Summary

Inflation trends, central banks and geopolitics to drive markets

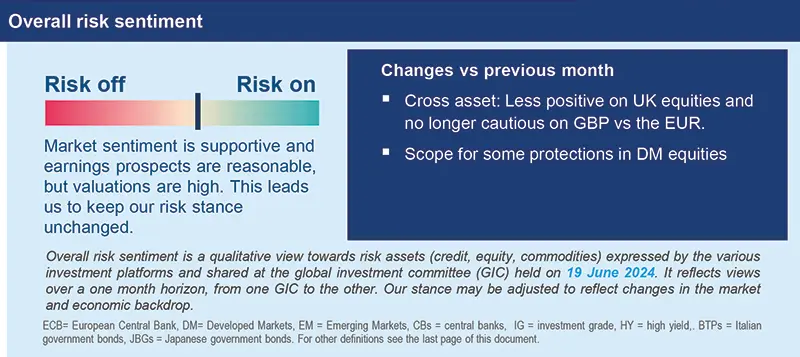

The economic backdrop is getting better but a lot of this improvement is already reflected in asset prices. Hence, we stay only mildly constructive on risk.

Recent weeks have signalled that, in addition to central banks’ policies and inflation trends, domestic politics and their impact on international relations are important determinants of financial markets and economic direction. In terms of markets, expectations of Fed rate cuts have been changing due to slowing US inflation and conflicting labour data showing strength in the economy. We think falling inflation is crucial for central bank decisions. This, along with the following themes, is likely to drive the markets.

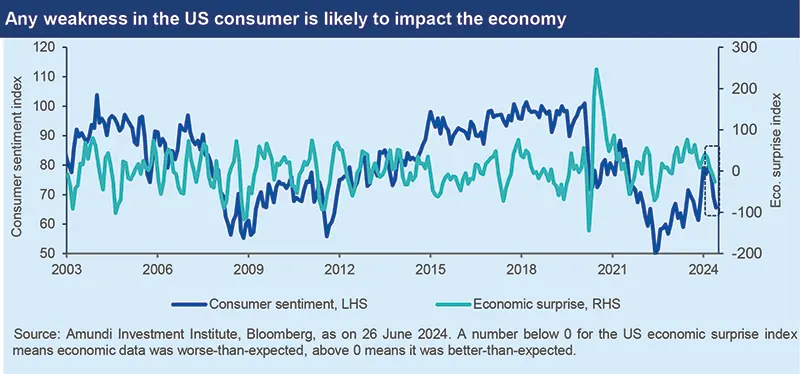

- Multi speed economic growth. We upgraded our global growth forecasts slightly for this year, led mainly by revisions in EM. But in the US, labour markets indicate that consumption will gradually slow and that is a large part of the economy. In Europe, economic activity is likely to be supported by domestic demand and real income.

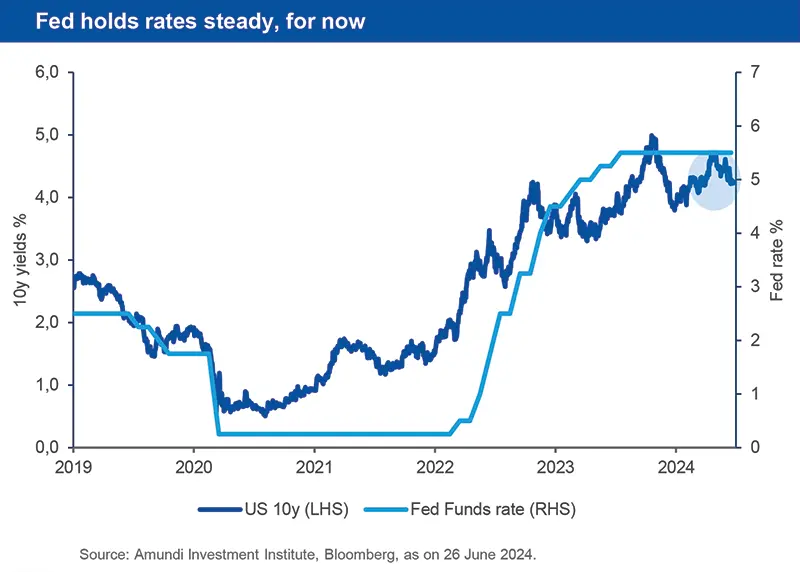

- US disinflation continues Recent. Recent moderation in US core services inflation is encouraging, but some stickiness will persist. We raised our headline CPI forecasts to 3.3% and 2.5% for 2024 and 2025. The Fed also upgraded its 2024 forecasts for personal consumption expenditure inflation.

- Asynchronous central banks. European banks (ECB, Swiss National Bank) have already started cutting rates. This divergence vs the Fed is unlikely to last very long as US inflation is declining. In addition, we do not think other central banks make decisions in a vacuum away from the Fed.

- We have previously highlighted the importance of geopolitics. Now, themes such as rising protectionism (ie, trade tariffs) and political uncertainty are playing out. A potential Trump Presidency could result in a deterioration of US ties with EU, and continuation of the rivalry with China.

In a late cycle phase, we outline our main convictions below:

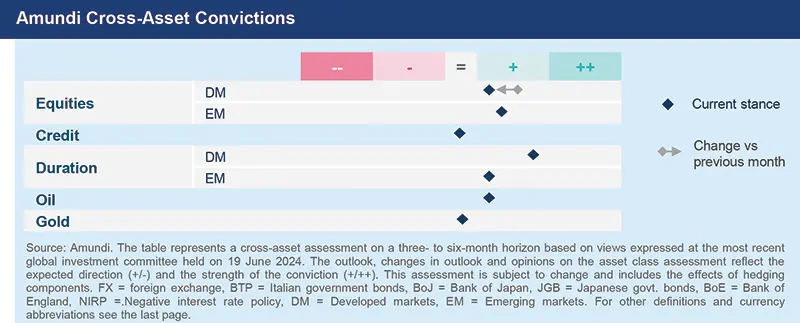

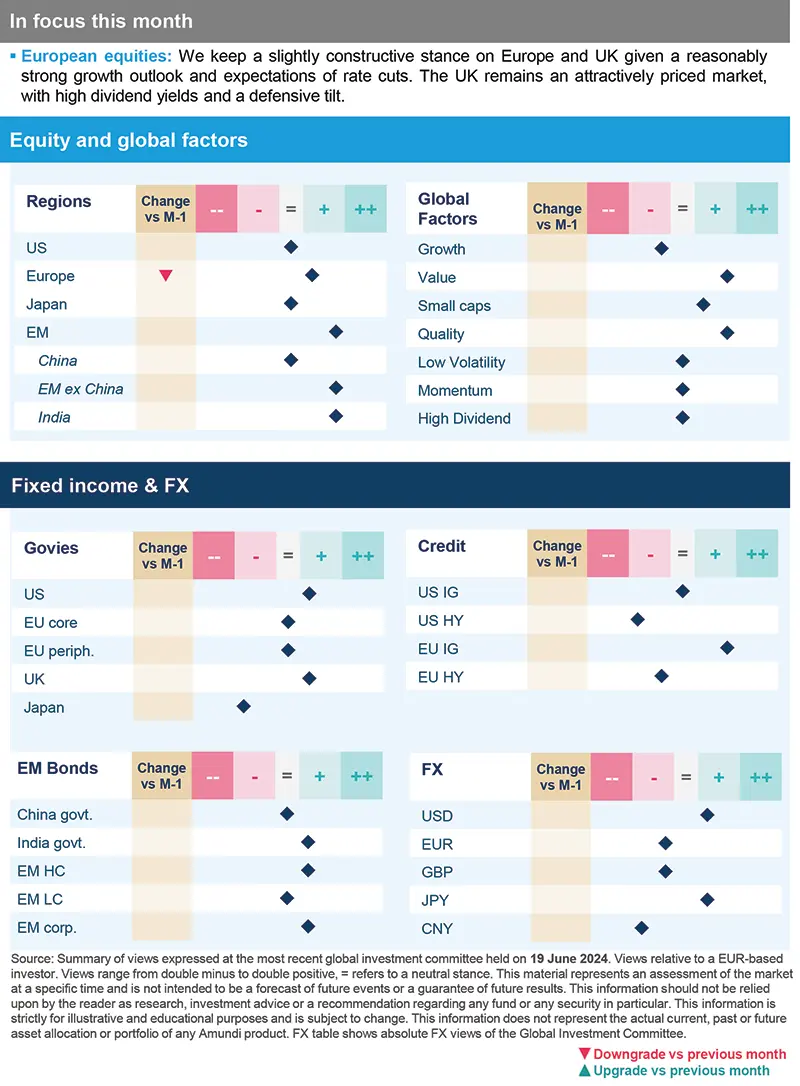

- Economic outlook is relatively robust, but valuations are tight in some areas of risk assets. This allows us to stay slightly positive on equities overall. However, we reduced our stance slightly in developed market equities and believe investors should consider building protection in some areas here. In bonds, we are constructive on US duration, core Europe, while we maintain our cautious stance on Japan. In corporate credit, EU IG is our favourite area. Elsewhere, EM bonds provide good carry amid decent economic growth in the region. Other important factors for us are central banks and their stance on inflation. We think a relatively hawkish Reserve Bank of Australia is supportive of AUD/TWD. However, we are no longer cautious on GBP vs EUR.

- Declining price pressures and expectations of rate cuts allow us to confirm our stance on duration in fixed income amid an active approach overall. In US, we are constructive, particularly on the front end of the yield curve. We also like agency debt, and quality corporate credit, but believe low quality debt could suffer from high interest expenses amid higher for longer rates. In Europe, although we are neutral on duration, we are assessing the timing to be constructive in future as the ECB progresses its easing trajectory. In contrast, we are positive on UK duration but cautious on Japan even as we evaluate this stance. EU IG has attractive valuations and we remain optimistic but on HY we remain negative.

- Equities. For many US companies whose stocks have received a boost from AI, the actual benefits will take time to play out. Thus, we are cautious on such tech names with high valuations and the mega caps, and prefer quality and value businesses that can deliver sustainable earnings growth. In Europe, we are closely watching the ability of companies to maintain margins. Our stance remains balanced, with positive views on consumer staples and health care, but a cautious stance on information technology.

- Emerging markets. Prospects of lower US rates, strength in commodity prices and EM growth imply that global macro conditions are supportive for carry and EM debt. Easing cycles in other DM could drive the search for higher yielding assets. We favour hard currency over local currency. From a country perspective, we like India and Mexico. In equities, we prefer strong growth prospects, such as South Korea, the UAE and Indonesia.

Three hot questions

|

Monica DEFEND |

In an environment of subsiding price pressures, central banks such as the ECB will continue to reduce policy rates, but the timings could differ depending on individual country/regional dynamics.

1| How do you see the US labour markets evolving this year?

We are seeing evidence of rebalancing in labour markets, with mixed signals and sometimes conflicting data. The latest data on payrolls and hourly earnings was resilient, but the unemployment rate increased to 4.0% in May. The last time it was this high was in January 2022. We think this overall data aligns with a labour market that is gradually weakening but not rapidly deteriorating. This suggests that consumption growth will likely slow down more noticeably in the second half of the year, affecting overall economic growth.

Investment consequences:

- Equities: cautious on US growth, constructive on equal weighted, quality and value.

2| What are your expectations for Fed and ECB policies?

The recent mild strength in the labour markets prevented the Fed from cutting rates in June. But eventually, we think, the central bank will reduce rates twice this year by a total of 50 bps as inflation progressively declines. The ECB, on the other hand, embarked on a rate cut cycle before the Fed, cutting rates for the first time in five years. As it gains confidence that services inflation and wage growth pressures are subsiding, we think the central bank will reduce rates a further three times this year. In the UK, the Bank of England is likely to ease rates beginning in August, and by a total four times in 2024.

Investment consequences:

- Duration: slightly positive on US and UK duration, close to neutral on core Europe.

3| What is your take on US EU China relations in the near term?

We see the US-China rivalry continuing irrespective of the outcome of US elections in November. Both Biden and Trump are likely to maintain their competition with China. In particular, given Trump’s confrontational approach to international relations including with the EU, the latter will be careful with respect to alienating China, its key trading partner. The new European Commission will face the difficult task of balancing its relations with the US and China. Elsewhere, in India the National Democratic Alliance formed the government for the third consecutive time. The country is likely to witness robust economic growth, although we are vigilant on fiscal policies and government spending.

Investment consequences:

- Close to Neutral on Chinese equities

- Positive on Indian equities.

MULTI-ASSET

Sentiment is positive but build protections

|

Francesco SANDRINI |

John O'TOOLE |

While staying mildly positive on risk assets, we reduced our stance on UK equities and see potential for hedges in select corners of equities.

Amid resilient economic performance in the US and reasonably strong earnings, sentiment on risk assets has been constructive. However, we are noticing some weakening in labour markets and vulnerable segments of the economy are being exposed to high financing costs. This translates into a mildly constructive environment for risk assets. But given that excesses are building up and inflation volatility could resurface, investors should consider some safeguards in select corners in developed market (DM) equities.

In DM equities, we reduced our positive stance on the UK for risk management reasons. But we believe UK stocks should benefit from their defensive and value tilts. We also stay positive on US and European small caps due to a robust earnings story and moderate economic growth, respectively. Interest rates are high and as central banks progress in their easing cycle, equities will likely benefit, although we see potential for some protection in DM. The EM advantage is supported by individual growth stories in Asia and Mexico.

We retain our constructive stance on US bonds and on the steepening of US and Canadian curves. Even though inflation is above the Fed’s target, it is still falling and weakening household consumption should affect US growth. Even in Europe, we are constructive. The ECB started its rate cut cycle and will continue on this path to stimulate the economy as inflation cools Italian bonds also offer attractive yields. However, we are cautious on Japan and stay vigilant on any indications of dovishness from the BoJ.

EU IG is showing strong fundamentals, along with robust carry. This is also true for EM bonds where yields are attractive and potential rate cuts in DM would only increase the search for yield. We are selective amid the potential for a strong dollar in the near term.

In FX, we are now positive on AUD/TWD. The former is likely to be supported by a relatively hawkish central bank and economic growth in China BRL/EUR and INR/CNH also offer good carry. In DM, we are now not cautious on the GBP vs EUR after recent movements. The Fed’s patient approach to cutting rates keeps us positive on USD vs SEK and the CHF. The last leg of our multi asset views involves exploring portfolio safeguards in the form of protection on US duration, and on US and UK equities. At the other end, oil remains a good hedge against geopolitical tensions.

FIXED INCOME

Central banks’ divergences may not last too long

| Amaury D'ORSAY Head of Fixed Income |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Marco PIRONDINI CIO of US Investment Management |

The slowing inflation numbers now indicate that data at the beginning of the year may have been aberrations in an otherwise disinflation story. While this indeed pushed yields down, the Fed is being patient and appears in no rush. In its decision making, the Fed will likely also consider slowing economic activity and employment data and wage growth, which is important for services inflation. Eventually the Fed will cut rates as current levels seem too restrictive for the economy. Hence, for investors, government bonds offer good value on a strategic long-term view as central banks (ECB) embark on an easing cycle. We think in an overall active approach, there are opportunities in US and UK duration. And for that extra yield, the high quality side of corporate credit in DM, and EM bonds are selectively attractive.

- Amid slowing inflation, UK bonds look attractive, whereas we stay close to neutral on core Europe for now. We see potential for our stance on Europe to change in the near future.

- We are cautious on Japanese government bonds, but are reviewing.

- EU IG offers good carry and quality, and we like financials and subordinated debt. But we are cautious on HY overall, with some value in BB rated credit in non cyclical segments.

- We maintain a long duration stance (short and intermediate part of the curve) which was supported by the yields’ movement.

- In credit, investors may consider directionally shifting towards high quality, where we like IG financials. Further rallies may present opportunities to selectively alter views in expensive segments.

- Agency mortgage backed securities are attractive vs other sectors and also display high liquidity.

- The macro environment is supportive for EM debt. As the Fed reduces rates, it could benefit search for yield in EM.

- In general, we favour countries with high real yields and believe selection is important.

- For instance, we like India where bonds and the currency demonstrated low volatility despite the surprising election results.

- In Latin America, Mexican debt will gain from rate cuts by the central bank.

EQUITIES

Stock picking: go for balance sheet strength, pricing power

| Barry GLAVIN Head of Equity Platform |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Marco PIRONDINI CIO of US Investment Management |

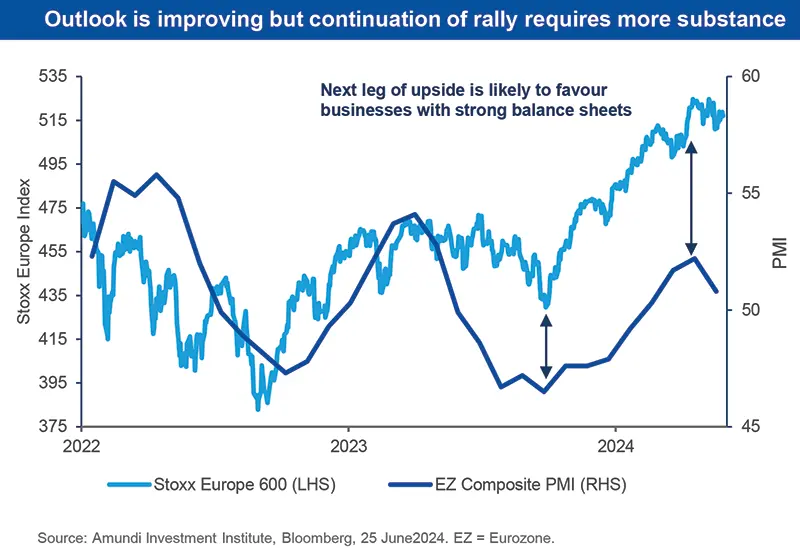

US markets touched record highs recently in hopes that artificial intelligence (AI) will increase earnings at corporate and macro levels. But the big question remains whether AI will boost earnings for the overall economy over the next 5 to 10 years. In Europe, equities partially recovered from declines amid a stabilisation in political newsflow. Looking ahead, we think markets have already priced in a lot of potential productivity gains and resilience in economic activity. Hence, it is hard to imagine that the next move upwards will come merely from multiple expansion or from an interest rates boost, whether in the US or globally. Thus, our focus is on finding good quality businesses that can maintain earnings growth, and paying reasonable valuations for them, in developed as well as emerging markets.

- Our views could be described as a barbell.

- We are drawn to defensives where valuations are attractive and the expected earnings evolution is favourable.

- We also favour cyclicals with strong balance sheets and exposure to structural themes such as energy transition and electrification.

- At a sector level, we are positive on consumer staples and healthcare but have a more cautious stance on technology.

- Our focus remains on identifying segment leaders, with solid balance sheets and rational valuations. We favour equal weighted indices as opposed to tech heavy markets.

- There are other sectors such as financials and banks, where we are positive, that should perform well. They also don't bring with them the risks of AI over exuberance.

- We also like high quality materials sector, US quality and value.

- The environment for EM equities is constructive, given strong economic growth. In addition, EM equities should benefit from some global themes such as the green transition.

- Structural growth stories such as Indonesia (financials), South Korea, India are likely to do well in long term on the back of domestic demand, exports.

- In LatAm, while we stay positive on Brazil (slightly less than before), we are monitoring the fiscal risks.

VIEWS

Amundi asset class views

Definitions & Abbreviations

- Currency abbreviations:

USD US dollar, BRL Brazilian real, JPY Japanese yen, GBP British pound sterling, EUR Euro, CAD Canadian dollar, SEK Swedish krona, NOK Norwegian krone, CHF Swiss Franc, NZD New Zealand dollar, AUD Australian dollar, CNY Chinese Renminbi, CLP Chilean Peso, MXN Mexican Peso, IDR Indonesian Rupiah, RUB Russian Ruble, ZAR South African Rand, TRY Turkish lira, KRW South Korean Won, THB Thai Baht, HUF Hungarian Forint.