Summary

Key takeaways

- The US economy is showing signs of deceleration, with falling profit margins and a decline in the leading economic index suggesting a potential slowdown in the coming quarters.

- Rising delinquency rates on credit card and auto loans signal increased financial stress, especially among younger and lower-income households.

- Restrictive monetary policy and high mortgage rates are contributing to low housing market activity and this trend should also continue in 2024.

Do you see recent US data pointing to stubborn inflation?

In January we had some upside surprises, encompassing import prices, producer prices, both headline and core CPI, and the PCE deflator. We think prices were in part boosted by seasonal factors which are not fully accounted for in the usual seasonal adjustment, something that also happened last year. While part of core services inflation remains supported by buoyant domestic demand, we expect core disinflation to continue over the rest of the year as shelter, and rent inflation in particular (a major part of the services component of inflation), move lower.

Can the US economy remain as resilient in 2024? What about consumption?

The weakness in January retail sales and a downward revision of November and December readings signal, in our opinion, a potential downshift in consumer spending – some survey data, such as Michigan consumer confidence, are down for the first time in six months. Some of the weakness was likely a payback following the rise in holiday spending. But we believe that real excess savings are being squeezed by ongoing high prices and the increased cost of borrowing, which are not accounted for in the inflation index, and we expect this to translate into further moderation ahead.

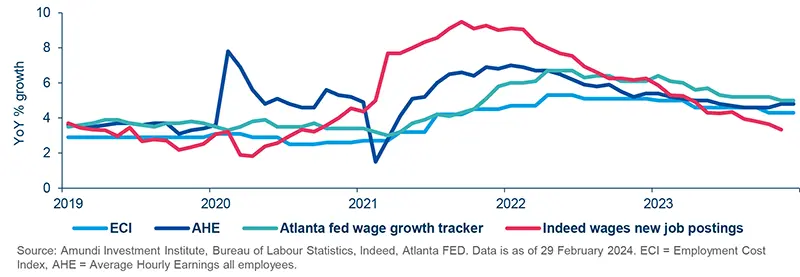

Wage growth is expected to moderate towards more normal levels

The labour market is showing signs that it is slowing with declining average weekly hours, a low participation rate, and a decline in job vacancies and hiring.

Mentioning the increased borrowing costs from households, what are the recent trends?

Credit Card and Auto Loan Delinquency Rates continue to rise according to the New York Fed report; consumption so far has been supported by the depletion of excess savings but US households have also taken on more debt, and some of those loans are becoming delinquent, especially credit card and auto loans, which are now above pre-Covid levels. About 8.5% of credit card balances and 7.7% of auto loans moved into delinquency in the fourth quarter. This uptrend signals increased financial stress, especially among younger and lowerincome households. Higher interest rates have kept monthly payments elevated and this is hitting purchasing power.

What is your assessment of the labour market?

The labour market is giving mixed signals. While payrolls posted upside surprises and the unemployment rate remains historically low, we see slowing cyclical employment and falling weekly hours (which are now back to pre-Covid levels) as evidence of slowing labour demand. Indeed, the low participation rate may have extended labour hoarding and companies may delay headcount reduction. But the labour market behaviour of workers is changing: the quit rate has been declining indicating that workers are finding it more difficult to switch jobs and many more workers holding two or more jobs; employment growth has stalled in the households survey; job vacancies and hiring are falling. In our view, this suggests a weakening in employment growth ahead and weaker wage growth as well.

The leading indicator, industrial production, and regional manufacturing indicators all point to a potential economic slowdown.

How do you see wage growth evolving?

Importantly, employment costs are moderating: the Employment Cost Index (ECI) is moving (slowly) lower, in line with our expectations and with projections related to the quit rate dynamics; wage growth, as measured by the Atlanta Fed, shows significant moderation from its peak, while wage growth from Indeed’s data on new job postings shows that wage growth is now back to the 2019 range, suggesting wage growth normalisation will continue.

What other signs are pointing to a significant slowdown ahead?

Leading indicator: the Conference Board’s Leading Economic Index dropped for the 22nd straight month in January, continuing to point towards a recession. This indicator suggests that weakness may start becoming more visible. Normally we would have expected a recession earlier, but this time around fiscal policy has been unusually active given low unemployment, together with excess household savings.

Industrial production stagnating: if computer and defence production have been strong and rising, overall manufacturing production has been deteriorating, driven by consumer-oriented companies in particular. Regional Fed manufacturing indicators remained on a weak trend and the latest manufacturing ISM posted its 16th straight month below 50, indicating protracted difficulties in manufacturing.

Falling profit margins: declining profit margins (e.g. S&P 500, as per FactSet), will incentivise companies to cut unprofitable investments and unnecessary costs. Also, a weak outlook for profits of small businesses (as reported by the NFIB survey), which account for around 40% of employment in the US, are in recessionary territory. This should prompt likely reductions in non-residential investments, capex and employment.

Gross Domestic Product vs Gross Domestic Income: real GDP has reaccelerated, while real GDI, which should be driving demand, has been flattish for seven quarters, something that is very unusual. The divergence between GDP and GDI suggests an increased reliance on borrowing and running down savings to fund demand, but we think that this situation will have to correct, especially in a higher rate environment.

Restrictive Monetary Policy: housing market activity (sales transactions) in 2023 was at a 20-year low due to high mortgage rates. Some have suggested it should recover in 2024. But we note that 30-year mortgage rates have again risen above 7%. Housing activity will likely stage a rebound but from a very low base.