Summary

Today climate change is arguably the most critical long-term challenge that humanity is facing. “Climate action failure” is not only the top long-term threat in the World Economic Forum’s Global Risks Report for 2022, but is also a key element for investors to factor in when building long-term assumptions on the economy and markets. Dealing with the changes driven by the energy transition is not about mere minor adjustments on some macroeconomic variables. It requires a complete rethinking of asset class returns forecasting and brings major implications for investors.1

This paper outlines the main findings from our annual asset class views document:

Discover our annual Asset Classes Views:...

In order to make the world less energy intensive and more climate efficient, policy makers will have to channel funds to the right investments. While on the one hand a targeted taxation policy could increase the cost of fossil fuels, a huge public and private investment effort is also necessary to support the transition. That is why central banks in particular will play a key role, for example through green quantitative easing and other non-conventional policies. This is a key element that needs to be factored in when forecasting long-term interest rates.

The side effect of higher energy prices will be lower productivity, which in turn will affect real growth and corporate profitability with uneven effects across countries depending on their initial energy mix. As such, the forecasting of equity returns and Earnings per Share (EPS) in particular will have to take cost pressures into account. In addition, since climate change will drive a commodity super cycle, access to key natural resources will be crucial and will shape a new geopolitical order, adding to a more fragmented world.

Over a 10-year horizon, in a central scenario that foresees warming remaining below 2°C by 2050, government bonds are only marginally impacted by the inclusion of climate considerations, even though they will offer lower returns than in the past, with the only exception of US Treasuries due to their lower starting level of yields and the inflationary environment. In the bond market, green asset reflation will be possible through monetary policies that help speed up the transition.

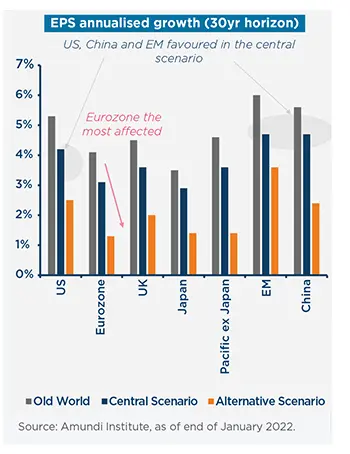

In equity, the reflation returns of the past decade are gone. We expect lower EPS growth to drive lower returns in the future. The impact will vary across regions, with the Eurozone most affected, while the US and emerging markets are more resilient. In this new and more challenging environment, investors should build their strategies around real returns. From a cross asset perspective, equities will be preferred with a focus on sector and country divergences. Some value sectors will be favoured, for example materials, energy and financials, highlighting a break away from the previous decade. The contribution of dividend yields to total expected returns will also be increasingly important. Ultimately, in a world of higher inflation, structural upward pressure on raw materials and huge infrastructure needs, real assets should be favoured and deserve a greater allocation.

The macro impact of the climate transition pathways

Higher inflation, huge investment needs (to be monetised by green QE) and increased

fragmentation.

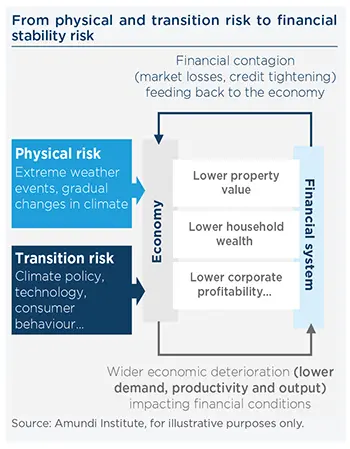

The rebalancing of energy sources at a global level will drive the transition towards a greener economy. This will not be linear and will come with increasing divergences across regions and countries depending on the starting point for each country on the reconversion path and the policies adopted. Furthermore, the transition will bring physical risks (related to extreme weather events and gradual changes in climate) and transition risks (relating to climate policy adoptions, changes in consumer preferences or the technology evolution for example) with varying degrees of severity across countries.

Monetary and fiscal policies will have to tackle these risks, as their initial impact on the economic outlook (through business disruption, higher commodity prices, migration...) could transfer to capital and financial markets where they could generate a perverse feedback loop through market losses and credit defaults further harming the economic outlook.

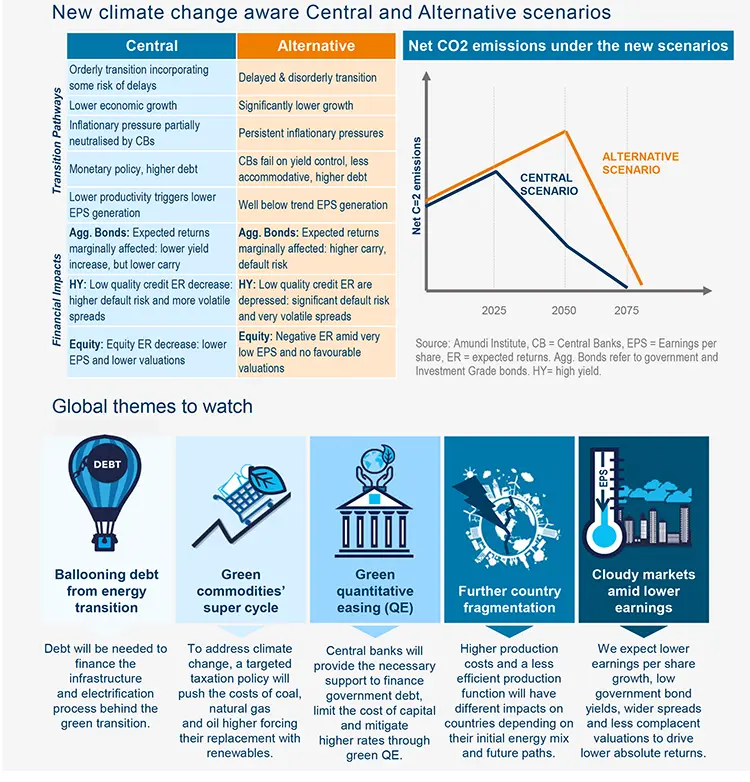

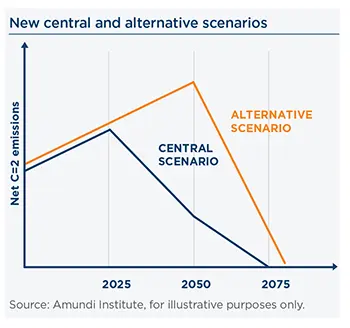

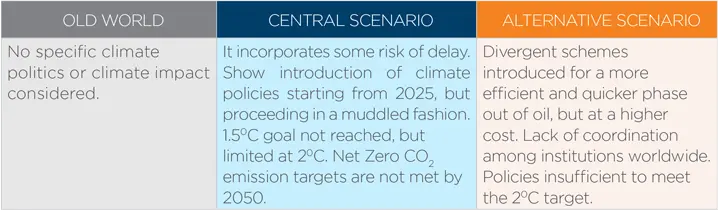

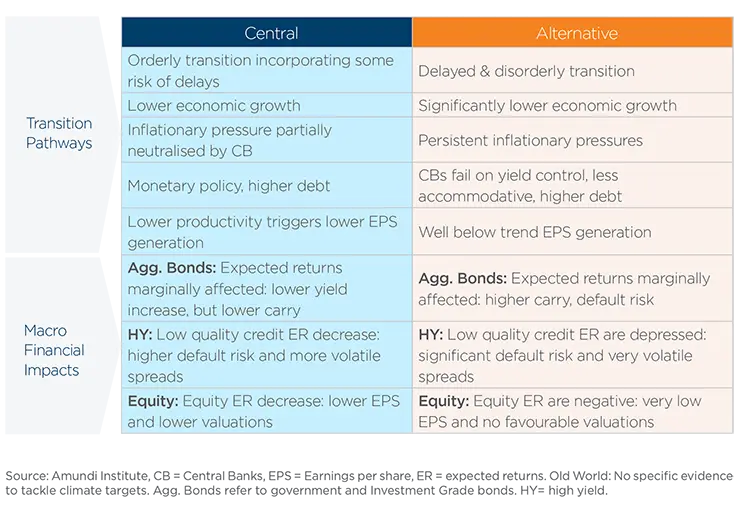

With this in mind, we assume a new climate-aware “Central Scenario” base case with a 30-year horizon and expect climate policies to be slowly introduced starting from 2025, but this will proceed in a muddled fashion, incorporating some risk of delays. Under such a scenario, the energy transition improvements will not be sufficient to meet the 1.5°C above pre-industrial levels goal, although we assume that global warming will stay below 2°C.

We also define a more adverse “Alternative Scenario” that will serve as a “what if” exercise. This scenario sees a significant lack of coordination among global institutions running mitigation policies that make it difficult to limit global warming to below 2°C. Ultimately, the transition to a Net Zero world would be delayed and the macroeconomic environment would worsen as the transition/ physical risks increase significantly. While the Central and Alternative cases present limited physical risks (e.g. chronic high temperatures, disrupted agricultural productivity, higher sea levels or cyclones and wildfires), they cause moderate to high transition risks that will unevenly affect growth and inflation dynamics.

- Central scenario: the impact on growth is marginal, while the erosion of household purchasing power by high carbon and energy prices (and overall higher inflation) will already be high in the next decade, particularly for high carbon users.

- Alternative scenario: while the delay in green policy adoption will limit the impact on inflation, fragmentation and the speed of the process will introduce more uncertainty, penalising investments and therefore growth particularly for countries with higher emissions (China, India).

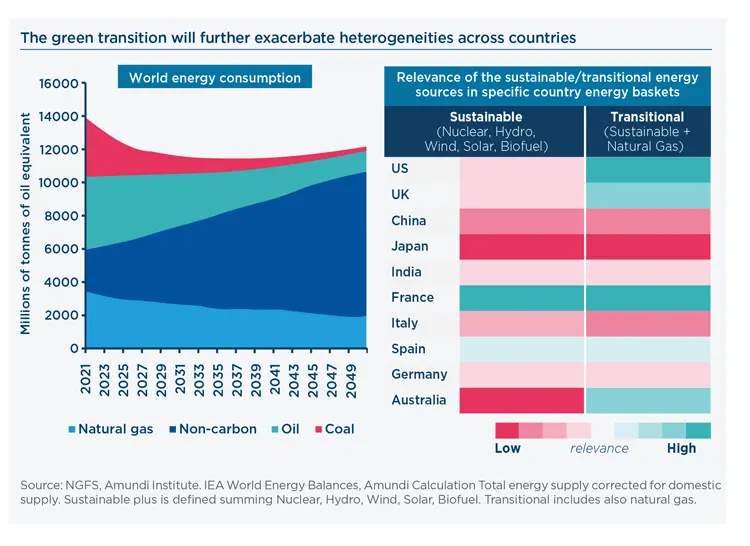

Overall, the energy transition will further exacerbate regional and country divergences, as the five main macro implications from an active Net Zero 2050 climate policy will all bring higher fragmentation.

- Ballooning debt will be a climate legacy. To address climate change a target taxation policy will push the cost of coal, natural gas and oil higher. The coal price is expected to increase most to force world production to become less energy intensive and more climate efficient. Debt will be needed to finance the infrastructure and electrification process behind the green transition.

- A green commodities super cycle will bring higher inflation starting with higher prices in less green commodities (coal, oil) forcing their replacement with renewables.

- The era of green quantitative easing will begin. Central banks will play a crucial role at different levels to provide the necessary support to finance government debt, limit the cost of capital and mitigate higher rates. Moving ahead, we expect green quantitative easing and further balance-sheet expansion.

- Heterogeneities across countries will be further exacerbated. Higher production costs and a less efficient production function will have different impacts on countries and regions depending on their initial energy mix and future paths. For example, France and the US are better positioned if we consider their sustainable and transitional energy sources. Efficient access to key natural recourses will be crucial and will drive geopolitical reordering.

- Expect lower earnings on the horizon and a less market friendly environment. Earnings per share will be lower on average. We also expect low government bond yields, wider spreads and less complacent valuations driving overall absolute returns lower. The fundamental picture will end in a less market friendly environment (from asset reflation to the green transformation).

Rethinking long-term equilibria to deal with the energy transition

Time to move to dynamic long-term trends and factor in green QE and higher costs in modelling

While acknowledging the enormous degrees of uncertainty on the transition path and the interconnections between variables (macro-economic, socio-demographic, environmental and financial) and the limitations of every model, we believe that revising the forecasting approach to incorporate the climate dimension is key to making better informed asset allocation decisions over the long term.

The energy transition will dramatically change the economic backdrop over the next 30 years. In particular, the forced economic shift towards a new green model will mean that traditional mean-reversion assumptions towards “old world” equilibria do not make sense anymore. Therefore, we assume that cyclical components will drive short and medium-term patterns for different risk factors, while over the longer term risk factors will convergence towards dynamic (no longer static) long-term trends.

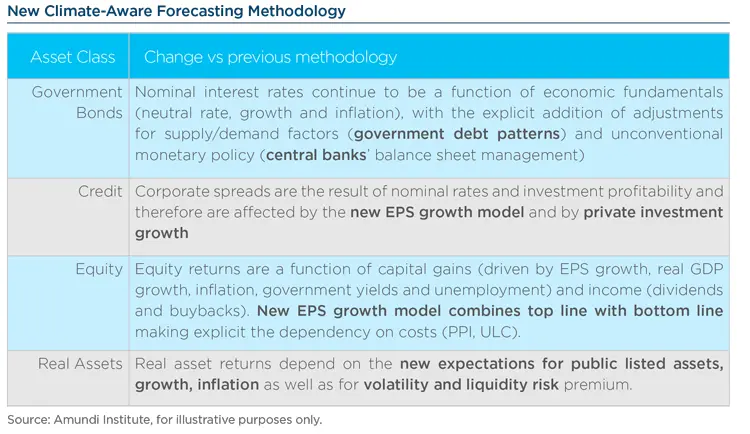

The move towards a new equilibrium will determine significant changes in debt patterns, commodity prices and production costs requiring a revision of capital markets assumptions modelling across various asset classes.

In particular, we consider whether huge amounts of public and private investment will entail unprecedented support from central banks to finance them even in more unconventional ways.

This entails explicitly factoring them into rate dynamics moving beyond traditional assumptions for nominal GDP and rate cycles. On the equity front, the major implications are for the forecasting of Earnings per Share (EPS). In fact, the reconversion of the production function to a greener one changes significantly the cost component. This means that the EPS growth model should combine both top line and bottom line assumptions. The impact is not linear and will vary depending on different macro-evolutions and specific countries’ sensitivity to energy and their different starting points in the green transition.

New climate-aware asset class assumptions and implications for investors

The age of green transition will offer fewer directional, but more relative value opportunities

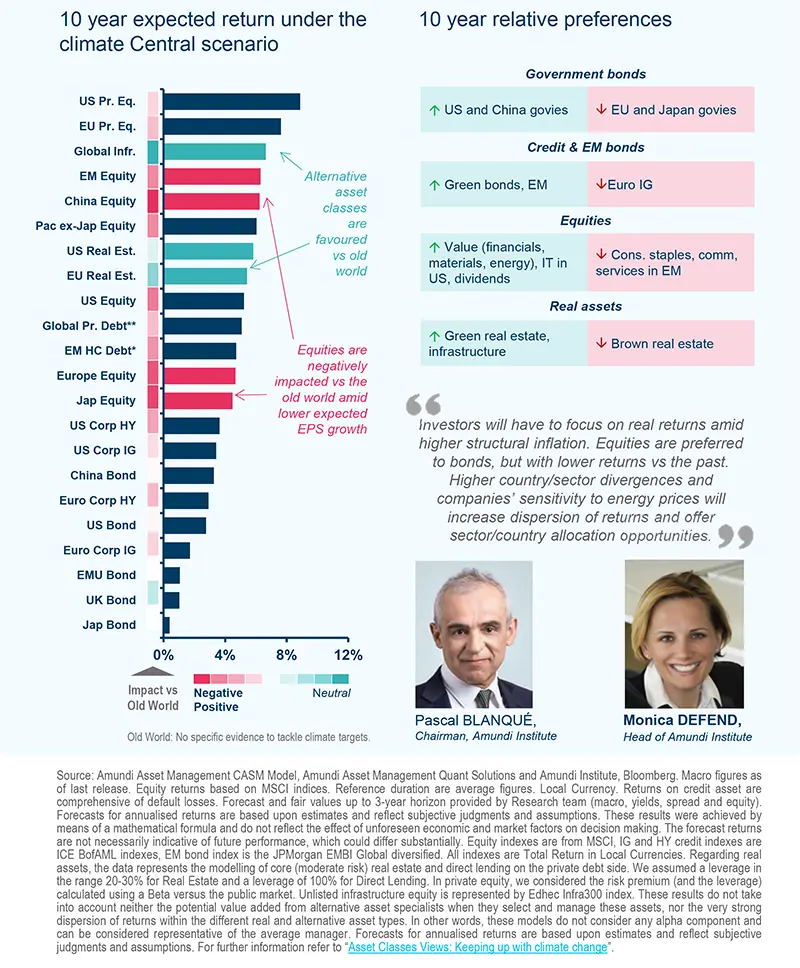

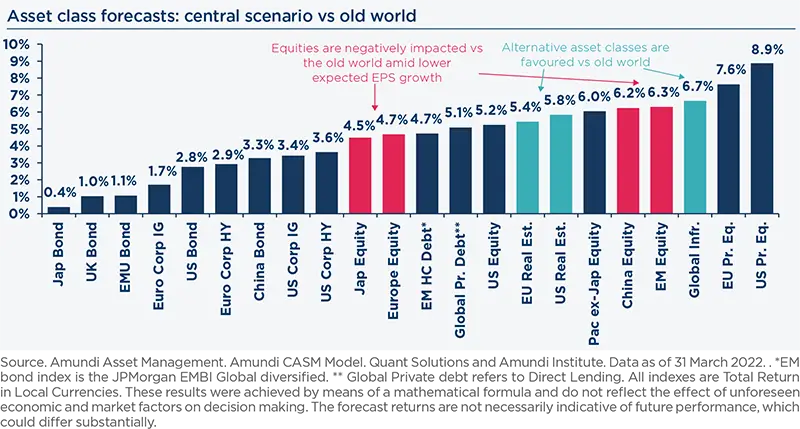

Over a 10-year horizon, expected returns will be somewhat lower under the new Central Scenario (embedding climate considerations) compared to the Old World environment, while the Alternative Scenario will be disruptive especially for equity markets. The transition will imply a general risk premium erosion with differences across asset classes.

Government bonds are only marginally impacted by the inclusion of climate considerations. Their returns will be challenged compared to the past decade, amid a lower starting rate and inflation challenges. This will be less the case for US bonds, as markets have already priced in part of the hiking cycle.

Credit and EM bonds will see general spread widening under the Central Scenario. The increased fragility of corporate fundamentals will have a negative impact on low credit ratings, causing higher volatility and default losses. Default risk and spread widening will be more extreme under the alternative scenario.

Equity: the reflation returns of past decades are gone. Even in the Old World setup, returns would have moved back to the long-term average. In the Central Scenario, returns will be impacted unevenly across regions and sectors due to the different impacts from ESG flows. Regionally, Emerging Markets and Asia should be favoured compared to the developed world.

When looking at the Alternative Scenario, the assessment changes completely. In fact, while the Central Scenario will see EPS annual growth for the next 30 years decrease by 20% relative to the Old World, the Alternative Scenario will see an astonishing 58% average decline in EPS growth.

Emerging markets will remain the most resilient, while Europe will be even more damaged compared to what is already anticipated under the Central Scenario.

While this is a low probability occurrence, it is important to consider how a delayed transition could impact unevenly across regions.

From a strategic asset allocation perspective the main implications for investors under the new climate-aware assumptions are:

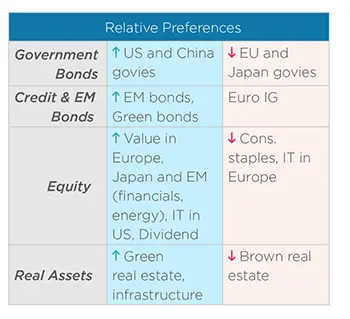

Asset allocation: investors will have to focus on real returns amid higher structural inflation. Equities are preferred to bonds but with lower returns versus the past. Higher country/sector divergences and companies’ sensitivity to energy prices will increase the dispersion of returns and offer sector/country allocation opportunities.

Bonds: green asset reflation will be possible via monetary policies aiming to facilitate the transition. This will favour green bonds globally. On a regional basis EM bonds, Chinese bonds and US bonds will be favoured.

Equities: some Value sectors will be favoured (Materials, Energy, Financials) – which is a change from the previous decade – with a Quality tilt (as Quality has more stable EPS generation), as well as the usual Growth sectors (IT, Communication Services), which is more a continuation of the past ten years. The contribution of the dividend yield to total expected returns will be increasingly relevant.

Real assets: in a world of higher inflation and structural upward pressures on raw materials and huge infrastructure investment needs, real assets will be favoured and deserve a greater allocation. Infrastructure is likely to benefit the most, while other real assets such as real estate could benefit from the higher inflationary environment.

Currencies: With somewhat lower growth and higher inflation via higher demand for commodities, the US dollar may be in demand at this delicate juncture. However, greater fragmentation and rising geopolitical rivalry may foster diversification among central bank reserves, potentially benefitting the Chinese Yuan and gold. Currencies from economies showing greater flexibility and a strong improvement in domestic conditions relative to external shocks may prove to be more resilient.

Hedging: as the Alterative Scenario (currently a low probability) has a significantly negative impact, any event pushing in that direction may cause spikes in volatility and risk-premia repricing. Investors should remain watchful and keep structural hedges in place.

Climate change risk has a specificity: it is not a risk anymore but a certainty. Climate change risk is therefore a question of magnitude, so we must envisage it differently.

The investment landscape is increasingly challenged by major transformations. Climate change in particular will have a nonhomogeneous impact across regions’ economies. This implies adapting portfolio construction to the new capital market assumptions to build more resilient portfolios.

In the climate change process at play, we can say that we’d rather know where we are today – unsustainable global warming trajectory – and where we should go – Net Zero that would provide economic and financial grid analysis integrating climate scenarios – in order to read the investment landscape and guide decisions towards the objective.

We cannot wait any longer to properly incorporate climate and ESG-related issues into our investment processes. We need to act despite the uncertainties and the modelling difficulties.

You can no longer build long-term performance and understand the risks in your portfolio without embedding ESG deeply into the traditional investment process through a best-in-class approach; as such it is a revolution in the making.

1 This paper outlines the main findings from our annual asset class views document "Asset Classes Views: "Keeping up with climate change”

Infographics