Summary

Macroeconomic focus

End in sight: Bank of Japan to complete policy normalisation

Japan’s Q2 GDP significantly outperformed expectations, soaring to a 6% SAAR* from 3.7% in Q1. This robust performance was primarily driven by a surge in exports, while domestic demand indicators, such as private consumption and imports, contracted. We have revised our 2023 growth forecast up from 1% to 2%, to reflect the Q2 surprise.

However, a divergence among sectors continued and we are not changing the growth profile for the subsequent quarters. A modest consumption growth is not enough to cancel out a contraction in exports, which will result in a mild economic slowdown in H2.

We expect private consumption to moderately recover in H2 despite the surprising decline in Q2. A steady increase in tourism, due to the economic reopening, alongside a tight labour market and increasing wage growth, will continue to support consumption.

Moreover, we expect the strong export performance to taper off, as manufacturing output and new orders fell further in August, indicating a weak demand.

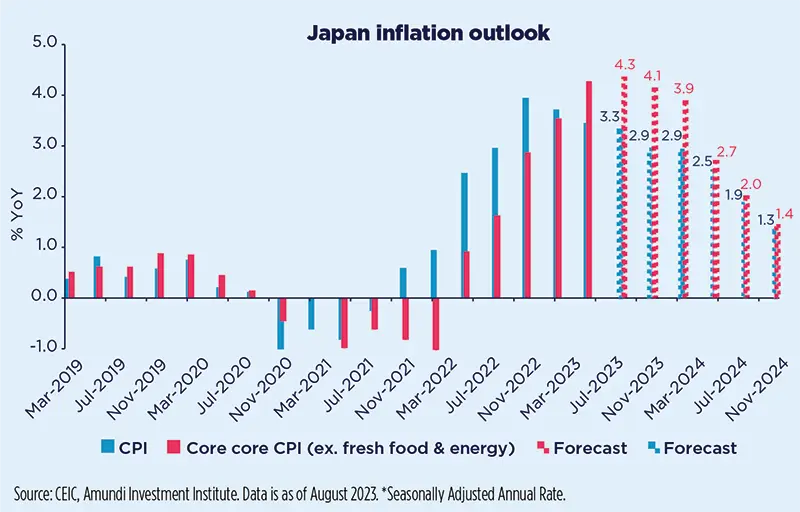

Finally, inflation persistently exceeded expectations, with the core CPI (ex. fresh food and energy) remaining above 4%. Inflationary pressure has remained strong across all measures. While we believe inflation has peaked and will start to decline, it will likely remain above the BoJ’s 2% target until mid-2024. Core CPI is likely to reach 4% by the end of 2023.

Persistent solid inflation prints pave the way for the BoJ to complete its Yield Curve Control (YCC) tapering. The BoJ started to allow for a controlled increase in the 10y yield towards 1% following its July meeting, having raised the strict cap to 1% from +/-0.5%. Market rates have gradually moved up, but have stayed below 1% so far, reducing the pressure on the BoJ to intervene. In its next move, the BoJ is likely to turn the +/-1% into a new reference band, without promising unlimited purchases of JGBs. The 18-19 December meeting or early 2024 are the most likely windows, if inflation proves to be stickier than expected.

Emerging markets

EM diversification amid exposure to China and US

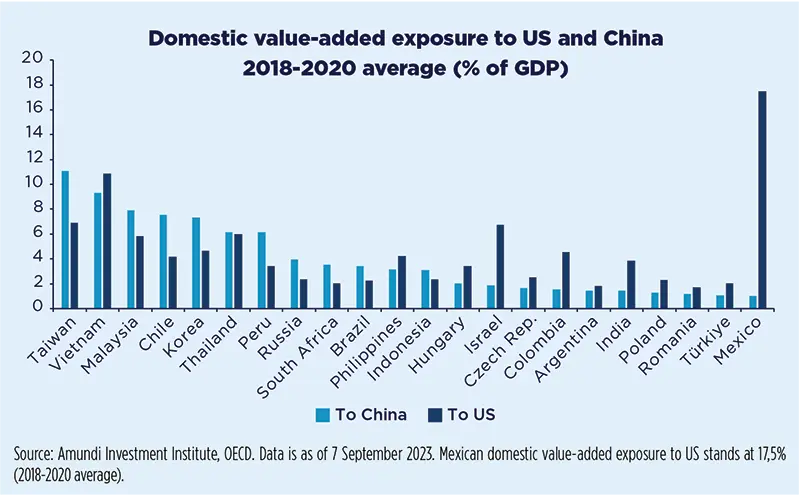

While confirming the growth premium remains in favour of Emerging Markets economies over the Developed Markets ones for 2023, the most recent economic readings and forecast revisions are signalling a reduction in that premium. The higher-than-expected resilience in Developed Markets prompted an upward growth revision there, while, in contrast, China is struggling more than expected, facing persistent acute weakness in its real estate sector as well as more moderate household consumption dynamics. The other Emerging Markets economies only partially offset this negative trend; indeed, growth dynamics are a mixed bag amid disappointing trends in South Asia, Eastern Europe and the Andean region, while large LatAm economies, such as Mexico and Brazil, or, in Asia, India and Indonesia have been showing robust momentum.

In China, recent data show that economic growth remains sluggish and below our initial forecasts. As policy decisions are gradually announced, they are being overshadowed by the persistent challenges facing various sectors, particularly the housing market, which has returned to a sharp correction mode. Despite the magnitude of easing, which could increase as economic growth slows, the pain threshold has become more uncertain. At this current juncture, we believe that to effectively revive growth, Chinese policymakers need to introduce a substantial fiscal easing package equivalent to at least 2% of GDP. However remains, a piecemeal approach is prevailing and the timing of much bolder interventions remains highly uncertain.

As far as LatAm is concerned, despite upward growth trajectory revisions for its two largest economies in 2023, their economic perspectives look somehow different. In Brazil, an exceptional agricultural boost in Q1 2023 has proven to be a one off and the economy should deliver zero/negative sequential growth in H2 2023 due to its very restrictive monetary policy. Mexico appears more insulated from the slowdown in China and is actually taking advantage of the near-shoring process; moreover, its exposure to the resilient US economy is resulting in much firmer domestic momentum than anticipated. If there is any risk in H2 2023 it would be a more pronounced recession in the US.

Macroeconomic snapshot

Due to still strong momentum in the US economy, driven by a resilient labour market and domestic demand, we have revised up our growth expectations for this year and delayed our call for material economic weakening to the first half of 2024 when we expect the tightening of monetary and financing conditions to hit the US economy; inflation will continue its downward path, with core stickier than headline.

Data flow on the eurozone front signals that some elements of resilience are gradually fading and, looking ahead, the most likely scenario is one of sluggish growth, where external demand is expected to moderate and internal demand will suffer from tighter monetary and financial conditions. Inflation will continue to trend lower, but core inflation will remain above headline for some quarters before converging towards target by the end of next year.

Regarding the UK economy, while we don’t expect a recession, we do anticipate some flattish quarters ahead as growth will be challenged by higher rates, a slowing labour market and a weaker external environment. The risk of recession, though, is increasing and recent PMI data show clear signs of deceleration, particularly in sectors that have been a bright spot so far. While we expect inflation to continue to trend lower, recent data show that core remains quite sticky and ongoing high wage growth poses an upside risk in the near term.

We have upgraded our full-year growth forecast for Japan to reflect the Q2 upside surprise. However, the divergence between the industrial and services sectors continues. Modest consumption growth is not enough to cancel out the contraction in exports, which will result in a mild economic slowdown in H2. Inflation has persistently exceeded expectations. We expect core CPI to increase at a 4% rate through to the end of 2023.

Following a mild downward revision in 2023 (from 5.1% to 4.9%), we have downgraded China’s 2024/2025 growth to 3.7%/3.4%, from 4.3%/3.9% respectively, reflecting our view of a more rapid and painful economic transition towards a lower 3% gear. We don’t expect a significant stimulus turnaround. The goal of Chinese policymakers is to manage the economic transition by moving away from debt-laden housing and Local government financing vehicle.

In August, Indian data confirmed a robust picture for growth with Q2 CY GDP printing at 7.8% YoY and lifting the CY 2023 GDP forecast to 6.4% from 6.0%. Domestic demand is proving strong, in both household consumption and investment. A drag in net exports is a consequence of this, driven by strong imports. Less positively, inflation printed higher than expected at 7.4% YoY for July, lifting the trajectory above RBI forecasts. Inflation should stay above target for the coming months and any easing by the RBI will be postponed to H2 2024.

The Turkish central bank increased its key rate by 750bps to 25%, surprising the market which was anticipating only 250bps. This decision follows the publication of the inflation report where forecasts were revised upwards (to 58% end of 2023 and 33% end of 2024) and where the risks to expectations were clearly identified on the upside. Additional hikes are expected before the end of the year. While growth beat expectations in H1, we expect it to slowdown sharply in H2 on the back of elevated inflation, stronger monetary and fiscal tightening.

Economic activity in Brazil is slowing in a fairly resilient fashion thanks solid labour market conditions and a positive supply shock courtesy of the agri sector. Sequential inflation is moderating though but will rise in annual terms amid unfavourable base effects in 2H. The Brasilian Central Bank has started cutting rates already and sees a gradual easing cycle ahead. Lula’s administration passed a new fiscal rule and submitted a balanced ’24 (primary) budget but risks are against it being executed as proposed.

Central bank watch

Easing cycle: a peloton of Emerging Markets Central Banks ahead of the game

Developed markets

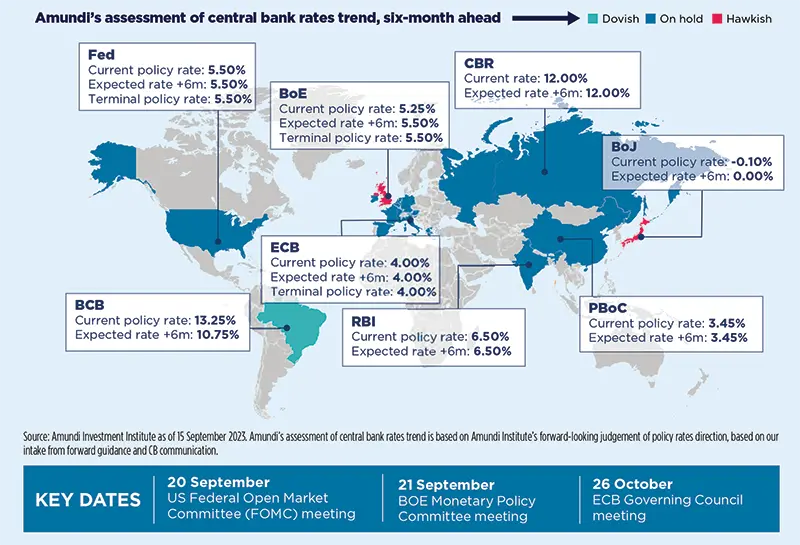

We expect a pause at the next FOMC meeting. However, the Fed could tighten monetary policy further on evidence that (1) persistently above-trend growth is putting further pressure on inflation or (2) the tightness in the labour market is no longer easing. The US economy is surprisingly resilient, thanks to its solid fiscal policy in particular. Some FOMC members have also observed that the real estate sector’s response to monetary restrictions may have peaked. Moreover, the job on inflation is not

yet done.

The question for the ECB is (1) whether inflation is still too high to risk a halt in tightening or (2) whether the economy is already weak enough to curb price growth on its own. Indeed, the outlook is deteriorating rapidly in the Eurozone. However, inflation remains too high. Domestic factors are now considered to be the main drivers of inflation in the euro area. The ECB has indicated that the rise in labour costs was the main reason for raising its inflation forecasts.

Emerging markets

While DM CBs may still be expected to hike, EM CBs have already started policy easing. Recent inflation readings, less disinflationary or surprising on the upside, didn’t change the direction of the expected easing, but perhaps marginally altered the pace or the terminal rate. The number of CBs switching to easing should increase in September, with the Central Reserve Bank of Peru (CBRP) and Narodowy Bank Polski (BNP) joining. In Peru, realised inflation and inflation expectations are looking increasingly more benign, opening the doors to easing; but the easing cycle should start slowly with El Nino risk looming and should then pick up in 2024. In Poland, despite inflation printing lower in August (10.1% YoY from 10.8% YoY), it failed to meet one of the pre-announced criteria for a rate cut (single-digit figure); however, considering the NBP’s strong bias on growth, the NBP delivered a surprising rate cut of 75bps in September. On a different note, in South Asia some CBs are still fine-tuning their normalisation (BoT) while others are likely to delay the start of easing due to higher-than-expected inflation (RBI) or tighter-for-longer global financial conditions (BI).

Geopolitics

Latin America’s geopolitical opportunities and risks

Central America both benefits and suffers from US proximity, while Pacific countries face a US/China balancing act.

Latin America stands to gain significantly from the geopolitical shifts underway. A likely commodity boom driven by the green transition and the need to diversify, the US Inflation Reduction Act, and the likely signing of the Mercosur trade deal with the EU will change Latin America over the next years. While the United States is interested in keeping its strong ties to Latin America, China wants to dilute US influence and cement its commercial ties, while also securing access to natural resources and important waterways. The EU is keen on binding Mercosur countries (Argentina, Brazil, Uruguay and Paraguay) closer to its orbit of influence. It is not only a matter of accessing consumer markets and commodities. Symbolism is also playing an important role, as powers vie for supremacy in terms of alliance networks. For example, several countries that have hitherto recognised Taiwan as a sovereign state have reversed their stance (most recently Honduras) in response to China’s diplomacy. Making the most of the opportunities arising from international interests will be a political challenge. Geopolitics, so far, has not been a priority for most political leaders facing domestic development and security threats. However, the new environment will require that political leaders adapt to balancing US and China’s interests. International crime, which the new environment will likely worsen (for example, illegal mining), will be an additional challenge. Moreover, diverging geographic priorities will also contribute to the difficulty of formulating a common stance.

Policy

The great return of risk premium on public debt

Investors should pay more attention to the dynamics of public debt than to monetary policy.

The rebound in government bond yields over the summer does not appear to be linked to monetary policy expectations. Instead, markets are beginning to take account of the sharp deterioration in public finances, particularly over the last three years.

While the US benefits from USD dominance and the safe-haven status of Treasury bonds, public debt well in excess of USD 30bn, the normalisation of the Fed’s balance sheet and rising interest rates have given markets other matters to worry about. Indeed, with the current trajectory, the debt-to-GDP ratio will reach 135% by 2028, and age-related spending on health and social security will further strain finances. A fiscal adjustment is needed but is highly unlikely in the near future.

The burden of public debt has not (yet) become unsustainable, and the US has plenty of room to raise taxes if needed. But, without corrective measures, high deficits and a lack of political consensus may justify a higher risk premium.

Conversely, despite the poor budgetary performance of several countries (France/ Italy), the Eurozone, as a whole, is performing better than the US, and its debt/GDP ratio has stayed almost stable since the financial crisis (although above 60%). Given fiscal policy remains an exclusive competence of Member States (MS), coordination and cross-border spillovers play a major role. The proposed reform of the Stability and Growth Pact would give MS greater room for manoeuvre, in exchange for greater responsibility (enforced by sanctions).

Scenarios and risks

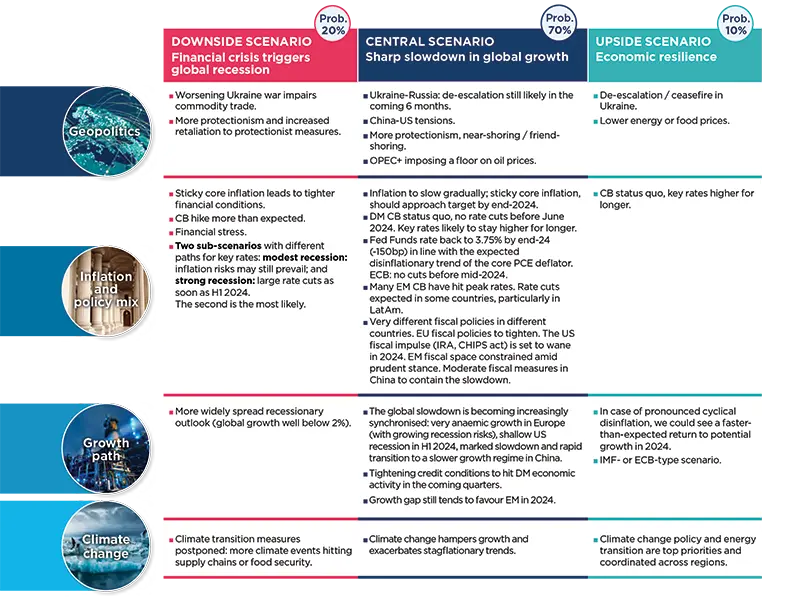

Central and alternative scenarios

Risks to central scenario

Amundi Investment Institute Models

Top-Down Macro Fair Value for S&P 500

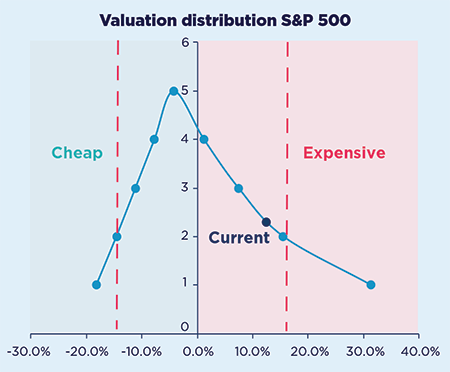

Markets remain very complacent about the macro-financial picture and current

levels already price-in a better picture than our central scenario.

What is the model about?

- The rationale: we believe that market price action varies in different regimes. Therefore, the assessment of market behaviour is essential to building a regime-based asset allocation, since: 1) Markets can make decisions based on an expectations discount process (valuation model); 2) They often diverge from fair value due to irrational expectations; 3) Each cycle has specific characteristics that markets usually price by diverging from the regime market’s behaviour.

- Model setup: as the world becomes more complex and dynamic, the concept of regular mean reversion is likely to be less effective than it has been in the past. In our view, dynamic forward-looking fair value, as a point to converge to and for assessing over- / under-valuation, is more suitable. These “Top-Down Macro Fair Values” are theoretical prices for an asset class calculated around an expected scenario, based on economic and financial variables.

- Model output: the pricing equation is specific to each asset class, as each one has its own sensitivities to specific macro / financial variables and the fair values are the outcome of this model. The variables used for the S&P500 Index are: S&P500 op EPS, 10-year UST, US real GDP, US CPI YoY, US unemployment and commodities trends.

What are the current signals?

- Despite the recent sell-off, there still seems to be an overvaluation of around 13% highlighting investors’ complacency.

- Even though markets do not seem to be in bubble territory, the recent profit recession and current normalisation in EPS, high rates and decelerating growth are inconsistent with the S&P500 at 4400-4500.

- Decelerating inflation and unemployment rates at historical lows supported the recent multiple expansion; nevertheless, it is very unlikely to gain further momentum from job markets, and inflation normalisation cannot entirely offset the weaker global growth and recession fears.

Source: Amundi Investment Institute, Bloomberg. Data is as of 23 August 2023. Valuation distribution is calculated taking into account the historical over- / under-valuation figures of the model since 1995. The chart shows the historical valuation deciles and the current one.

Infographic - Markets in charts

Equities in charts

Developed markets

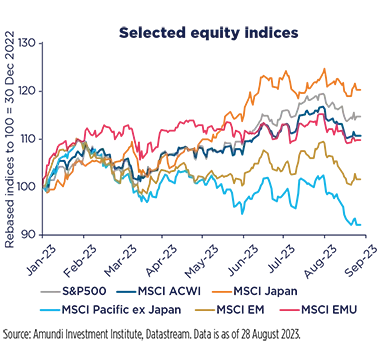

July’s rebound on the back of a reassuring earnings season did not hold up in August.

| Uneven regional performance |

|---|

Japan leads this year, followed by the US and EMU. Pacific ex Japan and EM extended their underperformance in August.

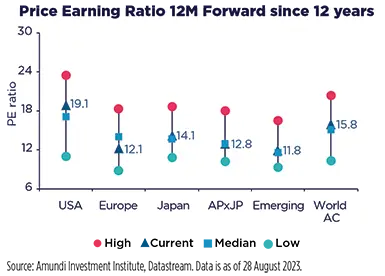

| Big valuation gap: US and Europe indices |

|---|

If the MSCI US remains the most expensive, most other regions are in line with their averages, with the noticeable exception of Europe.

Emerging markets

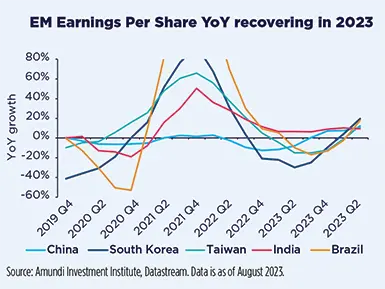

EM earnings are expected to rebound in the next 12 months.

| MSCI Emerging Q2 disappointing quarter |

|---|

MSCI EM Q2 2023 reporting season has ended and the final results are negative, confirming the decelerating trend.

| Earnings expectations improving |

|---|

Internal forecasts for a slight rebound in EPS growth for the next 12 months are coherent with the expected decoupling of EM growth vs developed market growth.

Bonds in charts

Developed markets

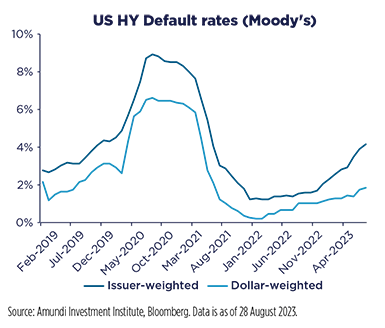

HY default rates continue to rise, both in terms of issuer-weighted and dollar-weighted.

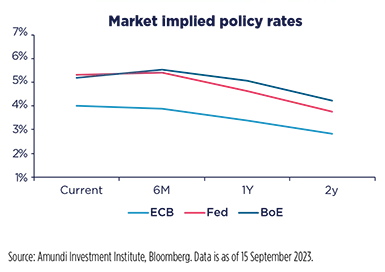

| Markets imply a closer terminal rate |

|---|

Following the latest CB meetings, markets’ implied rates moved closer to their expected peaks, particularly the BoE terminal rate which was revised down from 6.5% in early July to 5.75%/6.0% currently. ECB terminal rate up to 4% from 3.75% after the last rate hike by the European CB.

| HY defaults rising, mostly among small caps |

|---|

US HY Default Rates were 4.2% in July, up from 3.9% in June and 3.5% in May. In dollar-weighted terms, they are still low by historical standards.

Emerging markets

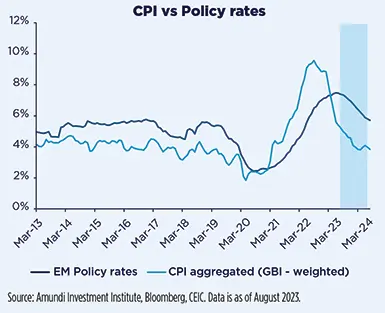

Both the CPI and the policy rates have peaked and this will favour EM lower yields.

| Markets express bearish China’s view via FX |

|---|

EM currencies have performed well so far this year, benefitting – among other factors – from our view that the dollar will weaken throughout the year.

| EM local bond yields to go lower |

|---|

Inflation in emerging markets peaked in Q4 2022 and monetary policy is peaking now. These two effects are going to favour lower yields in the coming months.

Commodities

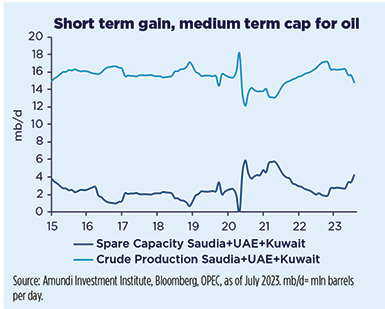

Evidence of tightness in oil

Modest deficit in 2023, less discipline from OPEC+ in 2024.

OPEC+’s pledged cuts are starting to show, and seaborne volumes suggest further efforts to reduce supply are under way. Meanwhile, demand remains resilient, albeit with downside risk, especially from China, which accounts for half of the projected

growth. As a result, we expect a modest 0.5/1 mbd deficit by late 2023, emphasised by depleting crude stocks, a deepening backwardation in timespreads, and by intensifying pressures on refining (as OPEC+’s disproportionate cuts reduce the supply of medium sour crude). A US détente with Iran and/or Venezuela could erase a $5/b premium amid limited support from tactical patterns. We see Brent prices anchoring in our $85/b-$90/b target range, ending 2023 closer to the higher end. We expect more volatility in 2024 within a similar trading range, as OPEC tries to release its surging spare capacity.

Currencies

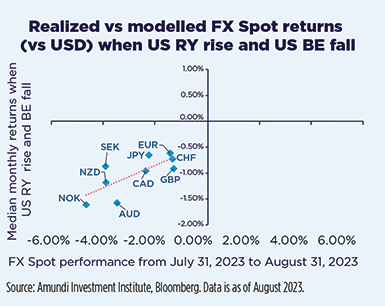

The FED and the lack of symmetry in the FX markets

In our view, an approaching FED pivot and the structural shift in the global bonds market may soon create non-symmetrical market behaviour.

Since July, the US economy has been surprising on the upside, particularly when compared to other regions where, beyond China, Europe’s weak economic momentum is becoming a concern. This has pushed US real yields higher and, in turn, highlights risks of further USD upside in the short term. However, given progress on US inflation, the contraction in consumption and our expectations for the US in H1 24, this US exceptionalism may not last long. An approaching FED pivot and the structural shift in the global bonds market (where the percentage of negatively-yielding debt has plunged) may soon create non-symmetrical market behaviour, where FX sensitivity to US news will be much higher than for data coming from abroad. Despite the lack of clarity, we see this as a headwind for the USD.