Summary

-

The shift to an inflationary late cycle has been confirmed with greater conviction and a focus on higher inflation (and rates). Economic momentum is still decelerating at a global level but with tentative signs of stabilisation.

-

This translates into a cautious equity stance with a significant tilt to asset classes that are resilient to inflationary regimes with decent growth. Due to short-term uncertainties on the European economy arising from the war in Ukraine, equities are tilted more towards global value, quality factors and inflation-resilient sectors, with linkers offering a hedge. Base metals are the favourite commodities.

Inflation Phazer Update

The inflation picture worsened over the course of Q1 2022. Before the start of the Ukrainian conflict, price pressures were seen peaking by the end of the first quarter, with oil (WTI) normalising within a range of $65-75/bbl. by yearend and prices of goods easing as pressures from supply bottlenecks would have partially subsided in H2 2022.

Instead, a few factors during the quarter added additional stress to prices, exacerbating the still ongoing pandemic-related supply constraints and bottlenecks, and spurring reported inflation figures and expectations to new record highs. The main event was definitely the start of the conflict in Ukraine, which renewed supply shortages, particularly in the food sector (Ukraine is one of the world’s biggest exporters of wheat and vegetable oil), triggering also a sharp rally in the prices of oil and natural gas, due to heightened geopolitical risk and sanctions on Russia. Additionally, the rise in the number of Covid infections and renewed restrictions in China threaten to make matters worse, suggesting that previous signs of improvement tentatively materialising on shortages indicators are unlikely to be sustained.

Looking at the next 12 to 18 months, developments in commodity prices will be a key factor in assessing the inflation path ahead. We foresee oil (WTI) around the current level ($110/bbl.) for the remainder of Q2 2022 and subsequently fading to gradually reach $75/bbl. in Q1 2023. Overall, energy prices are likely to remain sustained, at least until the Ukrainian conflict ends. In the US, broad inflationary pressures are expected to peak in early Q2 2022 and to gradually ease over the subsequent quarters, due to a moderate correction in commodity prices, a negative contribution from base effects and weaker economic activity (the Fed’s normalisation of monetary policy will play a crucial role in this respect). The average landing levels of inflation indices will, however, be higher than both what was previously expected and their pre-pandemic norm. More specifically, the still-high inflation projections are a by-product of the persistently strong PPI dynamics which are expected to be smoothly passed into CPI.

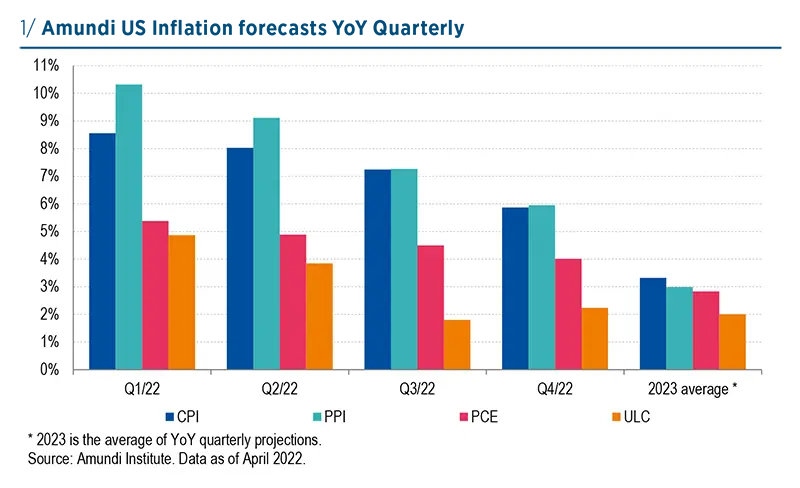

Amundi’s forecasts on US inflation for 2022:

- Headline CPI to continue averaging around 8% in Q2, following, however, a descending pattern from the peak;

- Producer Price Index (PPI): pipeline pressures are expected to remain elevated in the near term and to progressively begin to abate in H2 2022;

- Core inflation (Core PCE): we’re going to see a transition from the current 5.4% to 4% by yearend;

- The trend for unit labour cost (ULC) is projected to stabilise around pre-crisis levels (around 2%) but to average slightly higher during the year.

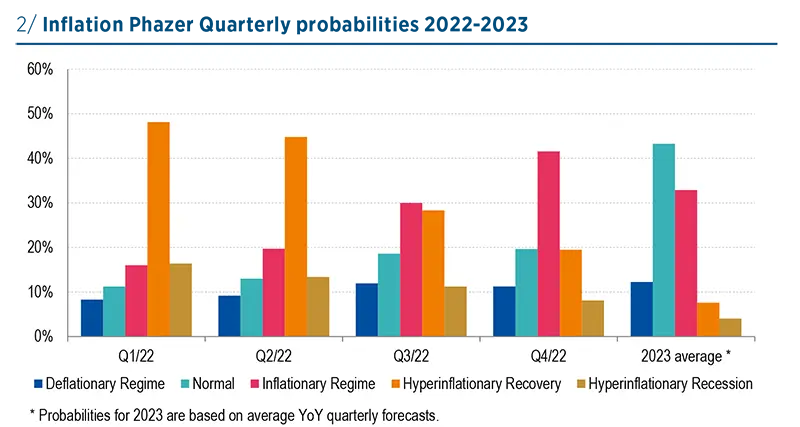

In 2023, the aforementioned measures of US prices should stabilise in the 2-3% range (based on YoY quarterly average), with the exception of CPI, which on average will decrease to a level slightly above the 3% mark. Based on the projected pattern of inflation for the main US price indices (see chart above), Amundi’s Inflation Phazer provides a probability distribution to each of the five relevant inflation regimes over the forecasting horizon.

Source: Amundi Institute. Data as of April 2022. Inflation Phazer is Amundi’s proprietary tool aiming to provide a compass for identifying the inflation regime most likely to materialise over both the short and medium terms, as well as the impact that can be expected on major asset classes. Five inflation regimes are identified using the following price indices as discriminating factors: the US Consumer Price Index (CPI), US Producer Price Index (PPI), US Core PCE (personal consumption expenditure) and US unit labour costs (ULC). Historical data are YoY monthly since 1959. https://research-center.amundi.com/article/resilient-multi-asset-portfolios-inflationary-regime

Current hyperinflationary regime extending to Q2 2022

According to the tool, the hyperinflation phase of Q1 (and actually ongoing since H2 2021) will extend into Q2, where we currently see inflation data peaking. Indeed, such a regime is characterised by inflation levels between 6% to 10%, where our forecasts for CPI and PPI currently land in Q2. Past the peak in inflation data, the regime will transition to inflationary, as YoY levels of prices move closer to the 3-6% range through year end. However, it must be noted that in Q3 hyperinflation risks will still be elevated (hyperinflationary only 3% less likely than inflationary regime). For 2023, the stabilisation of inflation indices in the 2-3% band (with the exception of CPI) will support the case for a further shift towards a more moderate inflation regime, called normal. Notwithstanding this expectation of inflation getting back to more balanced and sustainable levels, in 2023 the inflationary regime still has a very elevated probability of materialising (33%, vs 43% normal) and must therefore be taken into account when taking asset allocation decisions.

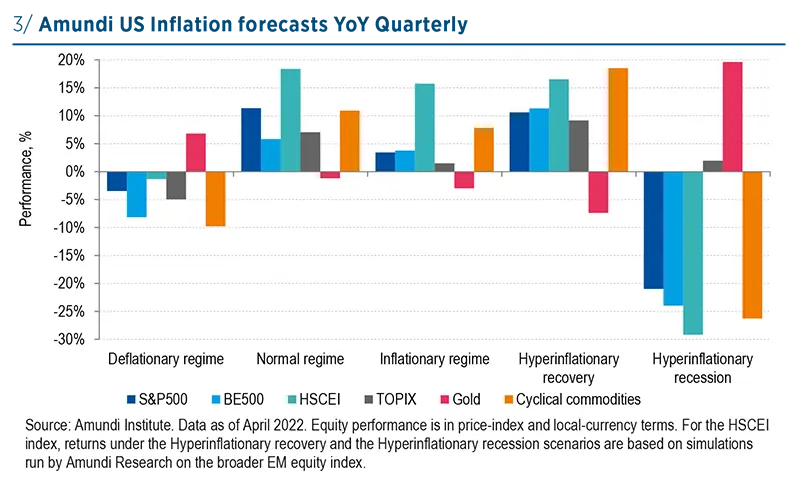

In terms of investment consequences, the reiterated sequence of positive inflation surprises since H2 2021 and the renewed threats to global supply chains due to the Ukrainian conflict, potentially resulting in a new geopolitical order, are strengthening the case for an allocation focussed towards assets that tend to benefit during regimes of elevated price pressures, in a still-decent economic growth context (as in the hyperinflation recovery regime).

In the equity space, investors may consider increasing their exposure to sectors that benefit from higher commodities prices and that possess good pricing power, such as energy, materials and financials, and playing their relative value against those sectors that are more vulnerable to interest-rate increases (e.g., technology and ‘growth’ sectors in general). Regionally, European equities is the area that historically bodes well in such an environment although Ukraine conflict uncertainties call for cautious here.

In such a context of pronounced demand/ supply imbalances, the positive case for cyclical commodities holds, particularly for base metals, which we are expecting to retain some appreciation potential, given the low level of inventories and the elevated future demand driven by the green transition. Finally, we believe that inflation-linked bonds still provide a valid hedge to protect portfolios against a scenario of elevated inflation.

In H2 2022 the economic cycle will transition from recovery to late cycle

Medium-term business cycle update

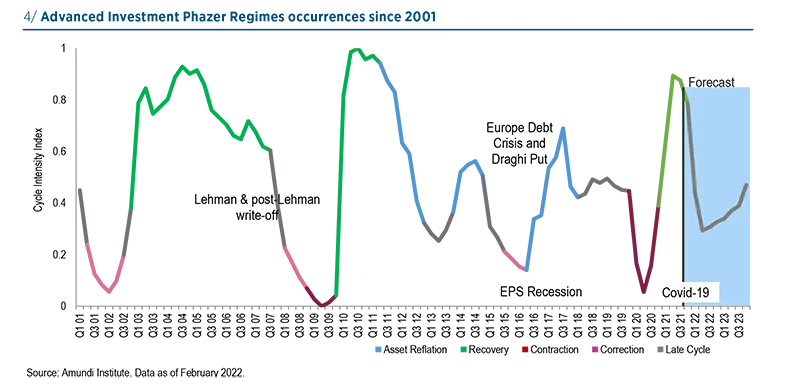

The geopolitical events that drive commodity prices and inflation expectations are also contributing to the deterioration of the global and regional growth outlook. Amundi has revised down its forecasts for average world GDP (3.2% in 2022 and 2023, vs 4% and 3.4%, respectively), with global inflation higher (6.9% in 2022 and 4% in 2023, vs 5.3% and 3.4%, respectively). Such an additional acceleration in prices has further fuelled expectations that monetary policy will get much tighter over the next 12-18 months, in an effort to restore price stability and prevent long-term inflation expectations from de-anchoring. A tightening in financial conditions will be the main transmission channel of central banks’ restrictive stance, with an overall softening in the current pace of economic activity. The expected deterioration of the macro-financial outlook is visible in the shift of the probability distribution among the regimes of Amundi’s Advanced Investment Phazer. The second quarter of 2022 will now see the late cycle phase taking over the recovery phase, which has been in place since Q4 2020, and extending through 2023. In such an environment, EPS growth has little scope to deliver and is expected to fall into the positive single-digit area. Asset allocation-wise, the rotation from recovery to late cycle calls for a reallocation from high-beta markets to more defensive/higher quality assets.

Looking at next year, as the business cycle matures further and as economic activity reapproaches trend or stabilises even below, correction becomes the second most likely regime, suggesting an even more cautious asset allocation, with an increasing focus on defensive assets (govies and gold).

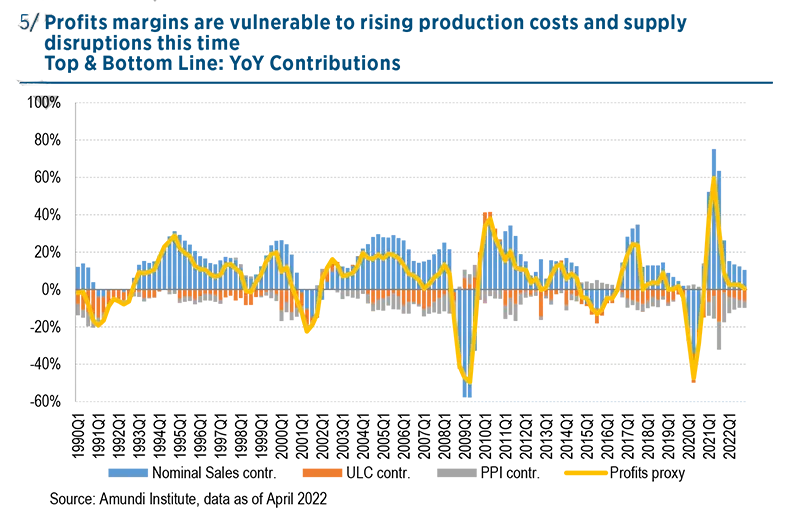

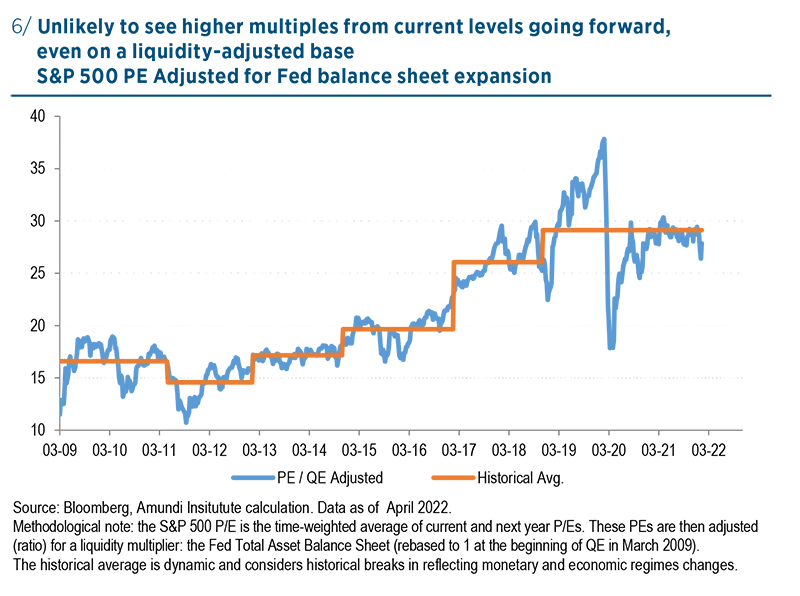

Quantitative tightening (QT) and a deceleration in profits not in favour of an expansion in multiples

The Fed’s monetary policy and unconventional tools have been pumping an extraordinary amount of liquidity into the markets, providing formidable support to the 2021 equity rally, besides the strong rebound in profits and economic growth. Liquidityadjusted valuation metrics have been in cheap territory, with few exceptions so far. Although the Fed is expected to remaining dovish, supporting the economy through monetary base increases, the QT process should reduce liquidity propellant to the markets, while the deceleration in EPSs should mitigate investors’ complacency. As a result, the shift from unconventional monetary policy to a more traditional one will be less marketfriendly and more capex-oriented, limiting the expansion in multiples going forward. Profits will come under pressure in term of squeezed margins, due to increasing labour (wages), capital (rates) and real (raw materials) costs.

Profits to come under pressure due to increasing costs