The emerging market comeback

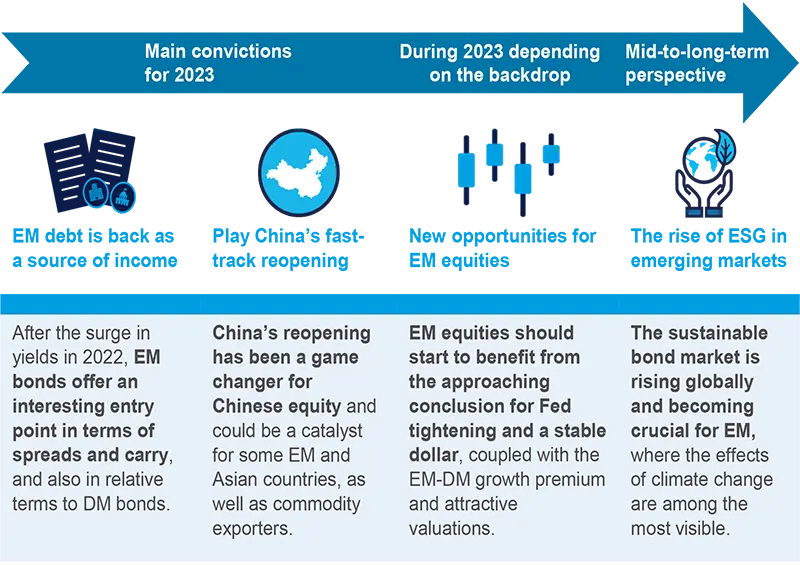

While 2022 was a challenging year for emerging markets, amid the Fed’s aggressive response to high inflation, we are more constructive for 2023 across four main themes:

|

Thanks to China’s economic reopening and a slowdown in developed markets, the growth disparity with emerging markets should increase in favour of EM in 2023. |

|

Despite regional differences, the peak of inflation is behind us, and we expect a more stable monetary policy. In some EM countries, rate reductions may already occur in the second part of the year. |

|

Weak fundamentals and a deteriorating outlook for the US, relative to the rest of the world, is more favourable for EM currencies in H2 2023. |

|

One of the main risks to watch out for is the excessive tightening of financial conditions affecting economic growth. Investors should also keep an eye on geopolitical developments. |

Thanks to the supportive backdrop, investors should start to reconsider emerging markets’ economic and market conditions in search for new investment opportunities.

Source: Amundi Institute as of 19 April 2023. EM: emerging markets. DM: developed markets

Bonds:

After the great repricing of 2022, yields in EM bonds are back to appealing levels from an absolute and relative standpoint. The DM-EM growth gap is expected to widen, favouring the hard-currency bond spread during 2023. Another important point to consider is the USD being weaker than expected in 2023, opening up interesting opportunities and valuations across EM FX.

Equities:

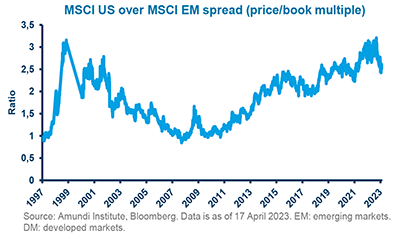

Valuation metrics show EM equity markets are at historically cheap levels, and offer interesting entry points on a standalone basis and relative to DM for global investors. However, a dedicated approach is required in a fragmented EM universe. We remain particularly positive on China, Hong Kong, Vietnam and Indonesia.

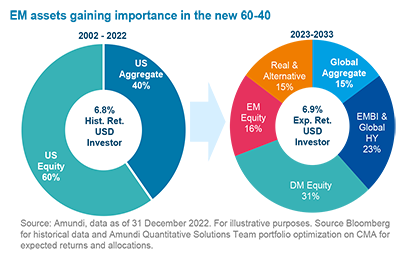

The new 60-40:

Based on the recent Capital Market Assumptions study, a new approach is required to target similar returns to the historical 60-40 portfolio. EM and real assets could help boost returns to levels that traditional 60-40 portfolios will struggle to deliver, with Chinese and Indian equity markets being one of the most interesting opportunities.