Summary

Declining US inflation is positive for US bonds, and investors should also keep a global approach to potentially benefit from attractive yields elsewhere, including in emerging markets.

- US inflation maintained its declining trajectory, even as it remains above the Fed’s 2% target.

- Whilst this may lead the Fed to reduce rates in second half this year, the bank is likely to remain vigilant.

- Thus, a flexible approach in fixed income may help unearth attractive opportunities, including in US, Europe.

US consumer inflation declined as expected in April to 3.4% (year-on-year), owing to slowing pressures in both the goods and services components. We think inflation should remain on a downward path this year, making the Fed more inclined to cut rates.

Inflation is key here and any upside surprise may lead the central bank to delay cuts. In particular, pressures from geopolitical tensions that could push up the prices of commodities such as oil, would not make the Fed’s job any easier.

Elsewhere, inflation patterns in Europe are also showing signs of a decline that could lead the ECB to reduce rates, potentially ahead of the Fed.

Actionable ideas

- Flexibility is important in US bonds

US government bonds offer an attractive potential for income. In addition, quality credit may do better amid uncertainty on the economic front.

- Global bonds

Given the slightly different central bank stances globally, bonds and high quality corporate credit could offer attractive opportunities in developed as well as emerging markets.

This week at a glance

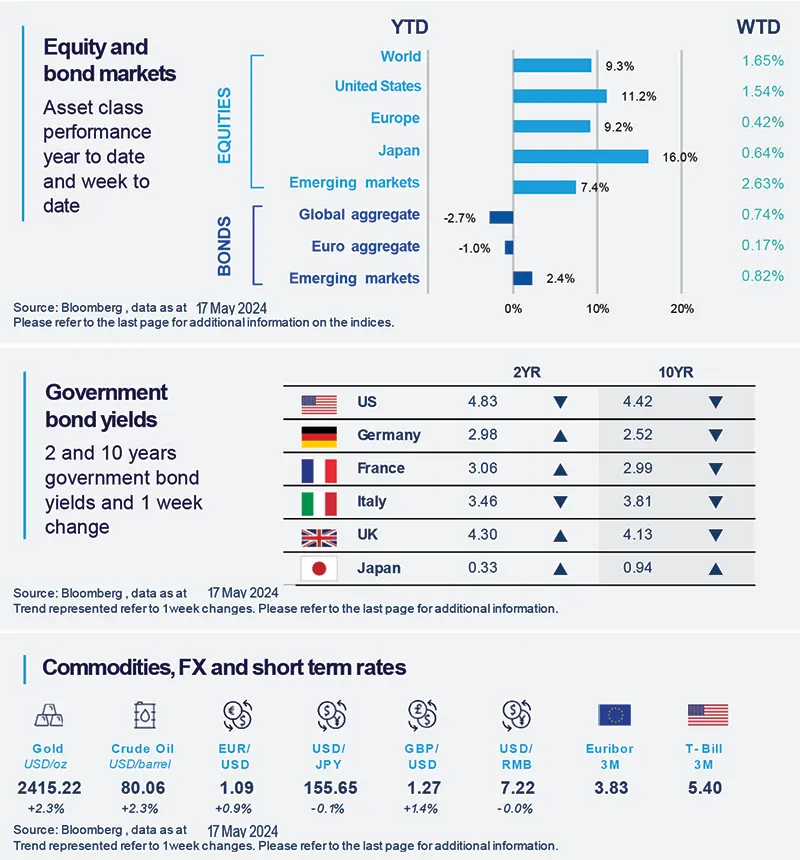

Global, US and European equities reached historic highs over the week. Sentiment was shaped by falling US inflation, which reinforced market expectations of rate cuts by the Fed. This led US yields to fall. In Asia, China announced measures to support the country’s real estate sector.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD) All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short term rates.

Source: Bloomberg, data as 17 May 2024. The chart shows Global Bonds= Bloomberg Global Aggregate Bond Index, Global Equity = MSCI World. Both indexes are in local currency.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Institute Macro Focus

Americas

Borrowers coming under stress from high interest rates and inflation.

The New York Fed’s debt and credit report shows rising stress on households. Consumers are finding it difficult to repay loans as is evident from the increase in overall delinquency rates. The latest figure for the first quarter of the year came in at 3.2%, compared with 3.1% in the last quarter of 2023. Specifically, nearly 9% of credit card accounts and 8% of auto loan accounts moved into delinquent status.

Europe

European Commission confirms economic expansion for Euro Area (EA) this year.

The Spring forecasts confirm that GDP growth in the EA will progressively increase, with 0.8% YoY in 2024 and 1.4% in 2025. Almost all countries would return to growth this year. In particular, economic expansion in the southern countries is likely to outpace the region’s average. Inflation is forecasted to fall from 5.4% in 2023 to 2.5% in 2024 and 2.1% in 2025.

Asia

China’s retail sales came in weak in April.

Growth in retail sales slowed to 2.3% (YoY) in April compared with 4.7% in the first three months of the year. Fixed assets investment growth also declined to 3.6% in April, dragged down by a fall in property investment and slower infrastructure spending. In contrast, industrial production growth rose to 6.7%, and export growth also held up. The overall numbers are in line with our expectations, wherein we continue to see weak underlying demand in the country.

Key Dates

|

20 May China lending rate |

FOMC minutes, Bank Indonesia policy, UK CPI |

23 May PMI: US, EZ, India |