Summary

Key highlights

Main investment implications of IFRS 9/17 for insurers

- The introduction of the SPPI test and the impairment model makes bond investments more complex as:

- it requires companies to assess a range of factors (including contractual terms of the bonds, issuer’s ability to make payments, assess whether bond investment has suffered significant increase in credit risk, recognize any resulting impairment risk)

- it makes accounting judgments difficult

- Equity investments do not receive favorable treatment under IFRS 9*, as they are typically classified as fair value through profit or loss* (“ FVTPL”) with change in fair value recognized in profit or loss.

Changes proposed by the IASB

- Refining the criteria for passing SPPI test to enable sustainability-linked bonds to meet the criteria and be classified as amortized cost

- Disclosing the potential impacts of contractual clauses that could modify cash flows of bonds and loans classified at Amortized Cost or at FVOCI*

- Enhancing reporting requirements for equity instruments designated at FVOCI* (IFRS7*)

Actionable ideas for insurers

- Consider increasing investments in fixed income products with predictable cash flows

- Evaluate the use of FVOCI classification for equity investments to limit P&L volatility

- Consider investing in stocks that pay high dividend rates which could provide stable returns

Preparing for IFRS 9 and IFRS 17 is a major topic for insurers in 2022 and 2023. On the one hand, IFRS 9 on financial instruments introduces new complexity in the recognition of debt securities, as well as a change penalizing equity investments. On the other hand, IFRS 17 requires the preparation of a transition balance sheet that should reflect the effects of the retroactive application of the standard on financial statements. This is therefore particularly complex for life insurance activities, which may include contracts written a long time ago.

In this article, we highlight the implication of IFRS 9/17 standards and the changes being considered by the International Accounting Standards Board (IASB) for classification and measurement of bond and equity investments. We also share some thoughts on how insurance companies can effectively address this new framework.

1. Debt instruments

Insurers must determine whether each security in their bond portfolio meets the test.

SPPI test*

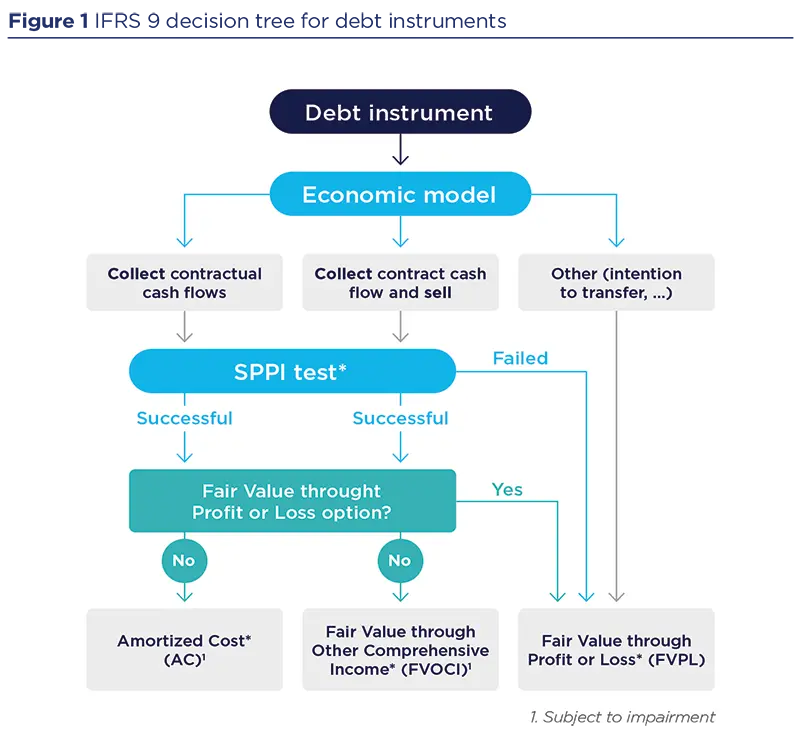

As detailed in Figure 1, for debt instruments, the Fair Value through Other Comprehensive Income (“FVOCI”*) accounting classification – a category that allows a fairly similar treatment to IAS 39 Available-For-Sale (“AFS”)* financial assets – is subject to the Solely Payment of Principal and Interests (“SPPI”*) test and no longer depends solely on the management intention.

Therefore, insurers must determine whether each security in their bond portfolio meets the test.

In the vast majority of cases, there is no ambiguity, but some investments contain clauses that change the timing or amount of contractual cash flows, thereby creating uncertainty in the SPPI test assessment.

The latest recommendations published by the IASB* provide clarification on the classification of bonds and loans with ESG-linked features.

Since the beginning of 2018, IFRS 9 has been applied, except for insurance companies that were given the option to defer implementation until the entry into force of IFRS 17, and its revision was initiated in 2021.

The challenge of implementing the requirements of the current standard on bonds and loans that integrate Environmental, Social and Governance (ESG) criteria has surfaced as a significant concern among those who participated in the consultation regarding topics related to the classification and measurement of financial instruments.

Therefore, the IASB* has decided to prioritize this issue, specifically to clarify the requirements regarding the assessment of the SPPI* nature of contractual cash flows.

On March 21st, 2023, the IASB published an Exposure draft* proposing amendments to IFRS 9* and IFRS 7* which will be open for comment until July 19 of the same year.

The IASB* has decided to prioritize this issue, specifically to clarify the requirements regarding the assessment of the SPPI* nature of contractual cash flows.

The Exposure Draft* has proposed changes that make it feasible to consider “sustainability-linked bonds”, which previously posed challenges for analysis, as meeting the “SPPI” test.

IASB* adjustment on SPPI* test in brief:

1. Introduction of additional criteria to the SPPI test

The draft amendment proposes additional criteria to assess whether financial instruments with contractual clauses that modify the timing or amount of cash flows meet the SPPI criteria:

- Criterion 1: The occurrence (or non-occurrence) of the contingent event must be specific to the debtor, i.e. depend on the debtor achieving a contractually specified objective, even if the same objective is included in other contracts for other debtors.

- Criterion 2: The resulting contractual cash flows must not represent (i) an investment in the debtor or (ii) an exposure to the performance of specified assets.

2. An automatic evaluation

The project also specifies that the assessment must be conducted regardless of the likelihood of the potential event occurring.

3. Illustrative examples

The IASB also adds two examples to illustrate the new rules:

- An example that meets the SPPI test: a loan whose interest rate is periodically adjusted by a specified number of basis points, if the debtor reaches a contractually specified reduction in greenhouse gas emissions during the previous period.

- An example that does not meet the SPPI test: a loan whose interest rate is adjusted periodically, when a carbon market price index reaches a contractually defined threshold.

IASB* adjustment on disclosure requirements in IFRS 7* in brief

To help users of financial statements to assess the variability of contractual cash flows that may arise from the occurrence (or not occurrence) of contingent events, the IASB* also proposes to supplement disclosures requirements about financial assets and liabilities. The IASB* adds qualitative information describing the trigger criteria and quantitative information specifying about the extent of possible variations.

The financial reporting burden will therefore be increased for insurers who hold a large number of financial instruments affected by this change.

The potential impacts of contractual clauses that may modify cash flows depending on the occurrence (or non-occurrence) of a contingent event specific to the debtor must be explained. To this end, for each category of assets measured at amortized cost or FVOCI*, the amendment requests to specify:

- The nature of the contingent event,

- The range of possible change in contractual cash flows that may result from the occurrence (or non-occurrence) of the event,

- The gross carrying amount of the assets and the amortized cost of liabilities subject to those contractual terms

The implementation of the impairment model has made it necessary to enhance the accounting systems used by insurers and requires additional processing at each reporting date.

Measuring impairments in loans and bonds with a more complex model

The implementation of the impairment model has made it necessary to enhance the accounting systems used by insurers and requires additional processing at each reporting date.

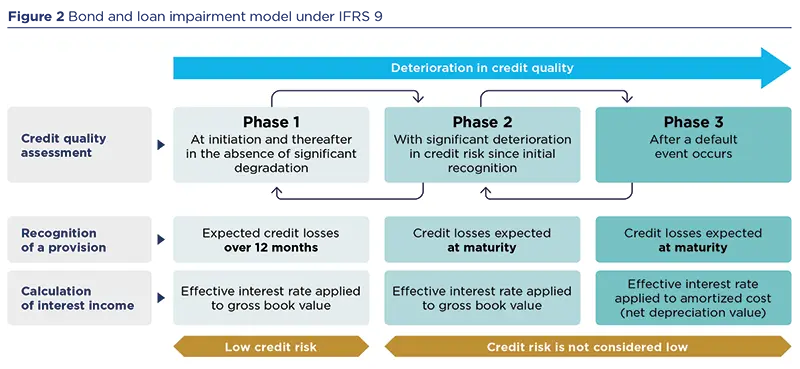

As described in Figure 2, unlike International Accounting Standard (IAS) 39, the impairment model of IFRS 9* is based on a prospective approach. It is therefore more complicated to implement.

Initially, the entity recognizes losses due to a default over the next 12 months (phase 1).

In the event of a significant deterioration in credit quality, the security purchased or loan granted enters phase 2 and expected cash flow losses should be taken into consideration in case of a default occuring anytime before the maturity of the security or loan.

2. Equities and equity-type instruments

Under IFRS 9*, investments in securities considered as equity instruments are generally recognized at fair value through profit or loss (“FVPL”*).

However, if the economic model is not based on “held-for-trading”*, the entity may opt to record changes at FVOCI*.

If the investor chooses this option, any capital gains or losses recorded at OCI* are not subject to recycling upon the sale of the securities (unlike the treatment of securities classified as Available For Sale* “AFS” under IAS 39) and only dividends are reflected in the net income. This classification choice is final and cannot be changed.

IFRS 17 includes a specific model, called the Variable Fee Approach (VFA*), developed for direct participation contracts.

IASB* adjustment on equity investments in brief:

Regarding equity investments, the revision of IFRS 9 does not bring the changes desired by many players in continental Europe.

- During the review consultation of IFRS 9 launched in October 2021, some participants expressed the desire for the standard to reintroduce the recycling of gains or losses realized from the sale of equities classified as FVOCI. Others suggested that assets invested indirectly in equities, such as certain funds should be eligible for FVOCI classification.

- At the October 2022 meeting, the IASB provisionally concluded that there was not enough evidence to justify making changes to the standard.

- As a result, the proposed amendment in the Exposure Draft published on March 21st, 2023 does not change the accounting treatment of equities held directly or through funds.

However, the IASB* proposes to amend IFRS 7* to require additional information about investments in equities designated at FVOCI*.

- Changes in fair value over the reporting period should be disclosed separately for assets derecognized during the reporting period and for assets held at the end of the reporting period.

- Disclosure of the total fair value of equity investments accounted at FVOCI* is also required but the disclosure of information by instrument is no longer required

IFRS 17 includes a specific model, called the Variable Fee Approach (VFA*), developed for direct participation contracts.

The application of the new standards IFRS 9/17* does not have an equal impact on all insurance branches

IFRS 17 includes a specific model, called the Variable Fee Approach (VFA*), developed for direct participation contracts.

Under VFA contracts, insurers are required to pay policyholders a significant portion of the economic return on investments, and the payable amounts to policyholders may vary based on the fluctuations in the asset value.

The VFA model is designed in such a way that insurers receive a variable commission for managing the savings entrusted to them. The model thus helps reduce the impact of economic volatility of the assets on earnings.

3. How can insurers address these changes?

Increase the allocation to fixed income

In order to reduce the volatility of their results, some insurance companies, issuing contracts not eligible for application of the VFA* model, increased their investments in fixed income products, at the expense of investments in equities or funds.

The increase in rates witnessed over the past two years has further motivated investors to carry out arbitrage in fixed-rate investments by making them more attractive.

Favor the FVOCI classification for equity investments

Using the FVOCI classification for equity investments is a method that insurers can use to limit earnings volatility. However, since only dividends are reflected in the income statement, this classification choice often requires a revision in the stock selection process.

This revision involves favoring companies that pay a high dividend rate, while potentially overlooking securities with higher long-term valuation expectations but provide little income. This selection criterion could potentially lead to a significant sector bias.

4. Current industry trends

During Q4 2022, several major insurance groups provided preliminary information to the financial community and investors regarding the application of IFRS 9/17.

During Q4 2022, several major insurance groups provided preliminary information to the financial community and investors regarding the application of IFRS 9/17.

Overall, the finance departments expect a decrease in balance sheet volatility and an increase in (stabilisation of) earnings stability.

It was also noted that the implementation of the new accounting standards would not have any significant impacts on the company’s solvency, cash generation, or dividend payout prospects.

* Please refer to the glossary in the document for definitions of key terms used in this article.

Sources

- EFRAG – November 2021: EFRAG’s draft comment letter in response to the IASB Request for Information on the Post Implementation Review - IFRS 9 Financial Instruments – Classification and Measurement

- COMMISSION REGULATION (EU) 2016/2067 of 22 November 2016 amending Regulation (EC) No 1126/2008 adopting certain international accounting standards in accordance with Regulation (EC) No 1606/2002 of the European Parliament and of the Council as regards International Financial Reporting Standard 9

- IASB March 2023 - Exposure Draft - Amendments to the Classification and Measurement of Financial Instruments - Proposed amendments to IFRS 9 and IFRS 7

- COMMISSION REGULATION (EU) 2021/2036 of 19 November 2021 amending Regulation (EC) No 1126/2008 adopting certain international accounting standards in accordance with Regulation (EC) No 1606/2002 of the European Parliament and of the Council as regards International Financial Reporting Standard 17

- IFRS Foundation, IFRS 17 Webcast Participation features slides, July 2018