Summary

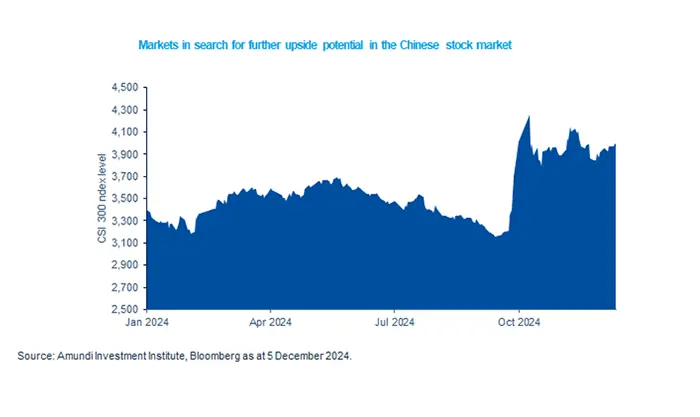

While the change in China’s policy stance is a significant development, we believe the market’s focus will shift increasingly towards the execution of these policies.

- While volatility may stay high, Chinese policymakers willingness to conduct broad easing is supportive.

-

We think under Trump 2.0, increased stimulus is a better approach than trade retaliations or currency devaluation.

- We expect 50 basis points policy rate cuts in the first half of 2025 and additional fiscal spending in 2025.

Markets had been waiting for signs of policymakers becoming more accommodative after the initial hint in late September. While we expect volatility to continue, as data such as the latest retail sales, confirm the slowdown, we also note that the leadership has turned to an unambiguous pro-growth stance and willing to conduct broad easing, amid a notable increase of US trade policy uncertainty. The annual Central Economic Work Conference decided that boosting consumption and improving investment returns will be the priority for 2025, by expanding fiscal spending and enhancing monetary easing. While continuing to invest in national strategic projects, the government vowed to increase the consumer goods upgrade programme for households, and to stabilise property and equity markets.

Actionable ideas

- Emerging market equities

The emerging world offers many investment opportunities beyond China, based on different growth stories such as India and Latin America

- Multi-asset investing

Multi-asset investors can exploit potential opportunities across asset classes and capitalise on tactical opportunities that may open up in emerging markets

This week at a glance

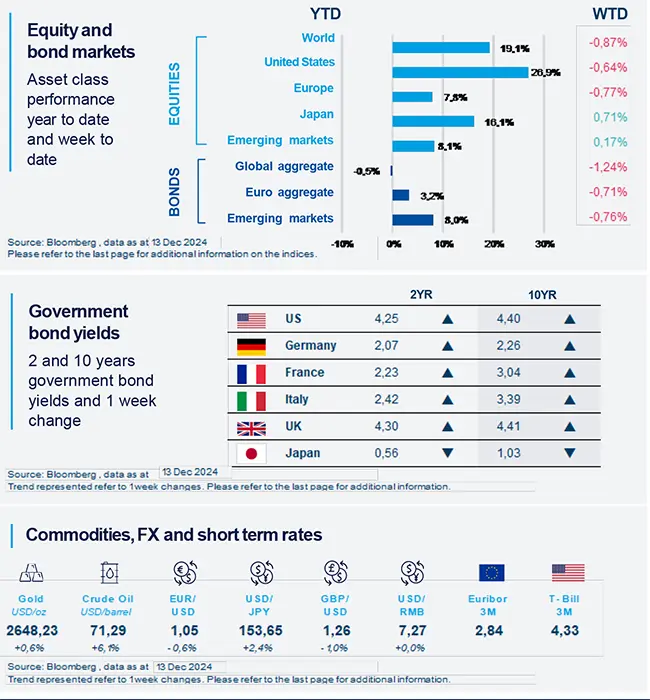

Global and US equities declined as markets tried to judge the Fed’s policy path. Most long-term bond yields inched higher. In commodities, gold and oil prices surged. Oil was supported by newsflow around fresh US sanctions and expectations of a policy boost to Chinese growth.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 13 December 2024. The chart shows the CSI 300 stock index.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US CPI accelerated slightly

US inflation for the month of November accelerated marginally at 0.3% MoM, but the number was still as expected. The increase was mainly driven by shelter and food components. Core CPI, inflation excluding food and energy prices, held at levels similar to previous month. Looking forward, inflation is likely to maintain its downward trajectory, although we could witness some volatility due to certain sticky components.

Europe

ECB downgrades its growth forecasts

The ECB downgraded its GDP growth projections to 0.7% and 1.1% for this year and the next, respectively. The bank also cut its policy rates, as expected, for the fourth time this year. The bank expects that an easing monetary policy will encourage companies to increase investments. At the same time, rising real incomes may be likely to support household consumption.

Asia

Korea more likely to ease amid prolonged uncertainty

Political uncertainty following President Yoon's impeachment process is likely to persist into 2025. We anticipate a prolonged period of market volatility. This is expected to trigger additional monetary and fiscal easing, including earlier rate cuts and supplementary budget. Challenges remain for Korean assets in the short term amid elevated political uncertainty, while, over the medium term, opportunities could arise.

Key dates

|

16 Dec China retail sales, India PMI, EZ labour costs |

18 Dec FOMC rates decision, EZ and UK CPI |

19 Dec Bank of Japan rates decision, US GDP |