Summary

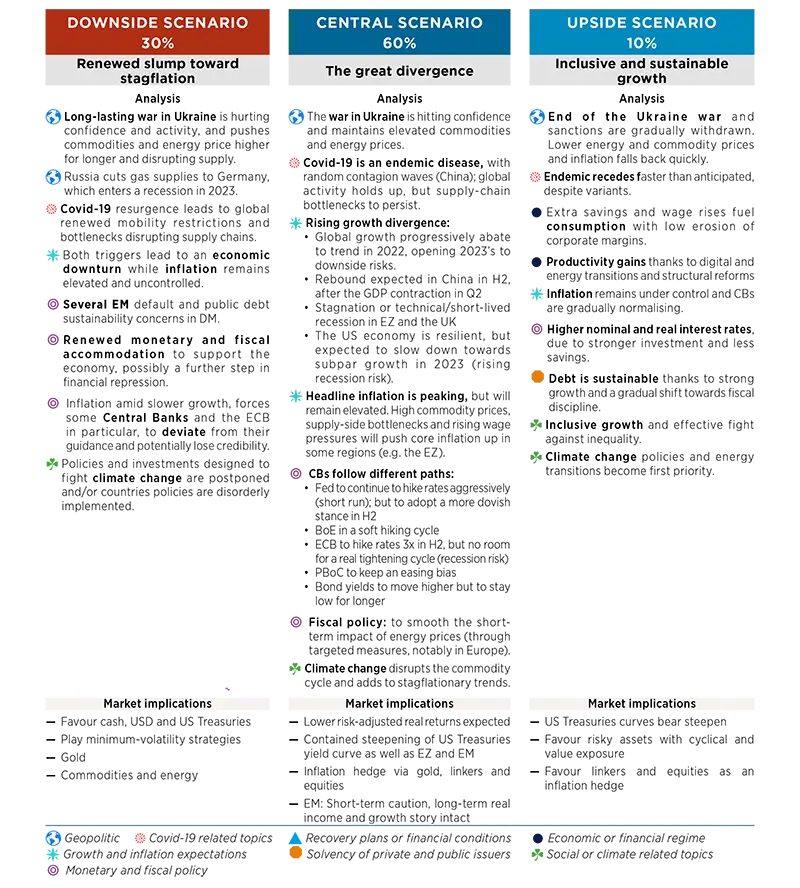

CENTRAL & ALTERNATIVE SCENARIOS (12 TO 18 MONTHS HORIZON)

Monthly update

We keep the probabilities of our central and alternative scenarios unchanged vs. last month. The new wave of Covid-19 and stagnation in the Eurozone are adding growth uncertainty over the short-term.

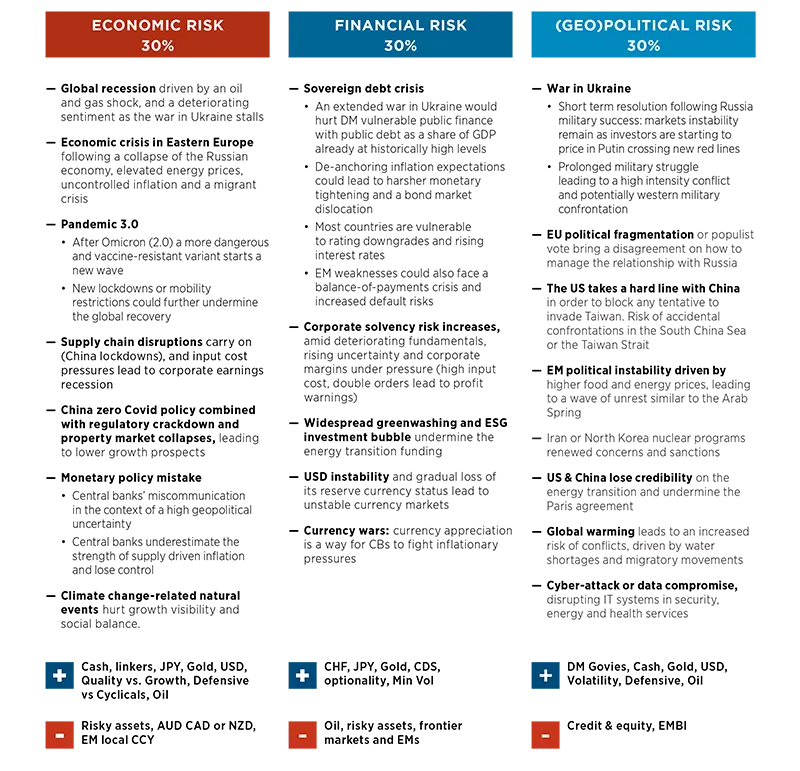

TOP RISKS

Monthly update

We maintain the probabilities of economic, financial and (geo)political risks to 30%. We consider Covid-19-related risks (including lockdowns in China) to be part of the economic risks. Risks are clustered to ease the detection of hedging strategies, but they are obviously linked.

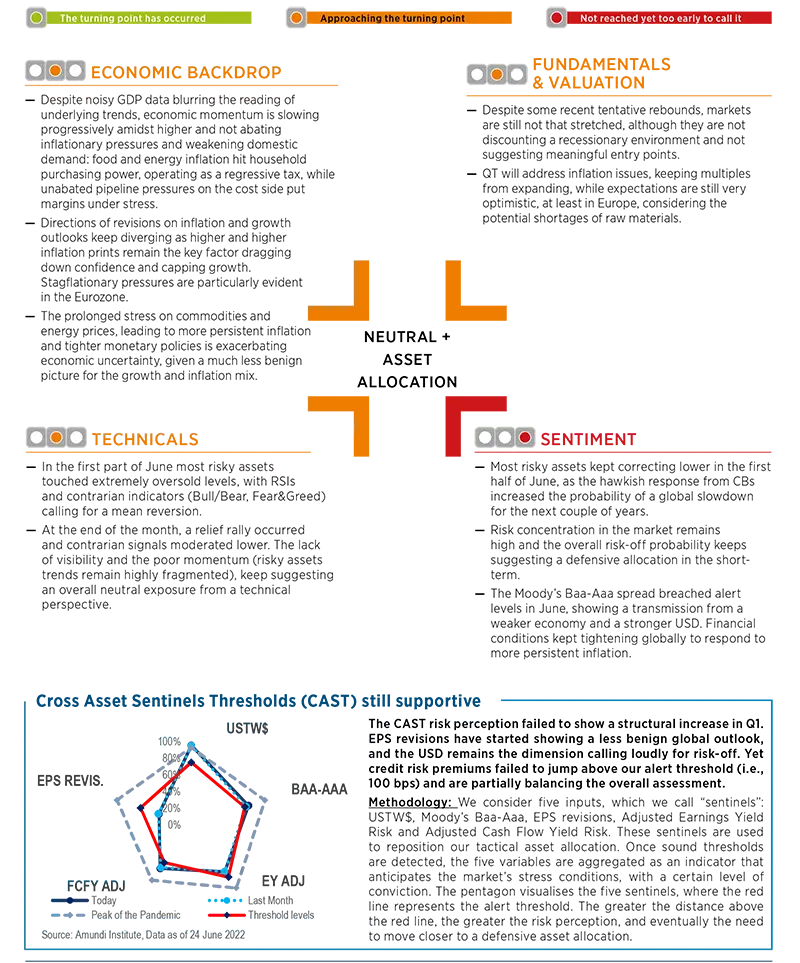

CROSS ASSET DISPATCH: Detecting markets turning points

GLOBAL RESEARCH CLIPS

1| Central Banks determined to fight inflation

- The ECB’s policy rate hike will depend on its ability to limit financial fragmentation.

- EZ fragmentation is the biggest threat the ECB is facing as it raises rates.

- A remake of 2011 is unlikely as the cost of debt is lower, nominal growth prospects are higher, and anti-fragmentation tools are already there.

- By accelerating the completion of the design of a new anti-fragmentation instrument, the ECB has shown a commitment to prevent the impairment of monetary policy transmission. As a result, a remake of summer 2011 should be avoided.

- The Federal Reserve plans to raise rates above neutral by yearend. The FOMC wants to pursue a more aggressive front-loading of rate increases, increasing the probability of a recession in the US.

- Bank of England likely to be capped on tightening by a deteriorating economy. We’re the most dovish on BoE vs the markets.

Investment consequences

- CB terminal rates: US @ 3.75% (slightly below the markets), ECB @ 1.25% and BoE @ 1.75% (both dovish vs the markets).

- Neutral on peripheral bonds, with flatter curves.

2| Lower growth and higher inflation is still the name of the game

- DM: faster deceleration to below trend growth for the US; stagnating growth for the EA with the rising risk of an outright recession.

- EM: We are revising 2022 Chinese growth on the downside, while upgrading commodity countries Brazil and South Africa.

- The war in Ukraine is having a various impact among EM countries, with some clearly benefiting from higher commodities & energy prices. The aggregate growth revision is flat, despite the downgrade to Chinese growth.

Investment consequences

- Positioning for stagflationary environment confirmed: equities still UW, OW inflation assets, UW in credit and OW govies & linkers.

3| Chinese equities: bad news is priced in

- More supportive policy signals and a gradual lift of the restrictions are leading to a more positive growth outlook

- Several factors behind the fall of Chinese equities since the beginning of 2021:

- new regulatory reforms, impacting mainly tech and property stocks;

- geopolitical tensions exacerbated by the conflict in Ukraine, followed by rising inflation and monetary policy tightening by most central banks around the world;

- delisting headwinds from the U.S. Holding Foreign Companies Accountable Act (requiring the companies listed on US stock exchanges to declare they are not owned or controlled by a government);

- Zero Covid tolerance.

- More supportive policy signals and a gradual lift of the restrictions in place (positive for growth) should stabilise the equity markets in the near future.

- China can be a good opportunity as a value trade, now that investors are looking to position themselves in an environment of high inflation.

- Fundamentals of MSCI China are calling for a rebound in the index from the correction that has taken place since 2021.

Investment consequences

- Long H shares, rates and commodities

4| Japanese equities decoupled from the yen

- In 2021 structural and cyclical forces supported a weaker JPY: Japan’s fundamentals weakened the most across DM, and ultra-loose monetary policy made JPY very attractive for funding strategies.

- We see a regime shift for 2022 onwards: fundamentals still justify a weak currency, and we see no imminent risks that the BoJ will change its dovish stance. Yet cyclical forces and competition challenges suggest most of the negative pressure should be behind us.

- Recessionary-like scenarios favour JPY and penalise Japanese equities:

- JPY has been pushed lower by structural and cyclical forces, but if a recession occurs the currency would be among the main beneficiaries;

- A recession would instead penalise Japanese equities, it being a cyclical market.

Investment consequences

- We see limited depreciation from current levels and expect a reversal of some of the recent losses over the next 12 months.

- USD/JPY targets, 129 in 6M (consensus: 130), 122 in 12M (consensus: 126).

5| Concentration risk is elevated by historical standards

- Volatility on rates is outpacing volatility in equities and FX.

- Historically, when the correlation among risk-sensitive assets rises, systemic risks turn much more acute.

- The ongoing risky assets sell-off has started with a low risk concentration as most of the move was translating into higher stocks volatility. The more the bear market has matured, the more gold and CHF have performed well, adding to the risk concentration.

- The current reading is above our internal alert, but we believe it may be too early for a mean reversion. The JPY has lagged its usual diversification pattern and its comeback may keep supporting a higher concentration.

- Although Amundi’s risk concentration index is currently above the alert level, we believe it may be too early for a mean reversion.

Investment consequences

- Tactically defensive cross asset allocation: ptf beta <1 and OW cash.

6| Markets are not yet discounting a recession

- The correction has closed the overvaluation. Now beware of the challenging environment ahead.

- What is priced in: the ongoing shift towards tighter monetary policy due to the elevated inflation regime.

- What is NOT priced in: the possibility of a profits or economic recession. The current underlying market narrative is not fully discounting the deteriorating margins, or the poisoned mix of liquidity drain, the deterioration in financial conditions, and productivity disruptions that have been starting to materialise.

Investment consequences

- Prices would therefore have to correct materially lower in a scenario of slower economic activity, with a subsequent worsening in employment and a downward revision in earnings.

- We reiterate the case for a cautious allocation towards risky assets over the following months, pending more visibility on profits.

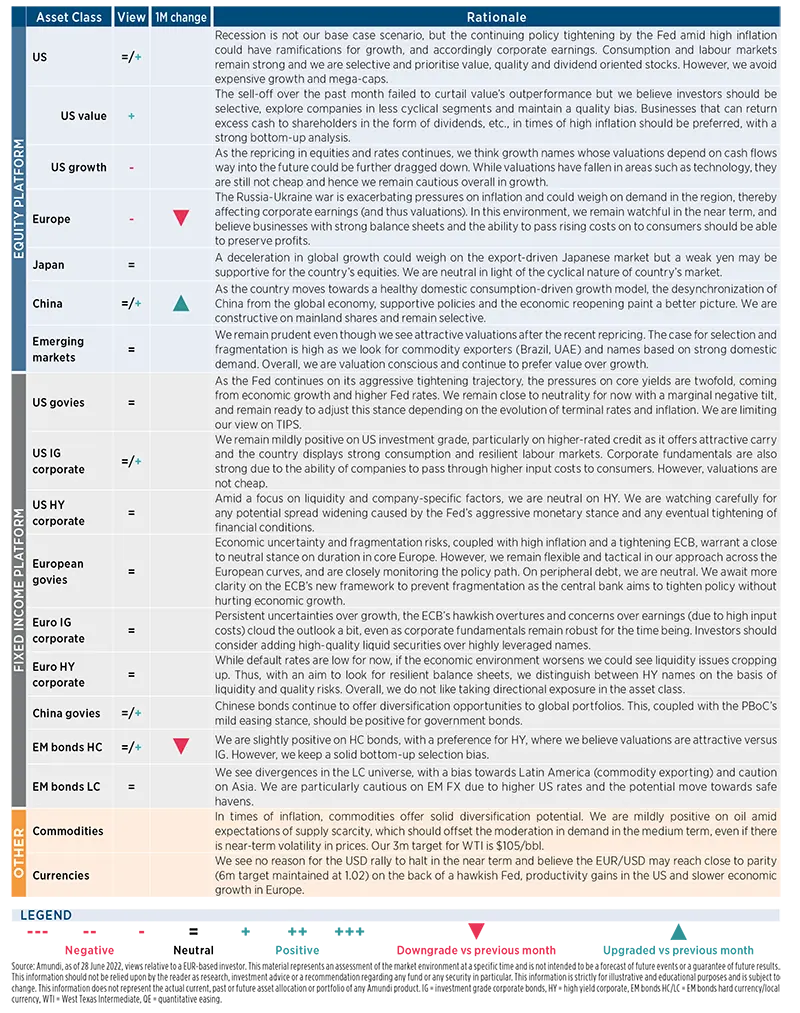

AMUNDI ASSET CLASS VIEWS