Summary

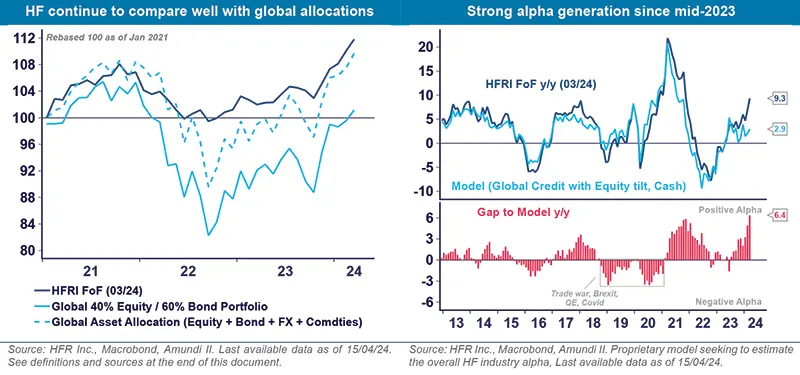

Strong alpha generation since mid-2023

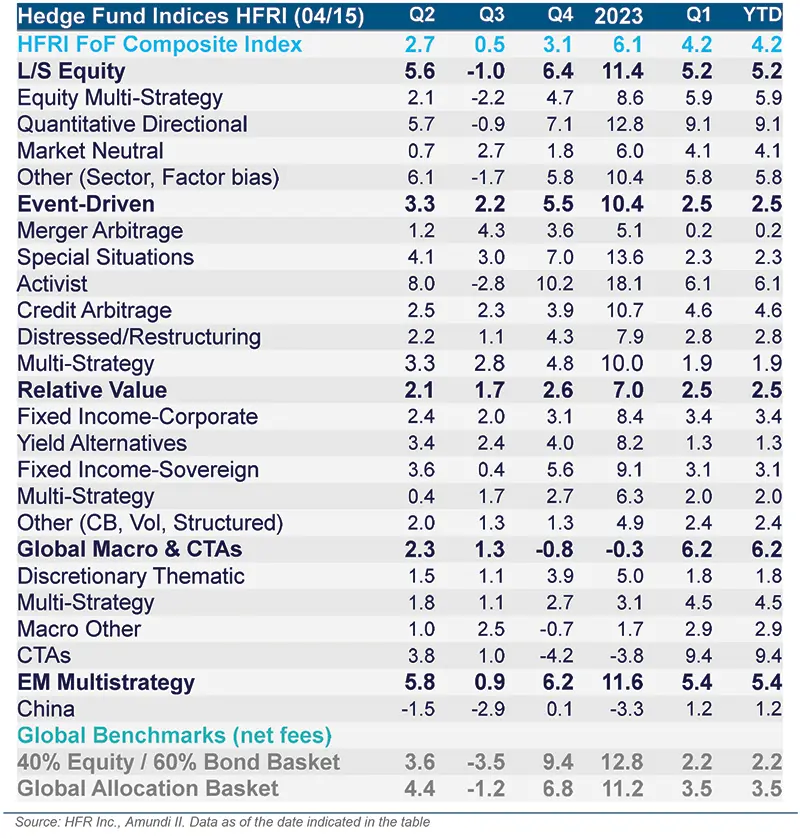

Hedge Funds (HF) are up 4.2% year-to-date as of March 2024, which compares well with diversified global allocations, including 40/60 Equity/Bond portfolios which are up around +2.2% and have higher volatility. HF performance year-to-date was led by CTAs, EM focused and L/S Equity both Directional and Neutral. Overall, the HF industry continued to produce very strong alpha, up an estimated 6%+ y/y.

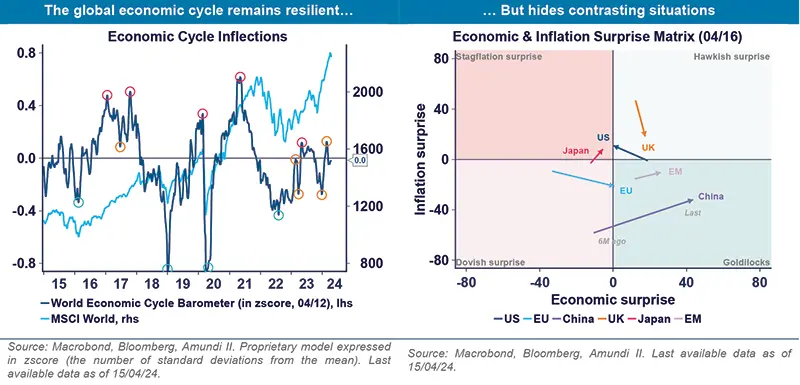

Markets have been switching from one goldilocks to another in 2024, and prepare for more fragmentation going forward

Late last year, markets had been pricing in that growth would slow enough to bring inflation down, leading central banks to start a full easing cycle, thus boosting risky assets. Since January, amid evidence of more resilient world growth, markets have priced in stickier inflation as well as delayed and shallower monetary easing. In other words, investors have retraced last year’s overly optimistic inflation and easing expectations, and overly pessimistic growth projections.

As consumption continues to defy expectations in the US amid ample global liquidity, inflation is now feared to be stalling, potentially leading the Fed to let nominal rates rise until both US consumption and global liquidity break, which would then put more pressure on dollar assets. Whether inflation is fuelled by strong demand, tight domestic supply or an external supply shock, it will likely determine the fate of cyclical assets. Beyond US exceptionalism, a more contrasting growth/inflation mix abroad could make room for more economic, monetary and market dispersion – once the initial contagion is overcome.

Despite rich valuations, benign global fundamentals are still perceived to provide a backstop, with limited odds for serious credit or tail events, which has supported risk appetite so far. Strong medium-term expectations from artificial intelligence (AI) also helped the tech sector reduce its reliance on rates, and gave markets extra wings. However, higher rates for much longer would eventually erode market confidence, especially if inflation proves to be sticky for the wrong reasons.

Nine implications for HF

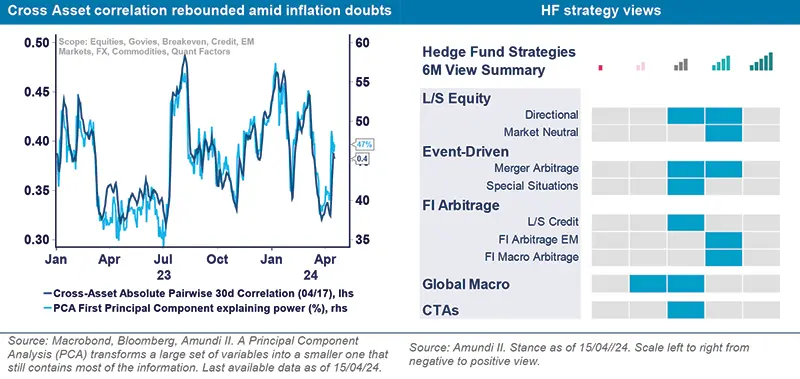

- More fragmented economies and monetary policy would open more regional relative value arbitrage opportunities, especially in bonds. Besides, as markets remain concentrated on tech, more differentiation should continue to be seen in other segments. This may support hedge funds (HF).

- The pulse in relative value arbitrage will nonetheless be capped by US exceptionalism, especially for assets tied to the US dollar, as the fate of inflation and rates will continue to dominate the narrative for longer.

- Momentum looks increasingly vulnerable, paving the way for less market directionality with more trials and errors especially in bonds and their proxies. In essence, momentum is stretched mainly in US and Japanese equities, and historically, when the macro backdrop has been supportive, a reversal in momentum has proved manageable for broader markets. Still, this means higher risk for L/S equity. On the positive side, it would imply less competition for HF from beta.

- Amid rich valuations in many assets, opportunities should continue to be plentiful for managers’ short books.

- Uncertainty regarding the macro scenario, especially in the US, remains a hurdle for top-down styles, forced to tailor their positions based on conditional scenarios, or alternatively face higher reversal risks. More agnostic styles deployed by systematic models look attractive relative to discretionary managers in this context. On the positive side, as markets start considering various macro outcomes, more convexity trades (i.e., opportunities with an asymmetric risk/reward) should emerge, providing arbitrage opportunities.

- Asset prices should continue to increasingly reflect their underlying fundamentals, due to elevated rates (more discrimination in discounted cash flow analysis), less global liquidity expansion (as central banks delay easing), and traditional growth drivers will increasingly matter when consumption starts to turn. Strong fundamental pricing is highly favourable for HF, especially those deploying a fundamental approach.

- Corporate activity is set to intensify, supported by a benign macro environment albeit constrained by higher rates in the US, providing a wider set of micro catalysts. This is good news for Event Driven and L/S Equity.

- The appeal of HF diversification stays intact amid unstable and poorly reliable equity/bond (and cross-asset) correlations, more versatile equity and bond implied volatilities, and greater risk for cyclical assets.

- HF are likely to benefit from an elevated extra cash contribution for the foreseeable future, as they are structurally long cash and tilted to carry.

For H2 2024, we favour L/S Equity Neutral and EM Fixed Income strategies. Merger arbitrage should also be appealing.

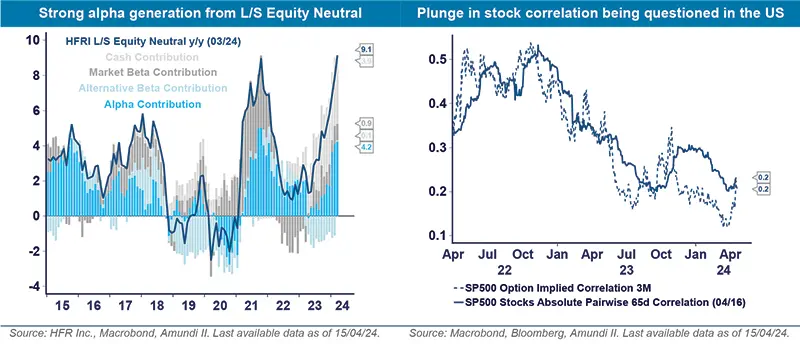

L/S Equity Neutral should continue to generate strong alpha, with more regional nuances

The alpha environment remains supportive, albeit with more regional nuances. Stock price and valuation correlations have collapsed in most regions year-to-date, while stock dispersion surged. It has been driven by a tiring equity rally, more economic differentiation as we moved along the economic cycle, and as investors anticipated a pending pivot from most central banks. It provided a very favourable environment for L/S Equity managers. These conditions remain largely in place in the EU but have reverted to average in the US and Japan, where rates will likely remain a dominant driver for longer.

A regional dichotomy is also probable in quant factors. There is now more differentiation across and within quant factors in the EU than in the US or Japan. Volatility in quant factors is also easier to manage for neutral styles in the EU.

Fundamental pricing (i.e., stocks’ price connection with their underlying fundamentals) remains strong in the US and the EU, less so in Japan where fear of rising rates is dominating.

With valuation remaining rich and after several months of strong momentum, the pool of short opportunities is supportive of neutral styles. Moreover, our long and short systematic stock opportunity indicator is back in the green in both the US and the EU, and especially for market neutral opportunities.

Finally, we still expect a strong cash contribution for the strategy (around 2% per year).

The main risks for the strategy include synchronised delays in Developed Markets’ (DM) monetary pivots, an abrupt turn in equity momentum and sudden rotations due to geopolitics.

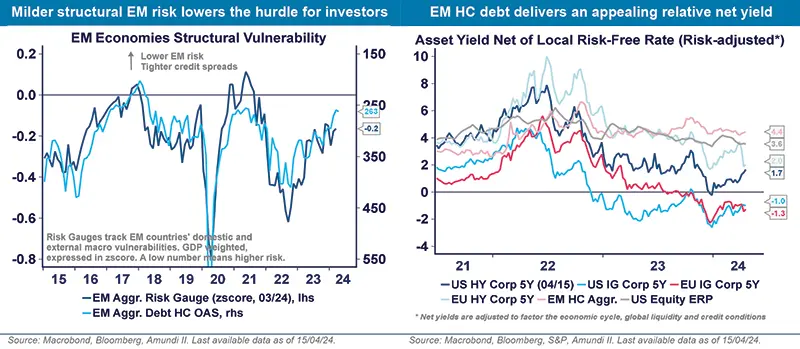

EM Fixed Income Arbitrage, access to EM markets with affordable risk

The EM debt backdrop remains attractive for EM focused HF, but the dominance of DM rates and implications from stickier DM inflation are the main risks.

The hurdles for investors to allocate in the segment are lower. Structural EM risks have receded, EM growth continues to outperform DMs, while EM rates have just started to decline. Chinese deleveraging is an obvious constraint, but should remain manageable. While EM debt valuations are fair-to-slightly-rich, the net carry (adjusted for risk) is one of the most appealing relative to other assets.

Disinflation doubts and delayed DM monetary pivots are holding back flows towards EM markets, and the alpha potential is not yet in full gear. The bulk of the flows remain in global EM indices, which is eroding dispersion. Just when investors were starting to be more selective, disinflation doubts have resulted in a significant re-correlation both in hard currency and local EM debt.

Yet, we expect fragmentation in EM to intensify, driven by countries’ sensitivity to Chinese deleveraging and by their uneven inflation pace and their leeway to ease monetary policy. Countries’ sensitivity to commodities and the tech supply chain should matter too. Geopolitics could be an extra source of differentiation, as some countries would benefit from diversification away from China. We expect all these dynamics to provide relative arbitrage opportunities.

We find that valuation opportunities at a micro level are starting to return in FX and to some extent in credit. Besides, our long and short systematic opportunity indicator for EM macro assets is back in positive territory.

Finally, we think the EM Fixed Income Arbitrage strategy provides appealing alternative access to EM credit at an affordable risk level, as managers maintain below-1 beta market exposures and focus on safe paper while favouring relative positions.

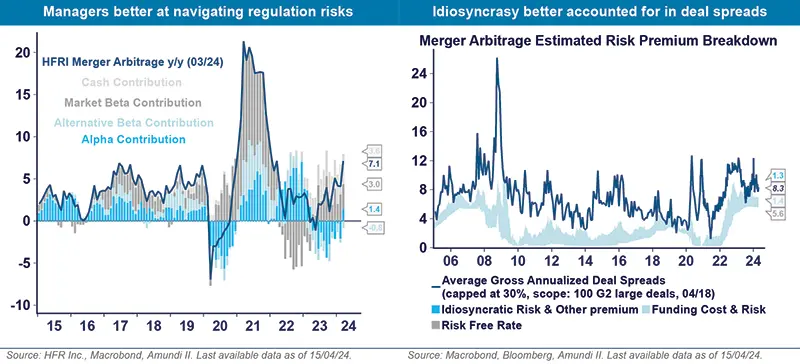

Merger Arbitrage to leverage on the return of corporate activity

We expect corporate activity to resume, which will provide managers with a broader menu of opportunities. Deal funding stress is receding as we enter the final phase of monetary tightening. Corporate confidence is reviving amid signs that global growth is remaining resilient and banks are willing to lend again, reflected by easing lending standards. Lots of dry powder is still waiting to be deployed ($2tn in private equity, $5tn sitting in corporate cash1), while a pipeline of delayed acquisitions since rates surged in 2022 is also ready to proceed. US election uncertainty might delay some operations in sensitive sectors, but there is a strong M&A rationale for strategic deals in sectors exposed to AI and digitalisation, the energy transition, re-onshoring and energy. Tighter corporate margins and moderating profit and revenue growth are also supporting external growth.

More importantly, the menu of deals remains of quality, as managers tend to focus on complex rather than vanilla operations. The deal premium stands above 30% on average, cross-border deals remain active, hostile acquisitions are still significant and there are more deals involving an exchange of stocks, which are usually juicier for arbitrageurs. While regulatory complexity is more frequently unsettling deal terms, there are still few deals being broken up.

Merger deals deliver on average an 8.5% spread, which stands above most credit yields and is achieved with lower volatility. We find that idiosyncratic developments are now better accounted for, deal breakup risk is conservatively priced, and the prospect of bidding wars is in line with the volume of hostile deals.

Regulation remains the key risk and is set to intensify in 2024, ahead of the US elections. However, antitrust laws are becoming better defined following recent rulings, and managers are becoming more experienced at navigating and pricing regulation hurdles.

Merger alpha generation has been weak in 2023, mainly due to regulation risk and an increasing deal correlation. Alpha is starting to recover, supported by greater corporate activity, more deal dispersion and better management of regulation risk. Moreover, the strategy enjoys a significant return contribution from elevated cash rates.

1 Estimation from Preqin 2024

Hedge Fund Indices Performance

The index returns are provided for purposes of comparison and include dividends and/or interest income. The indices are unmanaged and fully invested. Although information and analysis contained herein have been obtained from sources Amundi AM believes to be reliable, its accuracy and completeness cannot be guaranteed. Investors cannot invest directly in indices. The indices referenced herein have been selected because they are well known, easily recognized by investors, and reflect those indices that Amundi AM believes, in part based on industry practice, provide a suitable benchmark against which to evaluate the investment or broader market described herein.

Index Description

Other L/S Equity: equally weighted performance of HFRI Equity Hedge: Sector - Energy/Basic Materials, Technology/Healthcare

Other Relative Value: equally weighted performance of HFRI Relative Value: Fixed Income-Asset Backed, Convertible Arbitrage, Volatility

Other Macro: equally weighted performance of HFRI, Macro: Active Trading, Commodity, Currency

HFRI indices: for a comprehensive description of the HFRI indices used in the above table, please refer to the index description on HFR website: https://www.hfr.com/hfrx-indices-index-descriptions

Global Benchmark Description

40% Equity/60% Bond Basket: Combines the MSCI World and the Barclays Global Bond Aggregate

Global Allocation Basket: Combines the MSCI World, the Barclays Global Bond Aggregate, Global FX Carry in USD, and the S&P GSCI Commodity index. All indexes are in USD unhedged. Gross of fees and taxation.