Summary

Investment Convictions

Govies: “Higher for longer” does not mean “higher forever”

Growth is slowing, inflation is coming down and these trends will accelerate in 2024 due to the impact of global monetary tightening. Therefore, in Q4 2023/Q1 2024, we will have to add duration and yield curves will enter a bull-steepening episode. Investors should price in more rate cuts as the growth picture deteriorates. In this sequence, timing is essential.

We expect Central Banks to be done with rate hikes. Investors are assuming the Fed and fellow Central Banks are unlikely to cut rates quickly amid sticky inflation.

However, the US economy has surprised with its resilience in recent months despite the steepest rate increases in decades. The market adjusted higher the equilibrium level of rates that the economy can tolerate. Many new factors are changing the game: the labour market, fiscal policy and a decade of low rates.

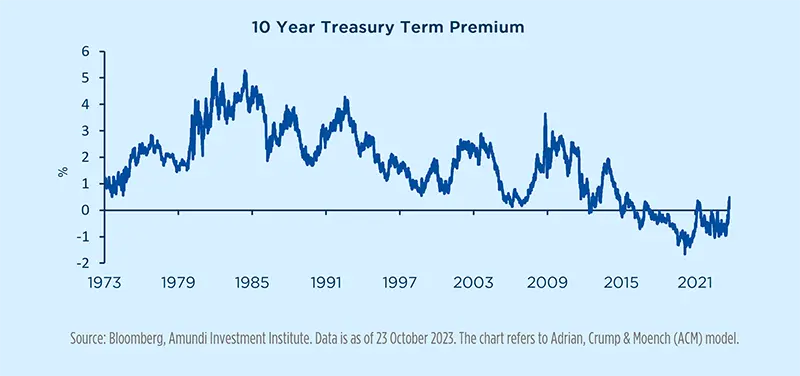

The term premium is rising amid a context of resilient growth (see graph), strong supply, lower Central Bank support and higher uncertainty around long-term trends. Additional compensation for holding long-term bonds may be necessary due to a structural increase in funding needs and inflation volatility. As Central Banks shrink their balance sheets, budget deficits have become the main concern for bond investors looking at the long end of the curve. In the US, Treasury supply has risen sharply and will keep doing so.

The change in the composition of the market is adding pressure. The Fed is reducing its bond holdings, while the holdings of foreign investors are waning. In their place, hedge funds, mutual funds, insurers and pensions have stepped in. These buyers are more interest rate-sensitive.

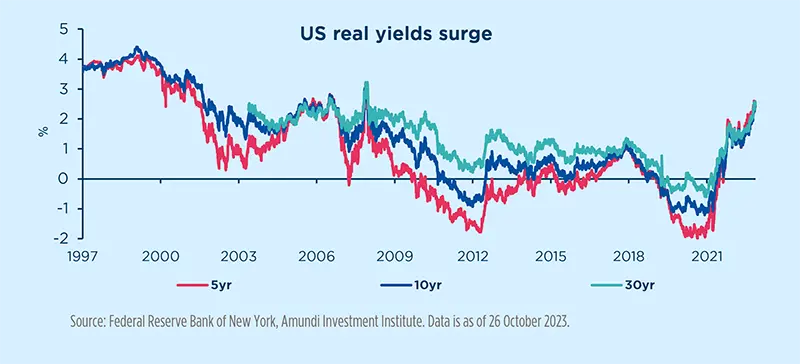

“Higher for longer” does not mean “higher forever”. Borrowing costs have increased following the rapid global cycle. US real rates have now returned to pre-global financial crisis levels. In 2024, the interest burden for highly-leveraged companies could begin to tighten.

We remain cautious about peripheral issuers as growth is slowing and the ECB is withdrawing support. Christine Lagarde has acknowledged that the “effects of monetary policy are already more forceful than expected”. The ECB is expected to remain cautious and fully reinvest securities under the PEPP until the end of 2024, as forecast in the current guidance. EMU-10 net supply, net of ECB flows, is projected to remain close to 2023 levels.

We expect Japanese government bonds (JGB) yields to rise further. The BoJ has de-facto lifted the cap on 10y JGB and we expect negative interest rates to end in January 2024. However, as inflation moderates, we don’t see the BoJ launching a hiking cycle in 2024. It will anchor terminal rate expectations at around 0%. The persistent monetary policy gap with other DMs makes Japan more vulnerable to external pressures on JPY and JGB rates.

Credit: Quality to remain in focus, supported by absolute valuations

Quality in focus. Credit metrics still sound but should feel the impact of weakening macro trend

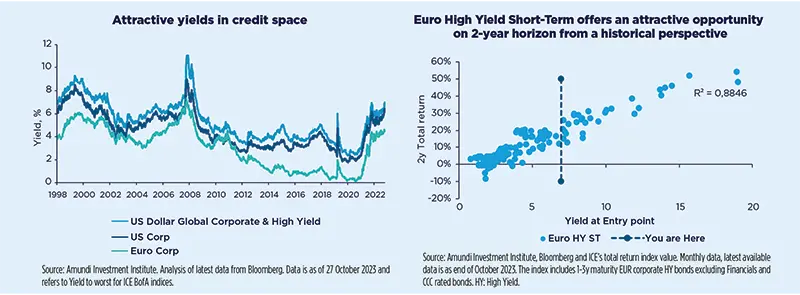

The expected upcoming economic slowdown, together with the assessment of relative value and technicals, supports the need to keep focusing on quality in credit markets, with a preference for Investment Grade credit over Speculative Grade and also for higher credit quality within the High Yield space.

Fundamentals show some deterioration, but credit metrics still look sound from a historical perspective, mostly thanks to margins supported by higher pricing power and lower input costs which are preventing leverage from rising as has occurred in some previous cycles. The impact of monetary tightening on corporate fundamentals has been limited so far, because of the huge liquidity accumulated during the Covid-19 crisis and low short-term refinancing needs. However, despite no immediate wall of maturities looming next year, the transition towards higher funding costs will be more painful and faster for low HY-rated corporates, which have less ability to generate cash flow and look more vulnerable to higher short-term refinancing needs and are more sensitive to the strong repricing in bank loan costs. Current and expected trends in High Yield default rates provide evidence of a cycle mostly driven by the lowest-rated names, while BBs and high Bs look more resilient than in the past, due to a less severe macro picture.

Demand flows to remain supported by attractive absolute yields, mostly in High Grade space

Despite not looking particularly attractive on a spread basis, corporate bond valuations look attractive at absolute levels and keep attracting positive flows from investor demand mostly in the High Grade space, thanks to the attractive trade-off between the yield offered and resilient credit quality. Among credit segments, US HY looks less attractive, while we already see opportunities in Euro HY Short-Term.

Technicals look more favourable for High Grade than High Yield on the demand/supply balance. Primary markets are likely to keep showing healthy activity in the IG sector, although without pressure being too strong in terms of net issuance versus the past. Meanwhile, the volume of new issuance from HY companies is likely to remain more modest, even though some pickup is expected on renewed refinancing needs. Demand flows are mostly targeting High Grade for the attractive balance between absolute valuations and duration.

*Scope 3 emissions are the result of activities from assets not owned or controlled by the reporting organisation, but that the organisation indirectly affects in its value chain, Source: US Environmental Protection Agency.

DM equity: follow the sequence, look for resilience

The path of least resistance for equities is on the downside in 1H2024

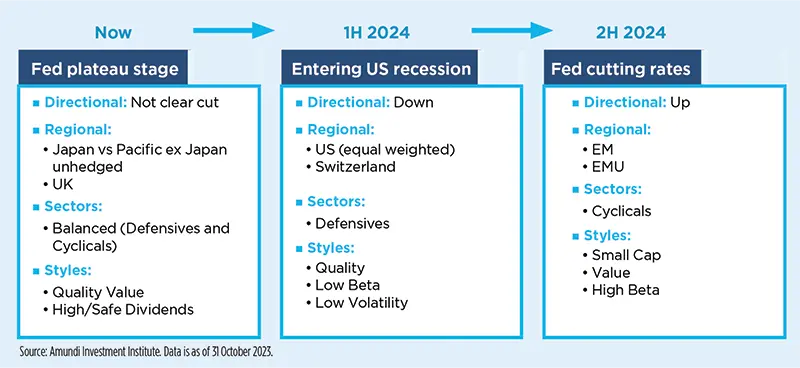

When Fed rates plateau, equities rise only if there is no recession ahead or if a bubble is building. Otherwise, after some resistance, equities give up. Our mild recession scenario, and the overvaluation of some US stocks (Magnificent 7), point to this second option. Revisiting the lows of October 2022 is a possibility for the MSCI World in 1H2024.

US 10Y yields breaking out the 4% on the top of rising oil prices and the USD suggests a downturn of Price / Earnings as in 2022, but also disappointment on earnings which will recover only later in the year. Ibes forecasts for FY24 (USA +12%, Europe +7%) are too high relative to our real GDP forecasts and should be more flattish.

The impact of monetary policy on the economy is just beginning to be felt. It usually has a cyclical impact on equity volatility with a 2-year lag, going potentially along with outflows.

It will therefore be advisable to shift from a balanced to a defensive profile entering 2024 and to only pick up cyclical bets again when the Fed telegraphs rate cuts.

Regions: Japan vs Pacific ex Japan unhedged (domestic appeal vs global synchronised slowdown) and the UK (proxy for Energy vs Industrials, high dividend yield) are a good starting point. The US (equal-weighted) and Switzerland could prove to be even more defensive. Fed rate cuts will then favour EM and the excessively de-rated EMU.

Styles: Safe dividends should now be considered alongside Quality. Value remains in focus (particularly in Japan); next steps will favour low volatility and small caps will benefit from central banks’ impulse.

Sectors: We favour Energy, Healthcare and Staples to start with, as we approach the recession, adding Utilities and Telecommunication when bond yields start to fall. We will add to Financials and Consumer Cyclicals only when monetary policy reverses.

Equity themes

Emerging Market (EM) assets favoured due to tamer inflation and earnings recovery

Room for optimism for EM equity in 2024

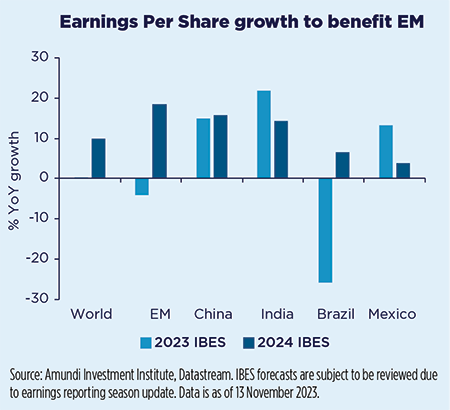

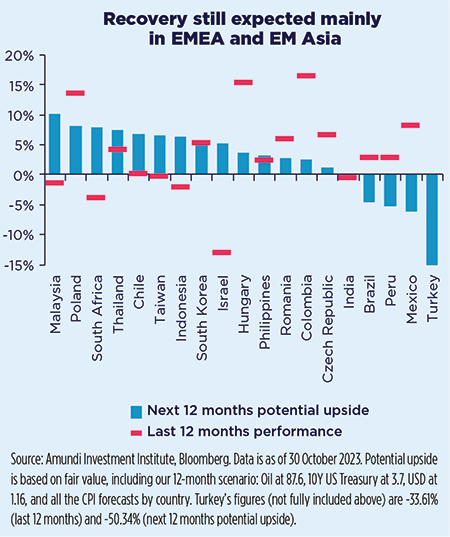

In 2023, EM equity experienced diverse dynamics with China underperforming, while MSCI EM ex China was flat and India equities outperformed. For 2024, we expect to see the appetite for this asset class return as both the capital expenditure cycle and growth premium should be more in favour of EM, but divergences will persist. In the short term, EM growth is expected to remain below the historical average and to decelerate mildly; this phase is still supportive for Quality and Growth styles (mainly EMEA and India). Moving further into 2024, a recovery in EM Growth would favour a shift to valuation styles (LatAm favoured). The tech sector slowdown was exacerbated by a slower global economy and less demand after Covid, and contributed to a series of negative reporting seasons during 2023 and to negative YoY trailing earnings. Yet, with the stabilisation and recovery of the export cycle, we expect GEM earnings to deliver double-digit growth in 2024.

EM bonds hard currency to be favoured

Geopolitical tensions and rising Treasury yields have recently raised concerns about the stability of EM currencies and the sustainability of external debt. On the latter, risks are lower than in the past thanks to pre-emptive hikes and the increased credibility of monetary authorities, while EM currencies are broadly undervalued in our view.

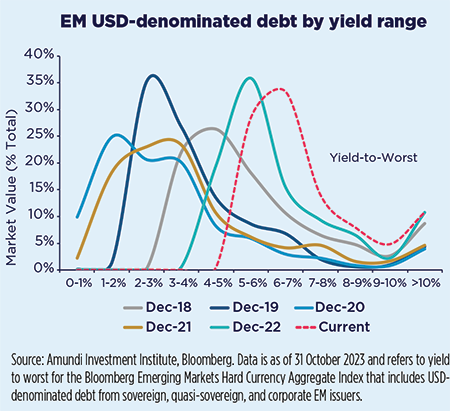

EM bond hard currency (HC) now offers a more attractive yield profile than in the last five years. The EM bond HC spread should be favoured mainly thanks to the high yield space tightening in the context of the improving EM-DM growth gap and less stretched financial conditions amid decreasing inflation, lower policy rates and yields. We are slightly positive on EM bonds in local currency, which we think are currently pricing in too much risk aversion. We favour EMEA and LatAm, which should benefit from a more rapid reduction in inflation and an advanced monetary policy cycle. We remain cautious on EM Asia, where there is less support from monetary policy and the yields are less attractive, with the exception of Indonesia and India.

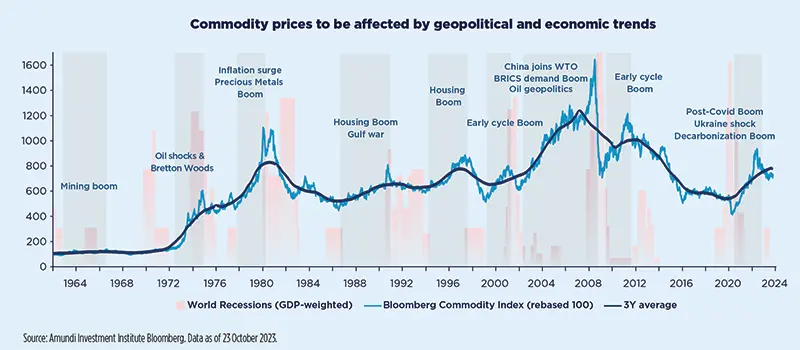

Commodities in a slowing cycle with geopolitical risks

We expect high short-term volatility in oil, rising dispersion in metals and modest upside potential in gold.

Oil: short-term upside from geopolitics and supply deficit.

While a serious escalation in the Middle East can’t be ruled out, our base case is that the conflict will remain reasonably local, as Israel, Iran and the US have limited interest in a broad confrontation and there would be major risks. Under this assumption, the conflict would erase any supply relief that might come from Iran or Saudi Arabia. We see geopolitics and tight markets pushing Brent towards $95/b, with temporary spikes until Q1 2024. We then expect a mean reversion towards the $85/b-$90/b range. We expect a cap on oil prices in 2024 driven by multiple factors: 1) declining geopolitical stress, 2) rising OPEC+ spare capacity and weakening member discipline; 3) OPEC is cautious about avoiding reviving output abroad or causing a hard-landing; 4) economic deceleration; and 5) US efforts to lower prices ahead of its elections. Upside risks, beyond geopolitics, include Chinese stimulus, a cold winter and a producer outage.

Base metals: limited directionality and rising dispersion.

We expect a lack of directionality in H1 2024, with prices capped by the economic deceleration and China’s property issue, but floored by light positioning and China’s extra stimulus. In the long run, China’s structural economic shift will have deep implications on demand that could mitigate the impulse from energy. We see dispersion rising in 2024 driven by metals’ supply/demand dynamics, their exposure to the energy transition, China construction, and world manufacturing. Copper prices should rise to meet demand, while nickel will face rising battery demand but also ample supply. We expect limited downside pressure on aluminium amid tight supply, while iron and zinc prices will be more affected by slowing global demand.

Gold: medium-term catalysts remain mixed.

Besides geopolitics, a central bank pivot would be a key support, but partially neutralised by the effects of quantitative tightening and by efforts to reduce deficits. We thus expect a modest upside in 2024 towards $2000/oz. Longer-term, pressure on DM debt and dollar diversification trends would become more relevant.

Currency: USD to weaken, EM currencies to recover

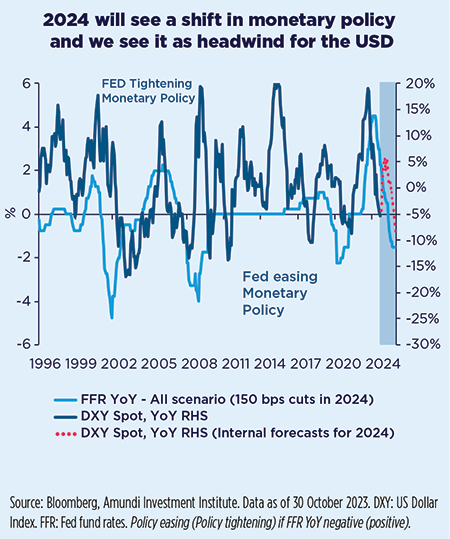

The USD in 2024 and the walk on eggshells

Intense geopolitical tensions, restrictive financial conditions and high macroeconomic uncertainty make it hard to identify imminent catalysts for a substantial USD sell-off. Aside from US “exceptionalism”, further shocks in energy prices pose the major risk, given the pass-through to inflation and the implications for the Fed (higher for longer). In our view, these are the main reasons for concern that make us believe that a mild US recession (our base case for H1 2024) may not be as positive for the USD as in the past. Barring a hard-landing scenario, worsening US data should hurt the USD via two main channels: i) reversal of US exceptionalism (even more likely if China stabilises) and ii) the Fed shifts focus to growth and enters a cutting cycle. Entering 2024, should the USD continue to trade at a higher premium relative to fundamentals (that have dropped compared to last year), it will be vulnerable to pullbacks when moving from policy tightening to policy easing.

When it comes to the JPY, prospects for policy normalisation are good news. Yet unless the BoJ takes significant steps, a more pronounced growth shock may be required for sustained appreciation vs peers. We maintain the JPY as the best hedge for hard-landing risk.

EM currencies set to recover in 2024

Following several months of correction, EM currencies vs USD seem oversold and are now extremely cheap. In addition, our USD internal expectation for depreciation reinforces our constructive view for the asset class in 2024.

We expect EM Central Banks to continue cutting rates to support the domestic economy, also in line with the sizable price stabilisation. This will result in slightly higher real rates, with CEE countries still enjoying most of this. The region will benefit from its strong undervaluation as well as from its ties to the EUR, which is expected to strengthen during the year.

On the other hand, LatAm currencies have already enjoyed some recovery in 2023 and valuations are now more stretched.

Overall this translates into positive expectations mainly for EMEA and EM Asia currencies.

The main risks to this constructive outlook stem from geopolitical tensions resulting on one side in volatility spikes (detrimental for such a liquid asset class) and, on the other hand, in higher commodity prices (impairing the ability of EM Central Banks to ease as expected because of a stickier or higher inflation).

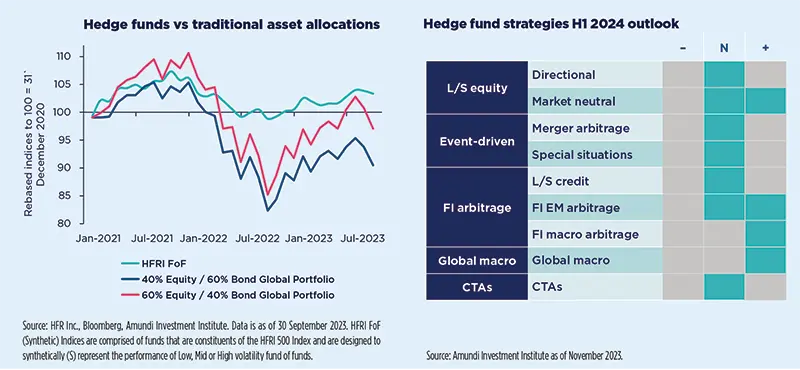

Macro and fixed income hedge funds favoured in 2024

In 2024 macro visibility should improve, setting more favourable conditions for hedge funds to generate excess returns (alpha).

Over the last two years, hedge funds have displayed more resilient returns with lower volatility compared to traditional asset allocations. Recent performance has been supported by fixed income and equity-biased strategies, while performance from Global Macro and Commodity Trading Advisors (CTAs) strategies was modest.

In 2024, we are entering a new phase of the cycle. The cyclical rebound since late 2022 (supported by China’s reopening, a fading EU energy crisis, and fiscal support) is coming to an end. As inflation slowly normalises, global liquidity is now tightening again, economic deceleration is intensifying, and higher rates are leading to a re-evaluation of risky assets. Cyclical turning points, such as the one we are living in, are usually uncertain with their many false starts and painful trades. This latest inflection point is about to end and soon, in 2024, macro visibility should start to improve when signs of a deterioration in the economic outlook materialise, setting favourable conditions for alpha generation.

As some clarity returns, alpha generation should improve. Indeed, we expect tighter liquidity to increase asset differentiation, while diverging world economies will open relative arbitrage opportunities. As investors’ focus moves to more traditional growth drivers, we see asset prices increasingly reflecting their underlying fundamentals. A manageable economic slowdown, which we expect, will keep equity and bond volatility regimes modestly above par, opening up exploitable market timing opportunities.

However, dispersion across hedge fund managers appears to be high, as increasing geopolitical risks and structural secular changes (including the rise of AI, unclear productivity trends and the energy transition) will add complexity to the macro scenario.

Against this backdrop, we expect top-down strategies, particularly Global Macro, Macro Fixed Income and EM-focused managers, to be the main beneficiaries, while more directional equity and credit strategies should be favoured later in the year when the easing of rates starts.

Private markets: Tailwinds in a lower growth world

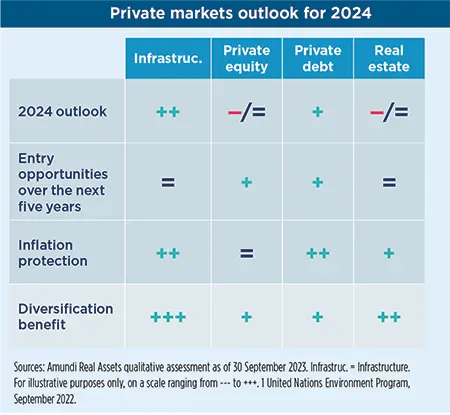

Sluggish economic growth, sticky inflation and weak consumer confidence are putting pressure on corporate earnings. Despite this, private markets and real estate offer opportunities that are resilient to slowing growth as well as risk and return diversification within portfolios.

We prefer infrastructure investment due to its steady cash flow and strong growth outlook for the year ahead and beyond. This growth is being boosted by the energy transition. Governments need to complement public funding with private capital in building renewable energy infrastructure and meeting transport electrification targets. We are particularly confident about European infrastructure as its regulatory environment is favourable, with a significant share of the EU 2021-27 multi-year budget and the Next Generation EU plan being committed to the green transition. Even though some repricing can be expected, we see no major downturn and believe there is a lot of value in this asset class in the long term.

Turning to private equity, transactions are slowing although a downward shift in pricing has yet to occur. Despite this, sectors such as healthcare are seeing robust structural growth trends (e.g. the ageing population) as well as pricing power. Although trading is weak in other industries, we expect that over the next five years the asset class will offer attractive entry points. As institutional funds typically have 5-year investment horizons, subscriptions made today should benefit from this market opportunity, in our view.

As regards private debt, these funds are suffering from the private equity slowdown, but are profiting from transaction refinancing and bank-financing constraints.

Banks have reduced lending, as loans on their balance sheets have fallen in value causing the banks to be reluctant to sell them.

Finally, the rising interest rate environment has led to a fall in real estate transactions, as investors react to a lack of visibility and higher refinancing costs. As a result, capital values have been negatively impacted. Despite this, in the leasing markets, real estate in prime locations should continue to profit from relatively resilient demand, low vacancy rates and robust rental income. Furthermore, we consider that ESG issues are critical and need to be included in the outlook for cash flows. With total return depending both on capital and income, the ongoing repricing might create entry points for investors, although a focus on quality properties is vital.

Asset Class Views

Financial market forecasts