Summary

We expect equity markets to take a breather after the recent all time highs. We look for opportunities beyond the mega caps and in emerging markets.

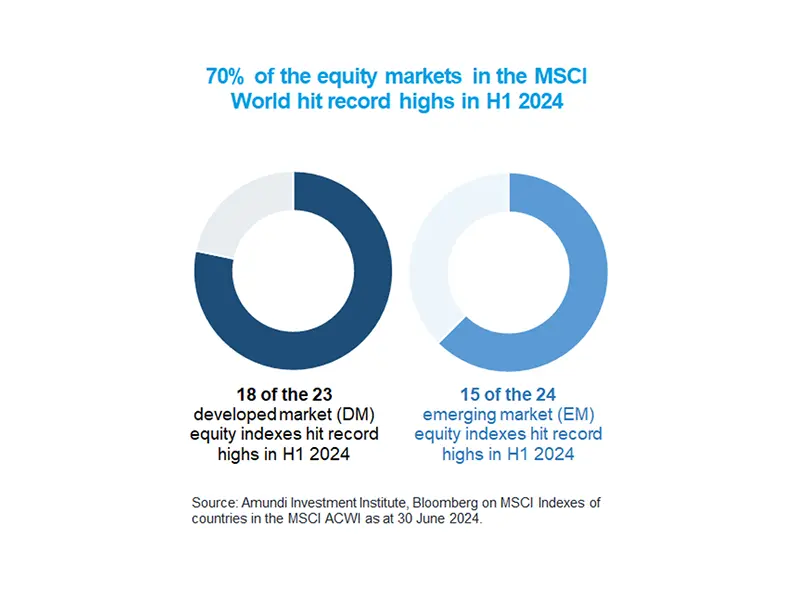

- 18 of the 23 biggest Equity markets have hit all time highs in the first half of this year.

- A resilient economic outlook and expectations of rate cuts should support a broadening of the rally.

- Emerging markets and global companies outside the expensive mega caps may be in favour later in the year.

In the first half of the year, the world's largest equity markets have reached new all time highs. This includes 33 out of the 47 countries in the MSCI World All Country Index of both developed and emerging markets. Several factors have contributed to this rally, such as expectations of interest rate cuts, a resilient and improving economic outlook, and solid corporate earnings.

While in the first half of the year, the rally has been heavily concentrated, particularly in the US, for the second part of the year we expect a broadening of the rally that should favour companies outside the mega caps and in Emerging Markets. In particular, different speeds in regional economic growth may potentially offer opportunities in companies with not too expensive valuations and strong business models.

Actionable ideas

- Global equities

Global divergences and improving economic outlooks may present opportunities in regions such as Europe, Asia and emerging markets.

- Multi asset

Investors could potentially explore multi asset investment strategies that combine attractive bond yields with exposure to the potential upside in global equity markets.

This week at a glance

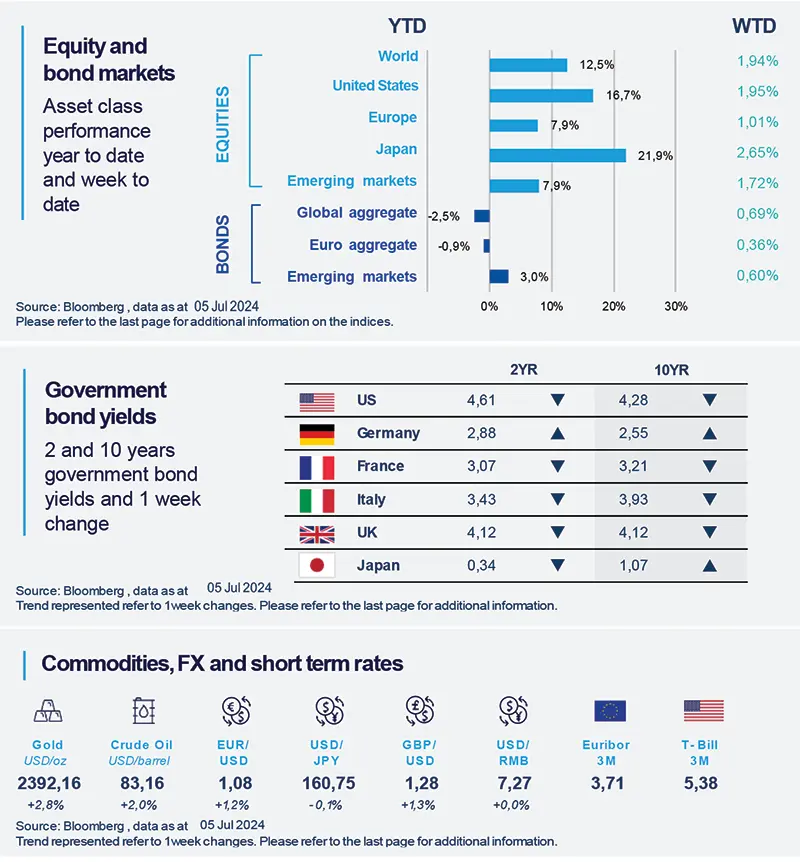

Global stocks traded near all-time highs and S&P 500 rose on the back of renewed expectations of rate cuts by the Fed. US Treasury yields were lower over the week. In commodities, oil prices rose amid hopes of strong demand, and mounting geopolitical tensions pushed gold prices higher.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short term rates.

Source: Bloomberg, data as 8 July 2024. The chart shows Global Bonds= Bloomberg Global Aggregate Bond Index, Global Equity = MSCI World. Both indexes are in local currency.

1 Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

United States: Manufacturing ISM slips further. Big drop in price paid

Weakness in manufacturing at the end of the second quarter as the ISM index contracted for a third straight month due to subdued demand and tight monetary conditions; a large drop in input prices paid suggests goods disinflation should continue.

Europe

Euro Area: no good news from core inflation as services inflation remains sticky

While headline inflation eased to 2.5%, core inflation, a measure of underlying inflationary pressures, remained at 2.9%, still far from the ECB target of 2%. Core services inflation remained sticky and steady around 4%. June data further confirm that disinflation will likely continue but on a slower pace than it has been so far.

Asia

Asia’s export strength continues, fuelled by booming AI demand

In June, exports from South Korea and Vietnam maintained their recovery, concluding Q2 on a strong note. South Korea's technology hardware shipments, particularly AI-related products, showed remarkable growth. Additionally, the rebound in exports began to broaden into other sectors.

Key Dates

|

8 Jul Japan trade balance |

11 Jul US CPI |

12 Jul US consumer sentiment |