Summary

The three major central banks issued restrictive signals last week. The banks have succeeded in changing the course of their monetary policies without harming the markets.

The Fed is accelerating the normalisation of its monetary policy on the back of inflationary pressures and a strong improvement in the US labour market

After well-orchestrated communication in recent weeks, the Fed has hardly surprised investors by adopting a much less accommodating, much more “hawkish” tone. The Fed is accelerating the normalisation of its monetary policy on the back of high inflationary pressure and a favourable economic environment. The Fed sold and the market bought the story that a short, rapid rate hike cycle will be enough to stem these inflationary pressures.

Main takes from Fed’s meeting:

1. Strong shift in inflation narrative.

The Fed is committed to fighting inflation, which has been described as “high” and no longer as “transient”. Any reference to transitory factors of inflation was removed. Instead, the FOMC underlined that pandemic-related supply and demand imbalances and the reopening of the economy have continued to contribute to elevated levels of inflation. The median core inflation forecasts was sharply revised on the upside to +4.4% (+0.7bp) in 2021 and to 2.7% (+0.4bp) in 2022, due to higher realised inflation and continued supply chain disruption.

2.The Fed is accelerating the normalisation of its monetary policy.

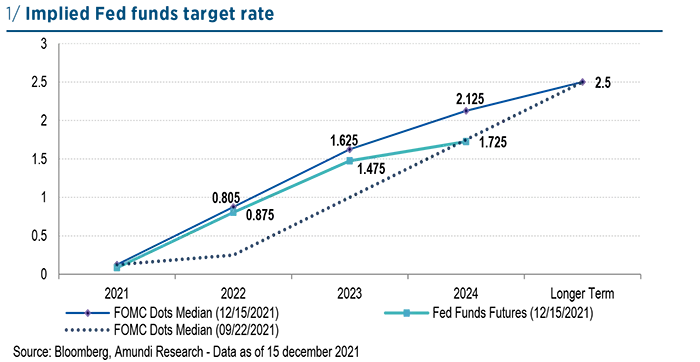

The Fed announced the acceleration of tapering in light of elevated inflation pressures and strengthening labour market. The pace of tapering will be doubled to $30bn per month in January. As a result, the Fed will end net asset purchases at the end of March, which should allow a first rate hike in the second quarter. Moreover, FOMC members are now considering three hikes in 2022, three hikes in 2023 and two hikes in 2024. This represents a major shift from the previous forecast in September, where the committee was split evenly between one increase in 2022 and no increase in 2022.

3.The Fed strongly emphasised the strong macro backdrop and the rapid recovery of the labour market.

Jerome Powell was optimistic about economic growth in the US: “Economic activity is set to develop at a sustained pace this year, reflecting progress in vaccinations and the reopening of the economy” and “Global demand remains very strong”. He continued to stress that the Omicron variant is a risk to the recovery. 2022 GDP growth was revised up to 4.0% from 3.8%. Powell cited the falling unemployment rate as evidence that the job market is rapidly approaching maximum employment. The projected unemployment rate improved down to 3.5% in 2022 from 3.8% previously. Powell also downgraded the importance of rising labour force participation as a pre-condition for rate hikes.

4.The Fed expects that a rapid and limited hiking cycle will ensure that inflation is transitory

- The Fed continues to believe that the upward trend in prices will weaken next year, as global supply chains are restored. It is unanimous in thinking that in 2023 it will be barely above 2%. Median core inflation is projected to be back to 2.3% in 2023 (range: 2%-2.5%).

- At the same time, the rate hiking cycle is expected to remain gradual and limited. The median forecast for rates in 2024 increased only from 1.8% to just over 2.1%. The longer run dots have stayed the same. In the coming quarters, monetary policy will be highly accommodative, with negative real Fed Funds rates. The Fed is signalling a policy move close to neutral only by 2024.

Strong Fed shift on the inflation narrative: High inflationary pressure figures are now considered to be a drag to achieving full employment

Market reactions and our views:

- Fed: we expect two hikes in 2022. This could be revised upwards if positive US macroeconomic dynamics are confirmed. The strength of US demand in the second half of 2022 will be decisive (on the labour market, fiscal policy and investment cycle).

- In the short term, we expect strong data on the US labour market and US inflation to remain high. The recovery in the US labour market is so far impressive and broad based. Consequently:

- We are short duration. 5Y yields are usually the most responsive when the employment gap closes

- We expect a massive upside for short-term real rates.

The ECB wants to massively reduce its purchases while maintaining a backstop strategy

The European Central Bank wants to end its pandemic-linked emergency measures

The outcome of December meeting was more hawkish than expected, but ECB policy will remain much more dovish than those of the Fed and BoE, with QE to persist and no rates normalisation in sight next year. The ECB will end its emergency measures linked to the pandemic, while leaving itself some room for manoeuvre if the situation were to deteriorate again in the Eurozone.

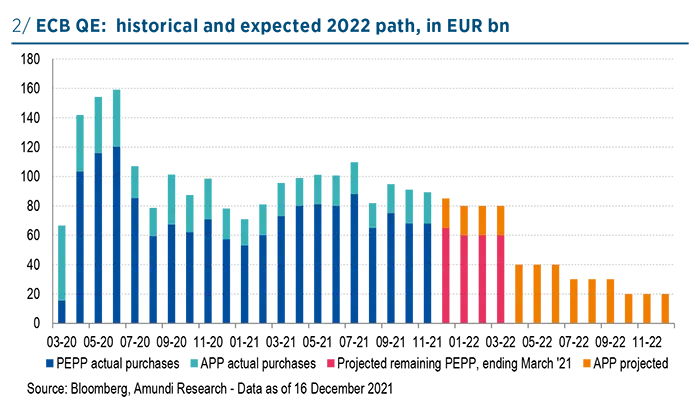

The ECB wants to massively reduce its purchases while maintaining a backstop strategy. A “large majority” on the Governing Council finally agreed upon 2022 for the quantitative easing outlook, combining more than EUR 500bn in additional net purchases. These decisions represent a very significant reduction in net asset purchases: they will be progressively reduced from EUR 90bn per month in 2021 to EUR 20bn in October 2022. At the same time, the ECB adopted a backstop strategy while maintaining the open character of the asset purchase program and introducing potential flexibility on reinvestment of the PEPP by asset class and by jurisdiction. This is to avoid financial fragmentation as long as economic fragmentation prevails in the Eurozone. The credibility of the ECB will be crucial in this approach.

Overall, the policy stance is still supportive for spread products (periphery and credit) in the short term but more volatility should be expected. The ECB announcements reinforce our short duration and curve steepening views going into 1Q-2022. However, we should be vigilant in the face of the growing divergence of views and interests within the ECB’s Executive Board. This could bring some volatility in 2022.

Main takes from ECB meeting

1. Stable outlook for rates: the ECB’s inflation projection is below target in the medium term.

As we were expecting, the revision to the set of forecasts kept showing mid-term inflation below target, despite having been raised to 1.8% in both 2023 and 2024. Therefore, the unchanged forward guidance looks still consistent with an accommodative stance through QE in 2022 and a stable rate outlook.

2.The ECB announced plans to reduce its purchases significantly.

Most of the increased debate and divisions inside the ECB focused on QE, namely on a wide range of combinations as to the form ECB QE could take in the transition away from the PEPP. This included the combination of size with other important factors like whether or not introducing a new programme instead of simply increasing the APP path, whether open-ended or an envelope, and finally on the indicated time frame/horizon (especially in the case of an envelope).

In the reported chart, we show 2022 QE path implied by the ECB announcement, vs dynamics of current and previous years. As PEPP will be run in Q1 “at a lower pace than in the previous quarter” before being discontinued, we assumed a monthly path close to EUR 60bn between January and March next year. Then, as announced, despite being increased in Q2 to EUR 40bn per month, and in Q3 to EUR 30bn per month, APP path will be back to current EUR 20bn in Q4 next year. According to this scenario, overall yearly QE firepower appears to be slightly higher than EUR 500bn, rather than close to the EUR 600bn we expected. In terms of quarterly breakdown, the reduction in the path is quite evident: from an estimated EUR 240bn in Q1 (the remaining PEPP + the EUR 20bn APP monthly path), down to EUR 120bn in Q2 (with APP at EUR 40bn), to EUR 90bn in Q3 (with APP at EUR 30bn), and finally at EUR 60bn in Q4. QE will therefore be concentrated mainly in H1, matching higher sovereign debt supply seasonality vs the lower primary market activity usually recorded in the second part of the year.

3.…. To move to a backstop approach : QE flexibility.

Despite not introducing a new programme for pandemic recovery, the ECB remains ready to resume PEPP, but only ”if necessary, to counter negative shocks related to the pandemic”. Then the ECB decided to address QE flexibility/optionality mainly through PEPP reinvestments. As they have been prolonged by one year (at least to end 2024), reinvestments actually represent an important backstop in order to retain its PEPP purchase flexibility in terms of asset classes and jurisdictions.

This represents an additional buffer the ECB may use to support periphery debt in the event of undesired volatility and is also aimed to support Greek debt till a potential rating upgrade triggers the APP eligibility of its bonds. As we know, the ECB does not publish a forward schedule of PEPP reinvestments as it does for PSPP. However, as PEPP reinvestments are becoming an important policy tool, the ECB should provide more guidance to investors, in the same way as it does with the APP.

4.The end of the special conditions applicable under TLTRO III in June 2022 was confirmed.

Still, the ECB will “monitor bank funding conditions”, in our view in order to avoid unwanted cliff effects: as with its purchase program, the GC will likely aim at a smooth transition away from its emergency regime, through decisions at coming meetings. Interestingly, the last TLTRO auction of the year preceding the ECB meeting saw a slightly negative addition of liquidity at -EUR 8 bn for the first time since the pandemic crisis, as some EUR 60 bn was repaid/rolled off vs a gross EUR 52bn take-up by almost 160 banks. We see this auction result overall supportive of overall financial stability, whilst having a limited impact on bank revenues as no new net liquidity was added to the system.

The divergence is widening between the Fed’s and ECB’s monetary cycles

Our conclusions and markets’ implications for EUR rates and spreads:

We should be vigilant in the face of the growing divergence of views and interests within the ECB’s Executive Board. This could bring some volatility late in 2022. In the short term:

- ECB announcements reinforce our short duration and curve steepening views going into 1Q-2022. Despite the taper and improved macro picture, however, we still expect the ECB QE to absorb most of net issuance to contain the upward yield move vs other developed areas. The potential tilt of reinvestments into non-core bonds may be an additional factors supporting the expected curve move.

- The positive view on periphery debt remains confirmed, supported by technicals (lower net debt issuance still expected in 2022 to be mostly absorbed by ECB new purchases, stable policy rates in sight) and by the potential tilt of PEPP reinvestments into the asset class, together with improved fundamentals, positive rating agencies news flow, and attractive relative value.

- APP will continue to provide support in the euro credit market

QE firepower announced by the ECB looks calibrated to cover sovereign debt net issuance projected in 2022

Among the G4 CBs, BoE was ultimately the first to end QE and start hiking rates

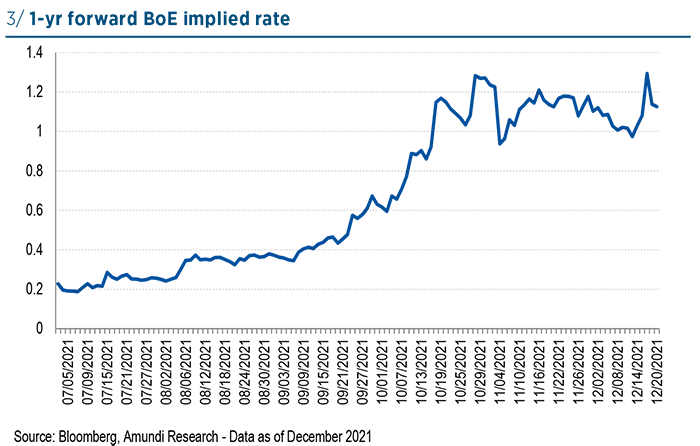

After surprising on the dovish side in November, the BoE again surprised markets and our latest expectations at its December meeting, this time on the hawkish side, with an unexpected hike of 15bp, taking the base rate to 25bp. The almost unanimous 8-1 vote, showing that the decision was largely consensual inside the MPC, looks a surprise, too, given some recent statements also delivered from hawkish members pointing to a likely stand-by on the back of the pandemic trend. At the same time, it is worth noting that, despite the lift-off delivered, the BoE seems to have chosen a halfway move with a 15bps increase (rather than 25bps).

Main takes from BoE meeting

- Going into the meeting, a first rate hike appeared fully consistent with latest macro data, as the latter showed an even greater than expected improvement in labour market trends in both October and November, in the presence of still high inflation prints in both months. At the same time, increased concerns over the Omicron variant and the UK’s increasing its threat level were causes of concerns. Here again, commentary drove expectations, where some members, also among hawks, pointed to caution to get more visibility on the impact of the Omicron variant and therefore reasons for remaining on hold in December and postponing the first move to February next year. After the meeting, Governor Bailey cited inflation concerns and a need to act as the main reason for the hike now, despite mounting uncertainties on the virus front. The rationale underlined by the governor appears consistent with additional risks posed by pandemic trends not only to growth but also to higher inflation potential, through negative impacts coming from eventual additional restrictions or disruptions due to a worsened pandemic trend.

- The macro rationale behind moving sooner rather than later appeared also consistent with the mix of the latest BoE revisions to its economic projections. Here are some details in terms of key macro updates vs the November Financial Stability Report:

- projections were revised down for 2021 Q4 GDP growth to 0.6% from 1% at the time of the November Report, leaving GDP around 1.5% below its pre-Covid level (of Q4 2019); disruptions in supply chains and shortages of labour kept impacting on growth, but

- the unemployment rate is now expected to fall more rapidly, to around 4% in 2021 Q4, better than the 4.5% projection in the November report, while

- twelve-month CPI inflation rose from 3.1% in September to 5.1% in November while BoE expects inflation to remain around 5% through most of the winter, and to peak at around 6% in April 2022.

Our conclusions on the expected path of monetary policy and view on UK Gilt curve.

On projected rate normalisation, we maintain the view that the market is still pricing in a too hawkish path for the MPC next year, with more than three additional hikes, each by 25bps, still priced in by end 2022. In our view, the BoE would rather take rates to 75bp, and then pause in the rate hiking cycle. This would be consistent with the need to keep flexibility in managing Quantitative Tightening planned to start when base rate have reached 1%. Although inflationary pressures suggest the BoE should raise rates again in February, it might consider instead a wait-and-see approach, monitoring closely how the economy develops coming out of another Covid-wave, in order to deliver the second hike.

In our view, while the front end of UK Gilt curve is probably pricing in too much of a rate normalisation, the long end is still looking rich vs inflation expectations and relative to other curve segments. Therefore, we see potential for a steeper Gilt curve in 2022, accounting for long end current valuations, not only relative to the 2-yr but also to the 5-yr maturities.

We maintain the view that the market is still pricing in a too aggressive path for the BoE’s monetary policy next year

| QE vs expected sovereign net supply in 2022 |

|---|

| Although lower than expected, QE firepower announced by the ECB looks calibrated to cover sovereign debt net issuance projected in 2022. This is more the case on the back of the very recent issuance guidelines published by Germany and other countries. In light of declining gross funding needs and according to the 2022 issuance plan released on 16 December, Germany is now expected to combine in 2022 net issuance of bonds close to EUR 53bn (down from EUR 93bn this year) and a negative net issuance of Bills of EUR 25bn (vs an increase by EUR 41bn in 2021). This would mean for Germany quite a fall with respect to 2021 figures, overall (bonds +bills) by more than EUR 100bn. In light of these and other recent releases, we have therefore lowered our previous estimates for EMU-10 countries’ debt net issuance to EUR 350/360bn, including Bills. On the demand side, we estimate ECB QE to reach EUR 510bn next year, out of which EUR 390bn may be allocated to sovereign debt. This would mean estimated flows of EUR 60bn available for corporates, roughly EUR 10bn for covered bonds, and finally more than EUR 50bn for supranationals (included EU issuance). The reported chart shows that, despite failing to make net issuance negative as in 2021 and 2020, the ECB role is going to remain remarkable in absorbing new sovereign debt. |