- A majority of pension plans interviewed in the Amundi-CREATE Research survey are implementing ESG factors in their portfolios, with the majority expecting to increase their share over the next three years.

- Asset managers are having to adapt to the growing demand, with pension plans requiring greater transparency and accountability, stronger alignment with core ESG values, and more active engagement.

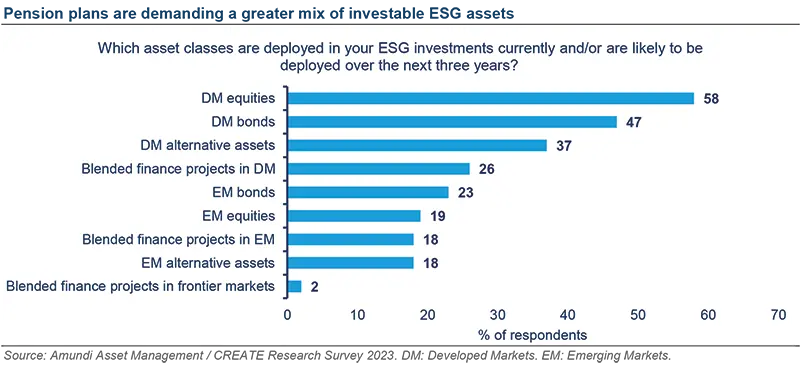

- Equities remain the preferred means to access this space, but demand for green and social bonds and alternative assets is rising. Developed market companies lead the way, but the gap with emerging ones will narrow.

Appetite for responsible investment themes remains strong among pension plans wanting to capture the transition opportunities towards a more sustainable future.

More than four in five pension plans interviewed in the latest Amundi-CREATE Research institutional survey are implementing ESG factors in their portfolios. Almost seven out of ten plans have also embraced a net zero goal or are in the process of doing so. These findings underscore the growing importance of ESG considerations in retirement strategies.

This shift is set to continue as the majority of those interviewed expect to increase their share of ESG investments over the next three years, both in active and passively managed portfolios. These plans want to see evidence that their investments are benefitting the planet and its people, while minimising the risk associated with ESG investments and maximising the returns.

Asset managers are adapting to such demand. Pension plans that select managers for ESG mandates require greater transparency and accountability, a stronger alignment between the manager’s culture and core ESG values, and active engagement that delivers on client’s goals.

European managers, incentivised by local regulations, are spearheading the advance, followed by North America, and Asia-Pacific. Their focus varies across regions. In Asia-Pacific the emphasis is on governance, in Europe it is on environment, and in North America on social issues.

There are also nuances within the pillars themselves. Decarbonisation and biodiversity top the list for an environmental focus, whereas employee engagement, and diversity and inclusion are most highly ranked when it comes to the social pillar. Executive remuneration and corporate board composition are foremost in governance.

New policies have laid the groundwork for these advancements. The United States’ Inflation Reduction Act is set to unleash USD 369bn of tax incentives for the green transition, and could further leverage USD 1.4tn of private investments over time, providing a big boost for nascent technologies like carbon capture. The European Union’s Green Deal Industrial Plan will help foster competitiveness of the bloc’s net zero industry, and expedite the transition towards climate neutrality. India’s Production-Linked Incentive scheme should also spur its renewable energy technologies.

Investors looking to couple financial returns with long haul positive change are resorting to several approaches. Stewardship and proxy voting to drive progress on ESG themes is the most popular, and have been adopted by 68% of respondents. Another is impact investing targeting long-term secular growth trends in sectors that are being reshaped by the climate and energy transitions. Others include seeking companies with high or improving ESG scores, integrating ESG factors in the investment process, and screening for companies with poor ratings.

These strategies address the fact that ESG is now seen as a financial indicator. It gauges both the damages companies may suffer for instance from adverse climate developments, and how firms can curtail their operations’ negative social and environmental impacts.

Pension plans are also diversifying the mix of invested assets to deploy their ESG ambitions. Equities are the preferred instrument thanks to their strong liquidity profile, and because they facilitate active engagement through voting rights. They also offer access to green industries like renewable energy, as well as hard to abate ones like cement and steel, encouraging their transition to a low carbon future.

Green and social sustainability bonds are also becoming more attractive, as their proceeds are deployed for specific projects that can be closely monitored. In the realm of alternative assets, green infrastructure, private equity and private debt are another means to buy ESG ‘laggards’ with the highest potential for improvement.

Demand is strongest for developed market companies, which have had a head start in the environmental transition race, stemming from stronger social and political pressures. But the gap with emerging ones is set to narrow. New avenues will open up for global investors, as more resources are deployed to combat the impact of climate change where it is felt most acutely. Industries sitting at the heart of emerging markets’ economic catch-up like cement, steel, and chemicals, represent an opportunity for ‘greening’.

ESG investing will have to face several more hurdles, like the widespread market rout of 2022, that may be due to larger dynamics. But the majority of plans interviewed believe it will not harm performances in the longer term, and will therefore become even more entrenched in the pension landscape.