Summary

Macroeconomic focus

Resurgence in oil prices renews inflation concerns

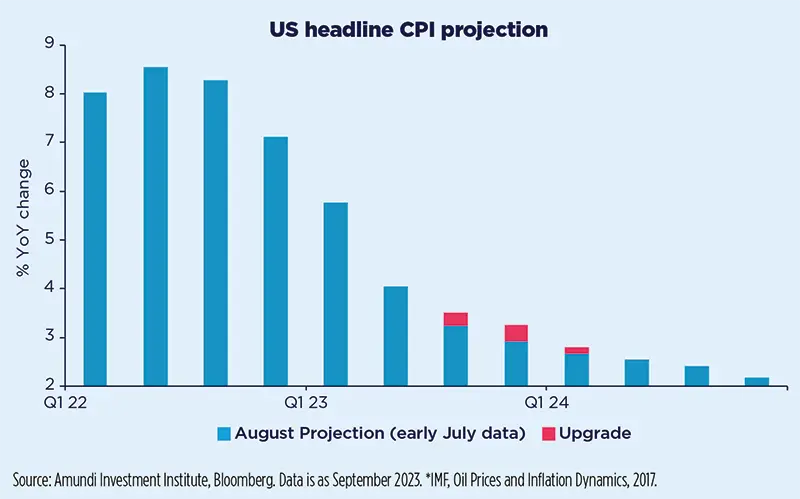

Inflation has been on a declining path in advanced countries, albeit with some stickiness in services inflation. But higher oil prices – which are up about 30% over the last two months – could add a significant hurdle to this disinflation process and keep policy rates higher for longer. The impact of higher oil prices typically depends both on how quickly and by how much they rise, and whether the shock is long-lasting or temporary.

Whether this takes us to a higher path for inflation will depend on how policy reacts: will central banks accommodate or strongly guard against the second-round effects of higher oil prices? An IMF study* finds that a 10% increase in oil prices leads to a rise in inflation of about 0.4%, with the impact lasting, on average, for two years. But the impact on inflation has been significantly lower since 2000, largely due to monetary policy acting to limit the contagion.

We view the current shock as temporary. Supply restrictions by OPEC+ likely account for about 60% of the rise in prices, while about 30% is due to demand – global growth remains subdued. A predominantly negative supply shock would tend to increase headline inflation and at the same time reduce consumer purchasing power. This in turn will weigh on growth and limit the impact on generalised inflation. With monetary policy already tight, we do not expect demand pressures to accommodate higher oil prices.

Historically, though, oil price shocks have occasionally been persistent, leading to persistence in inflation. The biggest risk is if that triggers another round of wage rises, which would then impact other prices. While we do not expect oil prices to remain sustainably above $90 (the assumption built into our forecasts), they could have a wider impact by keeping policy rates higher for longer. Notwithstanding our confident view on the persistence of this shock, headline inflation will be higher in the near term. But we continue to expect both headline and core inflation to make steady progress towards central bank objectives through to the end of 2024.

Emerging markets

Is Beijing’s pivot adequate?

China’s easing measures are too light for a secular downturn.

Since late August, Beijing has started to follow through with tangible easing measures, directing major cities and financial regulators to ease housing policies. We expect additional measures to be rolled out, which may include more cities entirely removing purchase restrictions, paired with an upswing in local government bond issuance.

While these policy adjustments are in line with the economy bottoming out in Q3 and slightly accelerating throughout 2024 (in % QoQ seasonally-adjusted terms), they lack the strength to trigger an upward revision in our forecasts. China remains in a secular downturn, mostly depending on the pace and depth of the real estate sector’s decline. In our view, this trajectory will persist for another year or two before we reach a stabilising state.

India: robust industrial cycle

The industrial cycle is back and is being pushed by infrastructure and capital goods.

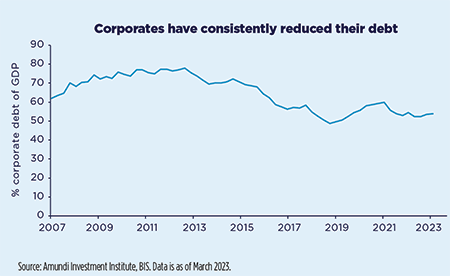

While softening from current robust growth rates (6.5% YoY in Fiscal Year 2024), India should maintain significant growth potential of around 5%-5.5% YoY for the near future. Strong Industrial Production, particularly in infrastructure and capital goods, paves the way for a needed investment cycle, that has been missing for many years. In addition, after a mild increase during the pandemic, corporates have consistently reduced their leverage (53.8% of GDP as of March 2023).

The recovery in household demand hasn’t returned to pre-pandemic levels yet, particularly in the rural sector, and the latest inflation dynamics (6.8% YoY in August, well above the Reserve Bank of India’s targets) are not fully supportive of consumption. Inflation should gradually reduce to within this target by 2024 and the RBI should overlook the recent figures and keep its monetary policy stance neutral.

Macroeconomic snapshot

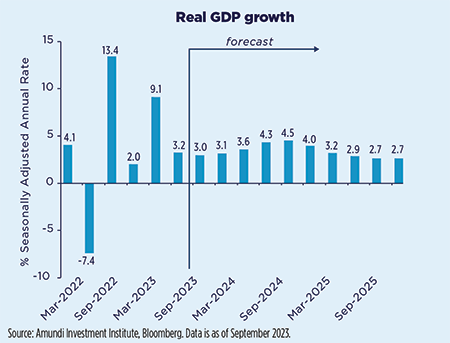

Although we expect headwinds to take a toll on consumption in Q4 2023, the US economy should remain resilient due to ongoing supportive fundamentals for domestic demand, before entering a more significant slowdown in 2024, when the tightening of monetary and financing conditions are expected to hit the economy. Inflation will continue its downward path but, in light of the recent oil price surge, headline inflation will plateau up to the year end, and likely remain above 3%.

Ahead of a scenario of sluggish growth in Europe, we expect external demand to moderate and internal demand to suffer from tighter monetary and financial conditions for a few quarters. A delayed pickup in real wage growth may put a floor on consumption. Inflation will continue to trend lower with upside risks linked to the recent surge in oil prices; core inflation will remain above the headline rate for several quarters before converging towards target by the end of next year.

For the UK economy, we anticipate flattish growth as monetary policy tightening takes its effect on the economy, slowing domestic demand on top of weaker external growth. A recession is unlikely, but the risk is increasing as rising oil/energy prices may place further upside pressure on inflation and push the BOE to tighten. While we expect inflation to trend lower, recent data show that core inflation remains sticky and ongoing high wage growth poses an upside risk in the near term.

Japan’s summer data was a mixed bag. The manufacturing sector faces challenges due to reduced export demand, while the non-manufacturing sector primarily relies on foreign visitors. We still anticipate a mild economic contraction in Q3 and Q4, largely driven by the external sector. Inflation has moderated in sequential terms. Still, core CPI increased 0.8% in Q3 or 3.1% annualised, above BoJ’s 2% target. This paves the way for further policy normalisation.

The Hungarian economy hasn’t exited recession yet. We have revised down our growth forecasts for 2023 and 2024 from -0.4% to -0.8% and from 2.5% to 2.1% YoY, respectively. Household consumption will only gradually improve as inflation will remain at double-digit levels until the end of the year. Poor private investment and net exports will continue to weigh on growth (EU funds are still locked, the prolongation of windfall taxes, lower external demand and higher imports).

Poland posted a highly negative Q2 in terms of growth (-1.45% YoY). We have revised down our 2023 forecast from 0.8% to 0.5% YoY this year but kept 2024 unchanged at 2.3% YoY. Household consumption is expected to expand further from Q3 due to strong fiscal support and looser monetary policy. Private investment will continue to increase but net exports could be a drag on growth. As mid-October’s election’s outcome is uncertain, risks for growth in 2024 are significant.

The Mexican President López Obrador’s pre-election 2024 budget will add fuel to the already surging economy. The pro-cyclical primary deficit is the widest in many years and will keep the economy growing above potential again next year (unless the US economy goes into a tailspin), keep inflation above target for the foreseeable future and the Bank of Mexico’s rates high for longer. The easing path should not start until late Q2 24 (after 2 June general election).

Brazil’s economic activity has been slowing in a resilient fashion and has benefited from a positive agricultural sector supply shock and solid labour market conditions. Annual inflation is rising purely because of unfavourable base effects and is slowing in sequential terms. The Central Bank of Brazil has continued to cut policy rates gradually, with inflation expectations and fiscal risks only being partially anchored despite the Lula administration submitting a balanced budget for next year.

Central Bank Watch

Still some inflation concerns on the easing cycle path

Developed markets

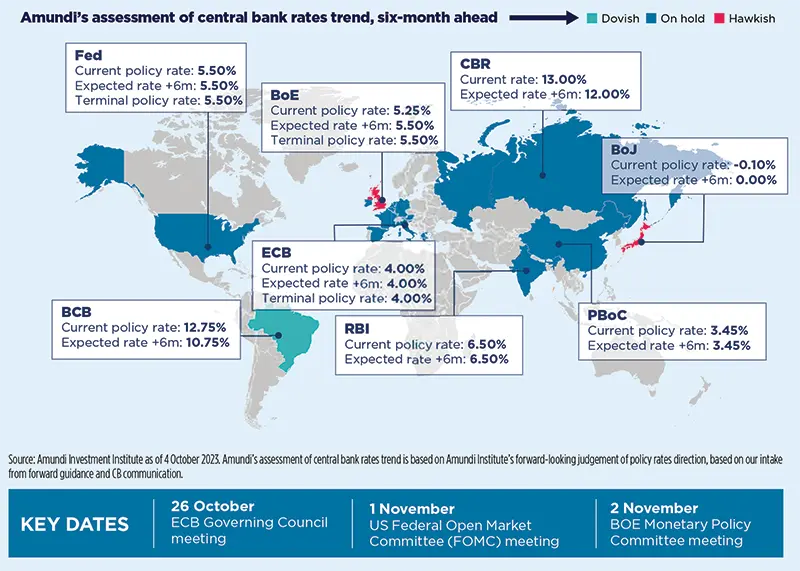

Last Federal Open Market Committee (FOMC) meeting kept rates unchanged. However, the Fed signaled that it could tighten monetary policy further in the case of persistently-above-trend growth, while its dot plot* was more hawkish than previously and signaled a high policy rate for longer. The US economy remains resilient in the Fed’s assessment with new quarterly growth forecasts revised up from 1.0% to 2.1% this year and from 1.1% to 1.5% in 2024. Most FOMC members are still on the hawkish side and the surge in oil prices is also adding to inflation concerns.

In contrast to most expectations, the ECB increased its key rates by 25bp in its last meeting, but at the same time it delivered a dovish message, suggesting that the terminal rate has probably been reached. The ECB cut growth projections for this year and 2024, acknowledging that the tightening is being transmitted to the real economy stronger and faster than in previous cycles. At the same time, inflation is still assessed as being too high for too long, supporting the message of higher-for-longer rates.

Emerging markets

In September, global financial conditions continued to move tighter on the back of the Fed’s renewed narrative of higher for longer. As a consequence, we have witnessed some protracted weakness in Emerging Markets FX that is adding to higher EM inflation risks, via imported goods, which could make EM CBs’ job more challenging going forward. Against this backdrop, we keep expecting the easing cycle, already started, to continue across EM, with more CBs soon joining the early starters in LatAm and Eastern Europe, and in Asia later on. Having said that, global financial conditions, as well as a less pronounced disinflationary path, should suggest a higher degree of prudence in the easing speed. EM are mostly far away from the conditions of the Taper Tantrum episode and current account deficit positions are in many cases funded by adequate Foreign Direct Investments and CBs have proven timely in their commitment to keep inflation anchored through their recent massive hiking cycle. Yet, EM CBs shouldn’t be too complacent with their inflation dynamics or expectations, especially in such a global context.

* The Fed dot plot is a chart that shows where each FOMC member thinks interest rates will be on a specific time horizon.

Geopolitics

EU tariffs on Chinese electric vehicles not a certainty

Assuming tariffs against Chinese EVs are certain is premature.

Following the recent announcement by European Commission Head Ursula Von Der Leyen that the EU will start an investigation into subsidies for Chinese electric vehicle (EV) makers, there are now expectations that the EU will slap tariffs on Chinese EVs. That assessment is premature. First and foremost, Von der Leyen’s speech was a campaigning one. European elections are coming up next June and she is likely to seek another term. Therefore, her message probably had several intentions: to showcase her credential as a China-hawk to ensure US support; to demonstrate that, despite being German, she is willing to go against the wishes of the German automotive industry (which has significant exposure to the Chinese market); and lastly, to signal her intentions for the next term: developing an industrial policy to prepare Europe for the next phase of US/China competition. In terms of the timeframe and likelihood of tariffs, the investigation could take several months. At the earliest, provisional tariffs could be introduced within 9 months, most likely by the time the new commission is in place (next Autumn). In terms of the possible size, similar past investigations have resulted in duties in the range of 10%-20%. Current levies on e-cars are 10%; US duties on Chinese EVs are 27.5%. In terms of the likelihood of implementation, there will be a lot of opposition from German industry. The outcome of the investigation is also uncertain, car analysts think the industry is no longer heavily subsidised. Overall, if the Commission is really keen to introduce tariffs, it is difficult for any member state to block this. However, the Commission is unlikely to go against the interests of both France and Germany.

Policy

The elusive compromise on EU fiscal rules

Without progress on the Capital Markets Union, financing the energy transition will be delayed.

At the last Ecofin meeting (on 16 September), all the EU ministers sought to reach an agreement before the end of the year on a reform of the Stability and Growth Pact. According to the Spanish Presidency, a technical consensus has been reached on 70% of the EU Commission’s proposals. Agreement on the remaining 30% requires political negotiations. These negotiations (currently underway) are challenging, particularly between France and Germany. In a nutshell, France would like to have a common fiscal capacity to finance certain investments, while Germany wants binding rules on spending.

A «fair balance» must be struck between the reduction of public debt and the investment and incentives needed to carry out structural reforms. The EU also needs (i) debt reduction criteria that are compatible with growth, (ii) mechanisms to guarantee compliance with the rules, and (iii) a fiscal framework that will enable the necessary investments to be financed. And all of this should be done with responses tailored to the specific characteristics of each member state, and with equal treatment for all countries.

The problem with the current reform of the tax rules is that it does not offer a long-term solution for financing the EU’s huge investment needs. Indeed, less than 30% of the Next Generation EU funds have been mobilised so far. But these funds are unlikely to be extended and private investment is still hampered by the absence of a genuine Banking Union and a Capital Markets Union.

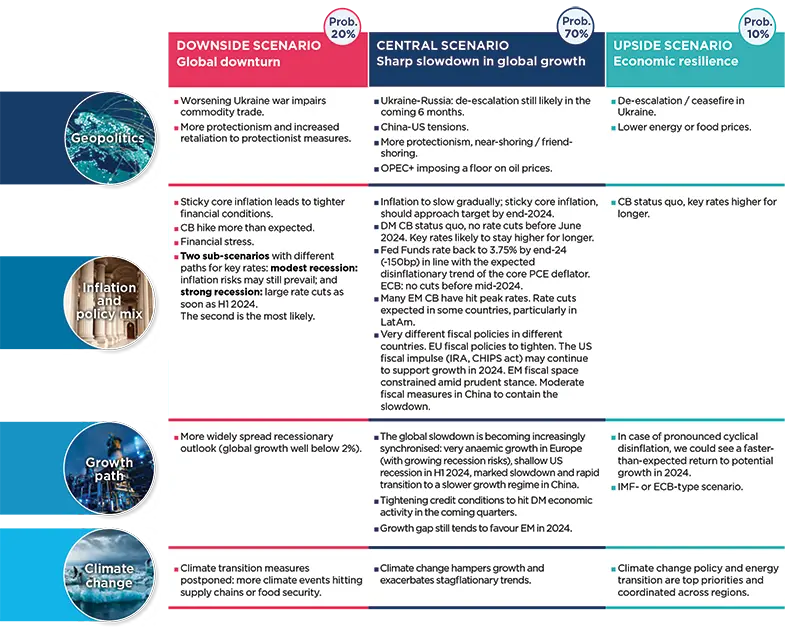

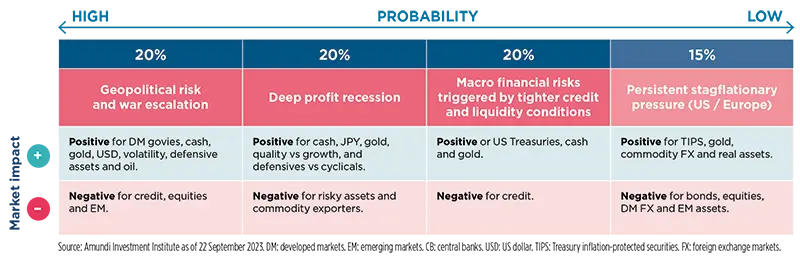

Scenarios and Risks

Central and alternative scenarios

Risks to central scenario

Amundi Investment Institute Models

Mood ON Mood OFF Indicator (MoMo)

Highly volatile markets require investors to dynamically assess their risk exposure.

What is the model about?

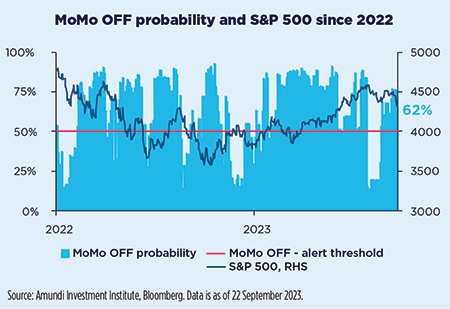

- The rationale: MoMo is Amundi Investment Institute (AII)’s highest-frequency risk-sentiment tool. Its main goal is to identify the best possible timing to enter a position in risky assets.

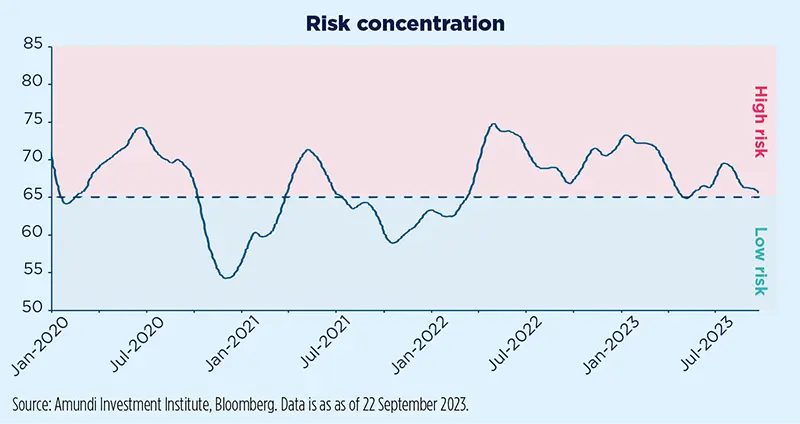

- Model setup: the indicator is based on a two-step approach. The first step is an analysis of cross-asset correlations (involving the most risk-sensitive assets) to assess the level of risk concentration (as this would indicate rising systemic risks, see chart below). Secondly, in order to assess timing, the previous indicator is complemented with additional tactical overlays, gauging short-term stresses, based mainly on: institutional investor flows, credit stress and FX market dynamics.

- Model output: the MoMo indicator measures the probability of being in a “Risk Off” environment. It uses pattern recognition algorithms to classify the selected set of tactical indicators based on past information: the closer the variables are to past stressed periods, the higher the probability of being in a risk-off scenario. The risk-off probability is then used to drive tactical risk on/risk-off overlay strategies, whereby the higher the probability, the lower the risk exposure.

What are the current signals?

- Starting from the middle of August, MoMo has been persistently calling for a lower risk budget for asset allocation.

- The main drivers of this signal are elevated risk concentration and institutional investors becoming risk-sellers, while the other high frequency measures span from neutral to a more pro-risk stance.

- The current risk-off probability is 62% and suggests a defensive tilt.

Infographic - Markets in charts

Equities in charts

Developed markets

US mega cap valuations are increasingly under scrutiny.

| Fading performance since July’s Fed rate hike |

|---|

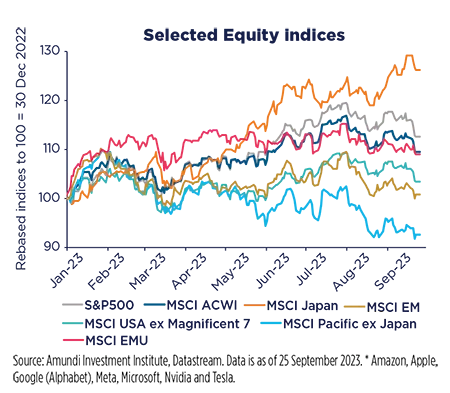

EMU has been trendless since February. The US has done better year-to-date but has been more volatile and, ex the «Magnificent 7*» has barely been better than EM.

| MSCI USA Valuation and the Magnificent 7 |

|---|

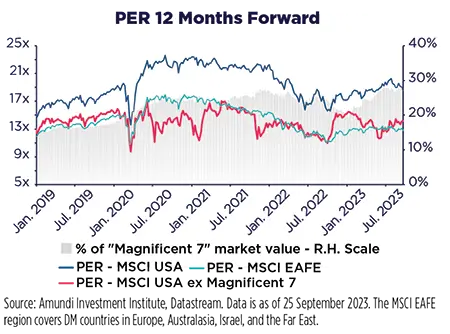

Excluding the Magnificent 7 (27% of MSCI USA capitalisation), the US Price-to-Earnings ratio is much more in line with MSCI EAFE, even if it is more pricey.

Emerging markets

After a negative Q2 2023 reporting season, EPS growth expectations for the next 12 months remain positive due to China.

| China’s earnings recovery to benefit GEM |

|---|

Q2 2023 reporting season closed with negative numbers for Global Emerging Markets. However, our earnings per share (EPS) growth expectations for the next 12 months remain quite positive, thanks to China’s earnings recovery.

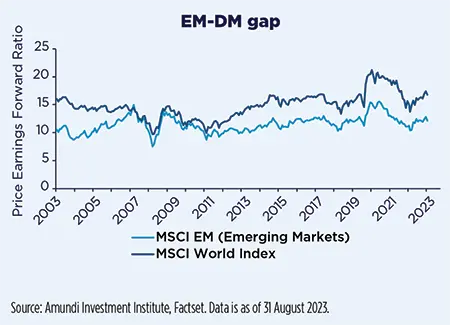

| EM and DM’s Price Earnings gap has widened |

|---|

Global Emerging Markets remain cheap in terms of 12m price earnings compared to Developed Markets. The gap has widened in the recent years and is now quite large.

Bonds in charts

Developed markets

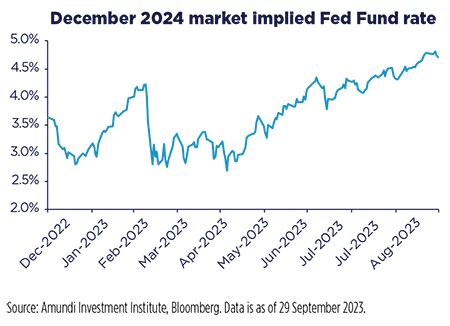

Upward revision on the Fed’s dot plot led implied policy rates for 2024 higher, ultimately supporting the recent rise in bond yields.

| Market shifting to the higher for longer scenario |

|---|

The soft-landing scenario being priced into markets, together with the recent upward revision communicated by Fed on its dot plot, led implied policy rates for 2024 higher, ultimately supporting the recent rise in bond yields.

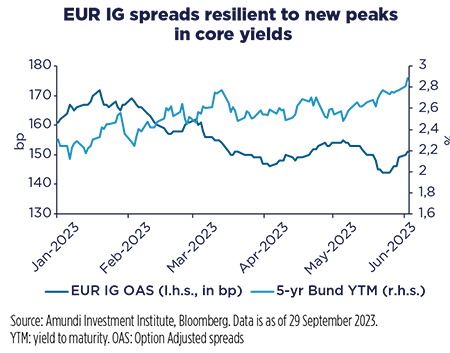

| IG spread resilient to recent rates volatility |

|---|

EUR IG corporate bonds proved to be resilient to recent spikes in core yields, as well as versus other risky assets, thanks to persisting demand not only targeting spreads but absolute levels of yield even more.

Emerging markets

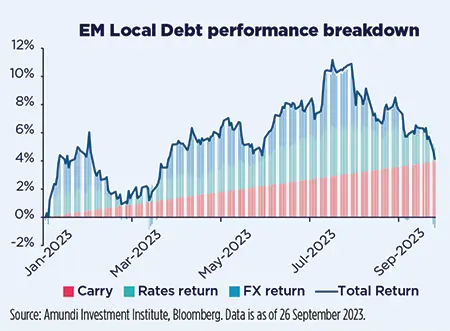

The positive FX contribution has vanished, but EM local debt remains positive.

| EM local debt remains positive YTD |

|---|

Emerging Market local bonds’ year-to-date performance has been positive, mainly for carry and curve contributions. The positive FX contribution has nullified recently.

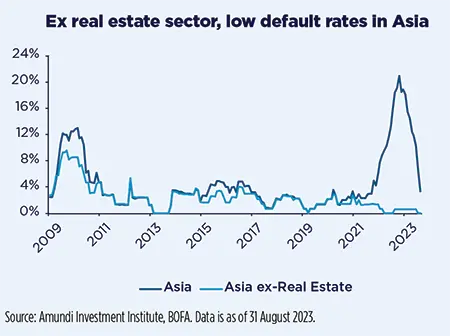

| Benign Asia ex Real Estate HY default outlook |

|---|

The default rate for Asian high yield (BOFA Index) is around 3.36% and is concentrated in China’s real estate sector.

Special focus on hedge funds

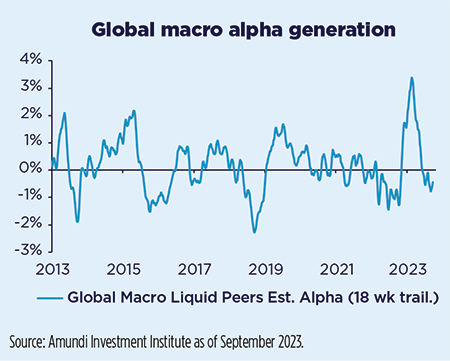

Global macro at an inflection point

Global liquidity is set to tighten again, which will be good news for Global Macro.

The environment for top-down managers has been challenging year-to-date, marked by a succession of macro turns, poor market directionality, multiple false starts, a pain trade for equities, extreme bond volatility and big swings in cross-asset correlations. Global liquidity has also re-accelerated after the SVB crisis – rarely good news for top-down managers as it generates anomalies while altering asset differentiation. As usual, these phases of macro inflection, with limited clarity and greater economic surprises, are uncomfortable for these styles. Alpha gains accumulated until early 2023 were retraced later on, with opportunities concentrating in fixed income markets. Managers remain cautious and are positioned for a deteriorating environment. With liquidity set to tighten again and central banks reaching their peaks, a greater focus is on assets’ fundamentals and trend opportunities are gradually returning, so the backdrop will become more supportive.

Currencies

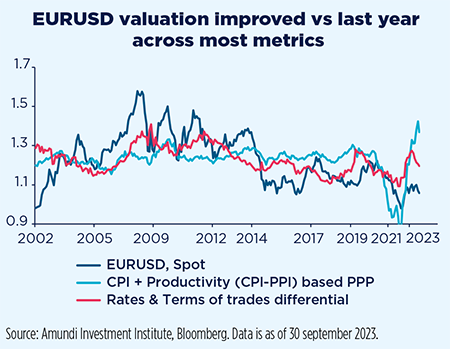

Uncertainty on Fed actions is supporting the USD

In our view, while the move may continue in the short term, we keep seeing limited room for a huge USD appreciation.

As US inflation surprised on the upside in August, markets are again pricing the need for the Fed to engineer a recession (higher for longer, with real rates explaining most of the move in US yields). This backdrop is supportive for the USD, as both stocks and bonds underperform and there are few alternatives to the greenback in the search for diversification. While the move may continue in the short term, we keep seeing limited room for a huge USD appreciation. In a difference to last year, fundamentals out of the US have improved substantially in 2023 and we see further uncertainty over the Fed as the only credible source of further risk premium from here. Any element confirming the Fed is done with monetary tightening (from lower inflation to evidence of a US slowdown) should gradually translate into a lower USD, in our view.