Summary

Mixed economic signals open up opportunities

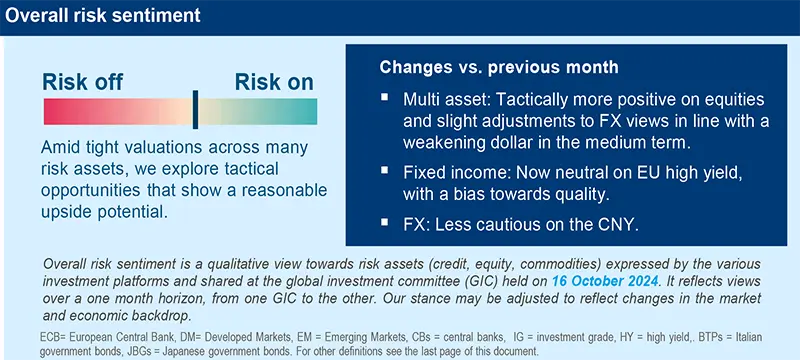

We are slightly constructive on risks towards segments where fundamentals are strong, and ignore areas where upside potential looks limited.

The move up in bond yields, US stocks (record highs in October), and Europe indicate markets’ perception of a perfect scenario centered around strong US growth and falling inflation and a positive impetus from monetary easing in Europe. Although we acknowledge the resilience of US, we think not all data in the US and Europe has been straightforward. In China, the key question is whether the fiscal policy will meet expectations and deliver a sustainable boost to economy. In this muddling in the middle scenario, the following factors could drive the global economy:

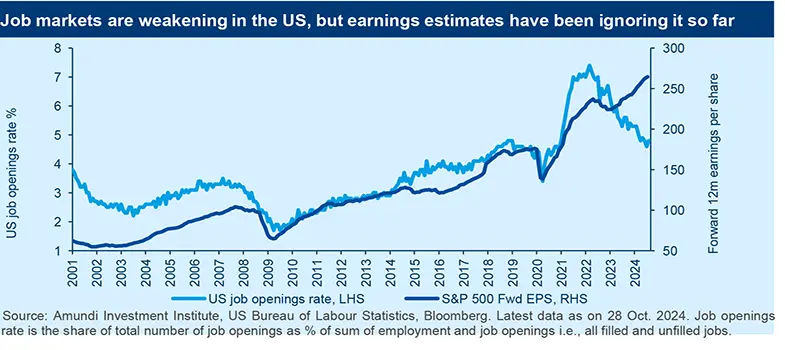

- Labour demand from companies is cooling. Amid a deterioration in US job markets, we expect an increase in the unemployment rate. Recent data show a continuation of the downward trend in job postings, hiring and wage growth. Consumers might respond to this ‘less hot’ labour market by curtailing non-essential spending.

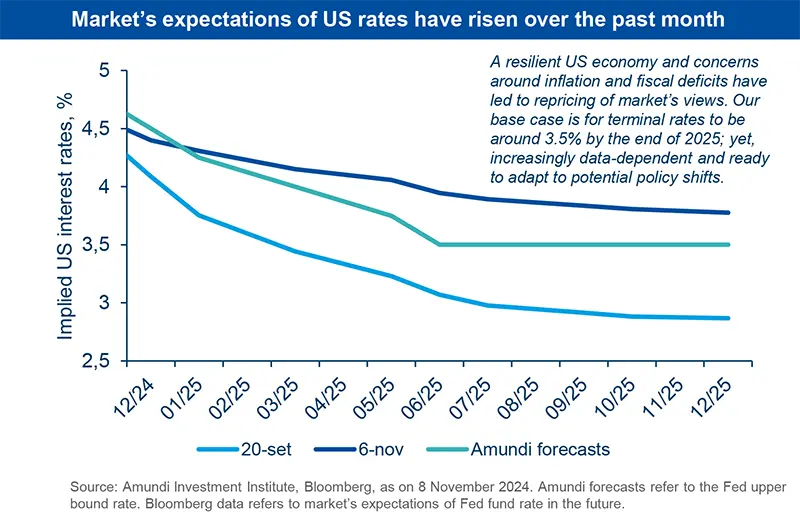

- Downward trend on inflation is maintained in US and Europe. Inflation should reach close to the Fed’s target around mid-2025. Some risks may emerge from sticky components and policies of the new US government. Europe could witness uneven growth and subdued domestic demand.

- Central banks will look through the temporary volatility on inflation, if any. Markets’ expectations on the Fed are now closer to our internal projections of two more rate cuts this year. The ECB has already delivered a rate cut in October as expected and is likely to cut once again this year.

- Chinese authorities have indicated their desire to make a policy shift but a clear direction to address the problems, for instance in real estate, is essential for a lasting impact on economic growth.

In a benign outlook, with growth decelerating but holding and inflation falling, the key question is how much of the good news is already discounted by the markets. Markets tend to react quickly to important news, as was the case in China and even in the US where yields tracked the noise around US elections, deficits, and strong economic data. We see a mild deceleration without a US recession, and in Europe, growth remains reasonable, but fiscal constraints could dampen the environment. Thus, we maintain a mildly positive risk stance and look for bright spots in this environment.

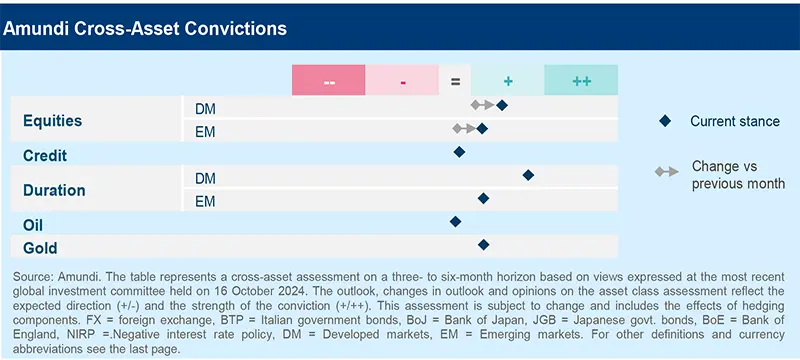

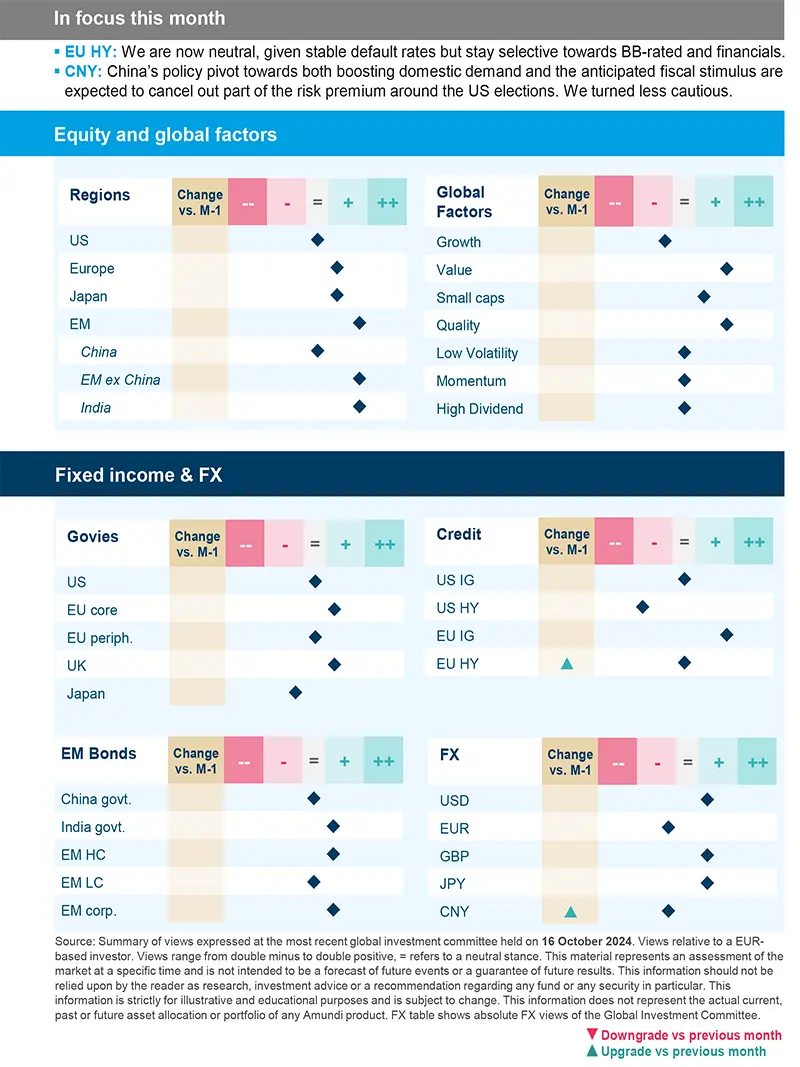

- Cross asset. Our active approach has now led us to turn slightly positive on US and Chinese equities amid pullbacks and better sentiment, respectively. We are also constructive on the UK and Japan, and our overall stance on equities is marginally positive. At the other end, we maintain portfolio stability through US Treasuries, European bonds and gold. We are also optimistic on EM debt for carry reasons. But on Japanese bonds, we stay cautious and are monitoring the central bank’s actions and fiscal policy, particularly after the recent weakening of the ruling coalition and any potential fiscal indiscipline.

- Play duration around market volatility amid falling inflation. The economy and fiscal deficit concerns have driven up US yields, making them more attractive than before, but we stay close to neutral for now. In Europe and UK, however, we are slightly positive and prefer to play tactically. In corporate credit, quality, carry, and idiosyncratic risks are important factors for us, and we like EUR IG (banking and insurance). We also keep our quality bias in the US.

- Balanced stance in equities. When valuations are high but risks of a recession are low and central banks are cutting rates, it is not a time to be cautious. However, we stay selective and balanced, favouring areas such as US equal weighted, which performed well in Q3. Such segments should also benefit from broadening of the rally. In Europe, we blend our views through quality cyclical businesses and defensive stocks from all areas of the market.

- Idiosyncratic stories in EM keep us positive. EM central banks are expected to ease policies at a slower pace than the Fed due to their own country-specific dynamics. This is likely to enhance the appeal of EM debt. In Chinese equities, we are close to neutral but stay prepared to alter this view depending on the extent to which potential details on fiscal policies could boost the economy.

Three hot questions

|

Monica DEFEND |

Slowing inflation in the US and eurozone, with some risks, would allow central banks to maintain their rate-cut paths. For markets, fiscal policies are becoming important as governance rules gain prominence in the EU and a new government takes shape in the US.

1| What are your views on the US economy after the recent revisions by the US Bureau of Economic Analysis?

The recent revision to the US GDP makes the economy more coherent with other indicators, and shows that some of the vulnerabilities (we expected earlier) around the consumer are less of a concern now. That said, an orderly cooling of the labour markets is the most likely scenario to play out. In particular, employee layoffs (including permanent layoffs) by companies is a key variable to monitor. We believe aggregate labour income would slow, impacting consumption and GDP growth. As a result, we maintain our view of a slowing US economy and continued disinflation.

Investment Implications:

- Neutral on US duration; curve steepening on 2-10Y and 5-30Y.

2| From a cross-asset view, what are the areas of opportunities?

This late-cycle environment is calling for a slightly positive view on risk assets, but it is important to note that valuations are expensive in many segments. In particular, equities overshot our fair valuation targets and S&P 500 appears expensive. On the positive side, a further upside to risk assets may come from a faster normalization of inflation without negatively affecting economic growth (low probability). But there are risks to the downside as well in the form of a potential credit event or escalation of geopolitical tensions. Hence, it is essential to focus on assets that are attractively priced and can provide stability in times of potential stress..

Investment Implications:

- Positive IG credit, gold and cyclical commodities; cautious HY.

3| Do you see higher geopolitical tensions in the middle east affecting oil prices?

We believe that higher volatility regarding the conflict in the Middle East is unlikely to completely offset fundamental factors such as excess supply next year. Supply outages due to strikes on Iranian energy infrastructure are possible but would only imply a modest premium on oil prices. In particular, Saudi Arabia’s willingness to accept lower prices to restore OPEC credibility and regain market share, along with rising output from non-OPEC countries, points to a weaker price equilibrium.

Investment Implications:

- Brent target around $75-80/bbl for 2025.

MULTI-ASSET

Explore tactical entry points and stay flexible

|

Francesco SANDRINI |

John O'TOOLE |

We have turned slightly constructive on equities amid evolving economic backdrops and fiscal policies.

Mildly slowing economic growth in the US, growth moving towards potential in Europe and declining inflation in both regions call for a moderately positive stance on risk. In particular, wage moderation in the Eurozone has allowed the ECB to maintain its course on rate cuts. This monetary easing, along with expectations of policy stimulus in countries such as China, led us to finetune our stance on equities. But we did so while keeping sufficient checks and balances that provide stability and diversification.

We are positive on DM equities mainly through Japan, the UK and now through the US. The August volatility earlier led us to slightly downgrade our stance on equities, but recently we saw a window of opportunity to tactically upgrade our views on the US amid continuing Fed cuts and recent economic data. We also turned marginally constructive on EM through China, given its valuations. Sentiment was boosted by monetary measures and announcements around support for local governments and housing.

We are exploring yield curves across the world and think the risks of a hard landing of the US economy and potential weakness in the Eurozone are not priced in. Thus, we are slightly positive on duration in the US and core Europe. We also like Italian BTPs over German bunds owing to expectations of further spread compression in favour of Italy. The country should benefit from an environment of monetary easing. On UK duration, our positive stance is maintained due to attractive valuations. However, on Japanese bonds, we stay cautious as we expect yields to rise there.

Corporate fundamentals in EU IG are robust, leading us to maintain our marginally constructive view. Elsewhere, EM debt should benefit from disinflation and yield differential with the US, but we are vigilant on any volatility from US elections results. In FX, we maintain that the USD should weaken over the medium term as the Fed cuts rates. Hence, we closed our constructive stance on USD/SEK. But near-term dollar strength is possible, and we are mildly positive on it against the CHF where central bank started the easing cycle before the Fed. We are slightly cautious on the EUR vs BRL and now also turned sceptical (on EUR) vs the JPY and the NOK.

Gold remains a pillar of stability for us amid rate cuts by major global central banks. In addition, we believe efficient hedges on bonds and equities are essential to safeguard portfolios.

FIXED INCOME

Inflation progress to keep central bank easing on track

| Amaury D'ORSAY Head of Fixed Income |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Marco PIRONDINI CIO of US Investment Management |

The apparent resilience of the US economy and the recent inflation data led the markets to raise their expectations on US interest rates. There now seems to be a debate in the markets as to whether the Fed believes inflation has been beaten and will therefore continue on its rate-cutting path. While there are some tail risks to the disinflation process, the overall trajectory of inflation is declining, and the Fed, along with the ECB, is very mindful of unemployment numbers and economic activity. On the last one, we expect a mild deceleration in the US as labour markets rebalance and consumption pressures emerge. Hence, while exploring the benefits and stability of government bonds, investors may consider quality credit for extra carry, particularly in Europe, US and emerging markets.

- We are close to neutral on duration overall, but see tactical opportunities across geographies. For instance, we are positive on European duration (because of some growth risks) and on the UK. We also believe the yield curve should steepen in Europe.

- IG credit is presenting opportunities where we like BBB-rated debt and the banking sector.

- On HY we stay selective, with a quality bias, and find value in shorter maturities.

- We are actively managing our views on USTs based on market volatility. Yields are attractive, but we are close to neutrality, preferring the intermediate parts of the curve.

- In corporate credit, our quality bias is maintained, and we like financials. We prefer shorter tenors, given flat issuer maturity curves and their better relative valuations.

- Consumer ABS are reasonably attractive compared with some corporate credit segments

- EM bonds present good idiosyncratic stories at a time of continued Fed easing that should enhance the appeal for the extra yield on offer.

- In hard currency, we maintain a bias towards HY over IG, given the attractive carry. In local rates, we are selective towards Brazil and Colombia, although a potential victory for Trump in US elections could hurt the region. We stay vigilant.

- Elsewhere in emerging Europe, we like Romania.

EQUITIES

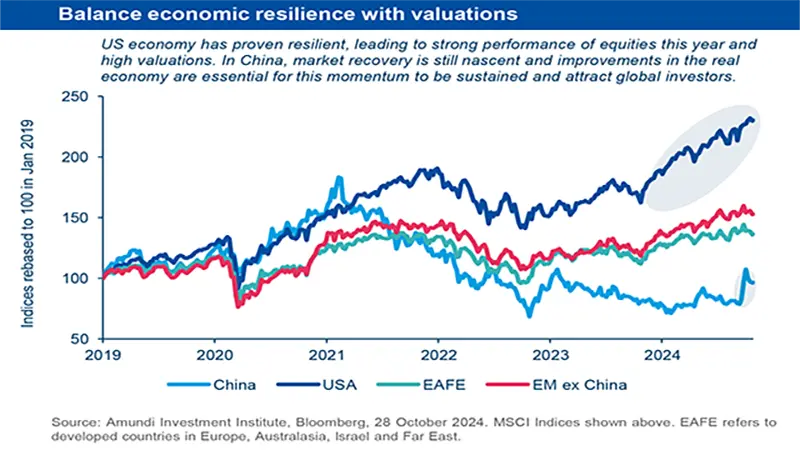

Balance the ‘no-recession’ narrative in US with valuations

| Barry GLAVIN Head of Equity Platform |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Marco PIRONDINI CIO of US Investment Management |

An environment of declining inflation and a mild US economic deceleration without a recession are constructive for equities. But it doesn’t call for an outright increase in risks because not all markets are displaying a similar earnings potential and valuations. On the former, this earnings season in Europe and US should give us some insights on forward guidance. Any disappointment could cause volatility and be an opportune backdrop for stock picking (based on balance sheet strength, potential to reward shareholders, etc.). In Asia, the measures announced by Chinese policymakers indicate their clear desire for economic support, but the details on fiscal policies to boost consumer sentiment are the most important aspects for us. As we monitor that, we explore quality businesses in other EM and in Europe and Japan.

- We blend cyclicals and defensive segments to stay balanced. Even though we are cautious on the financials sector overall, we maintain our main conviction on banks with robust capital positions.

- In defensives, rate cut expectations boosted some utilities businesses, and that may offer exit opportunities.

- The earnings season should provide indications of whether the momentum gained from earlier in the summer can be sustained.

- US economy appears to be in reasonable shape, but this could change if consumption deteriorates.

- Valuations are another key factor, and the gap between market-cap-weighted and equal-weighted indices is huge. The latter is also another way to play the small caps theme.

- While focusing on stock picking, we remain positive on the former and on Value, Quality names. In addition, we like defensives but aim to go beyond the traditional sectors.

- We are cautiously optimistic on China as valuations are attractive and policy shift looks imminent. But earnings growth could be affected by still weak consumption, and we await government measures that address the former.

- In the meanwhile, we explore other parts of Asia such as Indonesia (financials) and India.

- Valuations in LatAm countries such as Brazil are supportive, but we are monitoring fiscal risks.

VIEWS

Amundi asset class views

Definitions & Abbreviations

- Currency abbreviations:

USD – US dollar, BRL – Brazilian real, JPY – Japanese yen, GBP – British pound sterling, EUR – Euro, CAD – Canadian dollar, SEK – Swedish krona, NOK – Norwegian krone, CHF – Swiss Franc, NZD – New Zealand dollar, AUD – Australian dollar, CNY – Chinese Renminbi, CLP – Chilean Peso, MXN – Mexican Peso, IDR – Indonesian Rupiah, RUB – Russian Ruble, ZAR – South African Rand, TRY – Turkish lira, KRW – South Korean Won, THB – Thai Baht, HUF – Hungarian Forint.