Summary

Falling price pressures should be supportive of US government bonds and investors could also explore other quality fixed income assets in developed as well as emerging markets.

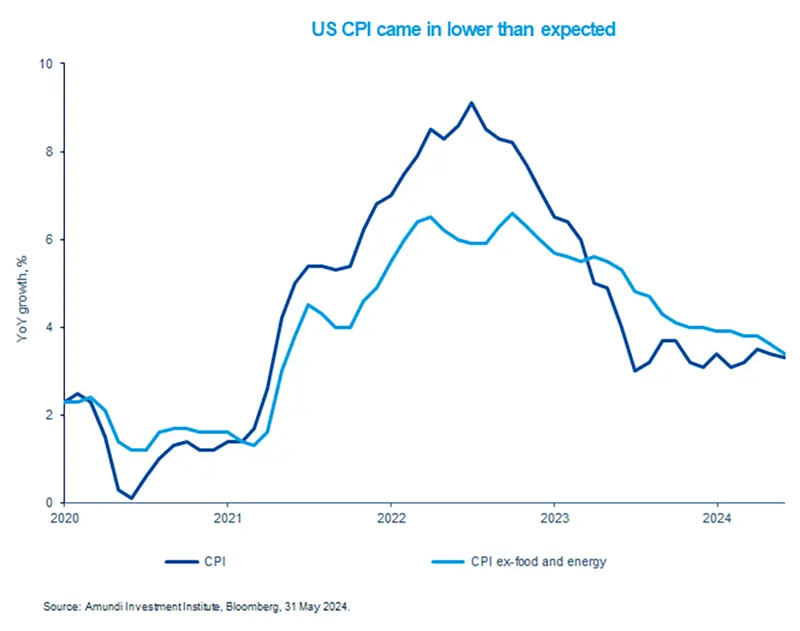

- The latest CPI data for May was lower than the April number and was also below market expectations.

- A sustainable decline in inflation is likely to encourage the Fed to cut policy rates, although the bank would remain vigilant.

- Fixed income assets may benefit from this progressively slowing inflation.

The US consumer price index (CPI) came in lower than expected in May. Prices rose 3.3% (year-on-year) which was slower than the figure for April. In addition, core CPI, which excludes the volatile food and energy prices, was at its lowest level in more than three years. Following a string of unfavourable numbers in the beginning of the year, both the data point to slowing inflation in the services as well as goods components. While this should be encouraging for the Fed, the central bank has indicated it will need more evidence of inflation falling sustainably towards its 2% target before reducing policy rates. The overall inflation numbers are in line with our expectation of a gradual decline in price pressures. This could be positive for select government bonds and quality credit.

Actionable ideas

- US bonds

In an environment of risks around economic growth, and falling inflation, US government bonds may offer good value. We also believe, high quality corporate credit is attractive.

- Global bonds

Expectations of interest rate cuts in countries such as the UK, and robust economic growth in emerging markets, call for a global approach to bonds. This could be complemented by quality credit.

This week at a glance

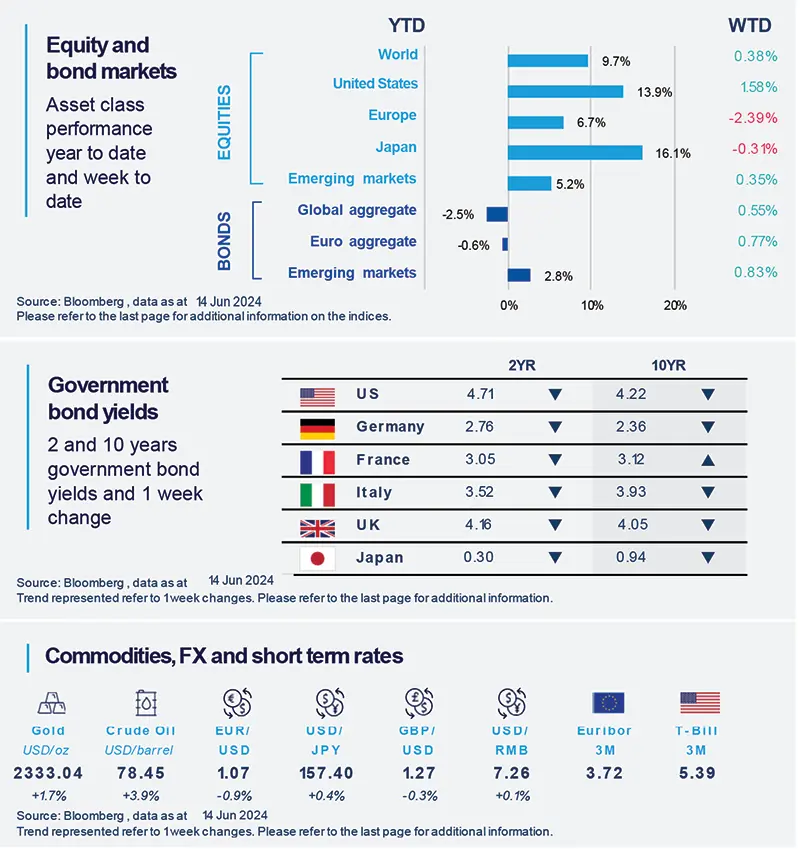

US stocks rose and bond yields fell amid receding inflation pressures. But European equities declined due to concerns over potential worsening of French government finances and political instability. Oil prices rose over the week, notwithstanding a report about excess long-term supply.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short term rates.

Source: Bloomberg, data as 14 June 2024. The chart shows Global Bonds= Bloomberg Global Aggregate Bond Index, Global Equity = MSCI World. Both indexes are in local currency.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Institute Macro Focus

Americas

Fed keeps rates unchanged in June.

The Federal Reserve kept its policy rates unchanged in June as it awaits more confidence on inflation to fall sustainably towards its long term target. In addition, Fed officials raised their inflation forecasts slightly for 2024, although they acknowledged that price pressures are gradually moderating. Looking ahead, we think the central bank would likely remain data-dependent to make policy decisions and would also maintain a close watch on labour markets.

Europe

Eurozone economic index shows gradual improvement.

The Sentix Economic Index for the Eurozone rose to 0.3 in June, indicating improving market expectations about economic activity in the region. While the sentiment improvement is only gradual, the June number marks the eighth consecutive monthly increase and the first time since February 2022 that the index is in positive territory.

Asia

Revised data for Japanese growth still weak

The Japanese real GDP (GDP adjusted for inflation) growth data for the first quarter was slightly revised upwards to -1.8%, quarter on quarter, from the previously released figure of -2.0%. However, the weakness in domestic demand still continues. This is also evident from the data on private consumption, which declined for the fourth straight quarter.

Key Dates

|

18 June Euro Area CPI, US retail sales |

19 June UK CPI, South Africa CPI |

20 June China 5 year loan prime rate |