Summary

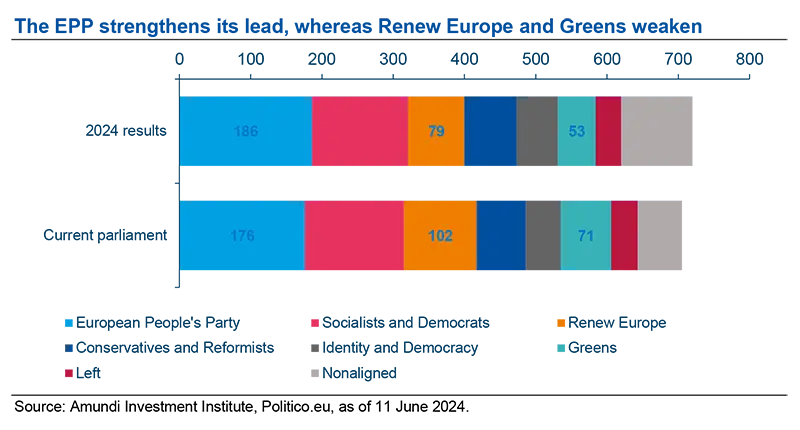

- Election outcome: The EU elections concluded with centrist parties, such as the European People’s Party, remaining in the lead. However, some far right parties such as Identity and Democracy and European Conservatives and Reformists also increased their presence in the European parliament. The far-right parties may try to slowdown new green policies, but it’s unlikely they will overturn existing climate rules that have already become law.

- Priorities for the next European Parliament: The new Commission will likely focus on priorities such as efficiency of climate regulations. Security and defence, as well as the EU’s geopolitical positioning, will become top priorities of the new Commission.

- Challenges and opportunities for Europe: Europe has strengths that can mobilise. In order to keep the pace and overcome the medium-term challenges of the EU economy (i.e. poor demographics, weak research investment), the region needs to enhance economic and financial integration, improve fiscal governance and strengthen the capital market union.

- The French snap elections: President Macron’s decision to hold elections now could have some upsides in the attempt to pursue a more stable domestic policy making, with more cooperation from non-far right opposition parties. In addition, he could benefit from a potentially better voter turnout in domestic elections, which are very different from European ones. If the far right manages to secure a governing majority (and the Prime Minister’s post), it is the President who presides over France’s foreign, European and defence policy. Indeed, foreign policy and military questions are of ‘domaine reserve’ of the French President and therefore stability is expected there, regardless of the outcome of the elections. The French President is also a key appointing authority in France for top executives’ positions in the public sector. Check and balances, the Constitutional Court and the administrative jurisdiction, and the centre right-dominated Senate will control the government’s decisions to ensure they abide by the Constitution, international conventions, European and other legal obligations France has committed to, as well as independent public agencies in charge of civil liberties.

- Outlook for Europe and France: EU elections took place amid an improving economic environment but there are divergences across countries and sectors. In France, after a sharp slowdown in the second half last year, GDP growth should pick up gradually on the back of reasonable strong household consumption. Public deficit, while still high as percent of GDP, should come down slightly from 2023 levels.

- Investment implications: This sudden call by President Emmanuel Macron for snap elections has created some volatility, both in equities and fixed income markets in France. France's budgetary situation will remain in focus. French government debt markets are very liquid and in addition, the context is supportive, with investors wanting to lock in higher interest rates before the ECB cuts rates further. On the euro, we are cautious in the short term, but do not see structural weakness.

What was the outcome of the recently concluded EU elections?

The 2024 European Parliament elections took place between 6 and 9 June 2024. The results indicate that the centrist parties should be able to form a working coalition. The European People’s Party (EPP) increased its parliamentary seats. At the same time, parties such as Identity and Democracy (ID) and European Conservatives and Reformists (ECR) with far-right credentials also gained seats.

The far-right parties may try to slowdown new green policies, but it’s unlikely they will overturn existing climate rules that have already become law.

How might the far-right parties influence EU policymaking?

Members of the European Parliament (MEPs) with far-right views are likely to influence policy making for the first time, despite being divided on many issues that include fiscal policies (some are frugal while others are not) and foreign policy (some are anti-Russia). But far right parties and representatives are united in their stance on immigration and slowing down environmental policies. On the former, we think, there is not much more to be done as the EU has already tightened its policies in recent years.

The far right’s main focus will likely be on slowing down the EU’s green ambitions. For example, there are plans to expand the scope of the Emission Trading System (ETS), the primary EU instruments for limiting emissions, to include buildings and road traffic from 2027. We do not believe that the ETS will be expanded in scope given the new dynamics of the European Parliament. While, it is unlikely that the new European Parliament (EP) will overturn climate rules that have already become law, it is also unlikely that the next EP will pursue new green policies.

In other areas, what should we expect from the next European Parliament and European Commission?

After years of prioritising climate policy, the focus will now go to competitiveness and efficiency of climate regulations. Many parties want less regulation, including the centrist European People’s Party (EPP) and Renew Europe. Therefore, the far right will have the biggest impact on areas where its views overlap with the centrist groups. Topics that will likely dominate the discourse at the EU level for the next several years will include: defence & geopolitics, economic security, protectionism, state aid, vulnerability of supply chains and economic dependencies, and cyber security.

Unsurprisingly, geopolitics will remain a hot topic, particularly amid the upcoming US elections and the country’s competition with China. Europe, we think, is unlikely to alienate either the US or China because the region relies on these countries for its trade. Despite more protectionist rhetoric and some symbolic measures, we think it makes no political sense to start a serious trade war with China ahead of a possible Trump administration, whose trade policies would most likely be a tit-for-tat stance with the EU.

To remain competitive, the EU will have to address different policies. On industrial policy, the EU should focus on overcoming its technological dependence. If it fails to do so, far more than the EV sector would be at risk in the years to come. On energy and climate policies, the Commission will have to ensure an affordable, secure and sustainable energy supply. This should require global energy partnerships.

The Commission will also have to consolidate climate commitments. EU member states must step up their decarbonization efforts in particular, by phasing out subsidies for fossil fuels (consumption of which has increased with the energy crisis). The next Commission will likely continue to focus on reducing greenhouse gas emissions and promoting renewable energies in line with current laws approved by the previous administration. In the field of green energies, the Commission may develop renewable energy production capacities. Investment instruments such as REPowerEU will not be enough. Strengthening energy cooperation is crucial.

Last but not least, the EU must become a geopolitical player in security and defence. The strengthening of the European defence industry has become a priority. It's not enough to buy ammunition and equipment together; Europe also needs an industrial base capable of meeting its growing needs.

Europe can mobilise its strengths to finance the green transition.

What are the main challenges and opportunities you see for Europe?

Europe has strengths it can mobilise. EU countries are highly diverse economically (countries have different specialisations) and Europe has very abundant financial savings of households (estimated at over €35,000 bn in the EU) that could be used to make these economies more dynamic.

The short-term outlook is improving. To keep the pace and overcome the medium-term challenges of the EU economy (i.e. poor demographics, weak research and development investment, low productivity) the EU needs to enhance the economic and financial integration, improve fiscal governance and strengthen the capital market union.

To benefit from its strengths and large pool of private savings, EU member states should agree on:

- Strengthening the single market to exploit all the opportunities,

- Strengthening integration within the EU (tax harmonisation),

- Completing the Capital Market Union to mobilise sufficient funds to meet the EU's investment needs,

- Completing the EU fiscal governance with more joint debt to finance common goods (eg. Defence).

Snap Elections in France

Following the EU elections, French President Macron called for snap elections. What could be the motivation behind this move?

Although the decision by President Macron may appear surprising, his current hold on power meant he was allegedly already contemplating holding a parliamentary vote later in the year. Without his decision to call a parliamentary vote, the next few years would have been difficult for him in terms of domestic policymaking. This would likely have benefitted the far right in the 2027 Presidential elections.

The first round of elections on 30 June will provide more clarity on how domestic French voters are behaving. In fact, European elections are very different by design from National Assembly’s elections. National Assembly elections are a majority vote in two rounds with 577 constituencies, which is very different from a proportional one-round election and a unique national constituency.

A potentially better voter turnout in domestic elections (than during the European parliamentary elections) may restore some of Macron’s credibility. Importantly, voters are likely to behave differently in domestic versus European elections – the latter continue to be used as a protest vote. And thus, voters concerned about allowing the far right into power will likely turn out to vote in bigger numbers.

Macron’s decision to hold elections now could have some upsides because it gives him a chance of more stable domestic policy-making.

How do you view the possible outcomes of these French elections?

Macron’s decision to hold elections now could have some upsides because it gives him a chance of more stable domestic policy-making. Non-far right opposition parties will mobilise to prevent the far-right taking power. A better electoral turnout than during the European parliamentary elections could also restore some of his credibility domestically and internationally.

If the far right manages to secure a governing majority (and the Prime Minister’s post), it is the President who presides over France’s foreign, European and defence policy. Indeed, foreign policy and military questions are of ‘domaine reserve’ of the French President and therefore stability is expected there, regardless of the outcome of the elections. The French President is also a key appointing authority in France for top executives’ positions in the public sector.

Check and balances, the Constitutional Court and the administrative jurisdiction, and the centre right-dominated Senate will control the government’s decisions to ensure they abide by the Constitution, international conventions, European and other legal obligations France has committed to, as well as independent public agencies in charge of civil liberties.

Our view is that no party appears to be in a position to win an outright majority and impose its own agenda. The Constitutional Court will also likely block any extreme measures in this respect – institutions of the 5th Republic in France offer protection. Overall, the snap elections will likely result in a hung parliament in which Macron will depend on more support from the opposition parties to govern.

What is Europe's macro outlook?

The elections took place in a clearly improving economic environment, following a technical recession in the second half of 2023. Leading indicators and surveys are increasingly pointing to a better second half of this year.

We expect Eurozone growth at 0.8% in 2024 and 1.2% in 2025. Employment rose by 0.3% in Q1, confirming anecdotal evidence that the labour market has continued to tighten, with companies hoarding labour in anticipation of a rebound in growth.

This comes, however, with considerable differences from country to country and from sector to sector. Germany is likely to be the main laggard this year due to weak investment and exports. Countries such as Spain should fare better. Services are improving while manufacturing remains under pressure. The only exception is Spain, expanding in both manufacturing and services. In 2025, we expect a more broad-based recovery in the Eurozone, supported by improved purchasing power and easing financial conditions.

After a slowdown in the second of half last year, GDP growth should pick up gradually in 2024 and return to its potential rate in 2025.

What is the outlook for France?

After a sharp slowdown in the second of half last year, GDP growth should pick up very gradually in 2024 (0.9%) and return to its potential rate in 2025 (1.3%). Household consumption is expected to be the main driver, thanks to a rebound in real wages and the easing of credit conditions. The deficit-reduction measures announced by the government will weigh on growth, but without jeopardising the recovery we expect. As in the Eurozone, inflation is set to fall significantly, thanks in particular to lower energy and commodity prices. Inflation should fall to 2.1% in 2025, after 5.7% in 2023 and 2.5% in 2024.

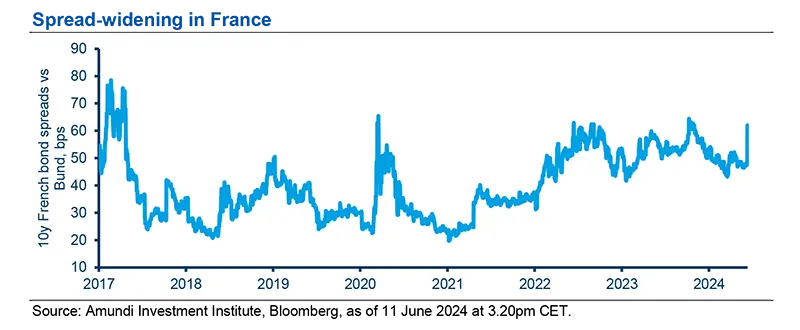

Public deficit would fall slightly from 5.5% of GDP in 2023, to 5.3% in 2024 and 5.0% in 2025, but will likely remain well above 3% in 2027 (at 4.5% according to the IMF), a level well above the forecast by the French government in its Stability Programme presented in April (2.9%).

An Excessive Deficit Procedure (EDP) may be initiated this year in France. And in the absence of additional fiscal consolidation measures, public debt would reach 112% of GDP in 2024, 114% of GDP in 2025, and would increase by around 1.5 percentage point per year in the medium term. This could result in a rise in the cost of debt, forcing the government to take stronger consolidation measures, with a potential impact on purchasing power and growth. Against this backdrop, the next government's commitment to controlling public finances will be closely watched by investors.

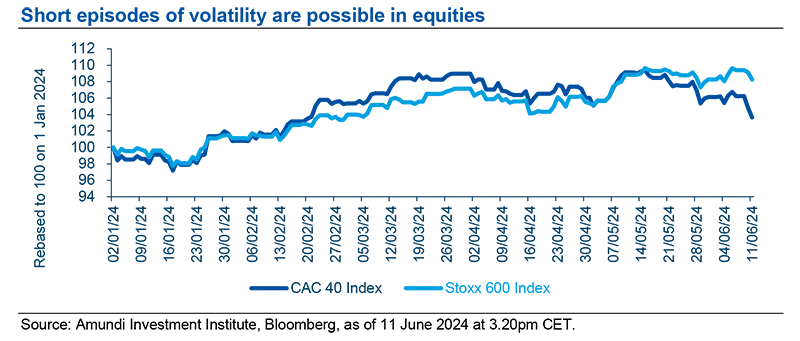

We expect some short-term volatility in French markets, which should fade when the political situation becomes clearer.

What are the implications for French markets and the euro?

This sudden call by President Emmanuel Macron for snap elections has created some volatility, both in equities and fixed income markets in France. French stocks may underperform their European counterparts briefly during this phase of uncertainty.

In fixed income, markets have already partly valued the deterioration of France's budgetary situation and French government debt markets are very liquid. We may witness some spread widening of French bonds vs. German bunds. Markets will likely look ahead to the results of the first round of elections on 30 June and to the second round on 7 July. Hence, the markets are likely to be in wait and see mode, before moving up or down later. Volatility should fade when the political situation becomes clearer.

On the euro, we are cautious in the short term, but do not see structural weakness. Due to recent political instability, volatility spiked and sentiment turned negative. Hence, the euro declined. Looking ahead, the currency is caught between high political uncertainty and the FedECB divergences in the short-term. Thus risk-reward is unattractive for now, but excessive falls may open up opportunities. Structurally, we see little reasons to be negative on the euro. In contrast to the political uncertainties of the past, the European peripheral countries are stronger today. Even the Fed remains skewed to rate cuts eventually, once it gets confident on subsiding US inflation.

To conclude, volatility is likely to continue in a phase of electoral uncertainty. However, we do not believe that political uncertainty opens the door to Eurozone instability. French government debt has positive points: it is one of the most liquid markets in the Eurozone. In addition, the context also remains supportive for fixed income, with investors wanting to lock in higher interest rates before the ECB cuts rates further.

Other contributors from Amundi Investment Institute:

- Federico Cesarini, Head of DM FX

- Valentine Ainouz, Head of Global Fixed Income Strategy