Summary

Macroeconomic focus

If only LatAm’s fiscal policy could mimic its prudent monetary policy stance

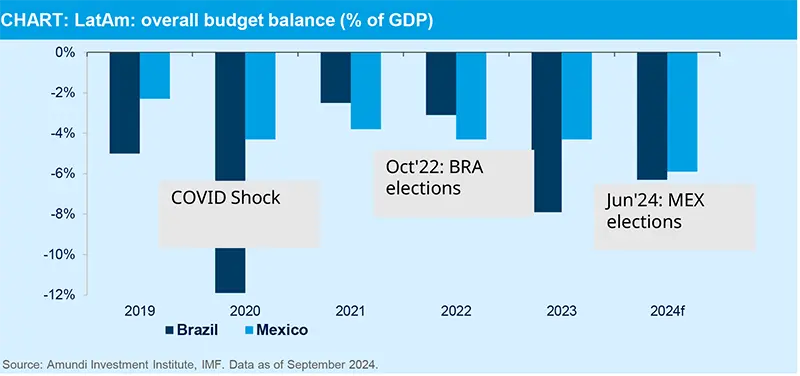

While monetary policy in LatAm has been nothing short of prudent, both on the way up and down, LatAm’s post Covid and post elections fiscal consolidation has not, or not yet, gone sufficiently far enough. The situation appears most pressing and politically challenging in Brazil and Mexico as highlighted below.

In Brazil, President Lula’s early overhaul of the country’s fiscal framework has allowed fiscal spending to grow in real terms after a far more stringent stance under Bolsonaro. But it was the change in the fiscal targets earlier this year alongside very robust growth in spending (above the allowed ceiling) that has made markets uneasy about where things are heading - the country needs a bulky primary surplus in order to stabilise its already high debt ratio. Thanks to Haddad’s relentless efforts the 2024 (official) primary deficit target looks within reach (0.00%+/-0.25) with far more challenges ahead. Moody’s generous credit rating revision - to only one notch below IG and a positive outlook - will boost the FinMin’s political capital and likely make him even more determined to anchor Brazil’s fiscal expectations with Lula’s goodwill in place for longer.

In Mexico, AMLO’s* fiscally austere stance survived the Covid years but not the elections, with the overall budget deficit expected to widen from slightly over 4% of GDP in 2023 to around 6%. AMLO’s Hacienda* guided for a huge 3pp deficit reduction earlier this year which sounds highly unlikely in light of slowing growth and the new President’s ambitious social agenda and policy priorities. Still, we think Sheinbaum’s 2025 budget, out on 15 November, is likely to propose fiscal consolidation of at least 2pp leaving the rest for 2026. That would ease the markets’ concerns about the extended fiscal starting point with investors’ patience having already been heavily tested by the recent passage of the Judiciary reform.

*AMLO refers to Andres Manuel Lopez Obrador, Mexico’s president from 2018 to 2024 and Hacienda refers to the Mexico's fiscal authority.

In LatAm, fiscal consolidation efforts post-Covid and post-elections still have a long way to go

CHINA

All eyes on fiscal policy

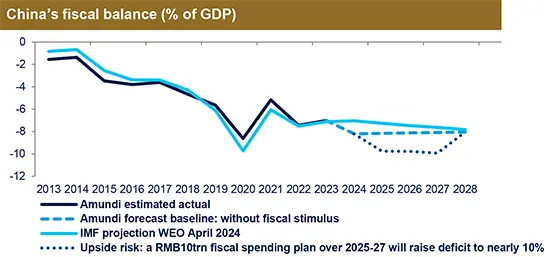

China’s policy shifts have sparked market optimism, prompting us to become cautiously optimistic on Chinese assets. The monetary easing and housing policy adjustments signal a renewed effort to support the economy, but seem unlikely to single-handedly reverse the slowdown. While these moves should help stabilise market sentiment in the short term, the real test will come from whether fiscal measures follow.

Details of fiscal spending are still missing, but consumer-oriented spending has to reach at least RMB 1tn (0.8% of GDP) to be effective in stimulating consumption and addressing deflationary pressures. Multi-child family subsidies and increased social security for low-income households are key areas to watch.

Source: Amundi Investment Institute, IMF as of 1 October 2024.

INDIA

Mild economic softening to support rate cuts

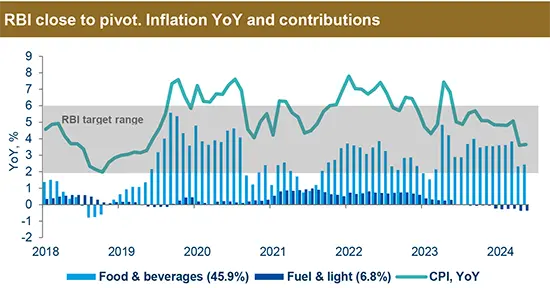

Indicators such as electricity generation, cement, and steel production show a mild economic softening over the summer. This trend aligns with GDP figures falling below 8% YoY, yet still robust compared to global growth at 6.8% YoY for CY24.

Despite weak July and August data, inflation is expected to rise to around 5% YoY, returning to the upper bound of RBI target range from September and stay there for the rest of the year.

Without reading too much into the latest inflation figures, we continue to expect RBI starting its easing in the current quarter, with 25bps of cut. At the same time, we reiterate the view that RBI has a limited room for easing if it wants to adhere to its neutral real rate, assessed in the range of 1.5%-2%.

Source: Amundi Investment Institute, CEIC. Data is as of 1 September 2024.In the chart legend, numbers between brackets are each component’s weight in the CPI basket.

Macroeconomic snapshot

The Fed shifted its focus from inflation to growth in an attempt to avoid a significant deterioration in employment. The US economy seems poised for a soft landing, with deceleration being driven by consumption and an easing labour market. Gains in productivity and softer demand should allow inflation to ease further - even for the sticky service component - and reach its target by mid 2025.

While we still expect Eurozone growth to gradually firm towards potential, activity indicators seem to be faltering, highlighting downside risks for the domestic demand outlook. Disinflation continues with some downside surprises. Growth and inflation patterns remain mixed across member countries, as do vulnerabilities to external factors.

The UK economy surprised on the upside in H1. Recent data revisions also pointed to past growth being somewhat firmer than previously assumed. We still expect some growth moderation in H2, associated with further disinflation, allowing a gradual easing of monetary policy.

Wages and inflation in Japan surprised on the upside, prompting us to revise up inflation forecasts. Core CPI gauge is now likely to settle at around 2% instead of moderating further, enabling the BoJ to hike more. Political uncertainties are expected to drop after the 27 October general elections, alleviating BoJ concerns about hiking in tight market conditions.

While September inflation data in Turkey declined from 52.0% YoY to 49.4% YoY, the drop was smaller than expected due to monthly growth remaining strong, at 3.0% MoM. The disinflationary path expected in Q4 as well as a prudent increase in the minimum wage for 2025, should drive a possible pivot by the CBT. The latest inflation data remains consistent with a first cut by December.

A few hours before the Fed delivered its first rate cut, Bank Indonesia (BI) started its easing cycle with a 25bp cut. A well anchored inflation path - within the target range since June 2023 - and decent growth dynamics, allow the BI to proceed with its gradual easing cycle, taking rates in the 4.0-4.5% range from 6.0% currently.

Brazil’s robust economy YTD has caught the attention of Moody’s, who revised its rating one notch higher to be only one notch below IG. Inflation has been well behaved, but the ongoing drought will add inflationary pressures over the coming months. BCB - which hiked hours after the Fed’s 50bp cut - is likely to accelerate the tightening pace, also by 50bp at its next meeting. The budget review was a slight disappointment in terms of budget freeze announcements, but the 2024 target remained unchanged.

Mexico’s economy did better in Q3 but this is likely to be a temporary bounce rather than the end of a soft patch that has lasted three quarters. In light of the soft growth outlook, the unwinding of the volatile components price spike and the Fed’s easing, Banxico delivered a slightly more dovish than expected 25bp cut in late September. We see the CB cutting in clips of 25bp per meeting, at least in the near future, while policy continuity and more constitutional reforms by Claudia Sheinbaum will be in line with her inaugural speech.

Central banks watch

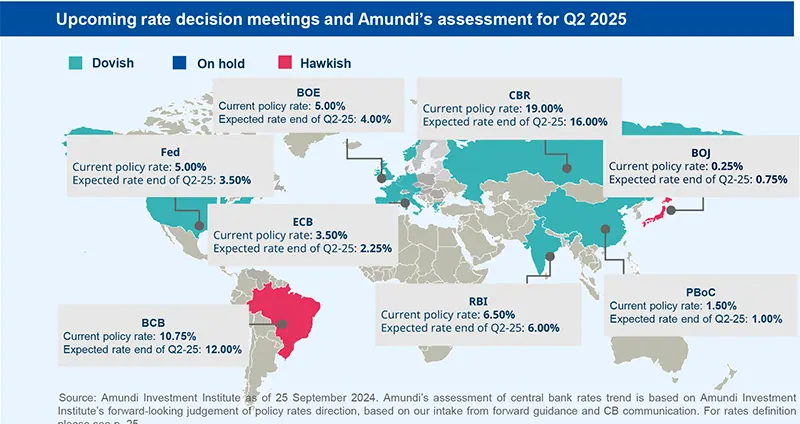

Fed pivot paves the way for more easing across DM, while many EM CB remain in easing mode.

|

Developed Markets |

Emerging Markets | |

|

The Fed delivered a 50bp rate cut at its September meeting, bringing the Fed Funds rate to 4.75%-5.00%. Such a large cut underscores the Fed’s willingness to pivot after the recent labour market softening and diminishing upside risks to inflation. We expect further 50bp cuts by year-end. The ECB cut rates in September as well and - even if stickiness concerns remain - the case for further cuts has strengthened, given the recent moderation in wage growth and rising signs of slowing growth momentum. We expect further The BoE started cutting rates in August and - after keeping them on hold in September - is expected to keep reducing policy tightness with two further cuts before the year end. In contrast, the BoJ signalled it will resume hikes when uncertainties drop. We expect one 25bp hike by the year end and another in May 2025. |

The Fed’s dovish pivot has not generated a wave of more dovish expectations across EM CB. The latter’s action has continued in a business-as-usual way, with some further easing in the Czech Republic, Peru, Hungary, South Africa, Chile and Mexico, while Brazil and Russia hiked their policy rates as expected. The only surprises came from Asia: first, Bank Indonesia surprised by cutting rates a few hours before the Fed. However, easing was expected in alignment with the Fed’s pivot Second, the PBoC cut policy rates more than expected by 20bp and - surprisingly - cut RRR by 50bp at the same time. It also launched two liquidity programmes to support the capital market, leading to big rallies in equities. Switching to LatAm, for t he second consecutive month fiscal noise got in the way of monetary policy: we adjusted our expectation for Colombia MP policy rates up by 50bp by year-end, frontloading a smaller cut.

|

Key dates

|

17 Oct ECB Governing Council |

7 Nov US Federal Open Market |

7 Nov BOE Monetary Policy |

Geopolitics

Growing risks require investors to adapt

Since Russia’s invasion of Ukraine and the Hamas attack, we have seen worsening bilateral relations. More countries are contributing to higher geopolitical risk, which is evidenced by our Geopolitical Sentiment Tracker. It is likely that the level of geopolitical risk will grow further this decade. First, there is the evolution of Russia’s war goals: it is increasingly likely that Russia’s ambitions are morphing from territorial expansion towards eroding the Western-led global order. In that regard, the growing Russia, Iran and North Korea ties are a game changer. For example, Russia’s protection of North Korea at the UN Security Council, and its new military cooperation with North Korea, are allowing the latter to expand its nuclear capabilities without the ability of other countries to contain it. This is a tangible example of the growing risk caused by declining multilateralism and the messier world we are moving to. Protectionism, export controls, sanctions and tariffs will increase and cause more economic friction. The United States-China relationship will deteriorate further, no matter who sits in the White House; while Japan’s new leader is seeking to create an Asian NATO, likely stoking tensions in the South China Sea. The situation in the Middle East carries a significant risk of further escalation. This overall dynamic will not change under Harris or Trump As risks rise, investors and companies need solid frameworks to monitor risks, adjust and ensure they are positioned to benefit from the changes underway.

Companies and investors have to become increasingly astute in monitoring and adjusting to geopolitical risk.

Policy

Many challenges for the new EU commission

The NGEU payments must be finalised by end-2026. However, loan repayment will not begin until 2028 and will run until 2058. Assuming that all the envelopes have been mobilised by end-2026 the EU budget will repay the NGEU subsidies (€421bn) to the Member States (MS) as well as the corresponding interest. Meanwhile, the NGEU loans (€386bn) -- computed as off budget -- will be transferred to the MS that have used them, and the interest on these loans will have to be repaid directly by these MS.

Reflection on the EU's finances post-2027 is ongoing. A number of key issues are on the table for the new Commission: repayment of the principal and interest on the debt for NGEU subsidies, additional funding requirements (for defence and security), and the introduction of new sources of revenue for the EU budget.

The question of financing the debt burden is a very sensitive one. The debt burden will depend on the future path of interest rates paid by the EU. The total bill could amount to over €220bn (0.6% of the EU's estimated GDP for 2021-58). From 2028 (the new budget cycle) the EU budget will also have to include provisions for repaying the EU's debt, in addition to interest charges.

Additional revenues will be needed. Otherwise, countries will either have to cut other expenditure or increase their national contributions. It remains to be seen whether the MS will be able to agree on new borrowing to finance the interest on the debt.

Financing the NGEU debt burden will be a test of cohesion for Europeans.

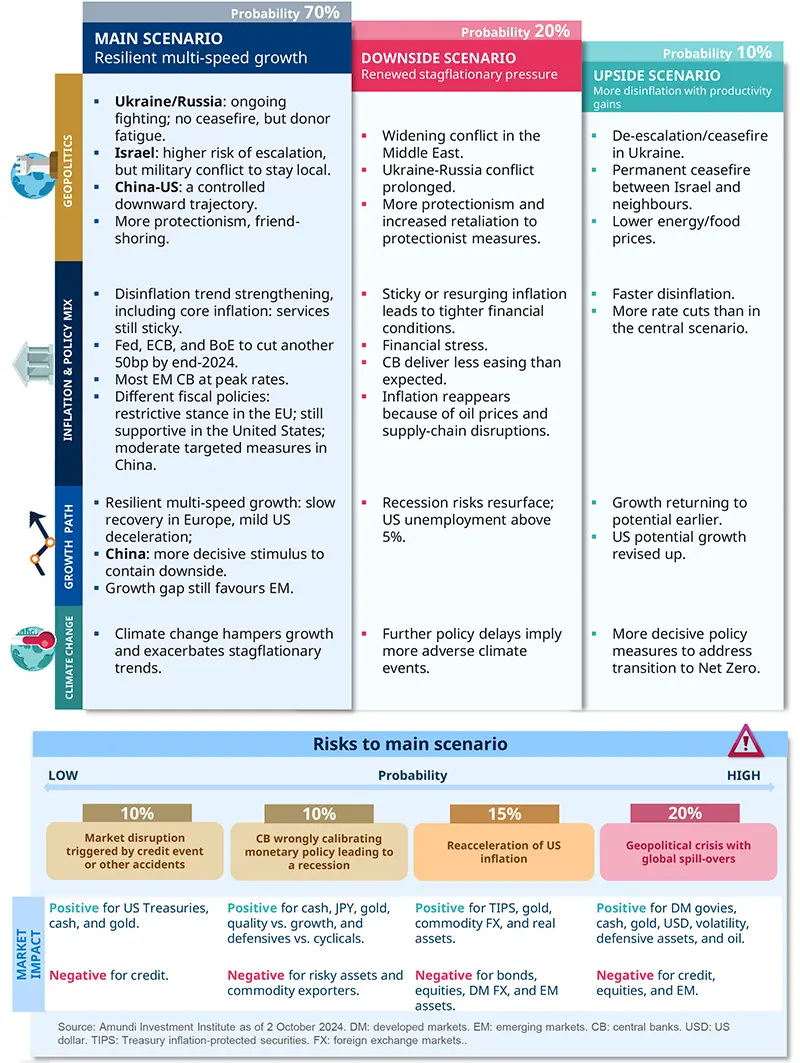

Main and alternative scenarios

Equities in charts

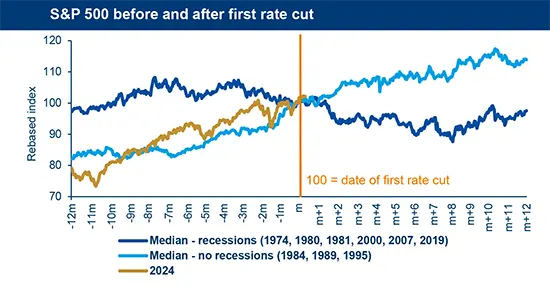

DM: The Fed's first cut, a binary outcome for equities

After the first Fed cut, the behaviour of the S&P 500 index generally depends on whether the landing is recessionary (negative) or non recessionary (positive). In general, it also takes a few months for the S&P 500 to choose sides Will this happen around the time of the US election?

Source: Amundi Investment Institute, LSEG Datastream. Data is as of 27 September 2024.

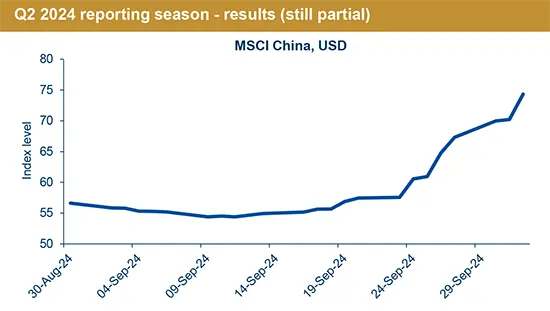

EM: Second positive reporting season in a row confirms earnings recovery

China’s recent policy shifts have sparked market optimism and a rally in Chinese assets. The monetary easing and housing policy adjustments signal a renewed effort by China’s leadership to support the economy. However, we prefer to keep a neutral approach, waiting for more details on fiscal spending to be unveiled.

Source: Amundi Investment Institute, Factset. Data is as of 3 October 2024.

Bonds in chart

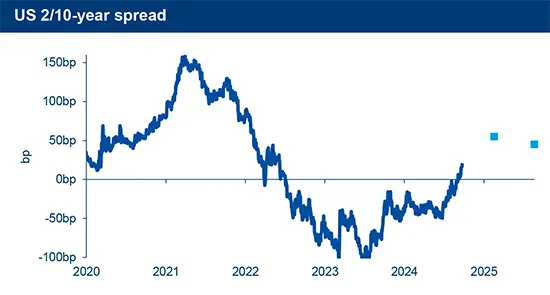

Fed rate cuts favour a steepening of the US curve

Source: Amundi Investment Institute, Bloomberg. Data is as of 26 September 2024.

The US yield curve stayed consistently inverted for the first half of 2024 as stronger-than-expected payrolls figures pushed out rate cut expectations. That situation changed in the summer and, as a result, the curve has started to normalise and is now positive (just) between 2-year and 10-year We think this trend will continue at a fast pace over the next six months, as our forecasts (blue squares) show.

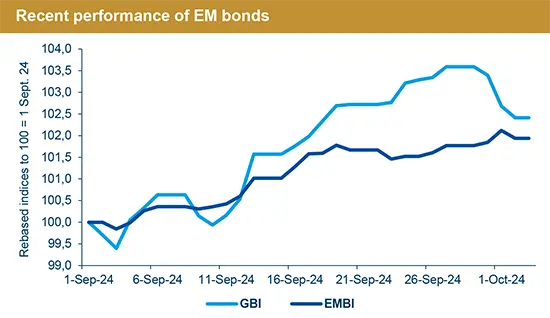

EM hard-currency bonds to remain resilient

Source: Amundi Investment Institute, Bloomberg. Data is as of 4 October 2024. GBI: Global Bond Index. EMBI: Emerging Markets Bond Index.

Recently, EM local currency bonds have suffered from dollar appreciation following the conflict escalation in the Middle East. Meanwhile, EM hard-currency bonds show a much sounder performance and their volatility is the lowest among GEM asset classes.

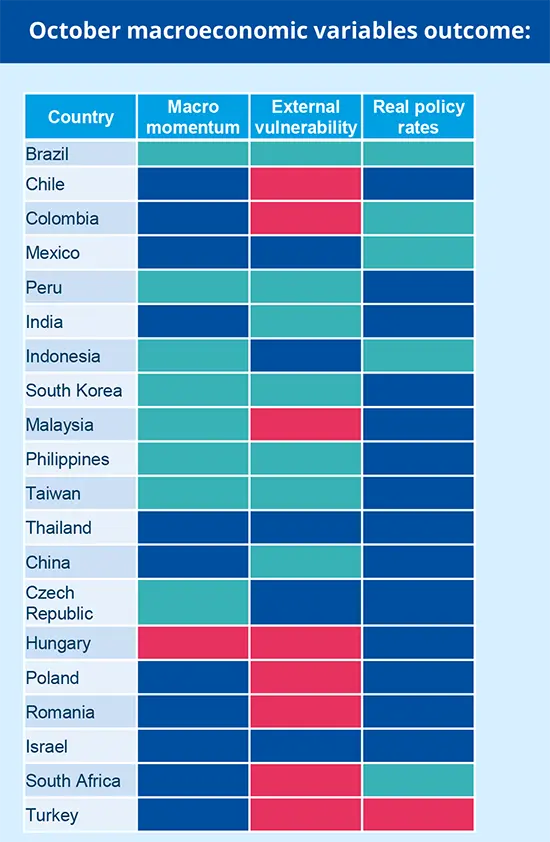

Amundi Investment Institute Models

Macro momentum, the external vulnerability index and real policy rates contribute to identifying opportunities in the EM FX space.

EMFX process: macroeconomic variables

When assessing the preference for a currency, key macroeconomic variables play a crucial role, as they can provide insight into the currency’s health and help seize potential appreciation/depreciation. These are some of the most relevant macroeconomic tools in our EMFX process.

1. Macro momentum includes a broad-based set of indicators to assess the short term forward momentum building in an economy. It includes:

- Growth momentum, based on GDP expectations and domestic/external demand momentum. Strong growth momentum points to a healthy economy, supporting the currency. Conversely, declining growth momentum can lead to depreciation. Liquidity conditions are indicative of policy expansion or tightening, ultimately contributing to growth momentum.

- Stability momentum refers to policy stability sheltering the currency in times of high volatility. It refers to fiscal balance momentum (how healthy is the balance of the budget) and inflation momentum (are inflation targets being effectively pursued).

2. External vulnerability index, built on four pillars: balance of payments, external debt position, reserve adequacy and domestic conditions (CB mandates). A low value reflects a positive currency performance thanks to higher/stable inflows compared to high external vulnerability positions.

3. Real policy rate is the nominal interest rate adjusted for inflation. It is crucial for assessing a currency's value and appeal. Higher levels offer better returns on investments denominated in that currency, attracting foreign capital and boosting the currency. Conversely, a negative real policy rate may prompt capital flight and a depreciation of the currency.

Source: Amundi Investment Institute, Bloomberg, CEIC. Data is as of 4 October 2024.

- If any outcome falls into the green area this is a supportive signal for the currency.

- On the other hand, if any outcome is in the red area this is a signal of non support for the currency.

- Otherwise, the overall call is for a neutral position (blue in the table above).

Commodities

We see gold range trading in the short term, as long positioning has become consensual and reflation forces shake up rate expectations. Risk remains on the upside though, given the alignment of medium term catalysts. We maintain our current target at $2,700/oz.

Monetary easing and stimulus in China are good news but no game changers for oil. Risk of outage due to Israel Iran retaliations deserves a premium lower than a ‘broad Middle East contagion’ premium. We maintain our ST Brent target at $80/b and our MT target in the $75-80/b range.

Stimulus in China, and to some extent DM monetary easing, lifted a key cap for metals. Some digestion is needed as investors seek stimulus confirmation and a reality check. Yet, we remain of the view that building a core allocation to key metals provides an attractive MT risk/reward.

Gold and metals still offer attractive medium-term risk/reward potential.

Currencies

Weak domestic growth and softer headline inflation figures are short term headwinds for the EUR, given the potential for policy divergence between the Fed and the ECB. However, as interest rates settle at higher levels than pre pandemic and as China attempts to boost economic confidence, we expect a strong EUR through 2025.

Dovish Fed pricing relative to most central banks has weighed on the USD since Q2. In our view, this is the first step towards a structural depreciation, but the road remains bumpy. Should the market reassess the Fed, the USD may appreciate over the short term, opening up better levels to exploit the trend.

The BoE held steady in September, while issuing hawkish signals compared to the FOMC, driving the GBP to YTD highs. Although a substantial divergence from peers seems unlikely, we believe that further cuts may not weaken the GBP, which we expect to outperform in a weaker USD environment.

The win by Ishiba in the LDP presidential election revived appetite for the JPY, given the new leader’s support for monetary policy normalisation. If this aligns with our lower USD/JPY forecasts, we believe more is needed for substantial cross JPY adjustments (i.e., a US recession or tighter BoJ policy).

Firmer Fed pricing from here poses a short-term risk but does not alter the trend.