Summary

- View on the UK economy: We still see a mild recession for the UK, and actually we think the economy is already in recession. While the fiscal package will stimulate demand in a supply-constrained economy, it will likely put a floor on growth but at the same time support inflationary pressures coming from demand, leading to higher inflation likely for longer in the medium term.

- Bank of England (BoE) may be forced to be much bolder: The sell-off in Gilts is consistent with the repricing of the BoE’s expected path and with the fact that the fiscal package represents a game-changer on supply, as it comes at a time when the BoE is about to start quantitative tightening (QT), adding pressure to Gilts’ technicals.

- Market reaction: Market reaction after the announcement of the new, unfunded tax cuts has been brutal, signalling that the UK’s policy stance is increasingly under scrutiny. The new fiscal measure may probably add too little to growth and much more on inflation, leaving real yields unattractive for most foreign players. The problem is that the current configuration of real yields and GBP seems unable to attract investors’ appetite at this stage.

- View on sterling: In few dramatic market sessions, sterling dropped to below our short-term target of 1.10. We believe risks remain tilted to the downside – given how much is already priced-in, less aggressive signalling from the BoE will accelerate the move to below parity, in our view. Therefore, despite this strong movement, we believe investors should avoid catching a falling knife and resist the temptation to jump into the GBP, as we still don’t see the light at the end of the tunnel with regard to the currency’s descent.

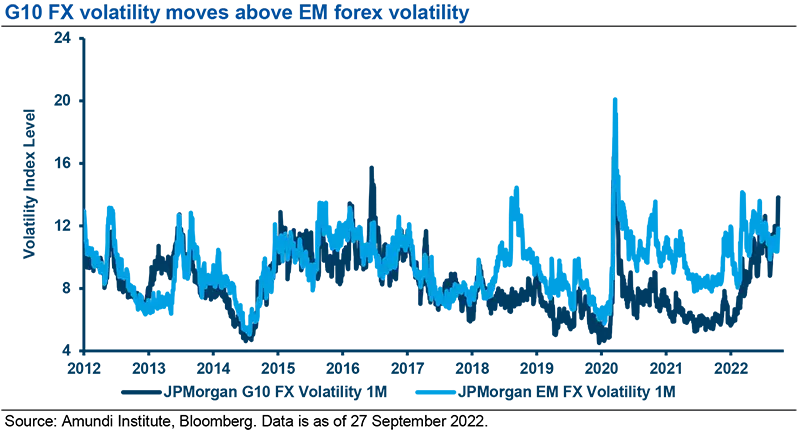

- View on currency markets: The global monetary policy normalisation process is implemented by CBs with different timings and at different speeds, which implies an increase of volatility regarding forex. Other factors are at play as well, including the current geopolitical situation, a slowdow in global trade, and potentially some forex reserves rebalacing.

What is happening with regard to UK financial assets?

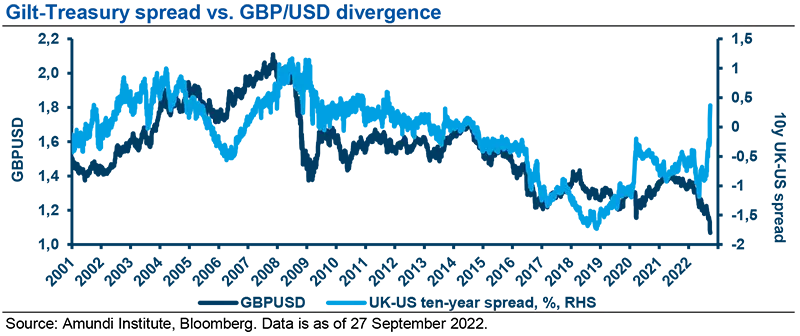

Investors’ focus is shifting from the poor growth/inflation mix to the extremely negative external balance picture in the UK. Last Friday (23/09), the government announced an additional 0.5% of GDP in unfunded tax cuts and the reaction of UK assets recalled actions we used to see only in emerging markets. The market is giving a strong signal that it is no longer willing to provide capital to fund the UK’s external deficit position. The correlation between interest rates (selling off in response to the announcement) and the currency (that broke sharply) signals that the market is questioning the credibility of UK policymakers’ actions.

What is your view on the new fiscal package and the trajectory for the UK economy?

The UK economy is corrently being impacted by different forces that makes forecasting of the economic outlook increasingly difficult. The news on the budget side may help counterbalance some upside pressures on inflation already present in the system and made more persistent due to higher energy prices for a more prolonged period, as per our updated projections. Although energy prices should not move higher, they will remain high both for households and companies and stress budgets. However, as the fiscal package will stimulate demand in a supply-constrained economy, while it will put a floor on growth, it will likely also support inflationary pressures related to demand, meaning that the inflation rate will likely be higher for longer in the medium term. This, together with a strong labour market and risks of second round effects, could force the BOE to tighten more.

- Growth. We still see a mild recession for the UK and indeed we think the economy is already in recession. We expect the economy to contract by around -0.5% in 2023 but to recover, growing by 1.3%, in 2024.

- Inflation. We revised down our peak inflation projections for 2022 and 2023, but raised core inflation for 2024, as we expect the budget to produce more persistent inflationary pressures in the medium term. Due to the energy price guarantee, inflation should peak earlier and at a lower level than it might have done otherwise and vs what we were originally projecting. But we see it staying higher for longer (see 2024 projections in particular).

The UK will not be able to avoid recession and core inflation may rise as the new budget will exert inflationary pressures.

What is the way forward for the Bank of England, and what are the implications regarding the bond market?

No hawkish surprise came from the last BoE meeting, as the 50bps hike was in line with most economists’ expectations, but markets had implied the significant probability of a higher, 75bps hike, and the decision was not unanimous, as five Monetary Policy Committee (MPC) members voted for 50bps while three pointed to 75bps, and one to only 25bp. At the same time, the MPC unanimously backed the launch of its Gilt sales programme, starting from 3 October, against speculation that the BoE could delay or scale back its Gilt sales because of the upcoming fiscal stimulus. The word “forcefully” retained in the statement already left the door open for a 75bps rise at the next meeting – even more so in light of the BoE stating that it had not incorporated the fiscal stimulus into its policy rate setting. Now, the stronger- and more-inflationary-than-expected fiscal package announced on Friday means that the onus for taming inflation will fall even more on monetary policy, putting the BoE in a more complex position: the central banks will be forced to react with stronger-than previously-expected hikes, ultimately leading to a higher terminal rate. The sell-off in Gilts is consistent with the repricing of the BoE’s expected path and with the fact that the fiscal package represents a game-changer regarding supply, as it comes at a time when the BoE is about to start QT, adding pressure regarding Gilts’ technical.

The BoE will be forced to react with stronger than-previously expected hikes, ultimately leading to a higher terminal rate.

What is your view on the British pound?

Our reading on sterling is that for some quarters already we were heading for a perfect storm. The clouds were there already (Brexit, current account deficit, domestic political leadership issues, BOE credibility, geopolitical situation) and they are all now converging to generate the strong price action observed in recent days. The trigger was the announcement of the mini budget by the new chancellor, Kwasi Kwarteng, last Friday morning. That was one of the most important fiscal stimuli in terms of tax cuts announced since the ‘70s, at a time when the new prime minister will implement new energy policy. As a consequence, the market is now expecting a significant increase in the funding needs of the UK government and also further upward pressure on inflation.

Therefore, the Gilt market has repriced dramatically, with the 2Y moving from 3.45% on 22 September to nearly 4.40% on 26 September (it was below 1% at end-2021). A similar violent reaction regarding the currency, which fell below our short-term target of 1.10/USD1, with the last few market sessions being among the most dramatic in the last 40 years, including 1992, when the pound left the ERM and, of course, after the Brexit referendum. Yet, risks remain tilted to the downside – given how much is already priced-in (the UK is the only developed market country where policy rates are expected to run above 6% on a 12-month horizon) – and less aggressive signalling from the BoE will accelerate the move below parity, in our view. Therefore, despite this strong movement, we believe investors should avoid trying to catch a falling knife and resist the temptation to jump into the GBP, as we still don’t see the light at the end of the tunnel.

On sterling, we believe risks remain tilted to the downside and therefore investors should resist the temptation to jump into the GBP, as we still aren’t seeing the light at the end of the tunnel.

Do you think we are heading towards a more generalised currency crisis?

We are already there. We are currently reaching levels not seen for many decades. Global monetary policy normalisation is implemented by CBs with different timings and at different speeds, which implies an increase in volatility regarding forex. And, forex is a relative game: other factors are at play as well, including the current geopolitical situation, a slowdown of global trade, and potentially some forex reserves rebalacing.

But remember what JP Morgan said in 1912 “Gold is money. Everything else is credit”. So, since the end of the Bretton Woods agreement, the amount of debt has increased to levels never experienced during peace time. Thus, it now seems that the position of reserve currency of value has been taken by the dollar at least in the short to medium term. The long-term question is much more about the future of fiat currencies when globally debt/GDP ratios are reaching 350% and at a time when yields are rising significantly.

We are entering a regime of higher developed market FX volatility amid different timings and speeds for central bank policy normalisation, rising geopolitical risks, and some FX reserves rebalancing.

Definitions

- Basis points: One basis point is a unit of measure equal to one one-hundredth of one percentage point (0.01%).

- FX: FX markets refer to the foreign exchange markets where participants are able to buy and sell currencies.

- Diversification: Diversification is a strategy that mixes a variety of investments within a portfolio, in an attempt at limiting exposure to any single asset or risk.

- Quantitative tightening (QT): The opposite of QE, QT is a contractionary monetary policy aimed to decrease the liquidity in the economy. It simply means that a CB reduces the pace of reinvestment of proceeds from maturing government bonds. It also means that the CB may increase interest rates as a tool to curb money supply.

- Spread: The difference between two prices or interest rates.