Summary

Macroeconomic focus

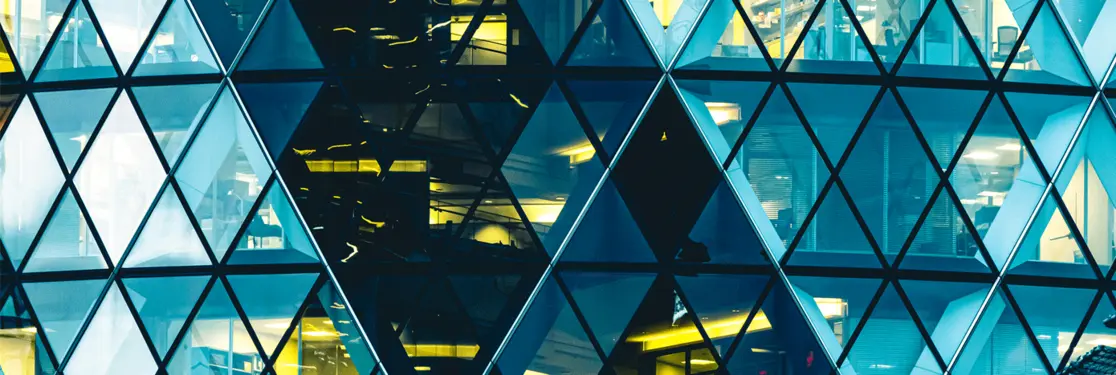

European PMIs recovering, but manufacturing / services dichotomy persists

European PMI data diverge not only in terms of sectors, but also in terms of countries and sub-components.

The Eurozone composite PMI for February increased to 49.2 from 47.9, which is still below the expansion threshold but signals a slower pace of the decline in activity and a potential bottoming out. The improvement was driven by a broad stabilisation in services activity up from 48.4 to 50.2, while manufacturing remains in an ongoing contraction, slowing to 46.1 from 46.6. Divergences persist not only between the services and manufacturing sectors, but also across countries and subcomponents. Looking at countries, Germany’s composite activity indicator continued to deteriorate in February at a faster pace (declining to 46.3 from 47 in January); France is contracting at a much slower pace (from 44.6 to 48.1); Italy and Spain improved for the fourth consecutive month in February, confirming their expansion in activity. While Italy recorded a mild increase, to 51.1 from 50.7, Spain expanded at a higher pace, from 51.5 to 53.9. Also at a country level, the manufacturing / services dichotomy was broadly confirmed. The only exception is Spain, which is expanding in both manufacturing and services. Looking at the underlying components, the composite employment indicator improved again, pointing to a resilient labour market, but, underneath the surface, sectoral differences at the activity level translate into employment dynamics, as the services sector increased jobs, while manufacturing firms reduced their workforce. Focusing on price dynamics, services maintained pricing power and price pressures remained elevated in the sector, with marginal increases in input prices, stabilising at high levels translating into much more significant increases in output prices, where the index reached the highest level since May 2023. Conversely, in manufacturing both input and output price indices remain in the contraction territory, signalling a disinflationary contribution on the goods side that has, apparently, not been affected by the Red Sea disruption, at least so far.

Eurozone PMIs

Emerging markets

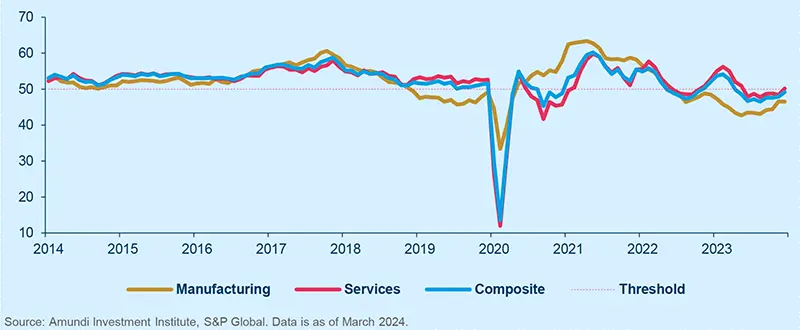

China: Ongoing housing dip

China’s new home sales in 30 major cities

Source: Amundi Investment Institute, Wind. Data is as of 29 February 2024.

New home sales have continued to fall sharply in the first months of 2024. In 30 major cities, the amount of floor space sold was down by 38.5% YoY in January and February. Sales from the top 100 developers dropped by 51% YoY in the first two months. We maintain a cautious stance on China’s housing market and overall economic outlook. The rising supply of existing homes, auctioned properties and public affordable housing is likely to further undermine the market for commercial new builds, exacerbating the housing downturn.

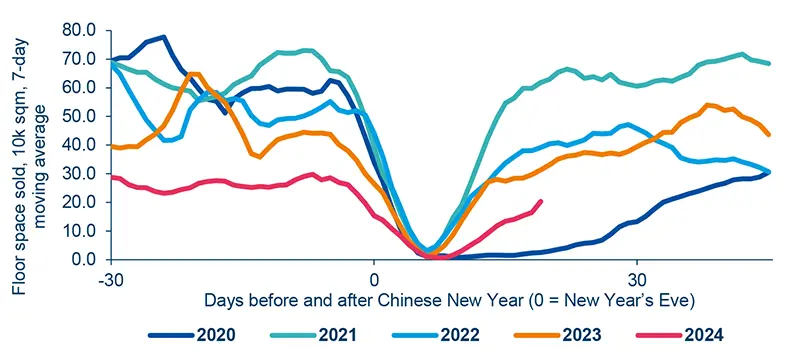

India: Buoyant end to 2023

India GDP vs GVA

Source: Amundi Investment Institute, CEIC. Data is as of 1 March 2024. GVA is GDP excluding indirect taxes and subsidies. Gross Value Added (GVA) is GDP excluding taxes and subsidies.

India GDP for calendar year (CY) Q4 2023 has turned out to be much stronger than expected, at 8.4% YoY (vs 6.6%). Domestic demand (private consumption and investments) has been driving growth, while net exports have been detracting from it. In addition, the GDP series has been revised for recent years and recent quarterly revisions alongside new data have shown much stronger growth from the previously expected. High frequency data, as the PMIs, point to a still robust, but much softer growth in the quarter (as reported in the GVA release at 6.5% YoY). For 2024 we keep a bright but more moderate growth path (around 6% YoY).

Macroeconomic snapshot

The US economy started the year on a stronger footing, but we expect significant deceleration as 2024 progresses. Data are still mixed, with several activity and leading indicators pointing south, while others – such as financial conditions and easing sentiment indicators – suggest resilience. We continue to expect inflation to decelerate thanks to moderating services inflation, although so far it has remained sticky.

We expect the Eurozone economy to see monetary policy tightening peak in the first months of the year; alongside modest global growth and less supportive fiscal policy, this will ensure Eurozone growth remains sub-par in 2024, although it should improve in the second half of the year. Inflation will progressively slow towards target, although this will be faster for headline inflation than for core.

We expect weak growth for the UK in 2024 due to slowing domestic demand, a deteriorating labour market and weak capex spending. Tight monetary policy and a weak external environment will cap economic momentum, although some modest offset may come from fiscal policy. Inflation is expected to moderate going forward, moving closer to target before year-end.

We have revised down our 2024 Japan growth forecasts to 1.1% from 1.6%, following the disappointing Q4 GDP figures and a likely stagnant Q1. That said, Japan’s growth is volatile in nature and our forecast still implies an above-trend recovery and a mildly positive output gap. The recovery will be mainly driven by external demand, while private consumption is expected to remain lacklustre. Inflation has stayed on a moderating path and does not support the BoJ to hike beyond 0%.

The Czech National Bank (CNB) surprised with a 50-bps cut to 6.25% vs 25bps expected. This decision was motivated by a sharp fall in inflation in January (below 3% YoY) and weak growth momentum. According to the Q4-2023 preliminary GDP figures, the economy contracted by 0.4% YoY in 2023 and the CNB’s expectations for 2024 are low (0.6%). We expect it to continue easing in the coming months.

While South African inflation (5.2% YoY) is already back within the target band, its current account deficit has narrowed and growth is currently flat, so the South African Reserve Bank (SARB) has not started to cut rates yet. Elevated fiscal deficits, global market sentiment volatility and elections in May weigh on ZAR and SAGBs (South Africa Government Bonds), limiting SARB’s room to manoeuvre. However, when the timing of Fed cuts is a “done deal”, this should alleviate some of these pressures and SARB should start to cut its rates.

Soft activity in Brazil in 2H23 is starting to reaccelerate, with another strong harvest (although not as robust as last year), lower rates and some fiscal stimulus (via ‘precatorios’) providing tailwinds. Inflation is already within the target range and continues to head lower as confirmed by the recent IMPCA-15. We see the Central Bank of Brazil continuing to guide for 50-bps cuts for now and easing below 9% in this cutting cycle, subject to Fed actions and domestic fiscal development naturally.

Chile’s economy is finally accelerating after undergoing a prolonged process of rebalancing and stagnation – e.g. January data surprised on the upside across the board. Meanwhile, inflation is moderating with the headline just slightly above target now. The Central Bank of Chile has been easing in a fast and furious way, cutting policy rates by 100bps at times to the detriment of the Chilean peso. The question is whether it will slow things down now that the economy is showing more momentum.

Central Banks Watch

DM Central Banks are lagging behind their EM peers on the easing cycle

Developed Markets

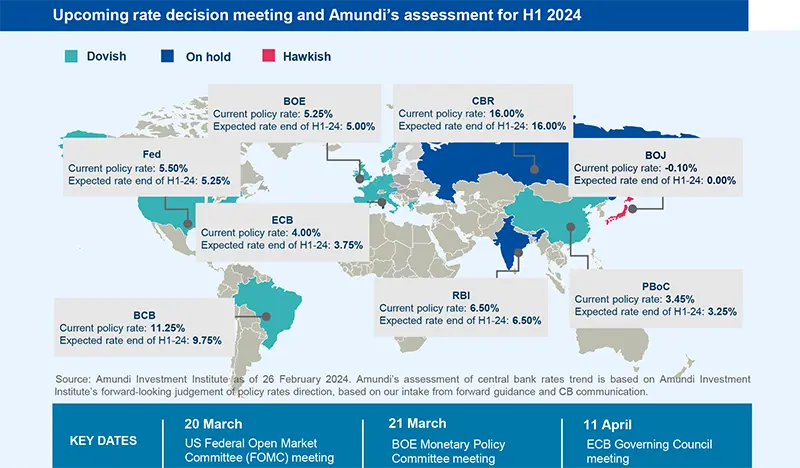

Towards the end of H1, the Fed, ECB and BoE are all likely to start cutting rates, with the year’s rate cuts totalling 100 bps for the Fed and 125 bps for the ECB and BoE.

The Fed should remain on the hawkish side given the recent rebound in inflation and the resilience of the US economy. The ECB remains cautious about the pace of disinflation, especially in the service sector and rising wages. Our attention is focused on the risk of overtightening in the Eurozone. Monetary policy has a much faster impact on the economy in the Eurozone than in the United States. The disinflation process also appears more rapid in the Eurozone than in the US. In the UK, headline inflation is likely to fall quickly and a majority of the BoE’s Monetary Policy Committee appears to be in the rate-cutting camp.

Meanwhile, we hold our view that the BoJ will seize this once-in-decades opportunity to normalise its monetary policy, but with a 0% terminal rate.

Emerging Markets

Amid an overall benign inflation picture, and the market pricing more prudent easing from the Fed, EM CBs have kept their easing activity on autopilot, with a few exceptions. Asia remains uneventful aside from China, with the PBoC cutting its 5-year loan prime rate by a largerthan-expected 25bp. In LatAm, after several prudent cuts in January (with the usual exception of Chile), the Central Reserve Bank of Peru again cut by 25bps and Banxico finally opened the easing door by suggesting its March meeting will be live. Again, the fastest easing train is passing through CEMEA. The Czech Republic CB unexpectedly sped up easing (50bps vs 25bps), with its next steps depending on the balance between currency stability and accelerating easing. Mindful of the same balance, the National Bank of Hungary could moderate the easing pace in the next future. While remaining on hold, Turkey’s CB is expected to pivot to easing soon, although robust growth performance and sticky inflation should dictate more prudent monetary policy conduct.

Geopolitics

The Middle East faces an uncertain future

Israel will continue to face existential threats as a result of the forces unleashed since 7th October.

While we currently do not expect an escalation in the short term in the Middle East from current levels, there are many serious medium-to-longer term risks emanating from the political situation within Israel, a possible war between Lebanon and Israel, and a potential escalation between Israel and Iran. Despite negative news flow with regards to Israel’s possible ground offensive in Rafah, the sluggish pace of ceasefire talks and ongoing strikes within Lebanon, overall, there are plenty of signposts pointing towards a ceasefire and hostage deal to be announced soon, most likely to be timed with Ramadan, which starts on 10th March. There seems to be an overlap of all parties to commence Ramadan with a deal in place, while Hamas is keen to delay/halt an Israeli manoeuvre in Rafah. The Houthis are continuing to strike, but the frequency seems to have reduced and ongoing US/UK attacks against Houthi capabilities seem to be bearing fruit on Red Sea traffic. Looking at the data, freight rates seem to be normalising and, all in all, developments are in line with our base case expectations. Over the longer term, Israel will continue to face existential threats as a result of the forces unleashed since 7 th October. The threat Iran poses to the US has also grown significantly. Its nuclear advance adds another dimension of risk, meaning Iran is a growing threat that the US and Israel may soon feel it necessary to deal with.

Policy

EU: back to the ‘guns versus butter’ trade-off

Policymakers have very little fiscal leeway to increase much-needed defence spending.

Defence spending in Europe has been rising for 10 years. Since 2014, the year marked by Russia's annexation of Crimea, European countries have made a very significant effort, with a rise in real defence spending of 44% (Germany), 15% (France), 37% (Italy), 58% (Spain), 75% (Netherlands). But the major countries still have spending of between 1.3% and 1.6% of GDP. France is the exception (with 2% of GDP) because of its powerful defence industry. Germany has announced that it will reach the 2% target this year. By 2024, 13 NATO Member States will be devoting more or less 2% of their GDP to defence spending. Moreover, the EU as a whole already devotes 20% of its defence spending to investment (another NATO objective).

But this is far from enough to build a credible defence. Additional efforts are required at a time when EU countries need to invest in transforming their economies, while at the same time putting their public finances on a sounder footing. The trade-off between military spending and other public expenditure (such as healthcare and education) is likely to arise at some point.

Operations with military or defence implications cannot be covered by the EU budget (Article 41 of the EU Treaty). Ursula Von der Leyen has just proposed the creation of an EU defence commissioner and announced a "European defence industrial strategy" designed to boost production and facilitate the acquisition of defence goods in the EU. But it remains to be seen whether the EU will have the financial and institutional means to match its ambitions.

Scenarios and Risks

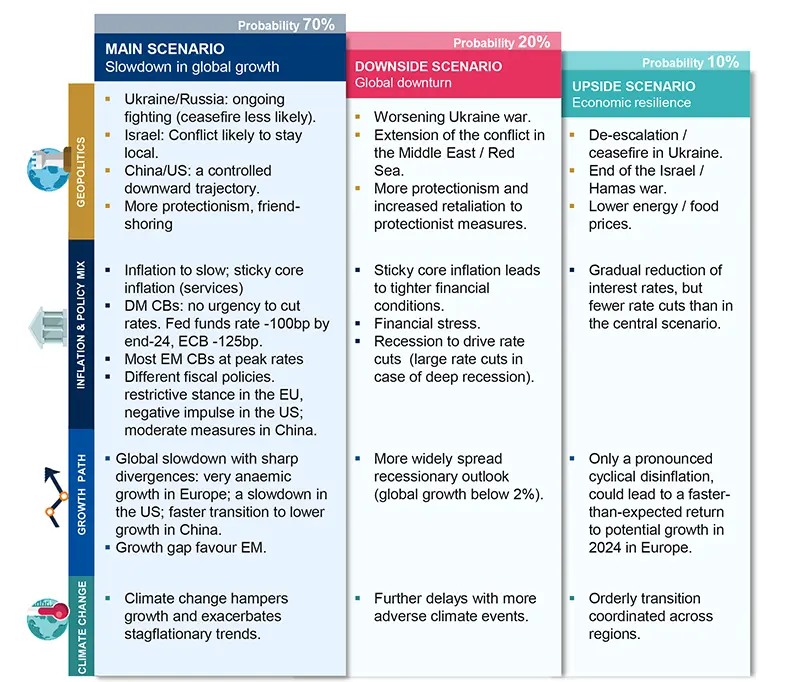

Main and alternative scenarios

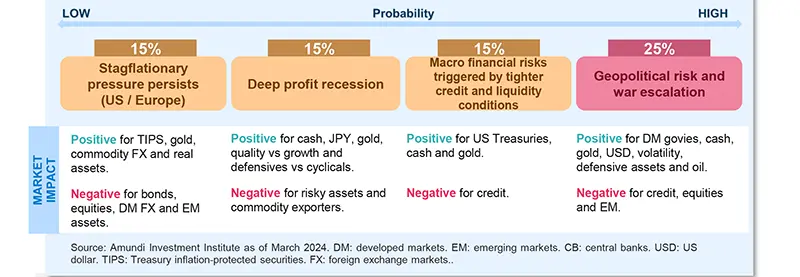

Risks to central scenario

Amundi Investment Institute Models

Nelson-Siegel yield curve fair value model – focus and update on 10Y rates path for 2024

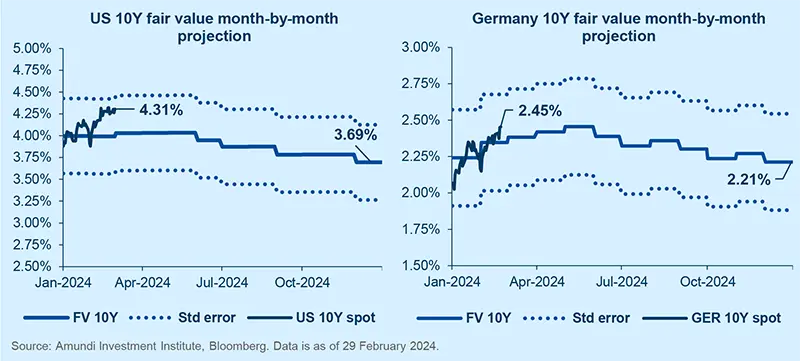

The current level of US 10Y yield is approaching the upper side of the fair value range.

- US 10Y: in the US, the first two months of 2024 have seen a resurgence of concerns around the likelihood of inflation converging towards the Fed’s target, in a context of very resilient growth. In particular, strong upside surprises on two key economic releases (January’s Non-Farm Payrolls and the Consumer Price Index data) have fuelled an upward trend in yields and exerted flattening pressure on curves. Additionally, GDP growth for Q4 23 cast doubts on the extent to which monetary policy needs to become less restrictive throughout the year. We continue to expect a delayed but pronounced US slowdown, and the uptick in January’s inflation data should not derail the disinflationary process envisioned for the coming quarters. In such a context, the Fed should be in a position to deliver a total of 100 bps of rate cuts this year.

- Germany 10Y: Eurozone economic releases were more in line with surveys. However, German rates struggled to meaningfully outperform those in the US and followed the move higher for global yields. We see Eurozone growth continuing to deliver on the flattish side, with Germany likely being the main laggard this year. Inflation converging lower should allow the ECB to cut rates by 125 bps this year.

- Valuation: the above assessment implies more value in the US 10Y from current levels than the German equivalent. The former is getting very close to the upper side of the fair valuation range and is 60bps above its year-end fair level (3.69%, chart 1). The Bund moved from being slightly expensive at the beginning of January to just above fair and is currently 30bps higher than where the fundamental scenario would suggest it lands by the end of this year (2.21%, chart 2).

Find out more about our model in the April 2023 Cross Asset edition.

Fair value ranges for 10Y yields in 2024

Equities in charts

DM: After a strong start to the year, a breather is due

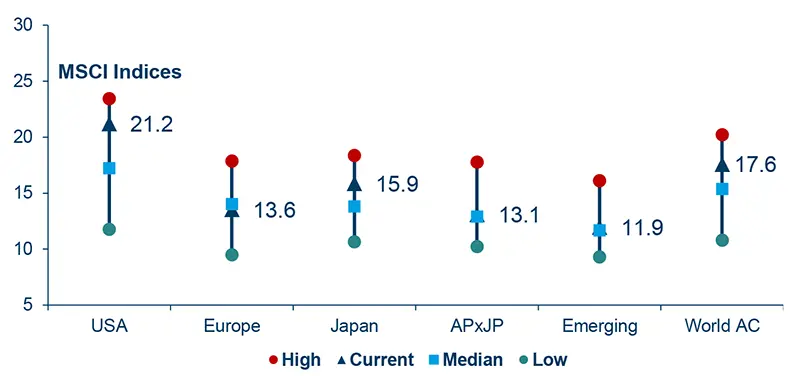

Price-Earnings Ratio 12M Forward over 12 years

Source: Amundi Investment Institute, LSEG Datastream. Data is as of 29 February 2024.

Equities are reaching historical records, notably driven by AI in the US, corporate governance, strong earnings and out-of-deflation themes in Japan. P/Es, including the one for the MSCI ACWI, are now far above their average. A breather would make sense.

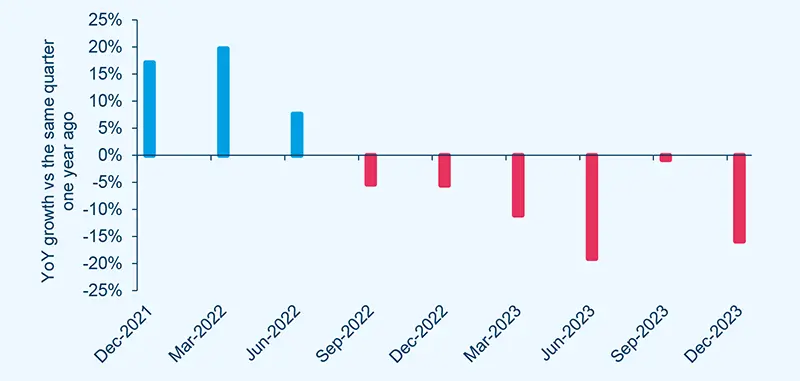

EM: Negative results from EM reporting season so far

MSCI EM USD – Latest Reporting Season

Source: Amundi Investment Institute, Capital IQ. Data is as of March 2024.

About 43% of MSCI EM constituents have reported Q4 2023 results. The growth of net income YoY is negative (-16% in USD). The reporting season, hitherto, shows positive MSCI YoY results in Greece, Qatar, India, Philippines, Indonesia and Thailand; but is negative in the other countries. At a sector level, the best results (on average) are in Consumer Discretionary, Energy, HC and Utilities; the worst are in Information Technology.

Bonds in charts

DM: Excessive sell-off in Eurozone front-end rates

Pricing of rate cuts in 2024 for the Fed and ECB

Source: Amundi Investment Institute, Bloomberg. Data is as of 27 February 2024. SOFR: Secured Overnight Financing Rate.

EU front-end rates have sold off even more than the US (year-to-date change in 2Y: +52bp in Germany and +35bp in the US). Given the ongoing divergence in growth and inflation expectations between the US and Eurozone, this seems excessive. US-EU rate spreads should widen further as the market reprices more ECB cuts.

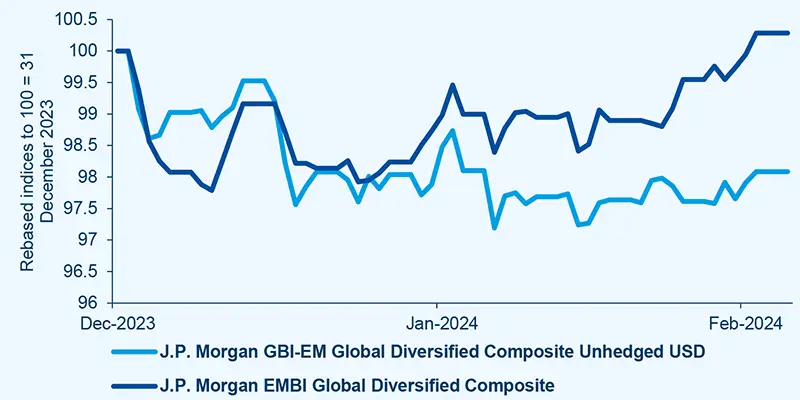

EM: Local Currency bonds penalised by increase in 10Y US bond yield

EM HC bonds have started overperforming LC bonds

Source: Amundi Investment Institute, Bloomberg. Data is as of 4 March 2024.

After a weak start of the year, EM Hard Currency bonds have recently been outperforming EM Local Currency bonds: notwithstanding the sharp inflation decline in EM countries, the total return of this asset class has been penalised by a sharp increase in the 10Y US bond yield and by the depreciation of EM currencies versus USD.

Commodities

Modest upside still in the cards for Gold. Range trading in Oil.

Gold remains in ‘wait-and-see’ mode as markets delay their pivot timing expectations. This is only a delay as we see gold surging to $2100/oz with extra support from fiscal profligacy, geopolitics and ETF flows.

We expect Brent to trade in a range near our $85/b target, capped by ample spare capacity, looser OPEC discipline, NOPEC output and softer Chinese growth. We expect more dispersion across refined products.

Temporary oversupply is capping prices in the near term, but a cyclical rebound in China and global growth resilience could provide modest extra upside. We see more strength in H2 as tight supply starts to lag demand, especially for Copper.

Currencies

Strong US growth supports the USD; the Fed will limit the upside.

Lower growth and faster inflation normalisation relative to the US represent headwinds for the currency, but it remains hard to breach the range of 2023 given limited anxiety over the Fed and the improving fair valuation.

A large US growth premium relative to DM points to a wider US rates differential and supports the USD in the short term. Expensive valuation and the Fed cutting cycle suggest strength is unlikely to persist into H2.

Falling economic and inflation surprises suggest the market may gradually require more cuts from the BoE in 2024. We expect weaker GBP in H1, but low volatility and high carry will limit the downside.

A huge discount to fundamentals and extreme short positioning suggest the trend for the JPY should be higher from here. Without a proper hiking cycle from the BoJ though, US rates will remain the dominant driver.