Summary

As the 2024 Amundi-CREATE report highlights, the private markets asset class is particularly suitable for responsible investing. This article explores how an investor in private assets, such as Amundi Alpha Associates, can approach and refine responsible investment capabilities, as well as the practical steps taken to integrate ESG factors into their portfolio monitoring processes.

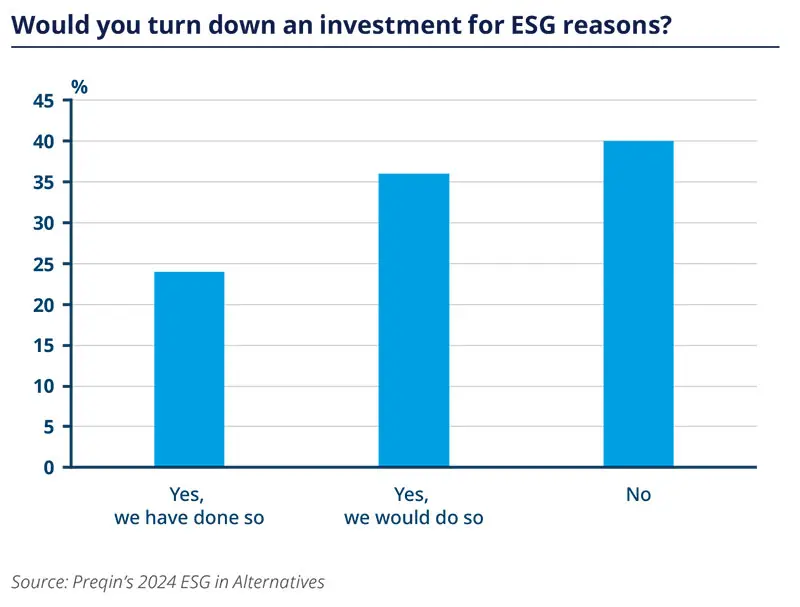

Today, investors rightly expect to receive transparent, clear, and comprehensive reporting on the Environmental, Social, and Governance (ESG) aspects of their portfolio. To meet these expectations, proactive engagement with portfolio fund managers is essential to steer their sustainability processes and drive meaningful and tangible change. The alternatives data provider Preqin indicated in their 2024 ESG in Alternatives report that 60% of investors would have or have turned down an otherwise attractive investment over concerns about ESG.

Meanwhile, more than 8,300 companies representing all sectors of the economy, including nearly 600 financial institutions representing USD 130 trillion in assets under management, have committed to net-zero targets under the UN’s Race to Zero initiative, reflecting a significant shift in corporate accountability. Institutional investors, however, bear an even greater responsibility—not just to demand high ESG standards from their investments, but to lead by example in driving sustainable progress at scale.

At Amundi Alpha Associates, we are committed to constantly building on the ESG foundations that we first established nearly 20 years ago. As an institutional investor, we have the ability to promote widespread, sustainable change that can benefit society. Furthermore, as a manager of multi-manager portfolios, we view the integration of ESG factors as essential to our fiduciary duty. Eric Tazé-Bernard of the Amundi Investment Institute notes in a recently published paper on responsible investing in private equity1 that responsible investing aligns with investors’ objective to maximise the value of companies upon exit: “If the invested company’s future prospects are hindered by environmental or social risks, or if its governance is inefficient, its value will clearly be negatively affected.” By thoroughly embedding ESG into our due diligence process, we can build more valuable, resilient portfolios for our stakeholders.

The interconnected sustainability challenges we face demand urgent and collaborative action, which further extends to robust and standardised monitoring practices. Without these, it becomes impossible to audit and assess progress meaningfully. Transparent measurement and consistent ESG reporting are the cornerstones of accountability and improvement of a responsible investing framework.

1. https://research-center.amundi.com/article/responsible-investing-private-equity

Establishing a Robust ESG Monitoring Framework

At the heart of effective ESG monitoring lies the establishment of clearly defined goals. For direct managers, these goals are often company-driven and tailored to the specific needs of the companies within their portfolio. Private equity (PE) managers, in particular, have a unique capacity to influence change by actively shaping company-level ESG policies. It can also be stressed that governance, one of the three pillars in ESG investing, is an essential component of PE as, according to General Partnerss interviewed by Amundi, “PE is about governance”, and “Governance is key as you must have accountable leadership first to get the rest right”. Through board representation, operational oversight, and capital allocation decisions, they can drive measurable improvements in areas such as emissions reduction, governance frameworks, and social responsibility. This proactive approach not only benefits individual portfolio companies but also contributes to broader, systemic progress in addressing global sustainability challenges.

In contrast to a direct fund manager, a multi-manager platform often spans hundreds or even thousands of underlying companies, but its influence is indirect, exercised primarily through the portfolio fund managers. This structure makes the assessment of a portfolio fund manager’s ESG practices a critical component of the multi-manager ESG due diligence process – see also the 2024 Amundi-CREATE Research2. Evaluating a fund manager’s ability to implement, monitor, and report on ESG data is key to ensuring meaningful outcomes at the look-through company level.

2. Amundi-CREATE 2024 - Seeking returns in private markets and emerging markets in a disruptive era

Turning Data into Direction – Progress over Perfection

At Amundi Alpha Associates, we recognise the importance of this indirect influence and have embedded rigorous ESG assessments into our due diligence framework. All short-listed portfolio fund managers are required to complete a comprehensive ESG due diligence questionnaire. This evaluation delves into the fund manager’s capacity to monitor and measure greenhouse gas (GHG) emissions and explores the climate commitments they have made, among other topics. By setting clear expectations and conducting thorough assessments, we ensure that the ESG practices of our portfolio fund managers align with our overarching sustainability goals.

We believe it is important to have an approach that prioritises identifying a manager’s capacity for improvement rather than expecting perfection from the outset. Recognising that the ESG regulatory landscape is continually evolving, we understand that many private markets managers are still refining their ESG reporting frameworks. To address this, we have designed our processes to first assess a manager’s baseline ESG capabilities, creating a foundation for tracking their progress over time. By collecting consistent and reliable data annually, it allows us not only to build a robust track record but also to enhance our ability to make informed decisions and evaluate meaningful advancements in ESG performance.

Tailored and Transparent ESG Reporting

In addition to maintaining continuous dialogue with the portfolio fund managers, the annual ESG questionnaire—now in its fourth year—forms the cornerstone of our ESG monitoring efforts. Given the nature of our funds-of-funds portfolio, transparency is prioritised as a key tool in our reporting campaign. We encourage managers to report as much data as possible, while we handle the aggregation, standardisation, and analysis. By minimising the reporting burden and complexity for our managers, we collect richer datasets and conduct a more meaningful assessment of our portfolio. This approach not only helps identify and mitigate ESG risks but also enables us to work collaboratively with portfolio fund managers to enhance their processes and seize opportunities for sustainable growth.

The ESG questionnaire is specifically tailored to our multiasset portfolio, encompassing private equity, private debt, and infrastructure equity. It is primarily structured around the mandatory Principal Adverse Impact (PAI) indicators outlined in the Regulatory Technical Standards (RTS) of the Sustainable Finance Disclosure Regulation (SFDR). Acknowledging that certain data points may be less relevant for some portfolio fund managers depending on asset class and investment strategy, the questionnaire is customised to ensure the collection of relevant, actionable insights. This process is carefully adapted to reflect each manager’s geography and strategic priority.

Once responses are received, the data undergoes a rigorous process of cleaning, analysis, and reconciliation through consistency and logic checks. Data cleaning is critical to enhancing the accuracy and reliability of the information, as well as strengthening the robustness of the statistical model estimates.

Internal consistency checks are applied to each response to ensure that data points align with other information reported by the manager, helping to identify and address any contradictions within the questionnaire itself.

Simultaneously, the questionnaire undergoes a series of external consistency checks, leveraging information from other data sources to validate and reconcile the data disclosed by companies with information reported elsewhere. For instance, if a manager erroneously indicates in the questionnaire that they do not have an Exclusion Policy, we cross-reference this with documentation from our initial due diligence. This process helps identify whether the discrepancy is due to a manual error, a misunderstanding of the question, or is indeed an accurate reflection of the manager’s practices.

The checks are designed to identify and address misreported data points. Wherever possible, we engage directly with managers to clarify discrepancies and correct the data as needed. Significant outliers that could distort statistical models are excluded. A common example involves carbon emissions: some managers report emissions at the group level, even when our investment is limited to a specific sub-entity responsible for only a fraction of those emissions. In such cases, the group-level data must be excluded or scaled appropriately to ensure accurate calculations.

To further streamline the data collection process, we have expanded our accepted reporting formats to include the ESG Data Convergence Initiative (EDCI) template and the European ESG Template (EET), alongside our online platform. This broader approach has significantly improved response rates to our data requests, though it has also increased the complexity of data processing. This underscores the importance of digitisation.

Over the past three years, we have transitioned to a proprietary in-house programmed tool that automates critical tasks such as validation and outlier detection, enabling greater efficiency and accuracy in our processes.

Our reporting campaign concludes with the distribution of individual ESG reports to our investors, evidencing our mission to facilitate clear, measurable, and transparent reporting across our portfolios.

Applying ESG Data to Mitigate the Climate Crisis

Building on these advancements, we have established a baseline for the reporting capabilities of our portfolio fund managers, with the intention of generating more qualitative insights and comprehensive assessments of the ESG data provided. As the market standard for ESG reporting requirements has evolved, we want to ensure that our monitoring methodology not only reflects best practice, but also reflects our raised expectations for the level of ESG reporting we expect from our portfolio fund managers.

Aided by three years of data and a robust algorithm-driven scoring system, we now have enough context to move beyond simply tracking completion rates and instead can begin evaluating the substance and quality of the information provided by our portfolio fund managers.

Our long-term goal is to derive meaningful, actionable insights from the data we collect, ensuring it informs tangible decisions and drives impactful outcomes. After all, private capital plays a pivotal role in accelerating sustainable change, and the quality of the information we gather is key to unlocking its full potential.

We believe that enhancing sustainability is a global challenge that demands collective action if we want to successfully mitigate its effects. By developing a more rigorous, data-driven approach to evaluating ESG, and consequently using quantitative analysis to better identify and manage ESG risks in our portfolio, we can play our part in contributing to measurable progress toward a more sustainable future.

About Amundi Alpha Associates

Amundi Alpha Associates is the private markets multi-manager business line of Amundi Alternative & Real Assets, with a combined team of 70 based across Zurich (HQ) and Paris. The team manages private equity, private debt, and infrastructure funds-of-funds as well as tailor-made investment programs (managed accounts) for a global, institutional client base.

Read more