Summary

- Human activities erode biodiversity but biodiversity losses also impact human activities.

- Amundi’s event study1 is among the first of its kind, examining the linkages between biodiversity events and micro-level security prices (e.g., Brazilian corporate debt).

- Using National Language Processing (NLP) and the GDELT event database2, biodiversity is considered a risk that affects companies’ operations, reputations, finances and physical assets.

- The results highlight that companies in sectors most affected by biodiversity face a widening of their corporate bond spreads following acute biodiversity events.

Watch the video where Amina Cherief, fixed-income quant portfolio strategist unveils some of the main findings of the research:

BIODIVERSITY, HUMAN ACTIVITY AND CORPORATES

Biodiversity is part of the Earth’s natural capital and considered the cornerstone of a well-functioning planet. The many benefits to humans provided by natural capital are often integral to the provision of clean drinking water, waste decomposition and food productivity as well as being critical for human health and mental well-being (see Box 1)3. These benefits are known as ecosystem services.

Box 1: Ecosystem services essential for human activities and well-being

- Increases the stock of natural capital by contributing to crop pollination, soil fertility, air and water purification, flood control and climate regulation

- Sustains economic value creation by supplying fuel, water, food and wood

- Contributes to social value creation (e.g., recreational activities, spiritual well-being)

Biodiversity is vital for human activities and companies ((for example, paper companies rely on forests for wood production). However, human activities can erode biodiversity but biodiversity losses can, in turn, affect human activities. The latter is referred to as the double materiality principle of biodiversity (see Figure 1).

There are strong interlinkages between biodiversity, food security, climate change and socio-economic systems. This ensures notable second-order effects. For example, a specie’s extinction may threaten a full food web and trigger a food security issue, while climate change can accelerate biodiversity losses.

THE RELATIONSHIP BETWEEN CORPORATES AND BIODIVERSITY

The impact of biodiversity losses on human activities can be multifaceted and difficult to measure. In particular, companies often struggle to appraise their individual risks arising from biodiversity losses. Although they generally recognise reputational risk as an issue14, regulatory, operational, technological, market (consumers changing suppliers) and financial risks (limited access to finance) also exist. In order to gain an understanding of the links between biodiversity losses and companies, we decided to investigate the impact of biodiversity events on businesses’ operational capabilities15.

Box 2: Biodiversity losses affect companies’ operations that depend on forest products

Using a Carbon Disclosure Project (CDP) dataset (questionnaire), we examined the impact of biodiversity losses on businesses’ operational capabilities in relation to their dependence on forest products. We defined operational risks as increases in operating costs, disruptions in production capacities and supply chain disruptions.

On examining companies’ answers to the questionnaire, we saw that reputational and market risks dominated, while operational and regulatory risks represented a sizable share of the impacts. Tangible cases of operational risk included events such as forest fires or droughts that decreased crop yields or fruit production, but also a lack of pollination or insect infestation. Our analysis also showed that flora diseases could trigger higher operating costs, while damage caused by insect infestation may disrupt workforce management.

The above study illustrates the material impact of biodiversity losses on businesses’ operations. There were other risks mentioned by companies in the questionnaire relating to biodiversity. These included: regulatory risk which was viewed as being the cost associated with a new material’s certification; reputational risk which was linked to the cost of the additional reporting needed to address sustainability concerns: and technological risks which related a lack of access to crop varieties developed by other countries, or poor innovative responses to changing raw materials.

MEASURING ACUTE BIODIVERSITY RISK

Although there has been a notable volume of studies on biodiversity, to our knowledge, the financial industry has not provided research focused on the linkages between acute biodiversity events and the pricing of securities. Sector analysis has been popular for identifying which activities are the most dependent on biodiversity. However, in our view, appraising the impact of biodiversity loss on a company’s finances solely based on its sector activities might conceal company-specific features. Thus, the objective of our event study was to shed light on the impact of acute biodiversity events on the pricing of individual corporate bonds. In particular, we aimed to measure the risk of these events on Brazilian companies’ debt. The decision to focus on Brazilian companies was due to the Amazon rainforest being a home to the most diverse flora and fauna on the planet, making Brazil a “megadiverse” country.

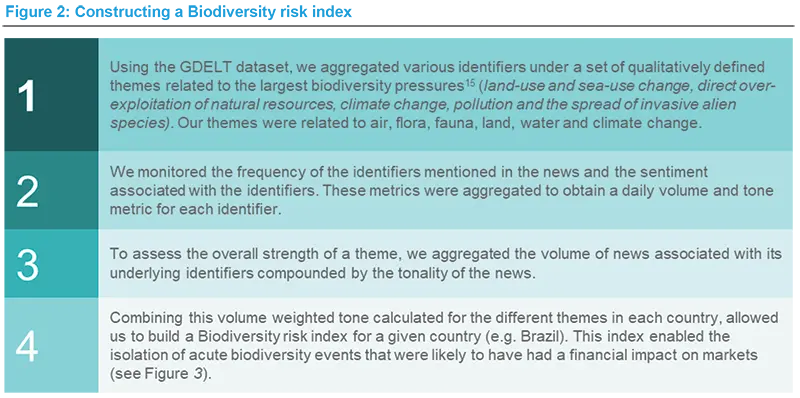

We used the Global Database of Events, Language and Tone (GDELT) dataset that records a large amount of global news for more than 23,000 identifiers. Importantly, this database provides the location of events and sentiment associated with the lexical field of biodiversity14. Our first aim was to determine a measure of biodiversity risk.

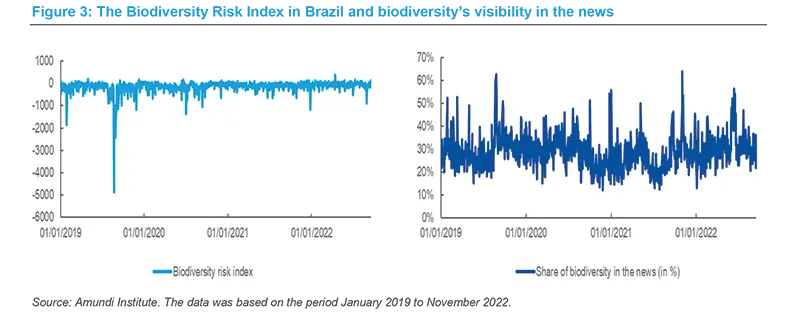

In Figure 3 below, it can be seen that biodiversity is more frequently mentioned in the press when risks are high, which we quantified with negative spikes in the Brazilian Biodiversity risk index (e.g., August 2019). In other words, the downward spikes correspond to substantial negative biodiversity events (see Table 1 below).

BRAZILIAN CORPORATE BOND SPREADS AFTER BIODIVERSITY EVENTS

We conducted an event study to investigate the impact of acute events affecting biodiversity risk on corporate bonds. To select notable biodiversity events, we split the Brazilian Biodiversity risk index (see Figure 1) into sub-indices related to air, fauna, flora, land, water and climate change (see Table 1).

Based on those sub-indices we selected dates where sentiment and news volume were the most negative and the highest. In doing so, we went back, as far as possible, to the first date on which the event appeared in the news. The Brazilian corporate bonds were drawn from the Intercontinental Exchange Bank of America Merrill Lynch Investment Grade Index (denominated in USD).

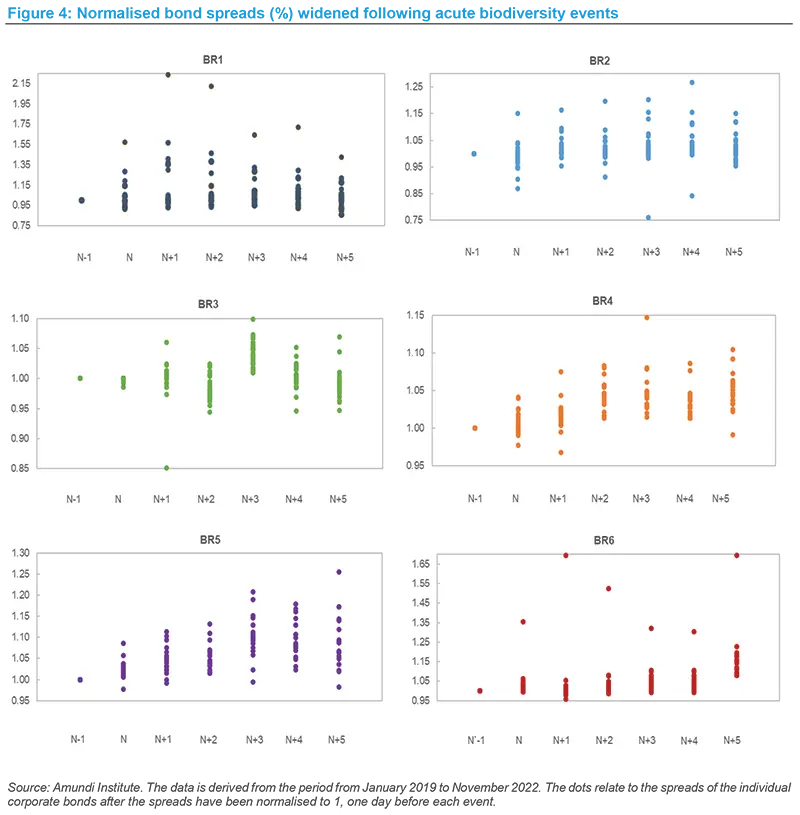

In Figure 4, we present the normalised bonds spread on the day before the event occurred and all 5 days after the event’s starting date. We normalised the spreads to 1, one day before each event and observed how the bonds spreads moved.

Our results indicated that in 83.3% of the cases after a negative biodiversity event, the average spread widened from the day prior to the event. Furthermore, we verified using a statistic test that the values of the average spreads in the following days after an acute event were significantly different from 1. In 20 dates out of 30, we noted the results were significant with a 1% confidence level.

To conclude, a widening of corporate bond spreads in reaction to acute biodiversity events highlights the issue of the potential future losses that may accelerate in the future as we reach biodiversity-tipping points. However, on a positive note, the widening of spreads following these events provides evidence of investors’ growing awareness of biodiversity issues and the necessity to integrate them into credit risk and valuation analysis.

Sources:

1 The Market Effect of Acute Biodiversity Risk: the Case of Corporate Bonds. There is limited research relating biodiversity to security pricing. In our paper, we examine the linkages between biodiversity and corporate bonds’ pricing as well as the data on biodiversity initiatives to date. We highlight the increasing acceptance of the Mean Species Abundance (MSA) metric as a state of biodiversity indicator.

2 The Global Data on Events, Location and Tone identifies the people, locations, organizations, themes, sources, emotions, images and events driving our global society every day across all countries.

3 Foll, J., and Minton, M., “There is no Place like Earth: How Investors can Address Biodiversity Loss”, Amundi ESG Thema, 0 (2022).

4 Greaver, T. L., Sullivan, T. J., Herrick, J. D., Barber, M. C., Baron,J. S., Cosby, B. J., Deerhake, M. E., Dennis, R. L., Dubois, J. J. B., Goodale, C. L., Herlihy, A. T., Lawrence, G. B., Liu, L., Lynch, J. A., and Novak, K. J. ,“Ecological Effects of Nitrogen and Sulfur Air Pollution in the US: What Do We Know?”, Frontiers in Ecology and the Environment, 10(7), (2012).

5 Ainsworth, E. A., Lemonnier, P., and Wedow, J. M., “The Influence of Rising Tropospheric Carbon Dioxide and Ozone on Plant Productivity”, Plant Biology, 22, (2020).

6 Falloon, P., Jones, C. D., Cerri, C. E., Al-Adamat, R., Kamoni, P., Bhattacharyya, T., Easter, M., Paustian, K., Killian, K., Coleman,K., and Milne, E., “Climate Change and its Impact on Soil and Vegetation Carbon Storage in Kenya, Jordan, India and Brazil”, Agriculture, Ecosystems and Environment, 122(1), (2007).

7 Verhulst, N., Govaerts, B., Verachtert, E., Castellanos-Navarrete, A., Mezzalama, Wall, P. C., Chocobar, Deckers, J.,and Sayre, K. D. (2010), “Conservation Agriculture, Improving Soil Quality for Sustainable Production Systems, Advances in Soil Science: Food Security and Soil Quality”. CRC Press, (2010).

8 Almond, R. E., Grooten, M., and Peterson, T., “Living Planet Report 2020: Bending the Curve of Biodiversity Loss”, World Wildlife Fund. (2020).

9 Ellwanger, J. H., Kulmann-Leal, B., Kaminski, V. L., Da Veiga, A. B. G, Valverde-Villegas, J. M., Spilki, F. R., Fearnisde, P. M., Caesar, L., Giatti, L. L, Wallau, G. L., Almeida, S. E. M., Borba, M. R., Da Hora, V. P., and Chies, J. A. B., “Beyond Diversity Loss and Climate Change: Impacts of Amazon Deforestation on Infectious Diseases and Public Health”, Anais da Academia Brasileira de Ciências (92), (2020).

10 Yang, G. J., Utzinger, J., and Zhou, X. N., “Interplay Between Environment, Agriculture and Infectious Diseases of Poverty: Case Studies in China”, Acta Tropica, 141, (2013).

11 Mooney, H., Larigauderie, A., Cesario, M., Elmquist, T., Hoegh- Guldberg, O., Lavorel, S., Mace, G.M., Palmer, M., Scholesand, R., and Yahara, T., ”Biodiversity, Climate Change, and Ecosystem Services”, Current Opinion in Environmental Sustainability, 1(1), (2009).

12 Duarte, C. M., Marbà, N., Gacia, E., Fourqurean, J. W., Beggins, J., Barrón, C., and Apostolaki, E. T., “Seagrass Community Metabolism: Assessing the Carbon Sink Capacity of Seagrass Meadows”, Global Biogeochemical Cycles, 24(4), (2010).

13 Lal, R., and Stewart, B., “A. Introduction: Food Security and Soil Quality, Advances in soil science series”, (2010).

14 Dempsey, J., “Biodiversity Loss as Material Risk: Tracking the Changing Meanings and Materialities of Biodiversity Conservation”, Geoforum, 45, (2013).

15 Using a Carbon Disclosure Project (CDP) dataset (questionnaire), we employ the question “F1.6a C2 ‘Describe the forests-related detrimental impacts experienced by your organization, your response, and the total financial impact’ Impact driver type” from CDP Forest Response dataset.

Read the long version of the paper