Summary

- Fed action: on March 22, the Federal Reserve (Fed) hiked the fed funds rate by 25bp to 4.75-5.00%, a pace similar to that of February 1, and a level not seen since 2007. Ahead of this week’s Federal Open Market Committee (FOMC) meeting, we were sceptical that the recent banking sector stress would persuade the Fed to pause its rate hiking campaign: the Fed could point to macro prudential policy tools (including its new Bank Term Funding Program) and a ‘policy pause’ could raise concerns that the banking sector situation may actually be systemic rather than idiosyncratic.

- FOMC statement: unsurprisingly, there were significant changes. The economic assessment was upgraded to reflect the recent strong growth in jobs and more persistent inflation than previously expected. The reference to the Russia-Ukraine war as a risk to global growth and inflation was removed. The Fed stated that the US banking system is sound and resilient, but expressed concerns that tighter credit conditions would weigh on growth, hiring, and inflation.

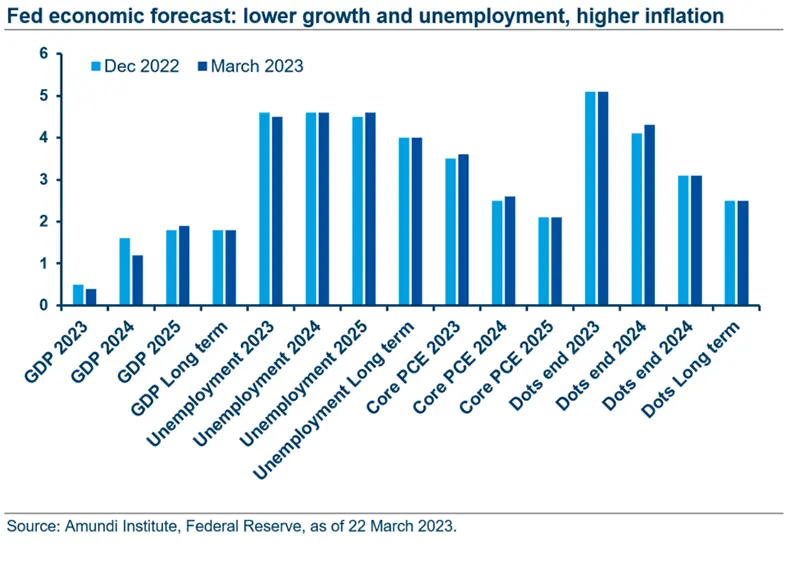

- Summary of Economic Projections (SEP) and ‘Dots 1: the updated SEP reflected an upgrade in inflation, and a relatively robust labour market. The GDP growth forecast was cut slightly for 2023 (from 0.5% to 0.4%), more sharply for 2024 (from 1.6% to 1.2%), and improved slightly for 2025 (1.8% to 1.9%). The unemployment rate forecast was also slightly revised downwards for 2023 (from 4.6% to 4.5%), was unchanged for 2024 (4.6%), and increased slightly for 2025 (4.5% to 4.6%). The Core PCE forecast was revised upwards for 2023 (from 3.5% to 3.6%) and 2024 (from 2.5% to 2.6%), and was unchanged for 2025 (2.1%). The Dots remained unchanged at 5.125% for year-end 2023, but rose to 4.25% vs 4.125% for year-end 2024, and were unchanged at 3.125% for 2025 year-end.

- Press conference: Chair Powell walked a fine line between reassuring markets regarding its measures to stabilise the banking sector, and its focus on bringing inflation down to its 2% target. His comments confirmed that the Fed is very likely close to the peak in its rate cycle, however he clearly did not endorse the rate cuts currently priced into the market.

- Market reaction and investment implications: following the meeting, bond yields rallied and the USD sold off, as investors saw the Fed as nearing the end of its tightening campaign. However, these moves were reversed after Treasury Secretary Janet Yellen indicated that the US Treasury was not considering a broad increase in deposit insurance. We remain cautious and anticipate market volatility since the Fed continues to be data dependent, and sceptical that the Fed will cut rates as early as June 2023, as expected by implied overnight rates.

Fed action raises rates by 25bp

Persistent inflation remains the main policy concern.

The Federal Reserve hiked the fed funds rate by 25bp, to 4.75-5.00%, a level not seen since 2007. Coming into this week’s Federal Open Market Committee meeting, there was some investor uncertainty regarding whether the Fed may pause its rate hiking campaign in light of recent banking sector stress. We were sceptical that this would be the case, as the Fed was able to point to macro-prudential policies such as the newly implemented Bank Term Funding Program, that have helped stabilise confidence in the banking sector. In addition, a pause in policy could signal to markets that the situation underlying the banking sector may actually be systemic rather than idiosyncratic. In the end, the Fed opted for another rate hike, as stubborn inflation remains its primary policy concern.

Key takeaways

- The Fed hiked the fed funds rate by 25 bp, taking it to 4.75-5.00%.

- The Fed walked a fine line between continuing its primary mission to cool inflation, and restoring financial stability.

- The fed funds ‘Dots’ remained unchanged at 5.125% for 2023 year-end, but rose to 4.25% vs 4.125% for the end of 2024, and were unchanged at 3.125% for 2025 year-end.

- Summary of Economic Projections (SEP): higher inflation and lower unemployment and growth in 2023.

Significant changes to the FOMC statement.

There were two changes to the statement. First, the Fed’s economic assessment was upgraded to reflect the recent strong growth in jobs, and acknowledge that inflation remains more persistent than they expected. Second, the Fed removed geopolitical references of Russia’s war against Ukraine as being a risk to global growth and inflation. The Fed stated that the US banking system is sound and resilient, but expressed concerns that tighter credit conditions would weigh on growth, hiring, and inflation.

Summary of Economic Projections (SEP) and the ‘Dots’ signal rate hiking is almost done

- The Fed slightly revised its annual GDP forecast from 0.5% to 0.4% for 2023, while the downgrade was more marked for 2024, from 1.6% to 1.2%. In 2025 it sees GDP growth climbing slightly higher, from 1.8% to 1.9%.

- The Fed lowered its year-end unemployment rate forecast from 4.6% to 4.5% in 2023, while leaving the 2024 projection unchanged at 4.6%. It raised its 2025 forecast by 0.1pp to 4.6%.

- The Fed’s Core PCE projection increased by 0.1pp to 3.6% for 2023, and another 0.1pp to 2.6% for 2024, while its 2025 inflation forecast was unchanged at 2.1%.

- Fund’s rate ‘Dot Plot’:

- Year-end 2023: the median dot remained unchanged at 5.125%.

- Year-end 2024: the median dot rose slightly from 4.125% to 4.25%.

- Year-end 2025: the median dot was unchanged at 3.125%.

- Long-term: the median dot remained unchanged at 2.50%. Note that this is commonly referred to as the ‘neutral rate’, and should be compared to the Fed’s long-term inflation target of 2.00%.

Press conference: Powell struck a balanced tone

The Fed believes that further future tightening will come less from interest rates, and more from tighter credit conditions.

Chair Powell struck a balanced tone between maintaining financial stability, and stressing the Fed’s ongoing fight against inflation:

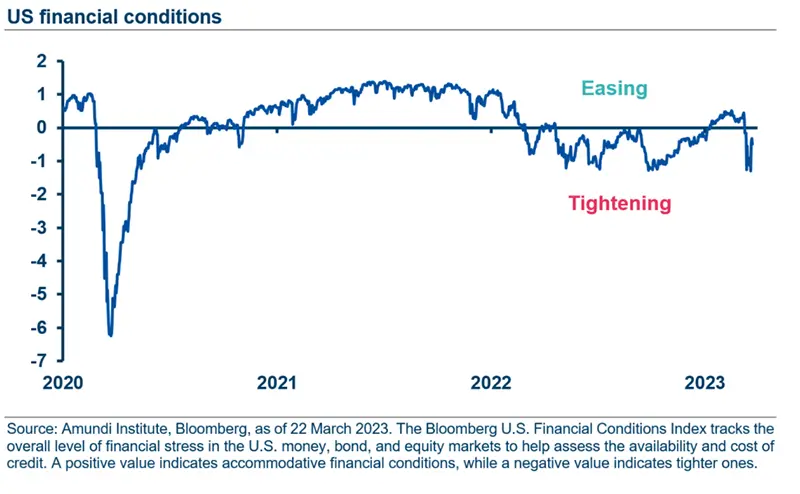

- He noted that while the Fed did consider a policy pause, recent stability in financial conditions appeared to have tipped the scales in favour of a hike.

- He addressed concerns about the banking system, stating that it is safe, and well capitalised. He pointed to the Fed’s programmes aimed at supporting the banking system, and reiterated that the Fed has the tools to address financial stability risks. Overall, he worked hard to alleviate concerns about the safety of deposits.

- In the end, the most important takeaway from the press conference was that the Fed believes that further future tightening will come less from interest rates, and more from tighter credit conditions as the banking system naturally recalibrates after recent challenges to depositor and investor confidence.

- Powell’s comments confirmed that the Fed is very likely close to the peak in its rate cycle, but he clearly did not endorse the rate cuts currently priced into the market.

Market reaction: mixed market performance following Powell Press Conference

The market’s reaction was twofold. The rate hike and FOMC statement were interpreted as dovish, and triggered a broad-based rally in asset prices, while taking the USD lower. However, as a real-time show of the current state of investor confidence, equity markets sold off towards the end of the US trading day when Treasury Secretary Janet Yellen reversed recent public comments, and indicated that the US Treasury was not considering a broad increase in deposit insurance. This was likely a self-acknowledgement that she does not have the authority to enact such an action: increases in deposit insurance limits must be authorised by Congress. Equity markets unwound their post-FOMC rallies with the Dow, S&P 500 and NASDAQ all declining by approximately 1.6%. The US bond market rallied, with the 2yr and 10yr yields falling 18bp and 7bp respectively. The USD depreciated 0.8%.

Investment Implications

We remain sceptical that the Fed will cut rates as early as June 2023 as expected by implied overnight rates.

While the FOMC Statement and the SEP/Dots suggest the Fed may be nearing a pause in its tightening cycle, we remain cautious and anticipate market volatility since the Fed remains data dependent. Importantly, the FOMC statement noted that, while recent developments are likely to lead to tighter credit conditions that will weigh on growth, hiring, and inflation, the extent of these effects is uncertain. Therefore, we remain sceptical that the Fed will cut rates as early as June 2023 as expected by implied overnight rates.