Summary

Uncertainty on policy and tariffs, and weakening US economic growth call for a continued rotation towards regions such as Europe and selective emerging markets that may offer strong long-term opportunities.

The recent IMF downgrade highlights how policy ambiguity could hurt global trade and economic activity.

The IMF raised inflation forecasts only marginally for this year; we think the disinflation trend should continue in medium term.

In such a context, the central banks’ task becomes difficult as they try to balance supporting growth and fighting inflation.

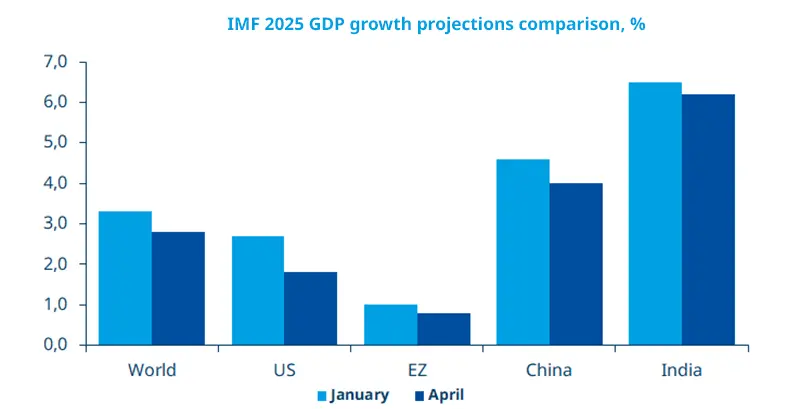

IMF 2025 GDP growth projections comparison, %

In its latest release, the IMF has slashed its global growth forecast compared to January, owing to the trade war and policy uncertainty unleased by the United States. 2025 global GDP growth is now seen at 2.8%, down from 3.3%, while for next year it is expected at 3.0%. Growth projections were cut across the board, with the United States having a sharp downgrade to 1.8% for 2025. We are more cautious on US growth amid concerns over consumption. European growth was not affected as much in the recent IMF projections. Germany is expected to show almost flat growth this year, following two annual contractions in 2023 and 2024. We forecast a mild expansion for the German economy this year. China was also downgraded, as the economy will be hit by external pressures from the United States.

Actionable ideas

Global bonds

In an environment of uncertain growth, government bonds such as those in EU could provide some stability. Investors may also explore high quality EU corporate credit for attractive returns.EM equities

Emerging markets equities such as those in India and Latin America offer good long-term prospects and diversification* benefits to global investors.

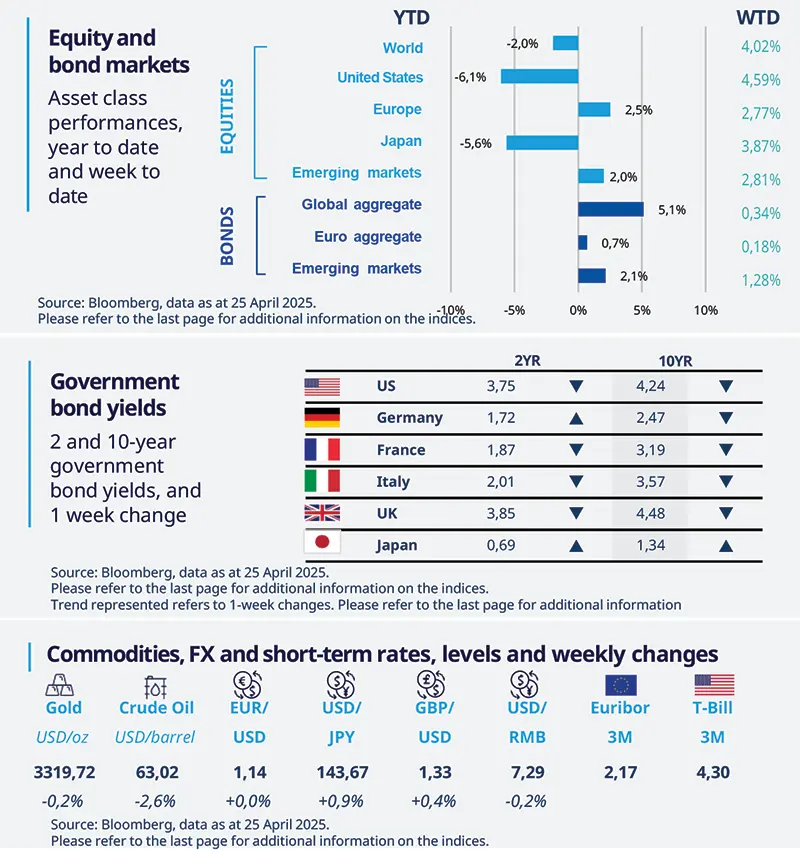

This week at a glance

In a week that saw corporate earnings from some large companies, equities got a reprieve on expectations President Trump may go easy on his stringent tariff measures. Concerns also eased over the removal of the Fed Chair. Bond yields were mixed, and gold touched new record levels during the week but later fell marginally.

Amundi Investment Institute Macro Focus

Americas

US labour market stays healthy, for now

US initial jobless claims printed at their lowest level since February (215K) in the week ending 12 April, suggesting a steady pace of job gains this month. However, other surveys point to less optimism in labour markets and business sentiment is also affected by tariff-related uncertainty. Given high ambiguity around tariff announcements, we think the labour market is expected to weaken over the coming months.

Europe

EZ composite PMI holds above the 50 threshold

EZ composite PMI dropped from 50.9 in March to 50.1 in April, pointing to weak growth. In particular, the services index fell below 50 for the first time in five months, while the manufacturing index rose slightly. This data suggests that the damage to EZ production from the US trade policy has been limited so far. However, it is difficult to believe that this trend will continue.

Asia

Business sentiment held up despite tariff news

Flash PMIs in Asia have held up well in April, against the backdrop of extreme trade policy volatilities. Japan’s composite PMI climbed to 51.1 in April from 48.9, driven by buoyant services sector activity and improvement in manufacturing output. India’s composite PMI edged up to 60 from 59.5, with new export orders surprisingly firming up. Australia’s figures ticked down marginally but held above 50.

Key dates

30 Apr GDP - US, Euro Area, Mexico; US PCE | 1 May Bank of Japan policy rate, UK consumer credit | 2 May US labour data, Euro Area CPI, India PMI |