Summary

The Q2 earnings season was again stronger than expected and contributed to the equity market rally up to mid-August. However, the results are of ‘low quality’ and are not a reason to turn bullish on equities. Ultimately, margins coming down from very high levels should drive the earnings downturn in our view.

The earnings season was positive once again; Q2 YoY earnings growth was +8.5% in the US on the S&P 500, and +29.8% in Europe on the Stoxx 600, based on Refinitiv figures as of 30 August. These are lower numbers than in Q1 (+11.4% in the United States and +42.1% in Europe), but are still excellent results and ahead of consensus expectations. As a first remark, it is worth noting that figures are stronger in Europe than the US, which has to be understood as Europe lagging the United States in the economic slowdown rather than being more resilient to it.

While inflation (and currency weakness in Europe) will continue to support top lines and consequently (nominal) earnings, margins coming down from very high levels will drive the earnings downturn in our view. That, in turn, means that while the current rally could have legs, ultimately, before turning more bullish on equities we would need to see a capitulation in earnings, together with a credible pivot by the Fed.

Beneath the surface, signs of weakness are already visible

Q2 results have been robust across regions. Although European earnings forecasts have been continuously upgraded since the start of the year, 60% of companies in Europe still reported quarterly results ahead of expectations. In the United States, 78% of companies reported results ahead of consensus after earnings forecasts were downgraded in the run-up to the reporting season.

When looking beneath the surface, however, the data gives pause for thought. The Energy sector has been the main driver of results: in the United States, when excluding the Energy sector, Q2 YoY growth numbers turn negative for the first time in this cycle (to -2.2% from +8.5%). In Europe, while the growth number remains positive, it drops drastically to +9.0% from +29.8%.

Moreover, the results are being driven by the top line. Inflation is supporting sales and earnings (nominal) growth. However, below the top line, a trend of margin compression is already clear. Both United States and European net profit margins peaked in Q1, based on Datastream data. Those levels were extreme, with all-time high margins in the United States and the second largest margin ever in Europe (just marginally below the pre-Global Financial Crisis (GFC) peak). Net margins have retraced down from over 12.0% in the United States and over 9.0% in Europe to 10.8% in the United States and 8.3% in Europe, respectively. However, those are still very high levels and further downside is to be expected as pressure on disposable income should intensify and economic activity slows.

Finally, in the case of Europe, the euro’s weakness is another key ‘low-quality driver’ of sales and earnings growth. A c. 10% move in the trade-weighted euro tends to lead to a c. 6% move in EPS. So far, the currency points to a boost of c. 3% to European earnings in 2022..

Finally, beyond these figures, which reflect the past, companies have been getting gradually more cautious in their guidance for the remainder of the year and for 2023. All in all, this implies that the next few quarters will be more challenging and we should not extrapolate the current results as an indication of what the next quarters will look like.

‘Low quality’ results: US Q2 year-on-year earnings growth turns negative if we exclude the energy sector

Our view remains that an earnings downturn is ahead of us

The resilience up to this point is not unexpected, even if greater than initial estimates. Despite inflation (and euro weakness in the case of Europe) as pillars of support for revenue growth, margins coming down from very high levels should drive the earnings downturn. Going forward, we may still see some resilience in Q3 results later this year, only less so than in Q2, but the odds are for 2023 earnings growth to turn negative.

The persistent climb up in IBES consensus forecasts for 2022 earnings is now showing signs of waning. Over summer, we saw the first downward revisions for the MSCI World AC FY22 EPS, but the forecast remains at a robust +10.9%. 2022 earnings growth forecasts are now pointing to +7.9% in the United States and +17.1% in Europe. Regionally, downward drivers were the Pacific ex -Japan region (FY22 earnings downgraded by -1.2%) and the United States (-0.6% from last month). However, Japanese earnings were still upgraded by +0.7% and European earnings by +1.8% on the same period. By sectors, as pointed out above, the main contribution comes from continued upgrades in Energy, which is part of the explanation of European earnings being revised up, given the greater weight of the Energy sector in Europe (6.1% of market capitalisation) when compared to US (2.5%).

Consumer Discretionary is the main sector seeing downgrades so far, both in the United States and Europe.

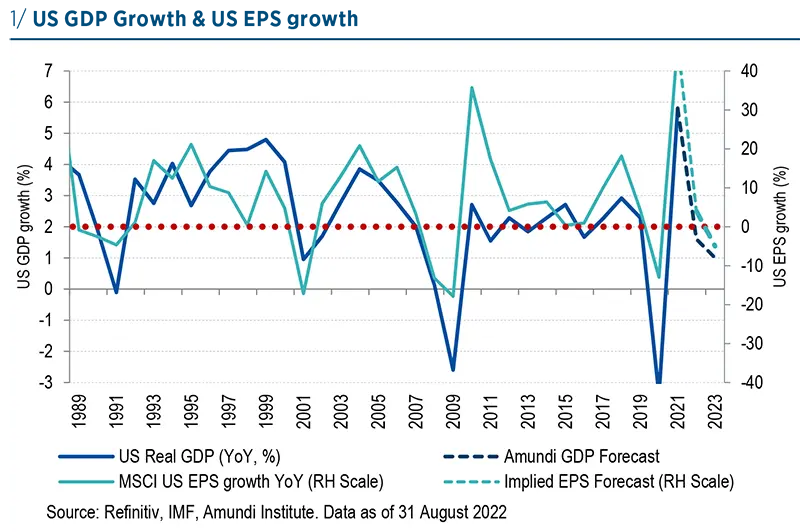

Looking at history, 2.0% GDP growth is usually needed for EPS growth to be positive in the United States. Our economists have recently downgraded their forecast to +1.0% from +1.5%, which should translate into a negative figure for US EPS growth next year. By the same token, 3.0% global GDP growth is normally the threshold for European earnings to be positive. Our economists have just revised their forecast to +2.7% from +3.1%. The odds are then for Europe also to deliver negative earnings growth next year.To be clear, in a high-inflation world, an earnings downturn should not be dramatic. The level of decline of earnings in recent recessions, such as 2008 (when US EPS collapsed by some 35% and Europeans by 45%, based on IBES) should not be the base case, but negative prints are due and capitulation is still missing on that front. In the 1970s, a reference for high inflation environment, earnings drawdowns were of the magnitude of -10% in the US. Moreover, in all recessions, at least since the 1970s, European earnings downturns have always been stronger than for the United States.

Margins compression has started: margins have peaked in the United States and in Europe, but levels remain very high

What is the impact on our equity investment case?

Beyond its apparent resilience, underlying earnings momentum argues for staying cautious on equities.

As the downturn of equity markets this year has been mostly due to a sharp rise of inflation and the late and strong tightening of monetary policy, the market perception of peaking US inflation has led to a retracement when equities were oversold. The resilience of Q2 earnings has just added another argument to support the rally.

Current US P/E (18.9x trailing earnings) is broadly consistent with inflation falling back below 3%. Based on this assumption, most of the repricing of equities would have been done (in terms of trailing P/Es). If not, a higher inflation regime of 3-6% would argue for a lower P/E with an equilibrium around 16x. On the earnings side, a regression of the S&P 500 to earnings tells us that after its rebound the United States market is anticipating only flattish earnings growth, everything else being equal, and only a small setback in Europe. While this scenario remains a possibility, should inflation fall and the US and global economy stay resilient at the top of the rally, markets seem to be priced for perfection; there is no room for any disappointment.

Adopting a pro-cyclical stance would require a successful pivot by the Fed and a capitulation on the earnings side; these conditions are not yet in place. As a conclusion, the odds are still for this move to stay a countertrend one.

Regionally, we maintain a preference for the United States over the Eurozone. The market focus should eventually shift from ‘too much inflation’ to ‘not enough growth’. Eurozone equities, which are both more cyclical and are lagging the United States in terms of earnings downgrades, should potentially be less resilient than the United States.

By styles, our approach is quite diversified. Combining Value and Quality still makes sense as a core position. Value remains an inflation hedge, should the market forecast be too optimistic on this side, and Quality usually benefits during end cycles, when earnings are in danger. High (and secure) dividends should benefit; when equity returns are low, dividends account for a big portion of them. Finally, Minimum Volatility also makes sense, as volatility tend to rise during end cycles, when earnings revisions are accelerating.

At the sector level, profit resilience is key.

While defensives have underperformed during the recent market bounce-back and cyclicals remain cheap, we see sustainability of margins/earnings as the key driver of allocation across sectors. This leads us to an overall preference for defensives. In some cases, cyclical sectors can also offer resilient margins and profitability. Therefore, our European sector allocation could be seen as a ‘barbell’ strategy, but with somewhat more weight on the defensive side.

The Healthcare sector remains key to us but we have highlighted the extreme gaps in valuations between Healthcare Equipment stocks and large Pharma stocks. So, we remain positive on Healthcare, but prefer to play it via Healthcare Equipment names. Staples remain a key preference despite high valuations, Personal Products and even Food & Beverages stocks continued to outperform throughout the rally, even after outperforming up to the rally. This should continue as those stocks should show resilience against the earnings downturn.

Across non-defensive sectors, we believe Energy might have further upside, especially if the economic downturn proves mild. High Quality areas such as Luxury Goods are a key overweight in our view as a sector where profitability and margins are very resilient. Construction offers opportunities, especially for stocks exposed to fiscal stimulus and government investments, which should protect profits through the downturn. Equally, Aerospace & Defence should have a long-term structural tailwind behind its profits going forward.

While Financials could buck the trend of margin compression, due to higher rates supporting margins, we maintain a preference to play it via Insurance stocks, given the higher risk of Banks in an economic contraction.

Finally, as for sectors to avoid, Mining was a key underweight for us in recent months, given the turn in metal prices and its large dependence on the Chinese market at a time when lockdowns are impacting activity, and the outperformance earlier in the year appeared overdone. The sector has underperformed sharply since June, so we have reduced some of the underweight but remain cautious. We continue to avoid Real Estate as a key underperformer in economic downturns, especially when inflation is high. Technology is a sector we have avoided and are not ready to move back into yet until we see more clarity on a path back towards lower inflation.

Stocks with earnings/margin resilience remains a key conviction