Summary

Key Takeways

- The sharp increase in net zero commitments from governments, corporates and financials comes with a renewed interest in carbon offsetting mechanisms. As a clear signal of this momentum, the voluntary carbon credits market is on track to double year-on-year in 2021.

- Carbon offsetting is meant to bring flexibility and efficiency in the fight against carbon emissions, notably by providing institutions with a mechanism to finance additional and permanent emission reduction/removal projects across borders and boundaries.

- A carbon offset transaction not only allows the purchaser to claim it has offset a part of its own carbon footprint, but also enables the issuer to receive financing for hard-to-finance projects with high environmental and social importance for the global net zero transition.

- However, voluntary carbon offset mechanisms should be considered as a last resort action for any entity looking to emissions during a net zero transition and at a net zero state as well. Carbon offsetting should not replace efforts to reduce principal emissions of a carbon footprint and instead should only be used for residual emissions.

- Moreover, as the voluntary carbon market grows, it faces a number of challenges. The credibility of this mechanism will depend on the adoption of best practices, formal market transaction infrastructure, and strong safety nets to build environmental and social impact integrity.

- With that in mind, investors should first measure and analyze their carbon footprint, then engage their investee companies on reducing their greenhouse gas emissions and any carbon offsetting strategy integrated in a company’s net zero strategy, and finally consider supporting the development of the carbon offset market through direct purchases as well.

Sector focus: Transport

- The transport sector is a large contributor to global CO2 emissions and accounts for 25% of global greenhouse gas emissions.

- The sector, which is almost exclusively dependent on a single energy source – oil, 90% of its energy needs in 20202 – faces significant challenges to reach Net Zero by 2050.

- In light-duty road transport, electrification will play a key role in the road to net zero. However, this is only possible if the production of electric vehicle batteries is significantly ramped up.

- The journey will be tougher for the aviation industry. Corporates such as airlines may choose to complement their operational carbon reduction efforts with the financing of carbon removal projects in order to make a Net Zero claim.

- Amundi expects automobile manufacturers to define clear roadmaps for climate-neutral transportation, including EV batteries strategies. Offsetting via nature-based or industrial emission removals techniques should be left to hard-to-abate sectors.

Introduction

The sharp increase in net zero commitments from governments, corporates and financial institutions comes with a renewed interest in carbon offsetting mechanisms. As a clear signal of this momentum, the voluntary carbon credits market is on track to double year-on-year in 2021.

Carbon offsetting is not new and has been meant to bring flexibility and efficiency in the fight against carbon emissions, notably by providing institutions with a mechanism to finance emission reduction projects across borders and boundaries.

However, positioning the contribution of this mechanism to the achievement of global 2050 net zero efforts brings new challenges. Voluntary carbon offset mechanisms should be considered as a last resort action. In our opinion, it can play a credible role in the fight against climate change by funding the reduction of residual greenhouse gas emissions (GHG) emissions and strengthen natural and/or technological carbon sinks.

With that in mind, this ESG Thema focuses on addressing the fundamental questions behind carbon offsetting: What is carbon offsetting? How does it work? Why is it important? What are its key challenges? How can carbon offsetting be used by investors to drive real emission reductions? And more.

What is carbon offsetting and how does it work?

What carbon offsetting is...

Carbon offsetting consists for an entity in compensating its own carbon emissions by providing for emissions reductions outside its business boundaries.

It allows an entity to claim carbon reductions from projects financed either directly or indirectly through carbon credits.

For instance, under the Kyoto Protocol, developed countries could account for carbon abatement projects financed in emerging countries to achieve their own emission reduction targets. The mechanism was built to bring flexibility and to first tackle the low-cost carbon abatement projects wherever and whatever they were.

Individuals, companies, and countries finance carbon-offsetting activities to complement their emission reductions and balance out their carbon footprint’s residual emissions in the face of growing CO2e emission compliance and taxation schemes. Self-financing exists but many times this means paying someone else to cut or remove a given quantity of CO2e from the atmosphere. Thus, any avoided or neutralized CO2e emissions from a carbon offset counts towards the balance of the buyer, rather than the developer of the project.

Today in focus, is the voluntary market for carbon offsetting whereby one ton of CO2e offset, structured as a verified carbon credit, can be purchased to contribute to financing a project absorbing or reducing CO2e emissions. A project can issue carbon credits every year for the individual tons of CO2 absorbed or avoided (ranging from one ton to Gigatons).

… what carbon offsetting is not:

Voluntary carbon offset credits differ from emission allowances linked to regulatory emissions cap & trade schemes such as the EU carbon market, where credits are used for compliance with regulatory emissions caps.

How does it work?

From projects…

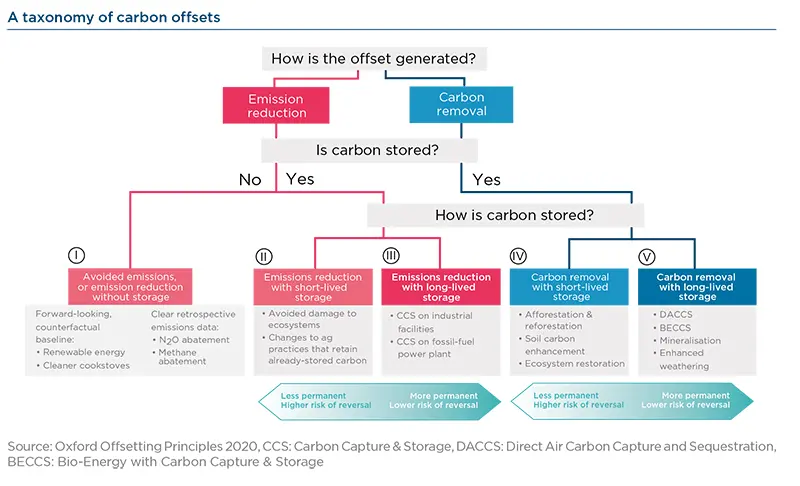

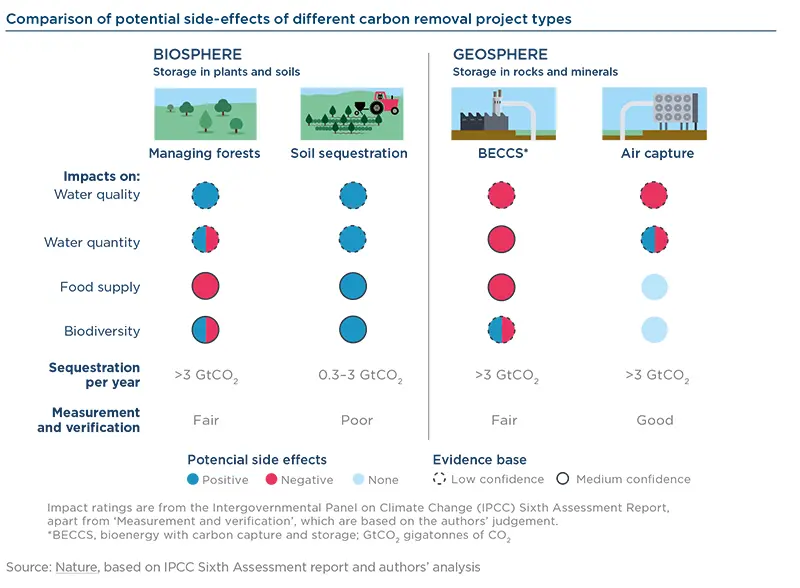

Projects contributing to net zero goals and possibly generating offsets vary a lot by project type (renewable energy, carbon capture & storage, avoided deforestation), type of action on carbon emissions (reduction, removal) and features (notably whether carbon is stored or not with implications for the permanency of abatement effects).

Offsetting can come from projects either supporting CO2e reduction or removal, mainly located in developing countries where finance additionality is most prevalent. Reduction offsetting prevents more carbon going into the atmosphere (such as REDD+* or renewable energy). Removal offsetting eliminates carbon from the atmosphere (afforestation, reforestation, soil enhancement, and carbon capture and storage technologies).

This is well depicted by the taxonomy below.

… to consumers of carbon offsets

The amount of carbon emissions reduced or removed by projects have to be estimated and an equivalent amount of voluntary carbon credits are generated.

The role of Standards: Before any credits are used, a project seeks verification against specific standards, such as international standards like Verified Carbon Standard (Verra) or Gold Standard, or national standards like the Label Bas Carbone in France. These standards set minimum requirements for project eligibility and technical assumptions such as baselines against which emissions reductions are estimated. Verification includes an audit on whether a project and its CO2e impact is real, measurable, permanent, additional, and unique.

The role of Registries: Thereafter, carbon credit issuance occurs, which is accounted for on an official registry. Once an organization decides to purchase a carbon credit, the ownership is transferred to the buyer on the registry and then canceled once the credits are retired. Retirement is when the buyer can claim the use of a carbon credit to offset one ton of CO2e.

Wholesalers, brokers and retailers source and aggregate voluntary carbon credits to bring solutions to final consumers. Final users can be citizens willing to offset air travelling for instance, corporations, financial institutions or public entities.

Voluntary offset credits are ultimately due to be cancelled once delivered to a final buyer. As such the purpose of the transaction is not to be exposed to fluctuations in the value of such credits (source: AMF).

Policy makers envisage market places for exchanges of carbon credits to enable financing opportunities at a national and global level. One can think of the carbon markets under the Clean Development Mechanism from the Kyoto Protocol, or the potential future development of the Sustainable Development Mechanisms in the Paris Agreement supported by Article 6.

*Reducing Emissions from Deforestation and Forest Degradation (REDD+)

Carbon offsetting in the race to net zero

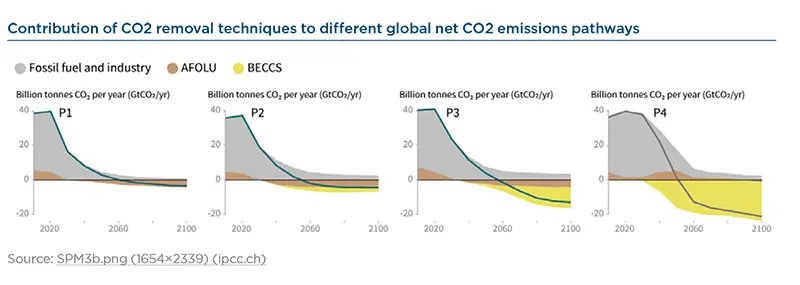

As highlighted by the IPCC 1.5°C Special Report, all net zero pathways use carbon dioxide removal techniques, such as Bioenergy with Carbon Capture and Storage (BECCS), and removals in the Agriculture, Forestry and Other Land Use (AFOLU) sector. The more mitigation actions on energy- and industry-related CO2 emissions are delayed, the more keeping with the carbon budget relies on offsetting through net CO2 removal techniques.

In pathways with no or limited overshoot of 1.5°C, global CO2 emissions decline by about 45% from 2010 levels by 2030, reaching net zero by 2050. All of these trajectories include a compensation for residual emissions on the order of 100-1000 GtCO2 (nearly equivalent to the CO2 emissions of the United States from 1990 to 20101 ) over the 21st century.2 On an annual basis, estimates range from 8 to 20 GtCO2 removal per year by 2050.3

Even in the most demanding carbon mitigation scenarios, some activities keep burning fossil fuels and emitting carbon emissions in 2050, due to a lack of low-carbon alternative. Corporates exposed to such ‘hard-to-abate’ activities such as cement or airlines may therefore chose to complement their operational carbon reduction efforts with the financing of carbon removal projects in order to make a ‘net zero’ claim.

Additionally, there is still a considerable policy gap to incentivize the carbon reduction projects needed to put the energy - and industry-related emissions on track with 1.5°C or even well-below 2°C pathways. In this context, private economic agents can positively contribute to global net zero efforts by financing/subsidizing relevant carbon mitigation projects through the purchase of carbon credits. Indeed, some low carbon projects are reliant on issuing carbon credits as a source of profitability. Thus, putting any accounting issues aside between who registers the carbon reduction (supplier/ purchaser of the credit), carbon credits can still have a positive contribution to net zero efforts.

To summarize, the importance of carbon offsetting is mainly twofold, as it is a potential solution:

- For an entity looking to address global residual emissions during our transition to net zero, but also at net zero as well, being a purchaser of a carbon credit.

- For an entity looking to attract climate finance who might find it hard to do so in the first place but has high potential for positive and social impacts, such as a project in a least developed countries. Indeed, carbon offsetting projects should bring economic, environmental, social and health improvements to whole communities and ecosystems.

Status of the voluntary carbon market: strong growth, low prices and a market skewed towards renewable energy and forestry projects

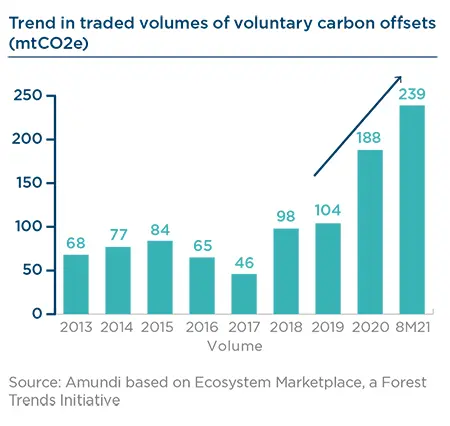

After having remained relatively flattish over 2013-19, the market for voluntary carbon offsets has been buoyant since 2019, almost doubling each year (+80% in 2020), according to Ecosystem Marketplace’s data.

Overall volumes remain relatively small and represent only a tiny fraction of global energy and industry-related CO2 emissions (188mt in 2020, or c.0.5% of global emissions).

What type of projects are financed? The voluntary carbon market is largely dominated by forestry and renewable energy projects which made up 80% of the market over 2019-21. Forestry and land use project gained market shares in 2021 (>50% of the total). Today there is still a clear supply bias for reduction credits, notably driven by the high supply of renewable energy projects. Projects removing carbon from the atmosphere remain minor (10% of the market).

What are the main standards used? The Verified Carbon Standard largely dominates accounting for two thirds of transacted volumes in 2019-20 and even more in 2021. The Gold Standard is the second widely used standard with a c. 10% market share.

What are the prices? Average prices are low at $2.5-3/t (ranging from $0.1 to as high $200/tCO2e).4 Credits from forestry projects have been 4-6x more expensive than when sourced from renewable energy projects. Removal credits are c. 5x more expensive.

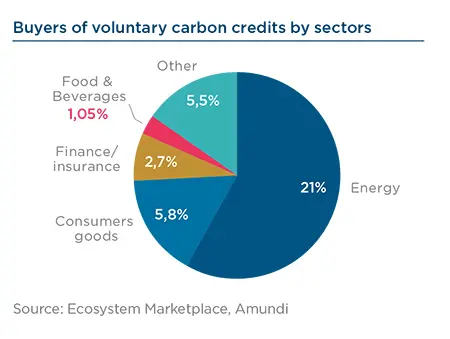

Who are the buyers? The energy sector has emerged has a key buyer of voluntary carbon credits in 2021 ahead of corporates from the consumer goods sector. Offsetting can be part of a group-wide decarbonization strategy, corporates also use offset for marketing offers to boast the ‘carbon neutrality’ of a product (e.g. LNG cargo) or a service (a conference).

Key challenges for the voluntary carbon credit market

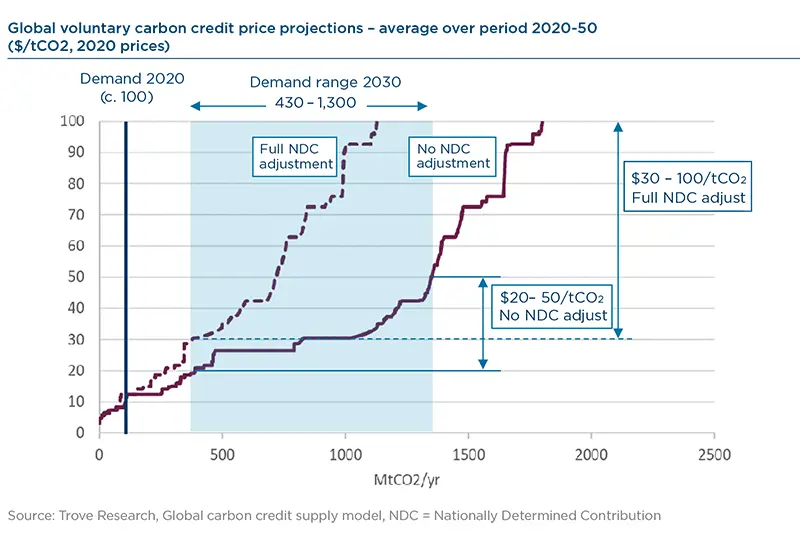

The voluntary carbon market remains relatively small and immature. It is set to enter a period of fast growth though. Advisory firm Trove Research expects the demand to grow by a factor of 5 to 10 over the decade. As it grows, the market faces a number of critical challenges:

- Additionality: for projects avoiding carbon emissions, the choice of the baseline will critically determine the amount of credits generated. Setting the baseline is anything but an easy task as it requires to assume a business-as-usual scenario sometimes for several years. The fast evolving environment for low-carbon technologies means that past trends may not be a valid proxy. In theory, the sale of carbon credits should be a key condition unlocking the investment decision in the project. Additionality can evolve over the lifetime of a project though if the project type becomes eligible to public subsidies for instance, hence no longer requiring additional revenues from carbon credits. The challenge is real. To draw a parallel with compliance carbon credits under the Kyoto Protocol, a study published in 2016 drew a lackluster toll of additionality of Clean Development Mechanisms concluding that “only 2% of the projects and 7% of potential CER (Certified Emission Reductions) supply have a high likelihood of ensuring that emission reductions are additional and are not over-estimated”. Leading standards in the voluntary carbon market have implemented exclusion lists for projects with low additionality credentials such as renewable energy projects outside least developed countries.

Only 2% of the projects and 7% of potential CER (Certified Emission Reductions) supply have a high likelihood of ensuring that emission reductions are additional and are not over-estimated.

- Leakage: for REDD+ projects in particular, reduced deforestation in one geographical area can lead to an increase in forest loss in another area, as demand for land remains and deforestation pressure can simply be displaced elsewhere. This can require evaluating the effectiveness of a project over a larger scope than that of the project or integrating the project within a largescale program.

- Integrity: the strict monitoring of the projects financed is required to verify that they actually deliver carbon savings. Forestry projects in particular can be subject to pests or fires that can possibly annihilate the accumulated carbon benefits. This risk is already a reality as highlighted by the fires in the US in the summer 2021, which damaged forestry projects sourced by companies such as Microsoft or BP. Carbon offset providers hold buffer reserves of credits but such risks and the temporary nature of forestry projects have yet to be better recognized and factored in, in our view. Satellite monitoring solutions exist for instance to monitor projects. Under the Clean Development Mechanism, afforestation projects were granted a specific type of credits in recognition of their temporary nature (temporary certified emission reductions).

- Market infrastructure: the market needs to be large, standardized, transparent, liquid, verifiable, and environmentally robust. Today it is fragmented and operates on inefficient trading due to a lack of common principles and standards, along with limited trading infrastructure. For example, pricing is limited due to heterogeneity between projects, causing inefficiencies in matching individual buyers to suppliers. Indeed, the Taskforce on Scaling Voluntary Carbon Markets aims to address this. The management of registries of voluntary carbon credits is another market integrity challenge: credits have to be properly retired and not sold twice.

- “Do no significant harm” principle: the other environmental and social impacts of carbon crediting projects will likely increasingly be regarded and valued by buyers willing to ensure that projects respect the “do no significant harm” principle both on the environmental and social angle. As they compete for land and water resources with other critical activities, bioenergy projects in particular such as BECCS can have adverse consequences on biodiversity or food supply for instance, that need to be cautiously monitored.

- Double offsetting: another question for the market and for buyers in particular is whether they want to offset their scope 1 emissions or extend to their scope 2 and 3 carbon footprint. Scope 3 emissions are most often based on assumptions, so in the latter case, in the absence of a clear transparency on B2B but also B2C supply chains, the market may face situations where the same ton of CO2 is actually offset by two (if not more) different companies or countries. However, this is a market inefficiency rather than an integrity risk.

- Availability and future price shifts: a research paper by Trove Research finds that demand is expected to grow by a factor of 5 to 10 over the decade and estimates that current prices in the voluntary carbon market are unsustainably low. Higher demand, combined with more stringent requirements in terms of project environmental integrity and additionality could push prices to $30-100/tCO2e by 2030 according to the advisory firm. Such a price is closer to CO2 prices modelled in the IEA Net Zero Roadmap ($15-130/t in 2030 depending on regions) and may better reflect actual abatement costs for real emissions reductions or removals. Importantly, along with the shift towards a fair pricing of offset credits, corporates may be rightly pushed to reconsider the relative cost of external vs. internal carbon mitigation projects at such price levels.

Implications for investors: setting expectations for corporate engagement and for investment funds using offsets

Carbon offsetting should not replace efforts to reduce carbon emissions. Indeed, carbon offsetting is no substitute for the efforts made to cut energy consumption and CO2 emissions. Still, investors’ main carbon emissions are the carbon emissions of the company they invest in.

Investors should therefore first measure and analyze their carbon footprint. Analyzing their footprint helps investors better understand their impacts, set priorities and define action plans. It could for instance help prioritizing the sectors they want to engage with.

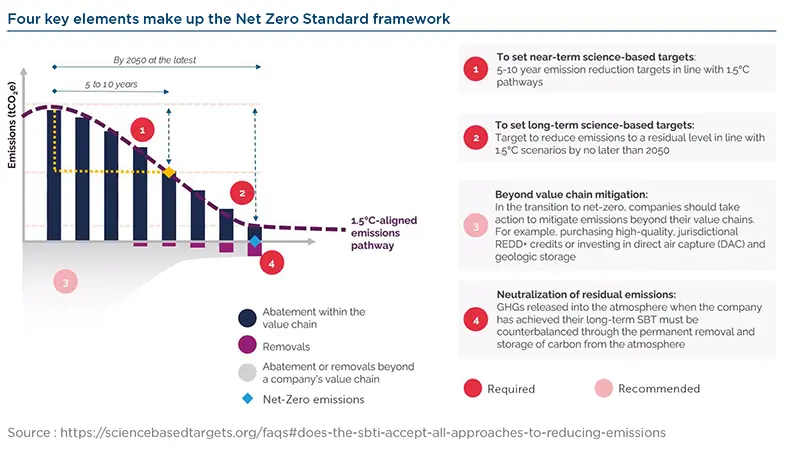

Carbon offsetting should not exempt companies from setting ambitious emission reductions. While carbon offsets have a credible role to play in meeting net zero objectives, they should only be considered as last resort actions supplementing real carbon reduction targets within companies’ business scope.

Indeed, after having measured the carbon footprint of their investments, investors have to engage their investee companies on reducing their greenhouse gas emissions. Reducing greenhouse gas emissions should be the number one objective, but offsetting can be a valid additional option.

To answer the specific challenges raised by offsetting mechanisms, investors willing to either engage corporates on their carbon offsetting strategy, or to set up carbon offsetting mechanisms for their investment funds, can consider the adoption of principles and best practices.

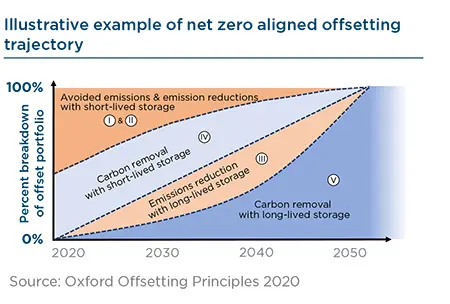

In this context, we see the Oxford Principles for Net Zero Aligned Carbon Offsetting released in September 2020 as a useful reference. It provides a list of recommendations to avoid risks associated with existing offsets, and to ensure that offsetting ultimately positively contributes to achieving net zero as early as 2050.

| The Oxford Principles for Net Zero Aligned Carbon Offsetting |

| Principle 1 Cut emissions, use high quality offsets, and regularly revise offsetting strategy as best practice evolves. Principle 2 Shift to carbon removal offsetting. Principle 3 Shift to long-lived storage. Principle 4 Support the development of Net Zero Aligned Offsetting. |

Source: https://www.smithschool.ox.ac.uk/publications/reports/Oxford-Offsetting-Principles-2020.pdf

When engaging with corporates, we believe it is key to:

1. Make it clear that companies should first take actions to deliver real emission reductions on their own business scope (including scope 2 and 3 whenever relevant) and seek alignment with 1.5°C-consistent reduction pathways. In order to best accompany companies in their greenhouse gas reduction journey, this implies that responsible investors must have a good grasp of Paris aligned/net zero scenarios. Only in this way will they be able to question and challenge companies’ emissions reduction targets and strategies. For instance, investors may question the share of carbon offset in companies’ strategies to ensure their decarbonization roadmaps are Paris-aligned. This is consistent with the position of the SBTi for target certification: “Offsets are only considered to be an option for companies wanting to finance additional emission reductions beyond their science-based target (SBT) or net-zero target”. The parallel reasoning for an investment fund is that offsetting should only complement engagement efforts. In other terms, it is better reducing emissions than trying to capture or offset them.

|

Does the SBTi accept all approaches to reducing emissions? The SBTi requires that companies set targets based on emission reductions through direct action within their own boundaries or their value chains. SOURCE : HTTPS://SCIENCEBASEDTARGETS.ORG/ FAQS#DOES-THE-SBTI-ACCEPT-ALL-APPROACHES-TOREDUCING-EMISSIONS |

2. Seek transparency on how the offsetting strategy is accounted for. Whereas carbon emissions reporting has significantly improved over the decade thanks to standardization efforts of the GHG Protocol for instance, offsetting brings new challenges. In particular, corporates and investment funds should be clear on the scopes covered by their reported emissions and whether these emissions are communicated net of offsetting. Other valid questions are: Is the same accounting rule applied to reduction and removal credits? How much does a corporate’s carbon reduction target rely on offsetting mechanisms, and does the corporate account for offsets used by its suppliers or customers in reported scope 3 emissions data? How does the investment fund account for the share of financed emissions and are the underlying corporates’ emissions data already net of offsets?

3. Get a strong visibility on the high environmental integrity of the offsets used: With observed prices of voluntary carbon credits averaging $3/tCO2e, we can easily question the robustness of some carbon offsetting solution proposals. Corporates and investment funds should be transparent on their offset selection criteria and apply high standards. This includes integrating “do no significant harm” principles for other social and environmental issues in their project assessment, avoiding project types or location with high risk of non-additionality, and tackling permanency issues in their offsetting strategy. Information such as 1) the average price of credits sourced, and 2) the percentage of credits retained as eligible out of the offers received, can help investors to sense the level of stringency of the selection criteria compared to market practices. A US tech company stated that it retained only 1% of credits offered by brokers, for instance. Regarding the permanency issue, robust project monitoring (e.g. satellite images) combined with building a buffer quantity of credits appear as best practices in our view. An oil major for instance intends to keep a 10- year stock of offsets as a buffer. Setting up a long-term sourcing strategy for quality offset credits, possibly through direct investments in selected projects or commitment to buy credits from a project on a forward basis, can provide assurance that sourcing will not be disrupted as competition increases in the market.

For corporates, compensating their own carbon emissions with removal credits is more straightforward from a ‘net zero’ accounting perspective than for reduction offsets. This supports the idea of gradually shifting to carbon removal offsetting.

The offset permanency issue is valid whatever the use case though and in the absence of clearer market recognition (such as the CDM temporary credits), shifting to long-lived/ permanent storage solutions (e.g. Carbon Capture and Storage) should be considered in order to limit risks of reversal. This could help the development of these long-term CO2 abatement solutions that have so far lacked adequate policy support, such as high carbon prices.

Conclusion

Although voluntary carbon offset mechanisms should be considered as a last resort action, they can in our opinion play a credible role in the fight against climate change, by generating funding to reduce GHG emissions and strengthen natural or technological carbon sinks.

The credibility of this mechanism will nonetheless depend on the adoption of best practices and strong safety nets to build its environmental integrity.

Reputational risks for not applying best practices can be real. Investigations led by The Guardian led the newspaper to call carbon offsets used by major airlines based on a “flawed system”, in a May 2021 article.

Some of these best practices already exist, some have yet to be found, but what is certain is that the engagement dialogue between investors and corporates will help disseminate best practices for offsetting.

Sources:

1.https://www.c2es.org/wp-content/uploads/2021/06/carbon-dioxide-removal-pathways-and-policy-needs.pdf

2.https://www.ipcc.ch/sr15/chapter/spm/

3.https://www.c2es.org/wp-content/uploads/2021/06/carbon-dioxide-removal-pathways-and-policy-needs.pdf

4.Nature (2021) “Microsoft’s million-tonne CO2-removal purchase — Lessons for net zero”

Net Zero by 2050 in the Transport Sector

The transport sector is a large contributor to global CO2 emissions and accounts for 25% of global greenhouse gas emissions with road-based, aviation and shipping emissions accounting respectively for 18%, 2.8% and 2% of emissions.1

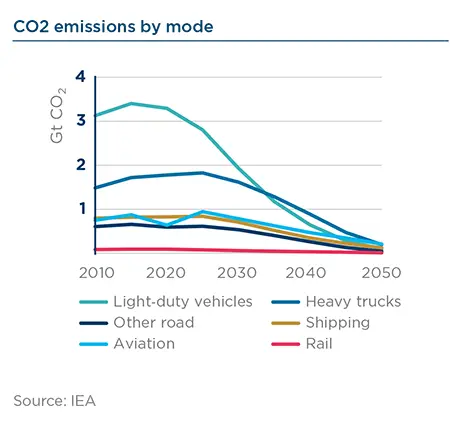

The sector emitted over 8.5Gt CO2 in 2019 before the Covid-19 pandemic and 7Gt CO2 in 2020. In the IEA NZE scenario, the sector’s emissions decrease to slightly over 5.5Gt CO2 in 2030. In 2050, they drop by 90% compared to 2020. The IEA’s scenario takes into account the growth in transport activity with passenger travel doubling in 2050 and the passenger car fleet increasing from 1.2 billion vehicles in 2020 to almost 2 billion in 2050.

The sector, which is almost exclusively dependent on a single energy source – oil, 90% of its energy needs in 20202 – faces significant challenges to reach net zero by 2050. It is considered as a hard-to-abate sector, with the speed of decarbonization depending on the transport modes and the cost and availability of substitution technologies and fuels. Indeed the pathway for the decarbonization of the automobile industry (with the fast development of electric vehicles) will be “easier” than that of the airline industry where alternative fuels and/or infrastructure are not mature yet.3 Most of the emissions of the sector are scope3 emissions (use of sold products).

To achieve NZE 2050, only emissions-free vehicles should be sold from 2035 onwards

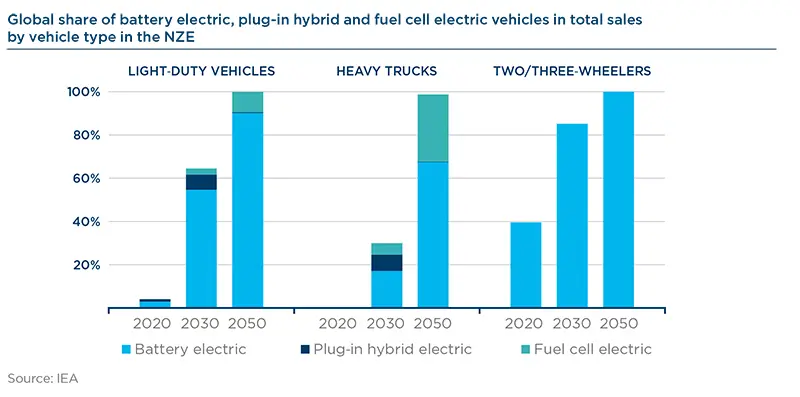

In light-duty road transport, electrification will play a key role in the road to net zero, as electric vehicles do not have tailpipe CO2 emissions (it is obviously important to note that emissions associated with battery and electricity production can be significant nonetheless). In 2020, there were 10 million of electric cars on the world’s roads and sales of electric cars represented 4.6% of global car sales4.

In the IEA’s scenario, the global share of electric cars (BEV, PHEV, FCEV5) reaches 60% in 2030 and almost all light-duty vehicle sales are electric by the mid-2030s6.

The technology is ready and the economics are also going in the right direction. Falling battery prices (57% of the retail price for a medium-size electric car to 30% in 2020 and 20% in 2025) and the fact that the retail price of electric vehicles should match that of ICE cars by the mid-2020s7 will accelerate the uptake of electric vehicles. However, the IEA’s scenario will only be reached if the production of electric vehicle (EV) batteries is significantly ramped up. As it stands, the announced production of batteries for 2030 would only cover 50% of the required demand in that year.

The roll-out of an efficient charging infrastructure will also be a prerequisite to the mass adoption of electric vehicles. However, this is less dependent on the actions of the sector than that of governments.

The electrification of heavy-duty vehicles is more complex as they need higher density batteries than those currently on the market. In addition, electric trucks have a much smaller range than their diesel-powered counterparts (200 miles versus 1,200 miles). Another issue is that of total cost of ownership which is higher for electric trucks than for diesel trucks. It is expected that cost parity with diesel trucks will be achieved by 2030. Trucks have seen so far a slow take-up in terms of electric sales with a 0.5% market share in 20208 in the EU. In the Net Zero Emissions by 2050 Scenario (NZE), electric trucks represent approximately 25% of sales in 2030 and two-thirds of sales by 2050, the remainder being powered by hydrogen.

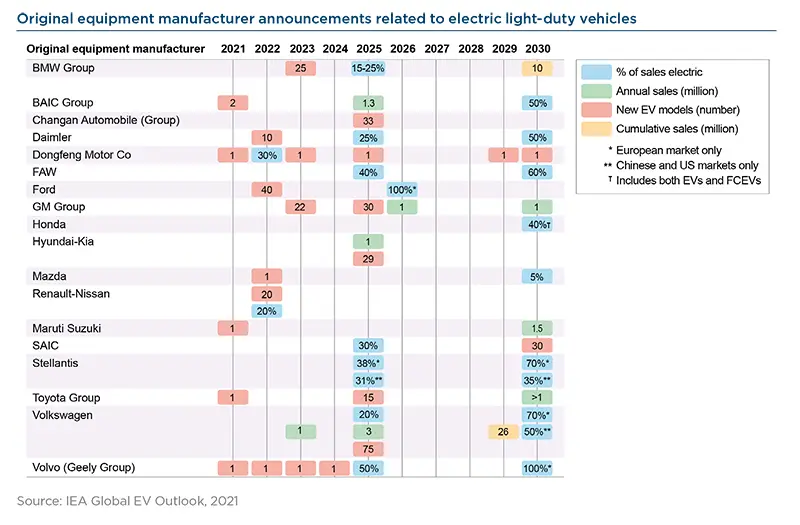

We expect car manufacturers to clearly set out their EV strategy

A number of manufacturers have already pledged to significantly increase the share of electric vehicles in their sales mix and/ or stop the production of ICE cars in the coming years sometimes as soon as 2030. We expect automobile manufacturers to define clear roadmaps for climate-neutral transportation.

Companies should set ambitious targets for the electrification of their fleet and show how their strategy will enable them to reach those targets. The latter should not only be limited to developed markets and anticipate ever more stringent regulations.

A tougher journey for aviation

Aviation is a particularly hard-to-abate industry. It accounts for 2.8% of the global carbon emissions9. The industry is under pressure as it is growing at a fast pace, with the International Air Transport Association (IATA) projecting air passengers volume to double from 4.4 billion in 2016 to 8.8 billion in 2037.10 CO2 emissions are set to triple by 2050 in a business-as-usual scenario.

In the IEA’s NZE scenario, global CO2 emissions from aviation peak at 950 Mt around 2025 and then fall to 210 Mt in 205011. The global use of jet kerosene decreases from virtually 100% to approximately 20% in 2050. The scenario assumes that the growth of the aviation industry is limited by government policies to “promote a shift towards high speed rail and rein in expansion of long-haul business travel” with taxes on commercial passenger flights. More importantly, the IEA’s projection is that the use of Sustainable Aviation Fuels significantly increases from 15% in 2030 to 45% in 2050. In addition, synthetic hydrogen-based fuels (ammonia and synthetic hydrocarbons) make up 30% of total fuel consumption in 2050. Finally, the use of commercial battery electric and hydrogen aircrafts increases but only accounts of global use for 2% in 2050.

The rise of Sustainable Aviation Fuels (SAFs)

Airline companies have several operational levers to reduce their carbon footprint: they can reduce the age of their fleets and thereby accelerate the development of new and more efficient engines and aircrafts. New technology aircrafts are on average 15-20% more fuel efficient than the models they replace12. However, part of the solution to decarbonization may lie in the use of Sustainable Aviation Fuels (SAFs). SAFs are aviation drop-in fuels with alternative feedstocks to crude oil. These range from cooking oil to plant oil, municipal waste and agricultural residues, provided they are sustainably produced. The use of SAFs can provide significant reductions in overall CO2 lifecycle emissions compared to fossil fuels, from 25% to up to 80% in some cases, depending on the feedstock and the production process.

The current proportion of SAFs amounts to 0.05% of total jet fuel consumption13. The key concern is cost, with SAFs 2 to 10 times more expensive than kerosene14. Fossil-based jet fuel costs typically vary from USD400 to USD600/ton. This compares very favorably with SAFs costs which range from USD 900/ton to USD4,500/ton. As raw materials account for approximately 80% of SAFs production costs, diversifying feedstocks will be key to reducing costs.

A number of airline operators have committed to supporting SAFs and to using this fuel. Some companies have agreements with suppliers to power a proportion of their flights with SAFs by 2030. Others have stated that they will adopt SAFs when available and commercially viable. We expect companies to gradually increase the share of SAFs in their fuel mix and set adequate targets to reach NZE come 2050.

Offsetting aviation’s emissions

For Amundi, offsetting via nature-based or industrial emission removals techniques should be left to hard-to-abate sectors. Aviation is one of them. Offsetting should not be considered as a way to replace operational and technological efforts but could help aviation reduce its footprint. 30 IATA members offer their customers the possibility to voluntarily offset their journey’s carbon emissions by paying an extra into schemes that carry out beneficial environmental projects.15

The Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) is a more official and stringent scheme. With CORSIA, airlines will use emissions units from the carbon market to offset the amount of CO2 emissions that cannot be reduced otherwise (through technological/ operational improvements and SAFs). In a nutshell, airlines will have to purchase carbon credits16 to offset the growth in CO2 emissions from international flights versus 2019 levels, at the end of three-year phases.

It is a complementary measure to reduce the aviation sector’s carbon emissions. The IATA estimates that, without CORSIA, the CO2 footprint of international aviation would increase from 600 million tons of CO2 in 2020 to almost 900 million tons in 2035.

| Europe’s “Fit for 55” package |

|

The European ‘Fit for 55’ package legislation17, if passed, will require cars emissions to come down by 55% in 2030 and 100% by 2035. In other words, the sale of internal combustion engine (ICE) cars will be banned in the EU, as all new cars will need to be zero emission by 2035. Member states will be required to install charging points every 60km for EV and every 150km for hydrogen on highways. As for aviation, the EU package requires 2% of SAFs in 2025, then 5%, 20% in 2035, 32% in 2040 and 63% in 2050. A jet fuel tax on intra EU-routes will also be implemented.18 Finally, free emissions allowances under the EU Emissions Trading Scheme will also be phased-out by 2027. Airline companies operating European flights will have to follow these rules. |

Sources and References

1. Morgan Stanley, European Transport, March 2021

2. International Energy Agency Net Zero 2050, a roadmap for the global energy sector

3. This paper will focus on the automobile and aviation sectors

4. International Energy Agency, Net Zero 2050, a roadmap for the global energy sector

5. Battery Electric Vehicle; Plug-in Hybrid Electric Vehicle; Fuel Cell Electric Vehicle

6. International Energy Agency Net Zero 2050, a roadmap for the global energy sector

7. Exane, Transport & Infrastructure, ESG : Europe’s problem child

8. Exane, Transport & Infrastructure, ESG : Europe’s problem child

9. Morgan Stanley, European Transport, March 2021

10. www.iata.org

11. IEA

12. Goldman Sachs, Carbonomics, June 2021

13. Morgan Stanley, ESG Sector Insights : Global Transport, September 2021

14. HSBC, Sustainable Aviation Fuel, the key to aviation decarbonisation, July 2021

15. https://www.iata.org/en/programs/environment/carbon-offset/

16. These credits will finance renewable energy projects or reforestation projects for instance

17. https://ec.europa.eu/commission/presscorner/detail/en/IP_21_3541

18. BoFA, EU’s « Fit for 55 » - increase baggage for airlines July 2021