Summary

Explore the broadening of the rally with Europe

Expectations of monetary easing by central banks may support areas that show earnings resilience and are attractively priced.

Equities and commodities such as gold touched historical highs in May. The stocks rally broadened to Europe, the UK and China after the Fed paved the way for a dovish environment. In line US inflation also boosted sentiment. On the other hand, corporate earnings proved better than expected in the US and Europe. Looking ahead, central banks, the inflation/growth mix, earnings strength and geopolitical risks will shape the global economy and markets:

- Outlook marginally improving. We upgrade this year’s economic growth expectations for the Eurozone and the UK due to domestic demand and slowing inflation. The US should remain resilient in the first half, but slowing wage growth and consumer delinquencies may weigh on the economy later.

- Temporary decoupling of the Fed with Europe. The disinflationary process in Europe and the UK will allow central banks to reduce rates, possibly ahead of the Fed. US inflation readings are crucial for the Fed to decide on the timing of the first rate cut. We expect 75bps of cuts this year.

- US-China geopolitical rivalry calls for a strategic rethink in Europe. Europe is unlikely to alienate the US or China completely because of their importance for trade. The region also needs to balance its priorities around fiscal impetus and sustainability, low productivity (vs. the US) and investments related to the green transition that may fill the fiscal lag.

- Mixed picture for China. Temporary relief measures to boost the real estate sector do not address the main issue of weak demand. But exports have been encouraging, leading us to be vigilant on these two factors.

Markets are likely to remain range bound, with possible episodes of volatility if inflation accelerates or geopolitical risks escalate. We outline below our main convictions across asset classes:

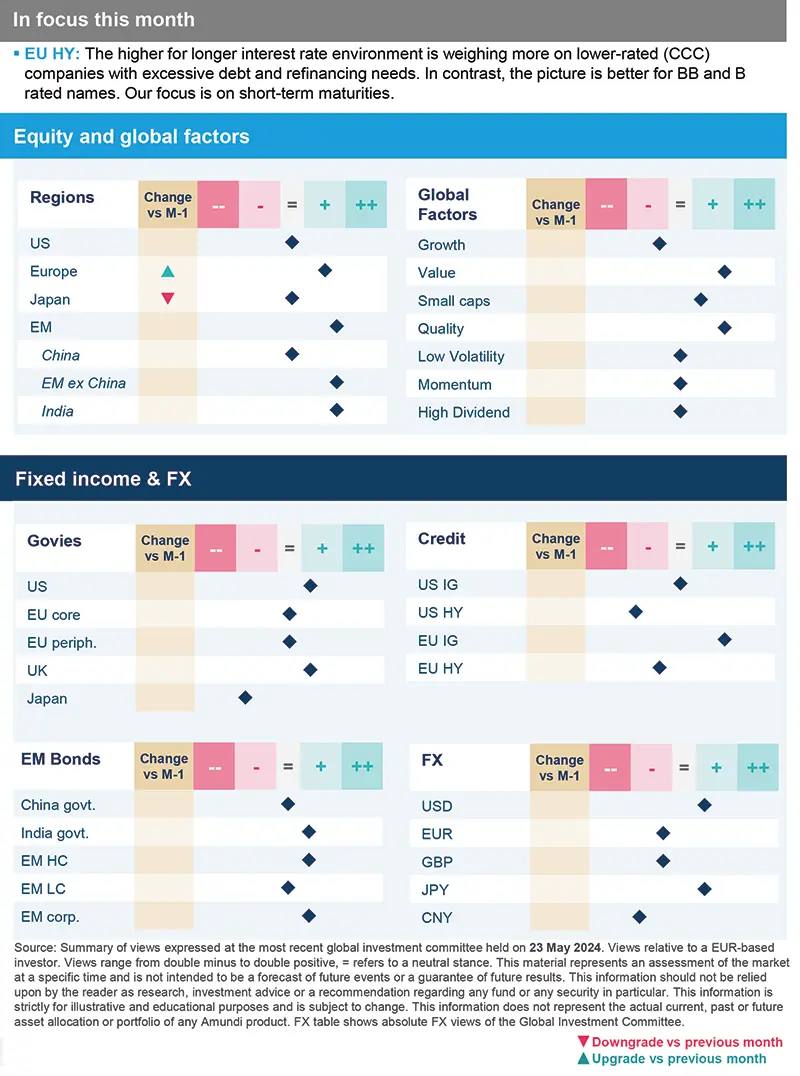

- The confirmation of a late-cycle environment leads us to stay mildly positive on equities, with some regional adjustments. In developed markets, we move to neutral from positive on Japan and we see scope for rebalancing in favour of the UK, European small caps and the US. While the US is displaying strong earnings, Europe should benefit from the moderately resilient economic environment and rate cuts. In government bonds, we are positive on the US and core Europe, along with Italy. In credit, valuations in Euro investment grade are attractive. We also look for selective opportunities across emerging markets and see oil as providing protection from geopolitical risks.

- In fixed income, subsiding US inflation enables us to keep our constructive and active view on US Treasuries. While we are positive on UK government bonds, we remain neutral on Europe and cautious on Japan. Credit markets were very receptive to the new issues this year in the US, thanks to the attractive yields on offer before the Fed starts to cut rates. This is a major risk, if inflation remains sticky, the Fed may be forced to delay cuts which could impact the stability of low-quality companies that have excessive debt. Hence, we favour investment grade over high yield, both in Europe and the US.

- We notice rotation opportunities in equities towards segments that show earnings strength and attractive valuations. Thus, we avoid the expensive growth names and US megacaps. Instead, we prefer equal-weighted indices and do not shy away from going down the market capitalisation spectrum in search of quality. Sector wise, we like banks and are exploring the energy sector. In Europe, we maintain a balanced stance through defensive and cyclical names. Our overall tilt towards value and quality stocks remains in place.

- EM bonds offer ample opportunities. We still prefer hard currency to local currency debt and from a regional view we like Latin America and EMEA (Hungary, South Africa) owing to robust carry. Asia is another important source of idiosyncratic opportunities, with countries such as India standing out. Even in equities, we keep a positive stance.

Three hot questions

|

Monica DEFEND |

We expect risk assets to remain range bound in the near term, and believe rotation opportunities may open as markets renew their focus on valuations and concentration risks.

1| What’s your view on the US economy this year?

We expect the US economy to slow as the effects of high real interest rates become more evident on domestic demand. US labour markets are cooling and consumer delinquencies are rising for the more stressed households. A deterioration in consumer sentiment may lead to a pullback in consumer spending, more likely in the second half of the year. On the other hand, the progress on disinflation is likely to continue, and this should give the Fed confidence to cut interest rates in the second half. Overall, the Fed is likely to stay vigilant on inflation, particularly on the more sticky components.

Investment consequences:

- Cross asset: Positive on US duration.

2| How will central banks’ policies affect the USD?

Our expectations of delayed rate cuts by the Fed (compared to other global central banks) support the USD in the near term, owing to the high rates advantage. In some countries (namely the Nordics, Switzerland, Canada, etc.), the private sector is already showing weakness. Central banks in these countries have bigger incentives to cut policy rates to stimulate their economies. However, we do not expect a huge upside in the dollar, given that the ECB and the BoE are unlikely to diverge too much from the Fed in their policy actions. Once the Fed starts its rate cutting cycle, we expect the USD to gradually weaken.

Investment consequences:

- EUR/USD target maintained at 1.12 for Q1 2025.

3| How are corporate earnings turning out this season?

The earnings season for the first quarter (Q1) of the year has been above expectations, both in the US and in Europe. We also saw a resurgence of buybacks. In the US, as of 17 May, about 93% of companies in the S&P 500 had reported, and blended earnings (actual numbers for companies that have reported and market estimates for those that haven’t) are forecasted to grow by 7.6%, led mainly by the communication services, technology and consumer discretionary sectors. In Europe, Q1 is expected to be the fourth consecutive quarter of negative growth, but results are still likely to be better than expectations.

Investment consequences:

- Constructive on UK; monitoring European small caps.

- Positive on US equal weighted, quality and value.

MULTI-ASSET

Regional divergences call for rotation

|

Francesco SANDRINI |

John O'TOOLE |

We see rotation opportunities in developed markets equities, particularly in areas that have lagged behind in this year’s rally.

The economic backdrop in countries such as the US has proved to be better than expected so far, which has helped to lift market sentiment. For the second half of the year, we expect a deceleration in the US economy and a small risk of an inflation reacceleration. We also acknowledge that valuations are high. Hence, despite the strong market momentum, we prefer not to increase risk substantially and rebalance our stance to take into account earnings resilience and the slightly better outlook in pan-Europe.

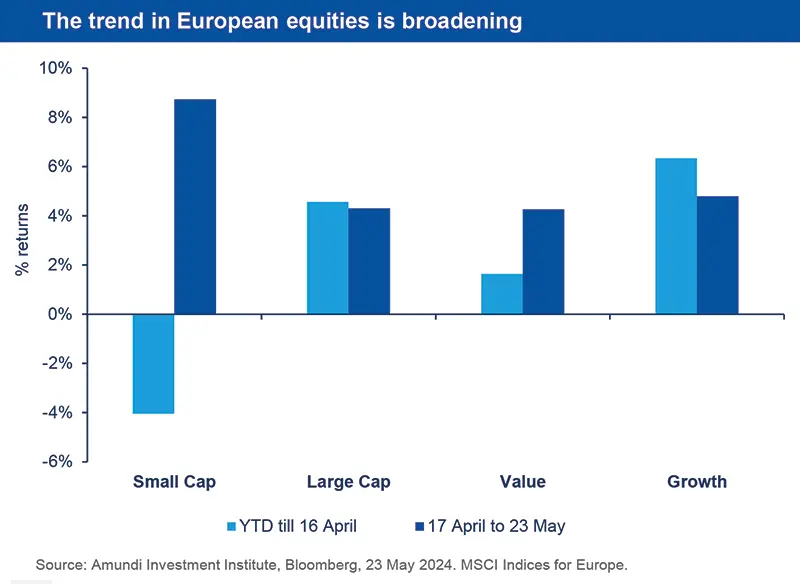

In developed markets, we downgrade Japan to neutral but upgrade UK equities, which are more oriented towards the value and defensive styles. They should also benefit from rate cuts and resilient oil prices. At the same time, we turn marginally positive on US, and European small caps. While the former are displaying strong earnings momentum, the latter will find support from the slightly resilient economy and policy easing by the ECB. On EM, we remain optimistic on select countries in Asia and Latin America.

In bonds, the upward yield movement this year and falling US inflation enable us to remain constructive on US duration. We also maintain our steepening stance on US and Canadian yield curves. In Europe, we are positive and believe the ECB will reduce rates more than the Fed. Our relative stance in favour of Italian BTPs vs German Bunds remains in place amid the limited idiosyncratic risks coming from Italy. We maintain a cautious view on Japan, which also acts as a diversifier.

In credit, EU IG may benefit from strong fundamentals and the ECB’s clear willingness to normalise policy, but we are cautious on HY. In EM bonds, we are positive due to falling price pressures in the region and attractive carry, although we acknowledge the risks from the strong dollar and Fed policy.

The divergences between central bank policies in Europe and the US allow us to stay constructive on the USD against currencies such as the SEK and CHF, where central banks have already started cutting rates. We are also constructive on JPY/CHF due to the former’s attractive valuations, and in EM, on BRL/EUR and INR/CNH for carry reasons.

Finally, we think volatility on US inflation is a risk and investors should consider safeguards. We also keep a small positive view on oil to protect from rising geopolitical tensions.

FIXED INCOME

Decelerating inflation paints a positive picture for bonds

| Amaury D'ORSAY Head of Fixed Income |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Marco PIRONDINI CIO of US Investment Management |

Soft data in the form of consumer surveys are pointing to weakness ahead in the US, along with cooling inflation and labour markets. The last two are the main factors the Fed, currently in pause, will need to consider in terms of judging when to start cutting rates. Across the Atlantic, the story is similar for the ECB and the Bank of England, which are keenly monitoring progress on wage growth and price pressures. But the difference (with the Fed) lies in the degree of expected monetary easing. While nuances in global bonds persist, we think it is a good time to explore US and UK duration in an overall active approach. In addition, corporate credit in Europe and emerging markets bonds also offer opportunities.

- We are close to neutral on European duration and slightly positive on the UK. But in light of the fluid economic environment and upward pricing of yields this year, we stay very active.

- On Japanese duration, we are slightly cautious (slightly less than before) because of the risks of higher rates in the country.

- In credit, we prefer IG to HY and see value in European financials. But there is selective value in Euro HY in the higher-rated names.

- In an overall agile approach, we are constructive on duration, particularly on the front end (1-5Y) of the yield curve.

- High quality is the main theme for us in credit, where we prefer financials to industrials, IG to HY and we also see value in shorter maturities. We are cautious on businesses with excessive debt that are facing high interest costs.

- Agency mortgages are attractive from a long-term view.

- The higher-for-longer rates narrative from the Fed is putting some pressure on EM debt, but we stay positive with a selective mindset.

- On hard currency debt, we are positive amid a supportive macro backdrop.

- Valuations and carry are attractive in HY vs. IG and thus we maintain our preference for the former.

- In local currency debt, we explore high yielding countries such as those in Latin America.

EQUITIES

Use earnings resilience to play the shift in equities

| Barry GLAVIN Head of Equity Platform |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Marco PIRONDINI CIO of US Investment Management |

Markets are still characterised by anomalies, even though we are observing some underlying shifts in favour of segments that have lagged behind in this year’s rally, such as value and small caps. In order to assess whether these shifts will continue, we assess the overall economic backdrop, the earnings strength of companies and corporate commentaries especially related to inflation, costs, artificial intelligence (AI) etc. While inflationary pressures are abating, we think the AI-driven benefits to companies and economies will take time to materialise. Thus, fundamental analysis remains a key pillar in our decisions, and we pay particularly attention to factors such as strategy, product differentiation and the intellectual property of companies. In particular, we see strong potential for quality and value in the US, Europe and EM.

- Our barbell stance towards defensive and cyclical sectors is maintained. Overall, we think cyclicals are expensive vs. defensive, and earnings do not support this premium.

- We favour good quality businesses with attractive valuations and are driven by secular themes.

- At a sector level, we are positive on consumer staples (slightly less than before) and healthcare.

- However, we are cautious on the technology sector.

- We expect a mild deceleration in the US, and thus remain cautious on the cyclical parts. But we do not ignore quality businesses that are attractively priced.

- For instance, we like select names in financials, energy, materials where business models are sustainable. In industrials, valuations are high and here we prefer the less-cyclical areas.

- Overall, we seek to minimise our risks on macro factors by identifying idiosyncratic risks.

- We are positive on EM, driven by the strong demand and economic growth.

- Countries such as South Korea (corporate governance, dividend story), Indonesia and India should do well. On China, we think recent measures to support the real estate sector are encouraging, but the size of the support was not huge. We stay vigilant.

- Elsewhere, Brazil is another opportunity in LatAm but we are monitor fiscal issues.

VIEWS

Amundi asset class views

Definitions & Abbreviations

- Currency abbreviations:

USD – US dollar, BRL – Brazilian real, JPY – Japanese yen, GBP – British pound sterling, EUR – Euro, CAD – Canadian dollar, SEK – Swedish krona, NOK – Norwegian krone, CHF – Swiss Franc, NZD – New Zealand dollar, AUD – Australian dollar, CNY – Chinese Renminbi, CLP – Chilean Peso, MXN – Mexican Peso, IDR – Indonesian Rupiah, RUB – Russian Ruble, ZAR – South African Rand, TRY – Turkish lira, KRW – South Korean Won, THB – Thai Baht, HUF – Hungarian Forint.