Summary

Disclaimer: This podcast is only for the attention of professional investors in the financial industry. Outerblue by Amundi. Welcome to Outerblue Talks Research, knowledge sharing on financial research.

Swaha Pattanaik: Hello, and welcome to this Amundi podcast. I'm Swaha Pattanaik, the head of publishing, and it's my pleasure to welcome Monica Defend, the head of the Amundi Investment Institute. Hello, Monica.

Monica Defend: Hello, Swaha.

Swaha Pattanaik: So, Monica, normally we speak for the Convictions series, and we're very lucky to have you here for a special research podcast, given all of the turmoil that we're seeing in the markets. We've been on a bit of a roller coaster ride in the last month, starting off with this optimism that Europe's going to use a sort of fiscal bazooka to get defense spending ramped up. And this will. absolutely have some substantial structural investment implications. But we've also got caught up in the US tariff situation, which has sent markets into a bit of a nosedive. Could I start off by asking you, how do you think the global economy and global trade is being rewired as a result of Donald Trump's approach to tariffs and trade in general?

Monica Defend: Thank you, Swaha. Well, I think that we are really witnessing a brutal disruption of the free trade model with an extreme reaction, as you were mentioning, on the markets, including those asset classes such as the US dollar that continue to depreciate, flagging perhaps some concerns on the US administration, the solidity of the economy and the rule of law. So to see how this is going to be rewarded, let me disentangle the short term, from the medium term consequences. So in the short term, everybody will suffer. This detoxing adjustment, how Trump is referring to it, will bite. Will bite out economic growth. And again, it's very difficult to pencil out some some of the results, but initially on a static approach, so implying no retaliation is imposed, we might lose 0.3% out of EU GDP, 0.4% out of Indian GDP, up to 1% out of the US. So the ideas stay always the same, that the country that is imposing tariffs is the one that is going to be the one that eventually is going to pay the highest toll, but also corporate profits are going to be bite out. So any asset that is connected will be eventually cheaper. By how much? Well we'll see how the retaliation and the responses from the various countries will materialize, but in the minute term I'm truly convinced that the countries will continue to rewire the trading system and they will find their way around the US protectionism at current levels. So the tariffs are really off chart. The last time we saw them was in the 1930s. So it's not really good memories what we have out there. But today the market, the economy is bigger, is much more connected. So really I see the potential for at least rerouting the supply chain, as it has been the case with the COVID and even before with Trump. Since 2016, Europe has closed eight new trade deals, China nine deals. Think about initiatives like the Silk Belt Road. So today China is looking at the continental, in Eastern Europe for manufacturing hubs. So there is this sense of looking for something and rebalancing the power. Does it mean that the US will wipe out? No, for sure they will remain at the centre of the global financial system. They will be a source of military power & equipment. There is no alternative in Japan and Europe to Google, Meta and Microsoft. But what Germany has been able to do in such a short time span with a government that was about to exit. It's huge. It's a matter of timing because the infrastructure plan will be deployed over 12 years as they said with these 500 billion. So probably there will be the short-term pain, but for a broader long-term gain, I hope.

Swaha Pattanaik: Thank you. So let me address that short-term pain. And some of that pain is coming through the markets as much as, you know, we're seeing the potential for damage to, well, we're seeing damage to confidence, for the potential for damage to economy. People were counting on a Trump put at the beginning when the tariff talks were coming in. That hasn't materialized so far, as far as anybody can tell. Can we still count on a Fed put given the short-term push-pull factors you were talking about? There is an impact on growth, but there is also the inflation push that's coming through. How do things look on either side of the Atlantic for the central bank policy?

Monica Defend: Well, I think that staying in power shoes is not really easy nowadays. So, as you were mentioning, the market has been very volatile in pricing in the Fed cuts. Yesterday, we were up to five, today it's four, extremely volatile. Basically what the market is pricing in is recession or near to the recession in the US. Growth matters more than inflation because inflation expectations are anchored and will stay anchored. Honestly, how we see things is a bit different here at Amundi because we see the risk of recession materializing, being really tangible and plausible. Just because tariffs are going to lift import prices higher and eventually this is a fiscal tightening on the US consumer and it will also imply a deceleration on investment. And second, global trade will slow down, but this will have a marginal impact on the US. However, inflation, that if you recall since we published the outlook is one of the things that matters, that worries us. The increase we see in inflation or in inflation proving to be stickier doesn't guarantee a dovish Fed. So all in all I think, first you need to focus more on the conditions, than on the number of cuts and second I think the three cuts for the time being is still an appropriate call we are making.

Swaha Pattanaik: Thank you, Monica. And things are looking a little bit easier perhaps for the central bank, Madame Lagarde's shoes, very elegant, probably higher than Dr Powell's, but they are looking in a slightly more comfortable position, perhaps. What are your views here?

Monica Defend: Well, first, I think it is important to remember that the European Central Bank will focus on the average inflation in Europe, which implies that probably we'll see higher inflation in Germany. But again, the ECB focus will be on the full region. With the euro getting stronger, as Madame Lagarde has said at the Central Bank Watcher meeting, this offering has some kind of help in facing inflation. So all in all, I think the ECB is better positioned, probably with less political pressure, and they will continue to cut. We have three in our radar and in probably to 175 or still 2% as the market is continuing to go. But 175 for us is the appropriate lending rate.

Swaha Pattanaik: Thank you, Monica. You evoked this picture of an economic rewiring, a diversification of export markets before. Let me turn to actual investments portfolios. There is a time of such high uncertainty, flux, volatility, wild swings, all of it. How can investors go about increasing a portfolio's resilience in this environment? And, you know, any good hedges perhaps?

Monica Defend: Yeah, so obviously it depends on the portfolio, how we're talking about. Let's take a balanced portfolio as a reference. Well, the idea that we've been pushing for a while was to downgrade the risk exposure at the point that I would say that today we are really neutrally risk exposed and we do prefer, and this is being a long-term call, relative positioning on the more structural themes like Europe versus the US might be the case, both on the equity, fixed income, and at this point, also FX standpoint. Because we are contained in terms of the risk exposure, you don't need much hedges, but still nice to have exposure through the realities just to pick up the potential legs up of the markets. But having asset classes such as gold, we've been revising upwards the target, but this is something that usually works well, as well as currencies. So the yen, which has been a long-term call on our side still, this is the anti-recession medicine you can have in the portfolio. So this is how we're navigating at the time the markets more long-term. Probably the diversification into private assets or emerging markets in particular on those countries that might prove to be more resilient and insulated from the tariffs might be worth it.

Swaha Pattanaik: Thank you, Monica. We have gone over a lot of ground. So perhaps I could ask you just to sum up a couple of the key messages our listeners should be keeping in mind as they deal with the current market turmoil.

Monica Defend: Yeah, sure. So keep your seatbelt fastened, as we usually suggest to our clients. Don't panic. So it's not time to sell position. The market is just too volatile. Look. on the intraday movement, it's really crazy. It's a roller coaster, as you were mentioning. Don't stay out of equities. We do expect further legs down in case earnings will be repriced down, starting from the analyst expectations, but material. There is a risk that is pending on margins, producer price index is moving higher, depreciation of the US traded dollar, some tensions on the credit spread. But I would hold the position at this stage and then consider gold and hedges in place just to shield and navigate the current turmoil.

Swaha Pattanaik: Thank you for those very calming words, Monica. We'll take them to heart. Thank you for joining us.

Monica Defend: Thank you, Swaha. Thank you everyone listening to us today.

Swaha Pattanaik: And indeed, let me join Monica in thanking you for joining us for this podcast. We have a whole series of other podcasts with Monica, which are called the Convictions Series, and we have other research podcasts if you would like to look them up on our research centre or on your favourite podcast platform. Thank you and we hope to have you with us again soon.

Disclaimer: This podcast is only for the attention of professional investors as defined in Directive 2014-65-EU, dated 15 May 2014, as amended from time to time on markets and financial instruments called MIFID II. Views are those of the author and not necessarily Amundi Asset Management SAS. They are subject to change and should not be relied upon as investment advice, as a security recommendation, or as an indication of trading for any Amundi products or any other security, fund units or services past performance is not a guarantee or indicative of future results.

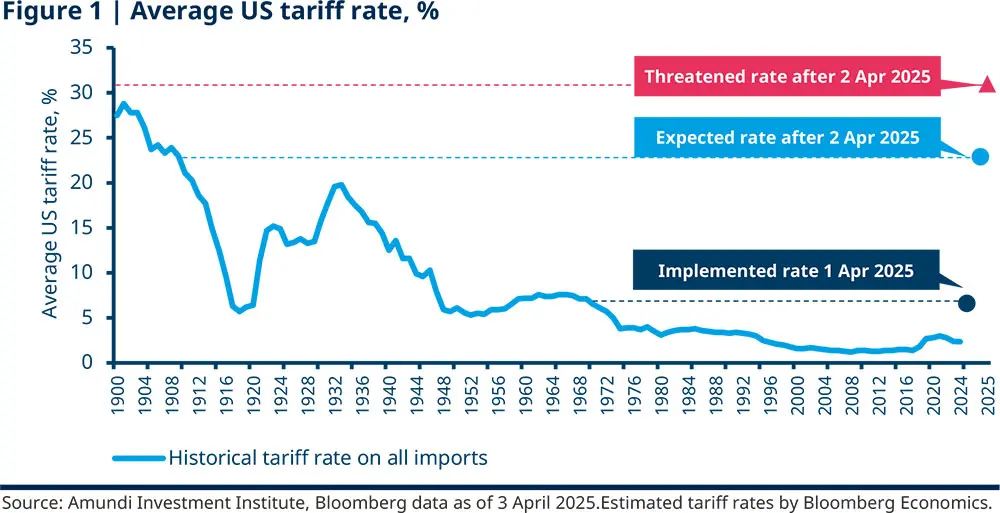

Trump has delivered above expectations on tariffs, taking a major step towards ‘detoxifying’ the existing trade regime. A 10% base levy with reciprocal tariffs up to 49% against major trading partners, plus a confirmed 25% tariff on car imports. The effective US tariff rate is expected to rise to over 20%, its highest level in a century. We expect negotiations to intensify and uncertainty to remain high, in particular until April 9th, when customised tariffs are due to be implemented.

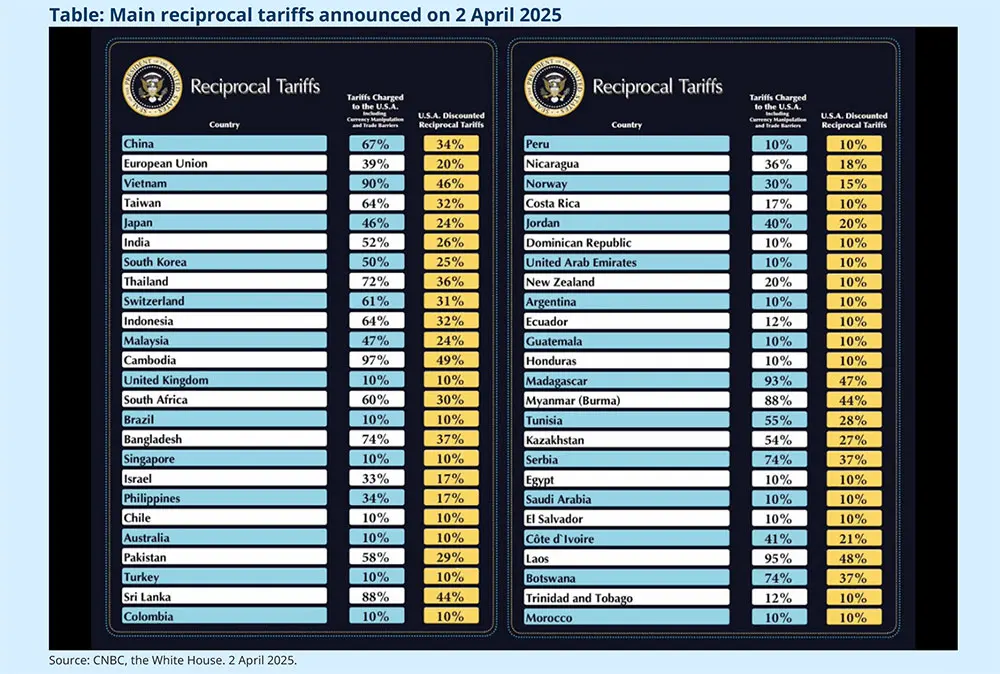

Main countries affected: Asia faces the highest tariffs, impacting not only China but also South Korea and most Southeast Asian nations, while Latam is relatively less affected. Longer term, the slowdown in globalisation will continue, with further re-rerouting of supply chains and new regional alliances emerging.

US economic slowdown. While tariffs may spike inflation in the short term, their real impact will be on growth, especially as the US economy already faces a significant slowdown amidst rising policy uncertainty. Therefore, the risk of a US downturn is growing, but at this stage it is still premature to call for an economic recession.

Investment convictions: Since such a large increase in tariffs had not been previously priced in by the market, the reaction has been with heightened volatility – a trend likely to persist in the coming weeks unless meaningful progress is made in negotiations, and a new trade framework begins to take shape. Market volatility is set to remain high in the next weeks. A marked slowdown in earnings growth is now likely, as costs could increase (higher labour and production costs). As the probability to move towards downside financial regimes increases, we have reduced the equity stance. We continue to believe it’s key to maintain equity hedges and gold. On US equities, we believe the impact will be more pronounced on US mega caps, while small and mid caps could benefit. On equity allocation, we continue to favour a diversified stance including selective emerging markets. On duration, we remain active with a positive stance in Europe and a close to neutral stance in the US. In currencies, as we already anticipated, the US dollar is likely to remain under pressure, while the Yen is acting more as a safe haven in the case of a sharp deterioration of the economic environment.

What has been announced?

If fully implemented, the new tariffs announced will raise the average US tariff rate to above 20%, its highest level in a century.

Trump has initiated the most significant challenge to the global trading system in nearly a century. With a blanket base levy of 10%, plus reciprocal tariffs – ranging from 10% to 49% – against some of the US's largest trading partners (see table on the next page), Trump has exceeded market expectations and even the commitments he made during his campaign prior to taking office. A 25% tariff on car imports was also confirmed.

With almost immediate effect (5th April for the base levy and 9th for reciprocal tariffs), these measures are estimated to send the effective tariff rate of the US from the current 6.6% to above 20%, its highest level in a century (Figure 1).

If the pending measures against Canada and Mexico and specific sectors were to be implemented, it could reach 30% (threatened rate in Figure 1).

Who is impacted the most?

Asia faces the highest tariffs, impacting not only China but also South Korea and most Southeast Asian nations, while Latam is relatively less affected.

Tariffs are hitting particularly hard the ‘Asian Factory’ (not only China, but also ASEAN1 and South Korea), given Trump’s aim of rebalancing the global trade system. Latam and Europe were relatively less impacted, while Canada and Mexico have not been addressed since the USMCA2 discussion is likely progressing in tandem.

Latam is emerging as a relative winner with ‘only’ a 10% import tax. Mexico so far has been let off the reciprocal tariff hook: although all foreign cars are subject to a 25% tax, auto parts coming from Mexico appear to be exempt. Additionally, Chile’s copper, a critical material for the US, seems to be excluded from these tariffs as well.

With regards to Asia several questions remain: What will happen to the current and also the upcoming Free Trade Agreements (FTAs)? What implications are there for Taiwan and its chip exports to the US? A major Taiwan semiconductor company is already expanding its capacity in Arizona, and in this context, exemptions appear to be under consideration for companies relocating to the US.

Additionally, some figures remain unclear. For instance, the so-called ‘China discount’ does not truly reflect a discount. The Trump administration is now considering a total of 54% in tariffs (34% + 20%). Furthermore, in a separate executive order, Trump is eliminating the de minimis exemption for small shipments from China, which would affect direct sales to US customers from Chinese sellers done through online platforms (64% of de minimis imports between FY2018-21 were from China, accounting for $149bn).

What can we expect now?

Trump has attempted to mitigate potential retaliation and opened the door for possible negotiations.

The announcement helped to end some of the tariff uncertainty, but it has not fully clarified the situation, as we will also need to see how other countries will react in terms of negotiations and how Trump will respond in case of retaliations.

Trump has attempted to mitigate potential retaliation by stating, ‘we are only taxing half the amount you are taxing us.’ However, it is unlikely that China and the EU will concur with the US assessment of the tariffs charged to the US, which claims that US products face tariffs of 67% from China and 39% by the EU. This assessment is not really an effective tariff rate, as it is instead based on the external balance position of each country, and likely non-trade barriers, currency manipulation, and other discriminatory measures were part of the investigation. This assessment leaves a marginal room for negotiation.

Trump has also suggested that tariffs will remain in place ‘until he determines that the threat posed by the trade deficit…is satisfied, resolved, or mitigated.’ We are starting to see negotiation proposals, such as those from the UK and Singapore, and we expect the news flow to remain very fluid in the next days.

The 10% universal tariff set for April 5 is likely to be implemented due to the tight deadline and the difficulty of global renegotiations, while the customised tariffs announced for April 9 may see changes and are the most open to negotiations.

We believe that what is currently unfolding represents just the first wave of Trump’s efforts to reorganise the existing trade and financial regimes. In the spirit of ‘short -term pain for long – term gain’, some degree of correction in the economy and financial markets may be acceptable as an initial step. In time, we expect a renewed fiscal impulse and potential tax cuts to trigger a new wave of momentum in both the economy and financial markets

How will tariffs affect the economy?

Tariffs will lead to a less favourable growth/inflation mix.

The US economy is slowing faster than markets had anticipated just three months ago, primarily due to extreme policy uncertainty. The higher-than-expected impending tariffs will further impact business and consumer sentiment, which already appears to have taken a nosedive, alongside heightened fears of rising unemployment. While tariffs will undoubtedly increase inflation in the short term, we believe their medium-term impact will be more detrimental to growth. In fact, tariffs pose a greater concern for growth than for inflation.

Although US recession risks are growing, at this stage it is premature to call for an economic recession. Fiscal policy remains strongly accommodative, the Fed is expected to continue cutting rates later this year, and oil prices remain subdued. Additionally, household and corporate balance sheets are not overly stretched. In short, the typical triggers of a recession are absent. However, we do expect to see a significant slowdown this year, with growth falling below potential and inflation pressure to rise. The main risk to our forecasts stems from ongoing policy uncertainty.

Globally, yesterday’s move and its magnitude have established the starting point for negotiations. The potential outcomes (retaliations, other commercial alliances, e.g., China-Korea-Japan, concessions…) and their timing are difficult to forecast. These factors will influence both linear and non-linear impacts on various growth and inflation trajectories.

What has been the market reaction?

Market reaction has been particularly negative across equity markets, with US equity indexes plunging 4-5% at the time of writing, and Stoxx Europe 600 down -2.6%, while the NIKKEI has closed at -2.8%. The yield on the 10-year Treasury fell below the year-to-date low, reaching 4.05%, while the 2-year yield, at 3.73%, reflects the market's pricing in of three anticipated rate cuts. Concerns about growth have continued to overshadow inflation fears for bond investors. Safe-haven assets such as gold, the yen, and Treasury duration are the main beneficiaries. Meanwhile, the dollar has shifted its role, behaving more like a 'US risk proxy' rather than a safe haven in times of uncertainty, a trend we have been anticipating.

What are the investment implications?

The pandora box has been opened. Investors should now expect more volatility and dispersion in both equities and rates.

The pandora box has been opened. Investors should now expect more volatility and dispersion in both equities and rates.

Pressure on the USD is likely to continue, while markets assess the downward impact on the US economy, new alliances budding in Asia, and the reaction of Europe to the Trump wake-up call. Against this backdrop, we reiterate our main convictions already asserted in our 2025 outlook and at the beginning of the year:

While it is premature to have strong conviction about the course of economic growth, we continue to believe that an economic recession in the US is unlikely. However, tariffs are expected to impact corporate earnings, primarily through pressure on profit margins due to rising costs – particularly producer prices and labour costs. Moreover, sectors that are the most exposed to tariffs could suffer additional setbacks: big corporations could be the hardest hit while small and mid-cap could be more resilient.

As the probability to move towards downside financial regimes increases, we have reduced the equity stance. In equities, we favour a diversified exposure towards selective EM (for example in China which is programming to increase fiscal spending to protect the economy and India) and Europe.

With increasing risks to growth, but also inflation pressure, an active duration stance is key. We currently favour European duration while we keep a neutral stance on US duration.

We continue to focus on enhancing diversification with gold, and keep hedges on US equities against a possible further deterioration of the earnings outlook, while the yen remains the optimal hedge in case the economic backdrop deteriorates faster than expected.