Summary

The impact of Red Sea traffic suspensions is more regional than global, but duration will be the key factor to watch. At this stage, it is no game-changer for our outlook.

- Disruptions to shipping via the Suez Canal may impact the economy through two channels: prices and supply chains.

- Key factors to watch are the duration of the stress and whether disruptions spread to energy goods.

- With additional uncertainty around inflation, the ECB will be cautious in assessing the next steps.

The intensification of attacks against cargo ships in the Red Sea has led the majority of large shipping companies to suspend transit through the Suez canal. This mostly impacts Asia-Europe trade flows, which need to take the longer and more expensive route around Africa.

So far, the situation is far from a repeat of the Covid crisis, as flows (mostly Europe-Asia trade) are delayed, not interrupted. Currently weak demand in Europe means that higher costs, if short term, are likely to be absorbed by companies rather than translated into higher selling prices.

Impacts on European growth and inflation would rise should disruptions last or extend to the energy sector. By themselves, these tensions are not a game-changer for ECB decisions later in the year, but they may be an additional incentive for the ECB to be more cautious before cutting rates.

Actionable ideas

- Euro Money Market

With the ECB deposit rate at 4.0%, Euro money markets are attractive. This will only last longer should geopolitical and other uncertainties lead the ECB to wait more before cutting.

- Euro fixed income

After dropping sharply at the end of 2023, Euro bond yields have rebounded in January, providing now better entry points for investors. An active approach is key as markets adjust their expectations on growth and inflation.

This week at a glance

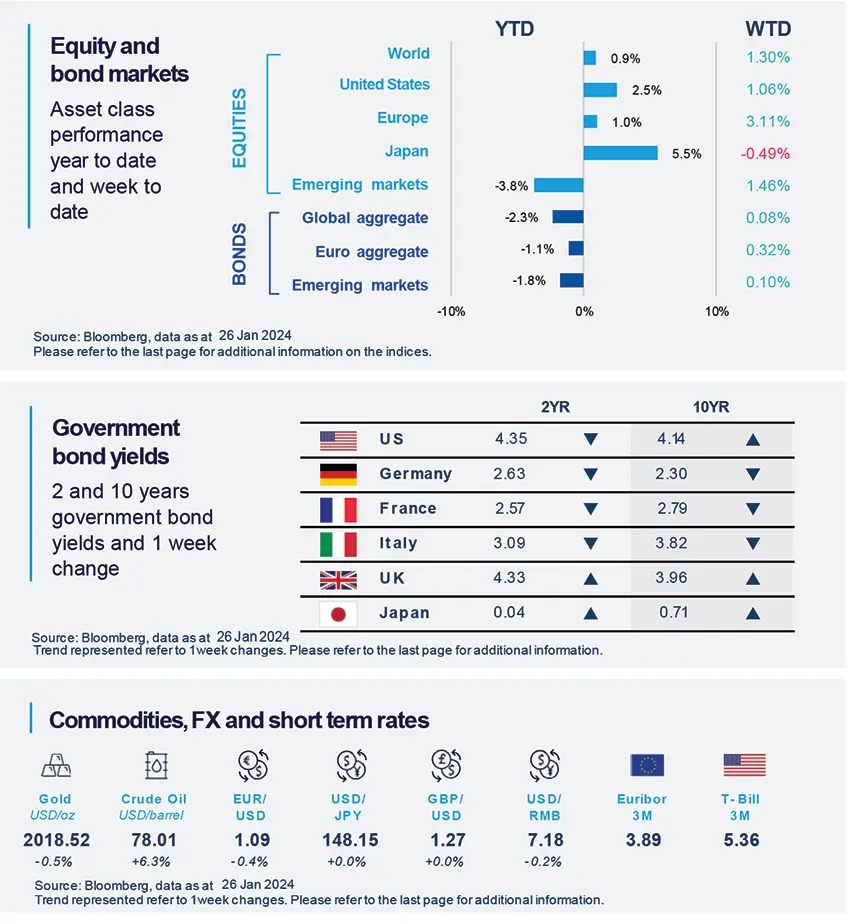

US and Euro equities rose on positive economic figures. Chinese equities were supported by policy measures. Bond yields declined as central bank (esp. ECB) communication was slightly more dovish than expected. Oil rose on strong US growth and persistent geopolitical stress.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short term rates.

Source: Bloomberg, data as at 26 January 2024.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US Real GDP growth of Q4 2023 was a strong upside surprise

US Real GDP growth in Q4 strongly surprised expectations of growth on the upside rising 3.3% (SAAR), as basically all major components had a positive contribution. However, domestic demand moderated (but less than expected), and this was also confirmed by the moderation in imports (which positively contributed to the upside surprise in GDP growth).

Europe

Flash PMIs improvement sustained by manufacturing, services edge down

Business surveys (Flash PMIs) were broadly in line with consensus expectations for the Euro area. Even though still in contractionary territory, Flash PMIs in Europe posted encouraging signs as rates of contraction keep decreasing. However, while Manufacturing is improving Services indicators slightly decreased, in January’s print. Positively, the Employment component shows overall stability (around 50 points) while new jobs expanded.

Asia

Japanese inflation falls

Tokyo CPI inflation fell faster than expected to 1.6% yoy in January from 2.4% yoy in the previous month. Core CPI eased in sequential terms, bringing the annual rate to 3.1% yoy in January from 3.5% in December. The critical question is whether this trajectory will lead Japan back into deflation. We believe not, and expect a sustained moderate inflation rate of 1.5% in late 2024.

Key Dates

|

31 Jan FOMC Meeting |

1 Feb |

2 Feb EU CPI, Europzone |