Summary

Key takeaways

The 2023 Amundi World Investment Forum (AWIF) focused on the transformative time we are living in and the key consequences for investors. Investors should embrace a dynamic asset allocation (DAA) approach, rethink fixed income and forex investing with a global mindset, pay attention to trends such as Net Zero and the emergence of Asian giants, and be aware of fashionable trends such as AI, while keeping an eye on valuations.

This year’s edition of the Amundi World Investment Forum (AWIF) was called “The global shake-up, where will the pieces fall?” and focused on the transformative time we are living in. In the words of one of our speakers, former Italian Prime Minister and ECB President Mario Draghi, the most relevant things to watch out for are: inflation, the Russia-Ukraine war, China’s global role and artificial intelligence (AI). How we manage these topics today will determine the future of the world. Such a global shake-up will have five main investment implications:

1. Deglobalisation, the energy transition and high inflation call for a DAA approach:

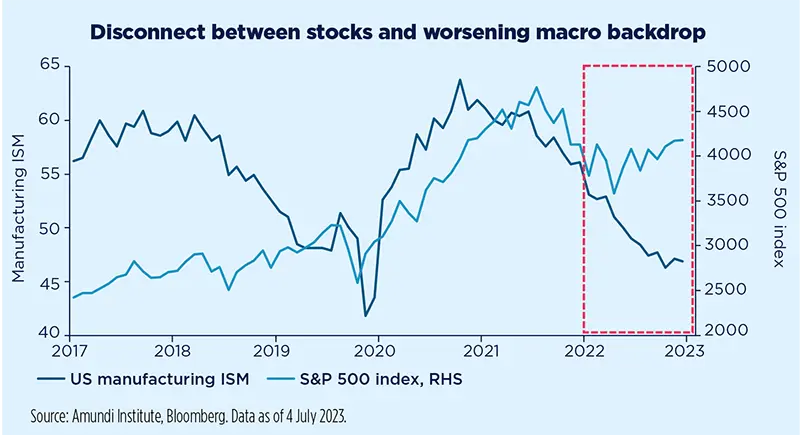

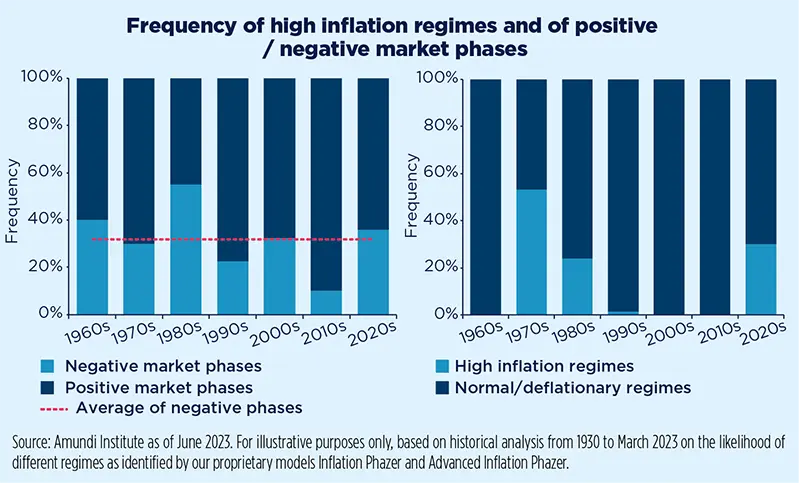

Today, the global economy is characterised by low growth – especially across DM – and high inflation, propelled by energy transition costs and supply-chain relocations, in a sort of transformative globalisation. This has led to the end of ‘cheap money’, as central banks fight inflation. Meanwhile, high public debt limits the room for fiscal manoeuvring during economic downturns. All this can make economic cycles highly volatile, with inflationary periods and more frequent negative market phases than in the past three decades. This will highlight the relevance of embracing a DAA approach. For the next few months, we will keep a cautious stance, given the risk of weak corporate earnings. Investors should favour bonds – including EM ones – as DM official rates may be close to a peak. Once visibility on earnings and growth improves, investors may raise their exposure to risky assets.

2. China and India as long-term investment opportunities:

These countries are different in terms of growth models, stages of development, and the role they play in the geopolitical landscape, triggering diversification opportunities, since their bond markets show low correlation both with each other and with the main global indices. Looking at sectors, India should see strong manufacturing growth, while China could develop its consumer and services sectors. Both countries can play a key role in technology and the energy transition and are large issuers of green bonds. Investors should consider a dedicated allocation to China and India, which offer high potential returns, while being aware of possible volatility in investment flows.

3. Desynchronised growth-inflation dynamics to put global fixed income and forex approach in focus:

The correlation between rates and credit is decreasing globally, opening up diversification opportunities for investors. For instance, China’s government bonds were a good diversifier and source of performance in 2022 as China was on a different growth path than most DM. FX management will also be a source of performance. For instance, the nearshoring of many US corporates’ production sites from China to Mexico has driven the strong outperformance of the Mexican peso against the dollar, as well as against other LatAm currencies. Asynchrony and deglobalisation call for global strategies, stronger FX management and overall active management.

4. Net Zero will be a significant trend for portfolio construction:

Embracing Net Zero investing will be increasingly relevant in the era of energy transition. For investors, this means looking at large-cap names with credible decarbonisation plans and low carbon intensity. Investors could also seek opportunities by focusing on themes such as responsible production, efficient consumption and the circular economy, or explore supranational entities and governments issuing green bonds to finance climate-friendly projects. Opportunities should be particularly relevant in Europe. Addressing the energy transition will also be key across EM.

5. AI and technological innovation:

Valuations and fundamentals still matter: market narratives around the AI miracle are likely to be tested when the economic slowdown spills over to corporate earnings.

AI will impact every aspect of our lives in the coming years. It could also affect productivity trends. We believe markets are ignoring any possible regulatory implications, and that valuations and earnings projections remain relevant. However, we think it is too early to buy the narrative of a secular bull run driven by AI productivity gains. Psychological behaviours are at play, leading to this market disconnect. They include different tendencies, such as following in-fashion trends irrespective of valuations and fundamentals, which often lead to the creation of bubbles, while forgetting about liquidity costs. As such, investors should assess any opportunity by comparing upside and potential downside risks over the investment time horizon.