Summary

Macroeconomic focus

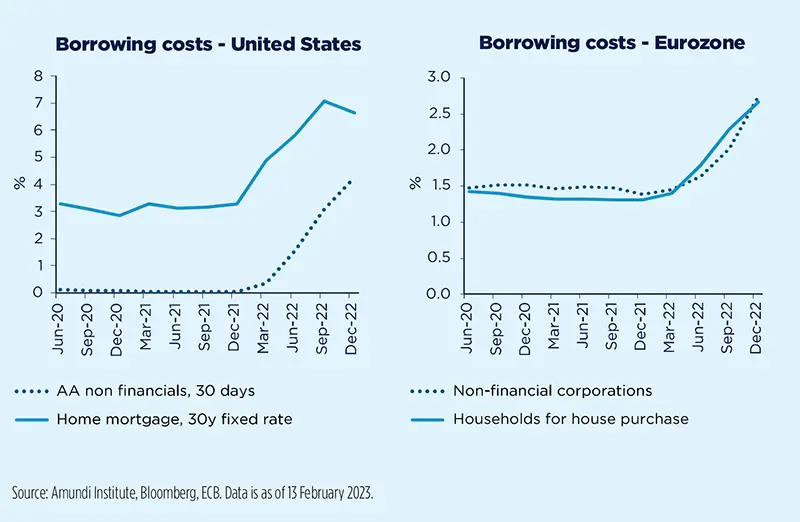

Financial conditions remain tight for the real economy.

Easing financial conditions, tightening conditions for borrowers

Market measures of financial conditions suggest significant easing over the last three months, but borrowing costs for corporates and households have risen a lot, and are still rising. This has led to market optimism with regard to asset prices. However, easing market conditions, as measured by the GS Financial Conditions Index, for instance, stand in sharp contrast to the interest rates corporates and households face both in Europe and the United States. In addition, lending standards have also tightened substantially, together with corresponding declines in lending volumes, especially in Europe.

Market measures reflect that we are past the inflation peak and the corresponding rate cuts priced in later this year for policy rates, together with inflation expectations, remain well anchored. However, it is unlikely that lending rates (and lending standards) for the real economy will fall until we see actual policy rate cuts, partly because market rates may be subject to volatile market expectations about the stickiness of core and services inflation. But also because demand for loans will remain very low until interest rates fall markedly. Moreover, expectations of policy rates might not move much below current indications (forecast for early next year) if core inflation remains sticky.

With real wage growth (except for the bottom percentiles) also remaining subdued, this is likely to keep domestic demand weak in Europe and in the United States, especially consumer spending. We are already seeing weakness in consumption spending. Investment spending will also remain weak until borrowing rates decline substantially and the growth outlook improves. Given growth is expected to remain well below potential growth even into next year, a meaningful recovery in domestic demand is some time away.

Bottom line: financial conditions remain tight for the real economy. The impact of this tightening underpins our subdued (below potential) growth forecasts for 2023 and 2024. While we see a reasonable prospect for a soft or softish landing, this should be seen as a modest increase in unemployment from the current unusually low levels. It does not preclude a very weak outlook for corporate earnings in the face of very weak domestic demand.

Emerging markets

Despite January jump, a deceleration in EM inflation remains in the cards

In January, EM headline inflation paused – on average – its declining path (which started in September 2022), while core inflation kept its mild ascending trend. The former has paused its decelerating trend despite stable oil prices (WTI below $80/barrel for the month) and food prices (FAO global index) being more decisively in negative territory (-3.3% YoY from a peak hit in March 2022 of 34% YoY).

Across the EM universe, the picture is heterogeneous beneath the average figures: in some countries, headline inflation has continued to rise or is reaccelerating to surprise on the upside (e.g. India, Philippines, Colombia, and Hungary). In other countries, the disinflationary path has been less pronounced than expected (e.g. Brazil, Chile, and Turkey).

Whenever we look at EM inflation, due to the weight of food items in their baskets, it is more credible to focus on core and non-core components. While inflation core components played an important role in halting the disinflationary trend across January’s reports, specific local factors relating to the most volatile components – especially food – still contributed to unexpected inflation bursts or to slow down disinflation. In the first instance, core inflation is higher where the automatic indexation mechanism is high (e.g. Colombia), the labour market is tight, and where minimum wages have increased significantly (such as Mexico and, to a lesser extent, Colombia again), or tax and subsidies have started to adjust (e.g. Hungary’s removal of the fuel cap in December). Among the second group of countries, food prices have driven inflation, as in Peru (bread prices), the Philippines (an onion shortage), and India (cereal prices).

Overall, while January readings confirm that EM are not out of the woods yet in terms of the inflation trend, we still expect the downward path to continue amid stable or mildly declining global inputs and decelerating domestic demand. The policy support withdrawal (reductions in subsidies and caps and increases in administered prices), on one hand, will add to the disinflationary trend through weaker demand, while on the other, could result in temporary inflation bursts. It is worth noticing that the declining inflation trend will still leave headline inflation above CB targets in most EM by end-2023, particularly Latam and Eastern Europe.

Macroeconomic snapshot

Mixed and still very volatile incoming US data is keeping economic uncertainty high: activity data has been noisy, with strength in consumption and labour markets, but weakness in relevant business surveys posing some upside risks in the near term. Inflation readings remain sticky at the core level. We expect 2023-24 growth to remain below potential, with weakness in H2 2023. Inflation has peaked and we expect base effects to drive headline inflation lower, while stickiness in underlying inflation will persist for longer.

Notwithstanding a modest upward revision to our growth projections, we still expect very weak activity in the first quarter, followed by flattish-to-below-par growth for the remainder of 2023, as inflation decelerates and sentiment improves. While recent developments on the energy front are removing tail risks, headwinds remain strong: the external environment is weak, geopolitical uncertainty is high, and monetary policy will remain restrictive on the back of tight labour markets, high nominal wage growth and above-target inflation.

With inflation staying above target for several quarters we see a cost-of-living-induced recession playing out in the United Kingdom going into 2023. Although we have slightly improved our outlook on the back of incoming data, we still see significant headwinds at play for the economy, as fiscal and monetary policy weighs on growth. We see the economy running below potential in 2024 as well. Energy remains a key risk for both the inflation and growth outlooks.

Despite missing expectations, Japan’s GDP grew by 0.6% QoQ annualised in Q4 2022, driven by a recovery in private consumption and tourism spending. In January, goods export growth slowed significantly. On the other hand, inbound tourism rebounded strongly to 1.5m tourists, half of 2019’s peak. With the ongoing boost from tourism and consumption, Japan is expected to avoid a recession in H1 2023 despite the global growth slowdown. Inflation has surprised to the upside and we expect core inflation to hold at around 3.0% in Q1, then gradually ease to 2% in H2.

Household mobility in China rebounded strongly in the first two weeks of February, defying concerns of disruption from a second wave of Covid infections. Meanwhile, the rebound in industrial production was less robust, as reflected in the below-trend operation ratios for certain industrial sectors and declining capital goods shipments from neighbouring economies to China. Services inflation started to bottom in January and we anticipate it will rise further. Nevertheless, we expect overall CPI inflation to remain low, as energy and food inflation is likely to drop.

India’s FY24 budget, announced in early February, was designed to pursue fiscal consolidation while boosting capex. The fiscal deficit target should narrow to 5.9% of GDP from 6.4% and capex should increase by around 30%. Still robust nominal growth assumptions – while lower at 10.5% YoY – and pre-electoralspending – not visible in the budget – represent the main risk for fiscal slippage, eventually tapping from the buoyant capital expenditure budget. As it currently stands, the budget should not pose an inflation risk in the short term.

The earthquake in Turkey affected ten provinces that represent 15.7% of the population, 15.0% of the agricultural sector, 10.0% of the industrial sector and over 9.0% of GDP. Growth is expected to slow, but only by a limited amount (-0.5pp) due to additional budgetary expenditure that could amount to 6.0% of GDP over the next two years. The public deficit is expected to exceed its target of 3.5% this year. Inflation (57.7% YoY) is likely to rise, especially as the central bank may cut rates further.

Brazil’s tight monetary policy stance is weighing on credit growth and economic activity in general: we expect GDP growth to slow from 3.0% in 2022 to below 1.0% in 2023 unless President Lula launches a sizeable fiscal stimulus. He is also impatient to see interest rate cuts, but above-target inflation expectations and fiscal uncertainty are keeping BCB’s Governor Roberto Campos Neto in a hawkish wait-and-see mood, despite real rates visibly in positive territory. We only see SELIC cuts in late 2023 and these are highly contingent on new fiscal rules and the BCB’s inflation target.

Central Bank Watch

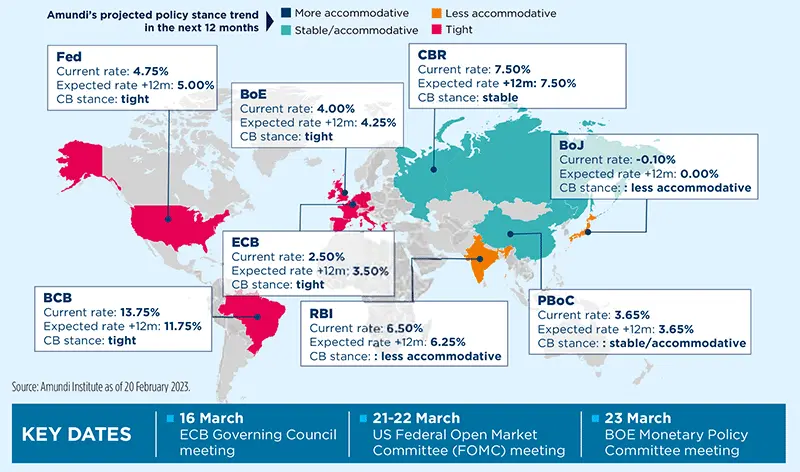

DM central banks to stay hawkish, in EM they remain driven by a fragmented inflation picture

Developed markets

We expect DM CB to remain hawkish. Inflation has peaked but remains high and we confirm our terminal rate expectations. Risks for the Fed remain skewed to the upside.

Fed Chairman Powell stated that the Fed has "more work to do" and "a long way to go”. He welcomed the moderation in recent inflation. However, disinflation is only at an early stage. The Fed does not see disinflation yet in core non-housing services and sees a better riskreward in overtightening.

ECB President Lagarde said the ECB intends to hike by another 50bp in March, but the commitment to hike significantly beyond March has declined. “Headline inflation has gone down, and more so than we had expected, and that many had expected, but underlying inflation pressure is there, alive and kicking”. She warned that

most fiscal support is not targeted enough.

The BoE signalled a likely reduction in the hiking pace, as its latest minutes dropped a reference to the «forceful» component (understood as 50bp rate hike rises) when referring to future moves. Its updated projections painted a less gloomy picture compared with November’s central forecast, with a shallower recession and a quicker inflation drop in the short term, while the medium-term inflation forecast was upgraded. Risks to the inflation outlook are skewed to the upside

Emerging markets

If there is still a need to discern what is driving EM CB across the universe, January’s action highlighted that domestic conditions, namely inflation, are in the driving seat.

Indeed, against market expectations, Banxico and Bangko Sentral ng Pilipinas raised their policy rates more than expected (50bp for both against 25bp expected), on the back of stronger-than-expected January inflation readings, which was mainly reaccelerating core inflation in Mexico and broader inflation in the Philippines. While markets reassess the Fed’s next steps towards a higherfor-longer terminal rate, EM CB appear less bothered by that and more by the fact that the Fed is getting close to a pivot that will bring a period of stable rates rather than returning to easing anytime soon. Historically, those EM CB more sensitive to Fed action, such as Bank Indonesia, ended their hiking cycles in January on a more-benign-than-expected inflation outlook – mainly for the core indices – irrespective of the ongoing US tightening. Despite recent hawkish reactions by a few EM CB, we still see some of them starting to ease this year. Unlike expectations, these are not the carry-rich banks, such as BCB or Banxico, but the ones dealing with the weakest economic cycles (e.g. Andean region). Economic weakness will also drive easing in Central Europe, despite slowly declining inflation.

Geopolitics

EU will face more hawkish Biden pre-US elections

The EU should brace for more protectionism.

While recent headlines have focused on tense US-China relations, the state of US-EU relations has received far less attention. However, recent developments have put new strains into that relationship – strains that are likely to intensify as the United States heads for elections in 2024.

Recent revelations about the United States being behind the Nord Stream pipeline attacks will fuel distrust among EU leaders and the wider public towards the United States and President Joe Biden, even if the allegations will never be proven right or wrong.

The allegations will have further rattled feathers after months of growing anger in the EU towards Biden following the introduction of the Inflation Reduction Act (IRA). The IRA seeks to attract European businesses in green tech and other eligible sectors to relocate to the United States by offering incentives and subsidies. Faced with high energy prices at home, uncertainties related to the war, the US proposition is attractive.

Months of diplomacy have yielded little result and EU leaders have come to understand that the IRA is not just a domestic policy, but one that is also aimed at the EU. As Biden reconfirmed in his state of the nation address: “I will make no apologies that we are investing to make America strong.” The EU will now realise that, while Biden is, in contrast to his predecessor, in favour of strengthening the transatlantic relationship, he also pursues a distinct ‘America First’ agenda.

Even if all these issues were to irk the EU, there is little it can do. The war has made Europe more dependent on the security protection that NATO – and essentially the United States - offers. As the United States enters an election period - Biden is expected to announce soon his candidacy for 2024 - the EU should brace for more disadvantageous US measures.

Policy

European Union: the great bargain has begun

Europe’s strategic independence and the challenges posed by the energy transition call for a bold response; we are still a long way from that.

Two major issues will require compromises this year. The first, and top priority, is finding a response to the US IRA. Adopted in August 2022, the IRA has had a shocking effect on Europe. Governments agree on the need to find an appropriate response but are at odds over how to do it. Sharp divisions came to the fore at the 9 February summit. So far, the European response to the IRA is focused on relaxing the framework of state aid rules, notably by allowing tax credits. The aim is not only to simplify procedures to facilitate the deployment of renewable energy but also to allow subsidies, without which EU companies might relocate to the US to take advantage of the benefits there. Small countries would be at a disadvantage. So, the creation of a fund has been proposed to avoid increasing economic fragmentation. This proposal is far from unanimous. The only compromise that has been found so far is greater flexibility in the use of the existing Recovery and Resilience Mechanism (RRF) resources.

The second hot topic is the reform of European fiscal governance. On 9 November, the European Commission made proposals for new governance. In essence, the aim is to make member states more responsible for controlling their debt-to-GDP ratios. The proposed procedure is based on bilateral negotiations with the Commission, which several countries, including Germany, consider too lax. Until now, Germany has refrained from responding officially to this proposal. A clarification is expected in the coming weeks. These discussions will be the focus of the March European Council meeting, although a compromise is highly unlikely by that date. The two issues are intertwined. With the fall in gas prices, national interests have resurfaced. Europe’s strategic independence and the challenges posed by the energy transition call for a bold response. We are still a long way from that.

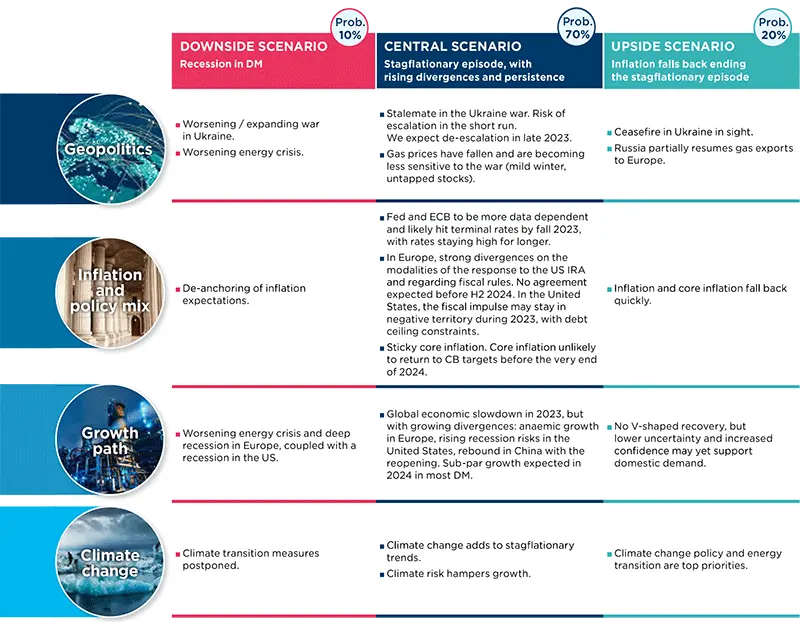

Scenarios and Risks

Central and alternative scenarios

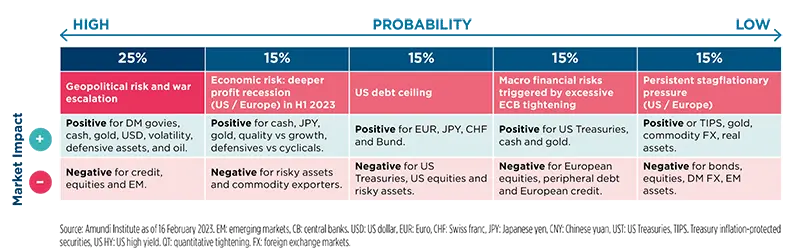

Risks to central scenario

Amundi Institute Models

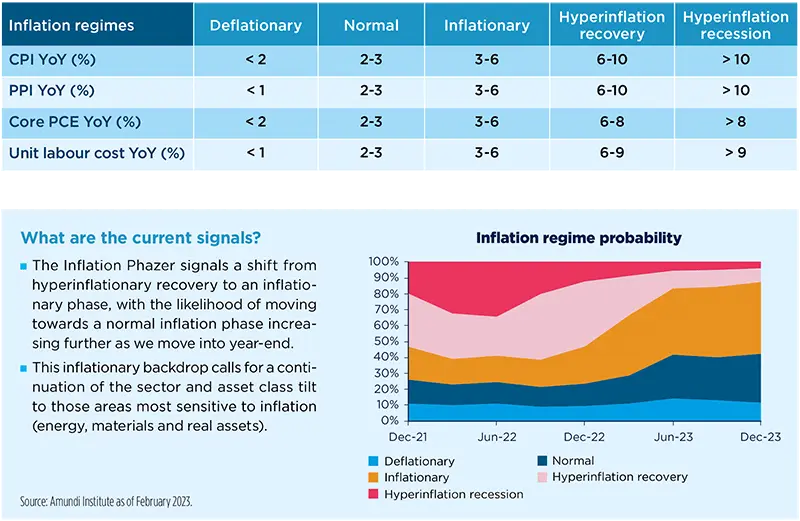

Inflation Phazer: a model that detects the most likely inflation regime and tilts asset allocation

Inflation regimes are key to finetuning risk exposure and rotation within each macro asset class when it comes to portfolio allocation.

What is the model about?

- The rationale: Inflation trends tend to follow economic growth. They drive both monetary policy and financial markets and define debt sustainability. In addition, financial markets and inflation-related instruments encompass highly anticipatory mechanisms. Hence, an ex-ante identification of inflation regimes is needed to fine-tune asset allocation choices, both tactical and strategic, as inflation regimes tend to endure over time. Assessing the evolution of the probability for alternative regimes is often the best indicator for capturing a change in expectations.

- Model setup: We developed a disciplined approach to the taxonomy of inflation regimes, in which we cluster price dynamics by building on US data starting from 1960. We use this dataset to identify the most relevant recurring inflation regimes and screen the overall cross-asset universe to detect which asset allocation models would have worked best during the various regimes.

- Goal: The Amundi Institute Inflation Phazer’s goal is to assess an inflation regime’s likelihood to persist over a certain time horizon and assess the asset allocation model that should be favoured in relation to the forecast inflation regime probabilities. In fact, we have found that asset classes and sectors display different behaviours during each inflation regime which investors should consider within their portfolio allocations.

- Model output: We can identify different asset allocations depending on the probability distribution, favouring the combination of assets that is expected to perform best in the inflation scenario deemed most likely to materialise.

Infographic - Markets in charts

Equities in charts

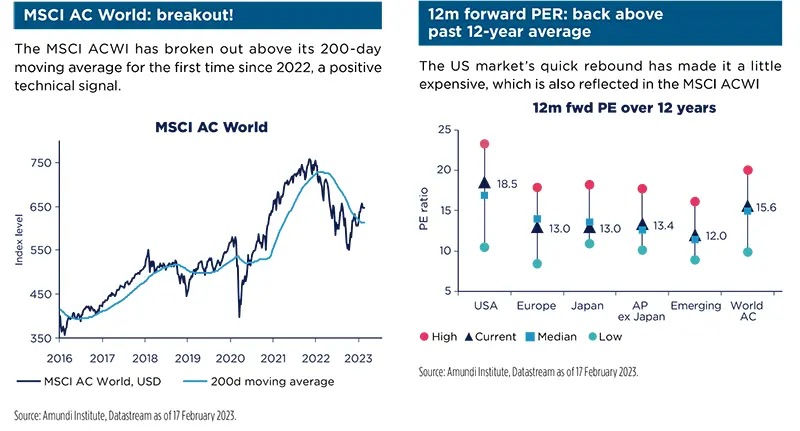

Developed markets

Technicals and fundamentals send diverging signals.

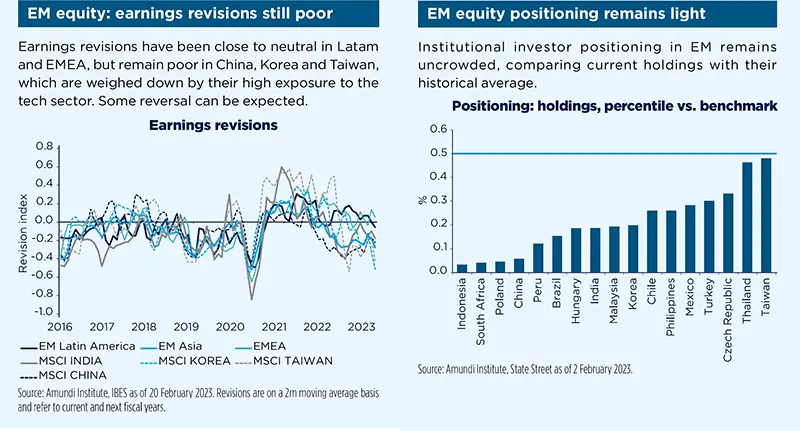

Emerging markets

Earnings momentum shows room for improvement, led by EM Asia; positioning remains light.

Bonds in charts

Developed markets

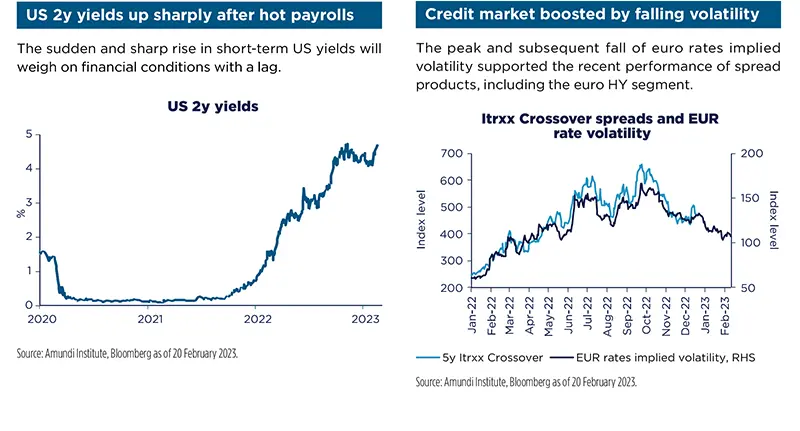

Both US and European credit markets have been supported by falling rates’ volatility.

Emerging markets

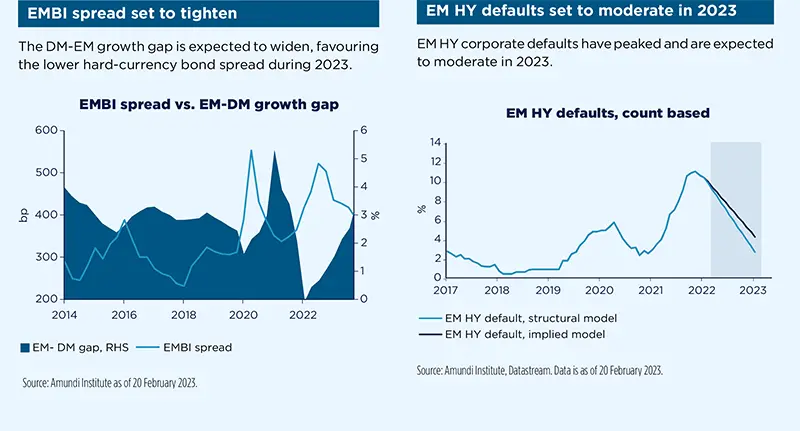

Conditions in both the EM sovereign and corporate bond space becoming more supportive.

Commodities

Conflicting supply and demand forces keep oil prices range bound

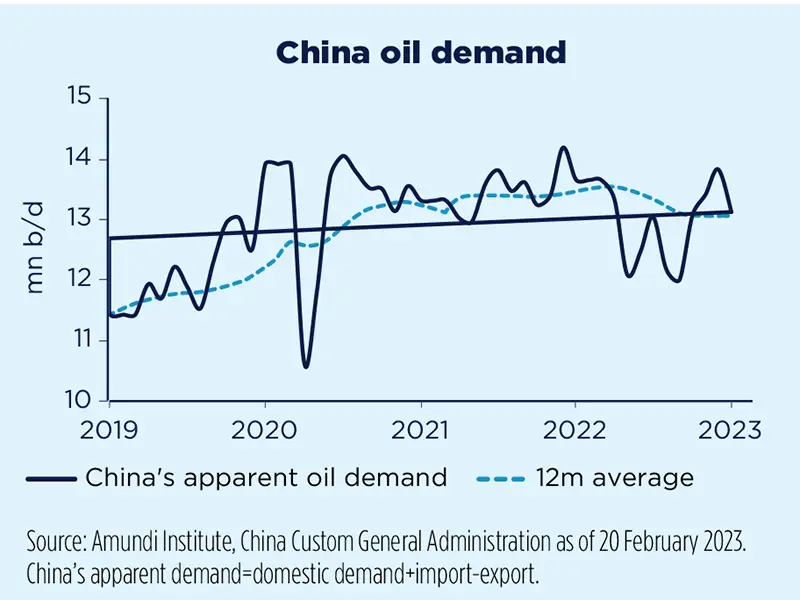

Lower Russian oil exports and mean-reverting oil demand in China will likely provide modest price traction in H2; range trading looks more likely in the near term.

Oil markets are subject to conflicting political interests, warranting high volatility. Russian oil exports and Chinese oil demand are the two main drivers. Price caps could take their toll on Russian exports, mitigated by greater flows towards Asia, limiting the drop to around 1.0-1.5m barrels per day (b/d). China’s demand may revert to cruise levels boosting demand by around 1.0m b/d. Access to cheaper Russian oil could limit inflationary pressure in China. Both factors would provide modest traction later this year amid US producers and OPEC+ output discipline. Dashed hopes for a nuclear deal with Iran and a fragile situation in Libya could also maintain a risk premium. However, crude futures may remain range bound in the near term, capped by sufficient supply, a strong dollar, and global demand concerns. Less compelling valuations and investor repositioning after China’s reopening could limit support. We are keeping our 3m and 12m Brent target at $90/b and $100/b, respectively.

Currencies

Expect a weaker dollar moving into H2 2023

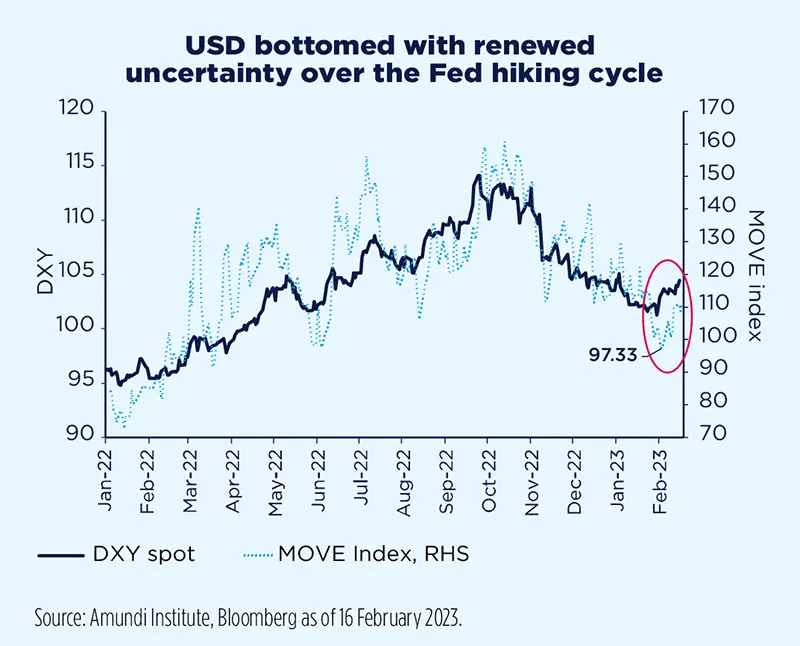

High macroeconomic volatility is preventing bold directional convictions in the short term; the ultimate outcome though should remain dollar negative.

Macroeconomic volatility is high and is preventing bold directional convictions in the short term. Both US economic activity and inflation proved stronger than expected, benefitting the dollar, given the strong correlation between US interest rates and their volatility. Higher real rates for longer come with support for the greenback; yet, the positive asymmetry should be limited when compared to last year. Fundamentals out of the United States are improving fast and relative growth-inflation profiles do not support a wider US yield advantage (the US economy has little growth advantage and US inflation is much closer to target than most DM). A negative growth shock would limit the dollar downside, yet the impact should prove transitory as it validates the end of the Fed tightening cycle. We are keeping a neutral dollar stance in the short run, but expect a weaker dollar moving into H2 2023.

-

Macroeconomics, Geopolitics, and Strategy - March 2023

-

The wheels of a Circular Economy go round and round

-

The wheels of a Circular Economy go round and round - N°5 The fashion industry: making circular the “new look” of fashion

-

The wheels of a Circular Economy go round and round - N°2 The automotive sector: ready to step up a gear