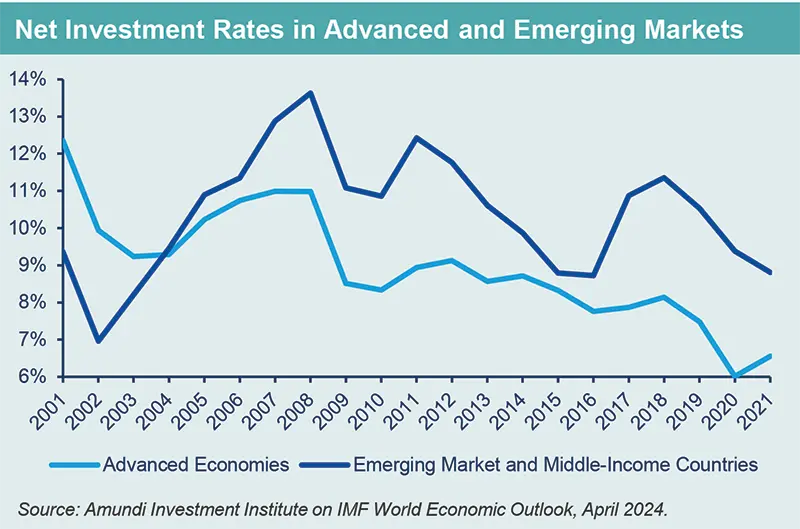

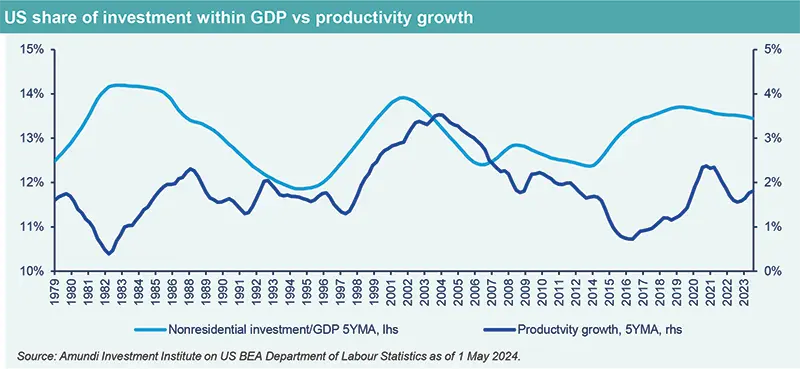

Forecasts of lower growth on the back of subdued TFP growth are largely based on experiences from the past. Which factors among the explanations for the slowdown in economic growth over the last two decades could turn around and yield a more optimistic outlook? Alas, one of the major factors, a strong demographic decline in the working age population – in most advanced economies and many emerging market countries – is projected to continue, with the exception of sub-Saharan Africa and India. Among advanced economies, the IMF’s recent analysis2 finds that the labour force contribution to growth declined from 1.3% in 1995-2000 to only 0.2% from 2019-2023. In EM countries, the corresponding decline was from 2.5% to 2%. Capital investment – the second major determinant – has also declined on a secular basis in most OECD countries and most EM countries. The decline in investment is a two-way factor. Firms invest less when they are pessimistic about growth prospects but that, in turn, also reduces productivity and growth.

Underlying these macro aggregate data, there are important trends in investment (capital formation), and innovation and advances in technology that contribute to productivity growth over time. Recent trends in the US and Europe provide a good illustration of how productivity growth has declined.

2 International Monetary Fund, ‘Steady but slow: Resilience amid divergence’, World Economic Outlook, April 2024.

- Gross fixed capital formation in tangibles between 1997 and 2019, gross fixed capital fell from 22% to 14% of Gross Value Added (GVA) in the US and from 25% to 17% in Europe – and were not fully offset by the increase in investment in intangibles, which only rose from 12% to 16% of GVA in the US and from 10% to 12% in Europe3.

These declines are larger once adjusted for the depreciation of existing capital stock. The proximate explanations include: weak demand, a partial reversal of globalisation, rigidities in labour markets that make it difficult for firms to substitute labour for capital, and corporate deleveraging following the GFC.

- There is widespread recognition that new game-changing innovations have become sparse and have less impact on productivity. Mass manufacturing transformed the world in the past two centuries and then IT added new impetus but, alas, that has not been strong enough to take over from manufacturing because its productivity impact was limited to a few sectors, such as communication and media, and it had a smaller impact on transport, education, housing, food and healthcare4. Moreover, the productivity impact of IT is considered to have peaked around 2015.

- Productivity in services, which accounts for a rising share of economic activity in most advanced economies, did not register strong gains. While productivity improved markedly in manufacturing, its share of GDP declined – in large part because of its success. Large efficiency gains led to falling prices (especially relative to services) and less employment. But this compositional shift toward services also offset any aggregate impact on productivity from the gains in manufacturing, despite very substantial declines in the prices of electronics, for example.

- Many other factors – some idiosyncratic – also explain important shifts in productivity. Levels of education clearly matter, but in the advanced countries this contribution likely plateaued after the 1980s (after rapid progress before the 1960s). Similarly, the 1990s “peace dividend” reduced military spending and had (often large) spillovers on civilian technologies; some detrimental effects stemmed from tighter IP rules on innovation and M&A rules on competition; and there was also growing political resistance to structural reforms and productivity-enhancing regulatory changes (stemming both from workers and business interests).

- Innovations, and especially mass adoption of technology can make a substantial contribution. The productivity growth revival in the US during the late 1990s and early 2000s showed how efficient mass implementation of existing technologies (computers and the internet, where the technological advances dated back to the 80s), combined with adequate regulation, could be a strong productivity driver.

- A note on measurement issues. Some have pointed to the complexity of measuring productivity in advanced economies and a possibility that productivity growth may be underestimated when prices do not reflect improvements in the quality of products, or a wider range of products on offer, and the perennial difficulty of measuring productivity changes in services. These issues are taken up in Box 1.

Productivity gains may be underestimated if deflators are overestimated (implying an underestimate of real GDP growth for a given, observed level of nominal GDP growth). This has sometimes been ascribed to using the same methodology for measuring service sector productivity as used for estimating manufacturing sector productivity. As an example, healthcare or public sector outcomes may not lend themselves to simple input costs and final prices. Conversely, however, wider measures of healthcare outcomes, such as life expectancy (declining in some countries, such as the US and UK) may go the other way – overestimating productivity.

Rising input costs may not be sufficient to ascertain any improvements in the quality of the output. The use of hedonic prices or survey techniques to assess how much value people attach to new products and services is an attempt to address these measurement issues.

In practice, this potential mismeasurement can only explain a very small part of the slowdown in productivity relative to the bigger macro factors discussed in the text5.

3 Mckinsey Global Institute, ‘Investing in productivity growth’, Mckinsey & Company, March 2024.

4 Robert Gordon, ‘The Rise and Fall of American Growth: The U.S. Standard of Living since the Civil War’, Princeton University Press, 2016.

5 For more details on the arguments presented in the box, the reader can refer to ‘Could the US Economy Be Experiencing a Hidden Tech-Driven Productivity Revolution? A Symposium of Views’, The International Economy, Fall 2019.

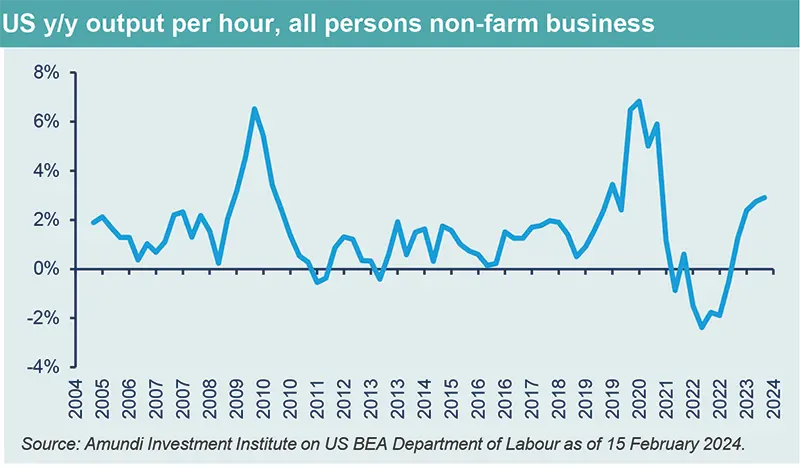

Does the current rise in productivity indicate a more positive trend?

The US has experienced a striking recovery in productivity during its recovery from the pandemic and energy price shocks. The annualised gains of around 2.5% in the second half of last year have been the strongest since 2010. Strong policy measures – investment incentivised by the IRA and the resilience of consumption supported by stimulus measures – have undoubtedly helped. But a significant increase in the formation of new businesses and the optimism about the potential game-changer narrative around AI have generated strong optimism among investors. Thus far, however, this rebound in productivity is largely confined to the US.

Following a Covid-related trough, US productivity increased to 1.5% for 2023, raising the 2020-23 average labour productivity growth to 1.2% per year. The UK has seen a similar rebound (albeit from a much lower level) from around 0.3% per year during 2013-2019 to 0.7% per year since 2020. By contrast, Euro Area productivity has fallen since 2020 by about 0.2%, albeit with wide variations across the block. Much of this can be explained by lower investment and firms being able to hoard labour through government-supported furlough programmes.

It is therefore too early to tell if Europe will experience a secular revival in productivity. There are however, important policy items on the agenda – a capital markets union that could raise investment; the drive toward net zero which could also incentivise private investment; and a return to macro stability following much bigger shocks than the US experienced – that bode well for a gradual increase in growth prospects.

As for AI, and its potential to raise productivity across many countries, lessons from previous episodes suggest that productivity gains typically occur when technologies have matured and can be broadly disseminated.

It is too early to tell if Europe will experience a secular revival in productivity. There are, however, important policy items on the agenda that bode well for a gradual increase in growth prospects.

Artificial Intelligence: Are we at the beginning of the next big wave?

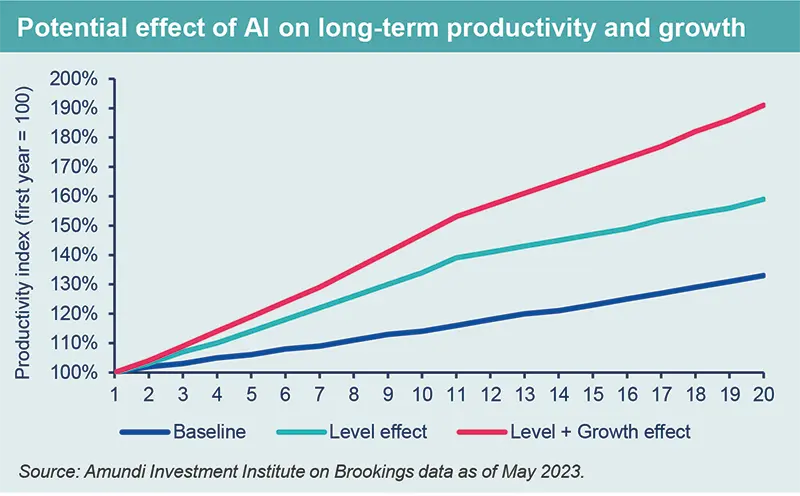

Seen under the lens of phases of adoption, we would expect the macroeconomic growth impact of AI to materialise beyond the medium term. As we explain in another note6, we expect AI adoption to follow three phases: firstly, limited visibility (2024-2033), followed by a broader diffusion (2034-2043) and finally a normalisation phase where the new technologies deliver diminishing returns (2044-2053). However, we acknowledge the considerable uncertainty about how fast AI will be adopted and, more importantly, its potential macro impact. The latter issue is closely associated with whether AI displaces workers or augments their productivity. This too, might have a time dimension, with a stronger likelihood of displacing some workers in the short run and a potential to enable new tasks in the longer term. Box 2 provides a range of views from other institutions.

A recent OECD report7 posits significant productivity-enhancement potential from AI technologies while acknowledging that there are widely diverging estimates of its macroeconomic impact. The IMF reaches similar conclusions – a potential long-term growth impact of between 10 and 80 basis points a year, but with the risk that 60% of jobs could be susceptible to AI in the medium term.

According to Goldman Sachs8, only around 5% of American companies are currently using AI in the production of goods and services. In the IT sector, however, this rises to over 2%. Beyond IT, Goldman and MIT Sloan School of Management9 both see AI use being most prevalent in manufacturing, healthcare, finance, and professional and business services.

Research commissioned by IBM10 found that about 42% of enterprise-scale organisations (with over 1,000 employees) surveyed are using AI actively. Early adopters are leading the way, with 59% of responding enterprises already working with AI intending to accelerate their investment. But ongoing challenges for AI adoption include hiring employees with the right skillsets, data complexity and ethical concerns.

In the EU, by 2028 – according to research commissioned by Amazon11 – some 86% of employers think their companies will adopt some form of AI, mainly in IT, R&A, Finance, Business Operations and Sales & Marketing. Some 81% of the employees that were interviewed also believed that they will use AI in their jobs by 2028.

Global investment in AI is rapidly increasing across sectors, from manufacturing to services, with a focus on generative AI – what economists call a general-purpose technology. This makes many optimistic about the outlook for productivity and growth. But there are significant doubts about how much AI can boost productivity. Acemoglu12 estimates the increase in productivity over the next ten years could be about 0.06% per year – largely because most AI applications are geared toward saving labour, estimated at about 25%, yielding overall cost savings of about 15%. AI investment that spans across many sectors may raise ten-year productivity to between 1.0% and 1.5% of GDP. This is consistent with the estimates for the next decade that we have used for our Capital Market Assumptions.

These “low” estimates of productivity gains over the next ten years reflect an underlying view of what AI will change. It is currently seen as being focused on automation and monetising data, rather than introducing new tasks. If, and when, AI extends to aiding the process of scientific discovery and coming up with new products, the gains will likely be larger. But it is fundamentally difficult to predict with any confidence what AI will do in 20 or 30 years. And not all countries will be able to overcome the requirements for infrastructure, availability of suitably skilled labour and the scale of investment.

The adoption of AI will also face other challenges, especially relating to its impact on labour and wider concerns about social and political consequences. The near-term threat of displacing workers will come up against many institutional and structural rigidities in many countries, with the likely effect that it will delay widespread adoption. A related risk is that the gains might largely accrue to owners of capital rather than workers, further increasing the profit share of value added.

The regulatory treatment of AI is at an early stage, largely confined to governments thinking about the appropriate framework to address competition and much wider concerns about data transparency, privacy and the possible misuse of AI. Over time, however, regulation will undoubtedly impinge on the pace and scope of adoption. Regulation could, therefore, also limit some of the productivity gains from AI.

6 Annalisa Usardi, ‘No straightforward productivity gains from Artificial Intelligence’, Amundi Capital Market Assumptions 2024.

7 Francesco Filippucci et al., ‘The impact of artificial intelligence on productivity, distribution and growth: Key mechanisms, initial evidence and policy challenges’, OECD Artificial Intelligence Papers, No.15, April 2024.

8 Goldman Sachs, ‘AI is showing “very positive” signs of eventually boosting GDP and productivity’, May 2024.

9 Kristina McElheran et al., ‘AI Adoption in America: Who, What and Where’, NBER Working Paper Series, No.31788, October 2023.

10 IBM Global AI Adoption Index 2023.

11 Access Partnership and Amazon Web Services, ‘Accelerating AI Skills: Preparing the Workforce for Jobs of the Future’, AWS study on AI skills in Europe, March 2024.

12 Daron Acemoglu, ‘Don’t Believe the AI Hype’, Project Syndicate, May 2024.

Investment implications

With no near-term macro impacts from AI as yet, the trend of a secular decline in productivity growth of the last two decades will continue to be determined by demographics (declining working-age population) and weak investment. And these will be the main determinants of the relatively subdued growth outlook over the medium term. Investment in AI-related companies will continue at a healthy pace given the longer-term promise of this technology. As a result, we believe the near-term investment implications are primarily for AI-related equities, which is an expanding sector.

Beyond the near term, as AI moves into the second phase of wider adoption, productivity and investment will move to a better trajectory and this will also improve the growth outlook. Such a macro environment should raise real interest rates, with implications for both bonds versus equities (better carry in bonds) and sectoral shifts within equities towards companies and sectors that are able to benefit from AI.

References