Summary

Key takeaways

The impact of energy on the US economy has declined over the last three decades, but a series of shocks since the pandemic and a +30% price surge since July has brought the topic back to light. We find that it would take a material rise in energy prices and a combination of negative factors for households before there is a visible toll on overall spending. We’re not there yet and anticipate only a marginal impact on consumption at this stage.

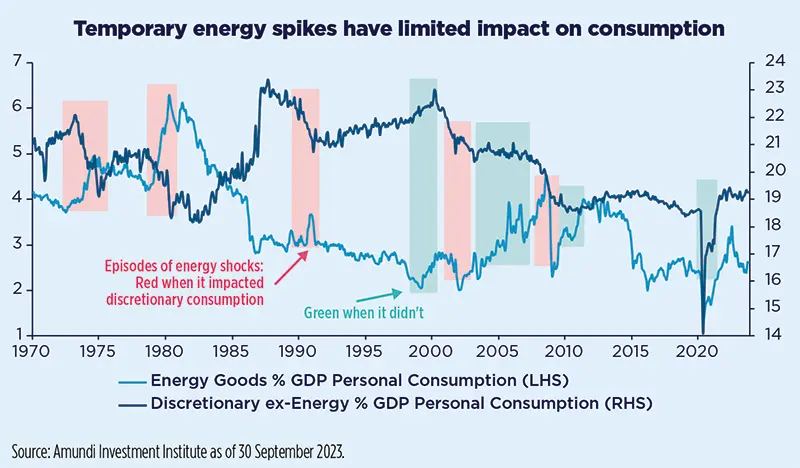

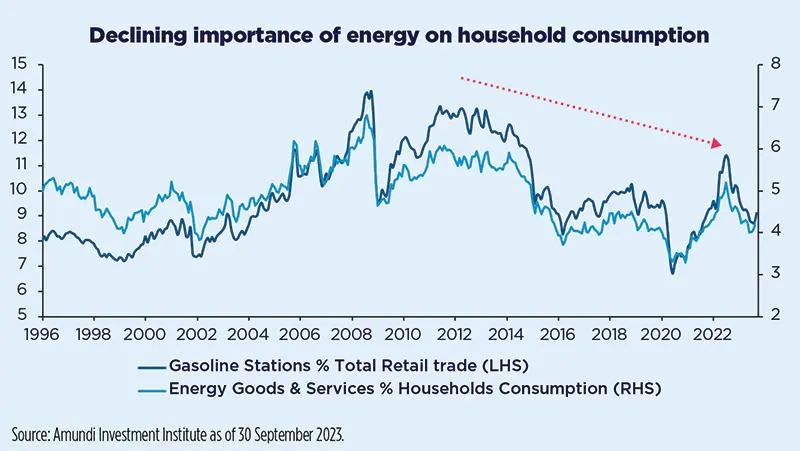

The significance of energy trends for the US economy has declined over the last three decades. The consumption of energy for each real dollar of GDP has fallen by 3% every year and this will continue with the energy transition. The share of services in the economy has also crept up at the expense of secondary activities. In particular, the energy impact on consumption has declined from 6% to 4% over the last two decades, and from 3% to 2% on production. After the great energy shocks of the 70s, authorities have gained experience in managing oil shocks, further mitigating their impact. Last, but not least, oil self-sufficiency via rising shale gas production over the last 10 years has been a game changer. While the importance of energy has gradually declined, the issue has returned to the fore following a series of energy shocks which have boosted price volatility: the pandemic (a demand shock), then Ukraine and, more recently, aggressive OPEC+ supply cuts (both supply shocks). Oil prices pass through to the economy via various channels, including inflation, consumption, corporate margins and investment, productivity, the balance of payment, and global savings (through petrodollars), and in the long run may accentuate social stress. Here we focus on the impact of oil prices on US consumption.

1. It would take a material rise in energy prices and a combination of negative factors to hit overall spending

The relationship between oil prices and consumption is not easy to establish because there have been few relevant case studies since the 70s, excluding times of recessions (the true energy effect is trickier to isolate). Assessing the impact today is even more challenging given the broken price/demand elasticity since the pandemic. As a start, given the looser energy weight in the US economy, bigger price surges are needed to be impactful.

We find that energy prices follow a typical sequence. A rise in raw energy prices usually takes a little more than a month to pass through to the end consumer. As energy goods become more expensive, households generally start cutting energy spending (purchasing a lower quantity thus mitigates the price factor). There are two main categories of energy goods: motor vehicle fuel and residential heating fuel. The former category is far larger and more sensitive to changes in energy prices (spending on heating fuel tends to be less cyclical). If these adjustments do not sufficiently absorb the loss of purchasing power, households then cut spending on discretionary items and later on a broader segment range. Hence, energy prices tend to hit energy spending before they spread to discretionary items. Therefore, we find that it would require a material energy price rise (typically higher than +50% YoY) and a combination of negative factors for households to take a meaningful toll on overall spending. The impact is also bigger when price surges are sparked by supply shocks (versus demand shocks).

2. How will the recent surge in oil prices impact consumption?

Surging oil prices should only have a marginal impact on consumption at this stage. We would start to worry if prices sustainably breach $110/b for Brent.

While driven by a supply shock (OPEC+ cuts and evidence of tighter supply/demand balance), we do not expect a significant hit to consumption yet. Energy prices have risen +27% since mid-June but are still down 19% YoY, which doesn’t yet qualify as a major shock. Household conditions have also remained relatively benign, considering income, employment and assets. Consumption so far has been supported by a cyclical economic rebound since late 2022, re-accelerating liquidity, persistent fiscal transfers, a recovering wealth effect (due to supportive markets in H1), and a very gradual deceleration in employment and wages. As a result, discretionary spending has remained resilient. Consumer surveys and high-frequency data tracking spending behaviours do not suggest a looming shift. We expect spending patterns to change later on, due to higher rates and moderating fiscal support rather than energy prices.

We conclude that in our base case for oil (which forecasts a transitory spike in prices), the impact on consumption would remain marginal unless prices reached at least $110/b (for Brent). Although manageable at this stage, we see more implications from surging oil prices on inflation and rates, and on corporate margins, than for consumption.

We note that this analysis focuses on the US. The situation in the EU has obviously been different with natural gas and is displaying all the ingredients for a bigger impact on consumption: a major supply shock, a powerful price increase, and no energy self-sufficiency, albeit partially mitigated by fiscal subsidies.