Summary

Macroeconomic focus

2024: a more challenging context for the Fed’s pivot

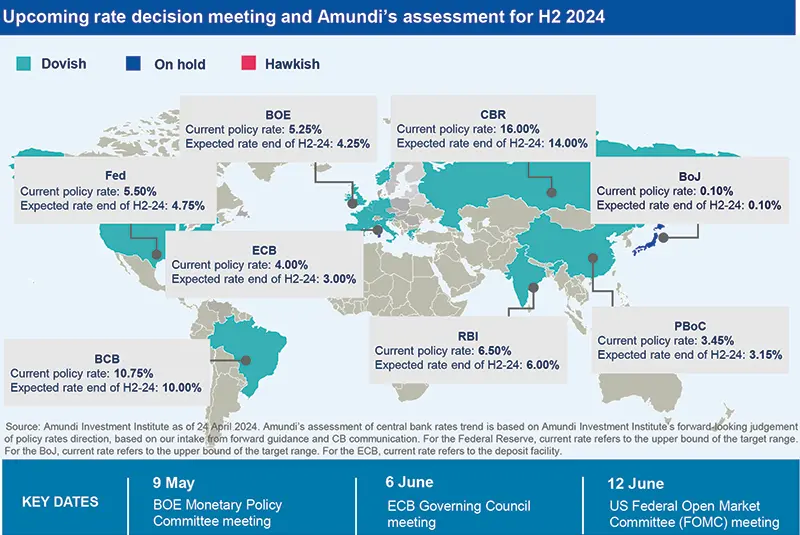

We expect 75 bps of rate cuts in 2024 as monetary policy remains restrictive, growth will slow down, and inflation data do not alter our projections.

We have markedly revised up our forecast for US growth, in particular for H1 2024. We continue to expect GDP growth to decelerate below its potential pace over the next few quarters, before recovering in 2025. Regarding inflation, although the downward trend in core CPI inflation has recently stalled, we think that the disinflationary process will continue, albeit along a bumpy road with stickier dynamics. The Fed will still be in a position to pivot towards rate cuts and we expect 75 bps of cuts in 2024 (vs 40 bps by markets) as: 1) monetary policy remains restrictive and will become more restrictive as inflation declines; 2) growth will slow down; and 3) recent inflation data have not altered our year-end projections.

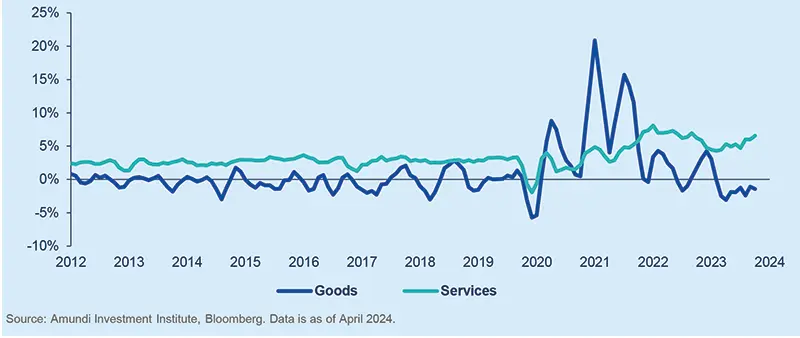

Easier financial conditions have supported growth so far, although the recent repricing of expectations about the Fed has produced some tightening. As long as financing conditions remain broadly accommodative, the odds of a recession will remain low. Also, the recent CBO (Congressional Budget Office) upward revision to population growth and labour supply, not previously accounted for, increases the probability of a “soft landing” scenario: higher potential growth and easing wage and inflationary pressures. Nonetheless, we still expect a deceleration to materialise as small businesses and lower-income households are likely to continue suffering in the high interest rate environment, while the recent relative tightening of financial market conditions and the increase in oil prices may compound and contribute to slowing the economy. We expect consumption to moderate as even the excess savings of middle-income households will be depleted soon. This should lead to a gradual increase in savings. We project core inflation to be stickier for longer at around 2.5%-3%, with momentum likely to remain strong, especially during H1; importantly, we do not expect a reacceleration of core inflation.

Core Services and Core Goods inflation, 3-month moving average

China

Domestic demand stalemate

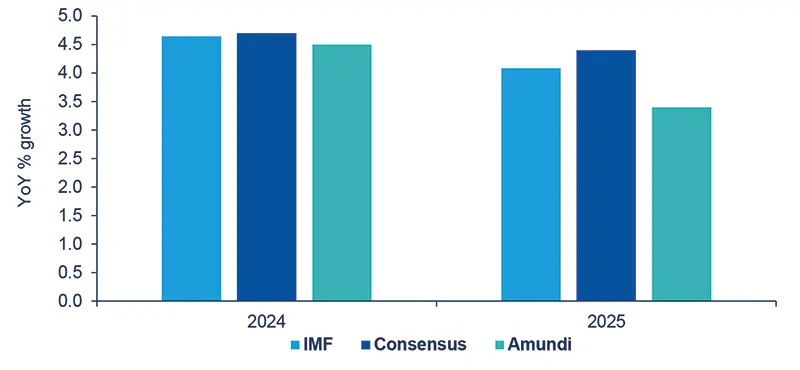

China GDP forecast comparison

Source: Amundi Investment Institute, CEIC, IMF. Data is as of 25 April 2024.

Real GDP exceeded expectations in Q1, growing by 5.3% YoY. This prompted us to revise our full-year forecast to 4.5%, up from the previous 3.9%. However, this revision is entirely retrospective. We lowered our growth forecast for Q2, anticipating a reversal of consumption momentum and an acceleration of the housing market decline. In contrast, export growth strength is likely to continue in Q2, supporting industrial production. After Q1 data, there is no urgency to step up fiscal stimulus despite persistent deflationary pressures. Our conviction of additional monetary easing has also decreased.

India

India’s economy remains robust

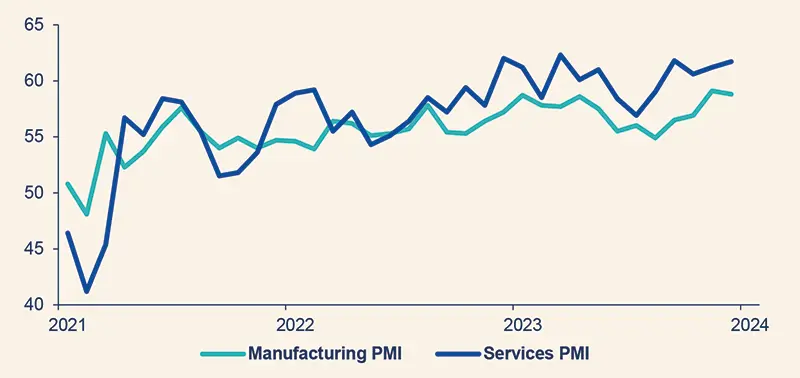

PMIs keep signalling strong expansionary business conditions

Source: Amundi Investment Institute, Bloomberg. Data is as of 2 May 2024.

The economic outlook remains robust. Q1 high-frequency data keep showing economic acceleration in credit, electricity generation, steel and cement production. Moving into Q2, Manufacturing and Services PMIs (58.8 and 61.7 respectively in April) continue to signal strong expansionary business conditions. Elections are ongoing (results are expected by early June) and the country’s economic performance remains one of the key factors behind the consensual view of Modi winning a third term. On the monetary policy side, India appears more insulated vis a vis the market repricing of the Fed Fund dynamics: RBI is not in a rush to cut and, in any case, the room is quite limited (25/50bps by the end of the year).

Macroeconomic snapshot

Even though we still expect a deceleration in the US economy later in the year, we slightly revised up our growth rate for GDP in 2024 based on stronger momentum and expected performance in H1. We also project core inflation to remain stickier for a bit longer than previously expected as momentum is likely to remain more solid in the first half of the year.

Positive signals from business surveys and a slightly better outlook for domestic demand and trade (exports) make us think that the Eurozone could grow in 2024, slightly more than we previously expected. Headline inflation data surprised us on the downside, while core inflation remains on the path that we have previously outlined, as we expect it to progressively slow towards target, with some volatility among countries.

Although the outlook for the UK remains subdued in 2024 (as domestic demand fundamentals are still relatively weak), we are now more positive than before, as headline inflation is falling relatively quickly and real disposable income is increasing, thus we have revised up our growth forecast for 2024. Core inflation is also proceeding towards target, which will be reached in 2025.

With real wage growth staying negative in Japan, private consumption remained soft in Q1. Underlying inflation indicators have cooled further to around 2% or below. While the BoJ is caught between a rock and a hard place, facing a quickly depreciating currency, we believe the Bank will prioritise its inflation target among others, maintaining accommodative financial conditions to allow wage-inflation dynamics to take deeper root.

At its 26 April meeting, the Central Bank of Russia (CBR) left the policy rate unchanged again at 16% with a hawkish tone suggesting higher rates for longer. According to the CBR, while inflationary pressures were gradually easing, they remained strong with domestic demand outstripping supply in a tight labour market. The CBR raised its forecast for the average key rate in 2024 and 2025 to 15.0–16.0% and 10.0–12.0%, respectively. The CBR also revised its 2024 real GDP growth forecast higher to 2.5-3.5% from 1-2%.

The Ukraine-Russia war continues with the risk of spilling over into 2025. In the meantime, Ukraine is in need of more aid from its allies. The country received approval for $61bn of aid from the US in the form of a loan, most of which is earmarked for the purpose of military equipment purchases. On the other hand, the seizure and use of Russia’s frozen reserves is looking unlikely, except for the accumulated interest on the part invested at Euroclear, which is around $5bn – not even equivalent to two months of Ukraine’s budgetary funding needs.

Brazil’s economic activity is picking up YTD after stagnating in 2H23 thanks to declining interest rates, some fiscal stimulus (via ‘precatorios’) and (min) wage hikes. Inflation is moderating but, like the rest of the world, it is suffering from the ‘last mile’ syndrome – services inflation is sticky due to solid labour market conditions. Banco Central do Brasil has turned more hawkish as a response to tighter global financial conditions but also domestic fiscal deterioration. Lula’s administration has indeed revised its 24/25 budget target lower.

After catching a breather at the turn of the year, the Mexican economy is regaining momentum as highlighted by February’s activity prints. Inflation is moderating again but the dichotomy between core goods and services persists. In light of that, Banxico seems to want to remove emergency hikes in a discontinuous fashion even if the Fed stays high for longer. The domestic elections on 2 June should result in policy continuity with a bit more of a business, environment and security-friendly approach.

Central Banks Watch

Fed diverging from main DM central banks; EM peers turning slightly more cautious

Developed Markets

The Fed is taking a different turn from other major central banks. The US economy remains remarkably strong and inflation has reaccelerated over the past three months, despite high interest rates. Jerome Powell said that persistently elevated inflation will probably delay any Fed interest rate cuts until later this year, opening the door to a period of higher-forlonger rates.

Conversely, the June ECB rate cut remains firmly in play if there are “no surprises”. Some ECB members state that the ECB should cut interest rates in June to avoid falling behind the inflation curve.

Bank of England Governor Andrew Bailey also remarked that the outlook in Europe differed from that in the US and voiced optimism that UK inflation was falling.

A “higher-for-longer” Fed also puts the BoJ under pressure. The Yen has done nothing but weaken since the end of negative rates.

Emerging Markets

Robust US economic data and sticky US inflation prints have led to a ‘higher for longer‘ Fed repricing that the EM central banks have clearly made a note of. Emerging central bankers have become more cautious in South East Asia, where Bank Indonesia has even felt compelled to raise interest rates on the back of Indonesian Rupiah weakness, and in the LatAm region, where BCB (Brazil) shortened its forward guidance even before the ‘last mile’ tantrum and fiscal events which have deteriorated the consolidation outlook occurred.

But the Fed’s extended ‘wait and see’ stance does not mean EM easing cycles won’t continue. On the contrary, policy rates are very likely to be reduced further from already (mostly) contractionary levels thanks to moderating inflation, better fundamentals and cleaner external positions, but with the caution and flexibility that the uncertain global (Fed and geopolitics) and domestic (sticky services inflation) environment very much requires. We suspect markets will be content with such an EM CB bias.

Geopolitics

The geopolitical heat is rising

All geopolitical trends are putting upward pressure on costs.

Not only did we witness a heightening of tensions in the Middle East during the last few weeks, but the geopolitical temperature has also increased overall. Our analysis points to the 2020s remaining a period of growing geopolitical risk for a variety of reasons. In a historical comparison, the level of tension witnessed up until 2024 is comparable to that seen during the Cold War. The 2020s have already seen a rapid succession of multiple crises with a global impact. Our data shows that more countries are now driving geopolitical risk as more bilateral relations are souring. Furthermore, there are even more sanctions and export controls, natural resources used for political leverage… effectively amounting to growing economic warfare and this increases the risk of hot war. The interests of Iran, Russia and North Korea are aligning and, while China is not a rogue state, it has increasingly common interests with Russia and Iran as tensions in the South China Sea mount. The next US administration will preside over worsening China ties, no matter who sits in the White House. The recent ‘tit for tat’ between Iran and Israel means a new direct front has opened. On top of this, there are the threats posed by AI and climate change. While inflation is not driven merely by geopolitics, all geopolitical trends put upward pressure on costs: on-shoring, near-shoring, rerouting, sanctions adaption and monitoring, defence spending, fiscally expansionary and protectionist governments, and growing risk premia – to name but a few.

Policy

EU: New proposals to deepen the CMU

The ball is now in the court of France's European partners, particularly Germany.

Christian Noyer (former Governor of the Banque de France) has just submitted his report for ambitious proposals to deepen the Capital Market Union (CMU). The starting point is well known: Europe faces massive investment needs (to finance the green and digital transitions), which, from now until 2030, are estimated at around €1,000bn a year. Moreover, there is a growing need for defence to also be included. Yet, neither governments nor banks will be in a position to support such an investment effort. Governments, because public debt ratios have risen sharply in recent years; banks, because they already dominate corporate financing and are subject to greater capital constraints.

It will thus be essential to mobilise the very abundant household financial savings (over €35,000bn), which are poorly allocated. Europe exports its savings by acquiring foreign debt securities and imports the equity needed to develop its businesses. This poor allocation is detrimental to the returns offered to European savers. The Noyer report proposes a new approach to deepen the CMU, including the creation of long-term savings products to better channel household savings into the European economy. The taxation of savings products favours bond investments to the detriment of equities. This penalises long-term investment, which helps to explain the underinvestment in Europe and widens the gap with the US. The report also recommends bold and decisive action to relaunch the securitisation market, with a European guarantee of last resort for the securitisation of mortgage loans or loans to SMEs.

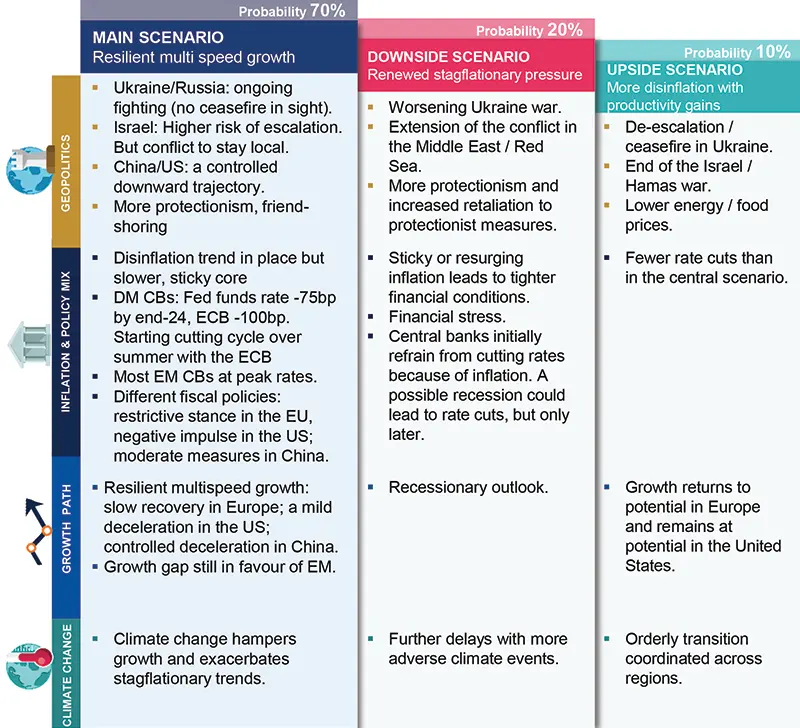

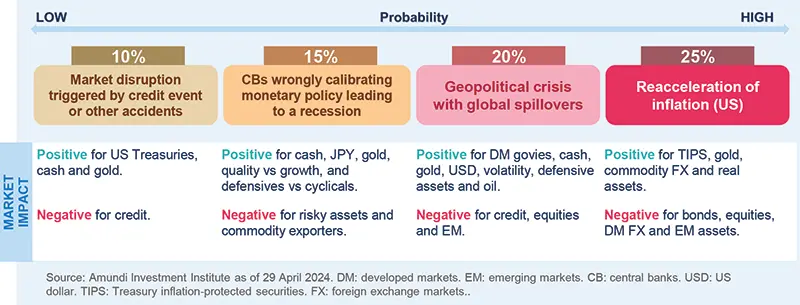

Main and alternative scenarios

Risks to central scenario

Amundi Investment Institute Models

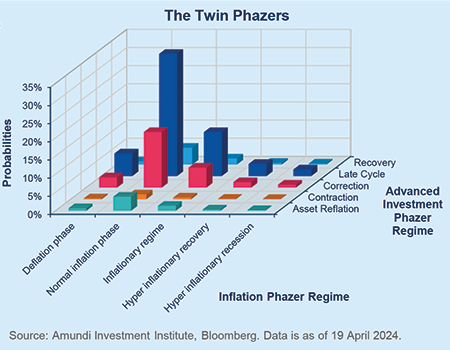

Combining Economic and Inflation Cycles: Amundi Twin Phazers

Stocks-bonds correlation is highly dependent on inflation dynamics through the business cycle.

- The rationale: the complex environment we have witnessed in the postpandemic years has reinforced the notion of a strong interconnection between economic-financial regimes and inflation dynamics. The role of monetary policy in such an intricate context has become an even more relevant driver of financial markets and debt sustainability. As a result, Amundi Investment Institute leverages the synergy of its Advanced Investment Phazer and Inflation Phazer: the Twin Phazers.

- Model setup: the combination of the 5x5 regimes defined by the two Phazers results in 25 states of the world. According to their characterstics, these can be grouped into 4 broad categories: 1) Normal conditions, reflecting the 4 typical economic cycles and inflation centred around central banks targets; 2) Exceptional Inflation conditions reflecting hyperinflation; 3) Exceptional Liquidity conditions reflecting extremely expansive unconventional monetary policies in times of subdued inflation; 4) An uncharted territory of extreme easing of monetary policy during times of hyper hyper inflation. We then analyse the historical behaviour of the main asset classes through each of these broad regimes, aiming to find recurring patterns for performance and correlations.

- Goal: the aim of the tool is to define the asset allocation that best fits each interconnection of regimes, taking into account both the most likely scenario and alternative ones.

- Model output: it is a probability distribution that covers every combination of the 5x5 regimes, along with the respective allocation that historically delivered the optimal return/risk profile in a diversified portfolio.

Late Cycle paired with Normal Inflation in 2024

What are the current signals?

- The central scenario for the rest of 2024 is Late Cycle, within a context of Normal Inflation. Price pressures stabilising to more conventional levels suggest a decreasing correlation between equity and bond returns, with the latter gradually getting back their hedging properties versus risky assets in a balanced portfolio context.

- Late Cycle favours a positive stance on developed markets equity and high quality credit. Potential risks of stickier inflation suggest keeping a moderate exposure to cyclical commodities.

Equities in charts

DM: A breather and a broadening would make sense

US Equity vs Bonds and ISM Manufacturing

Source: Amundi Investment Institute, LSEG Datastream. Data is as of 17 April 2024. RI: total returns.

In the US, the performance of equity vs bonds is consistent with ISM manufacturing being back to 60. This is one way to say that a lot is currently in the price, which argues for a breather. As ISM manufacturing, a good proxy of earnings, is effectively rising and is now just above 50, it argues for a broadening of participation.

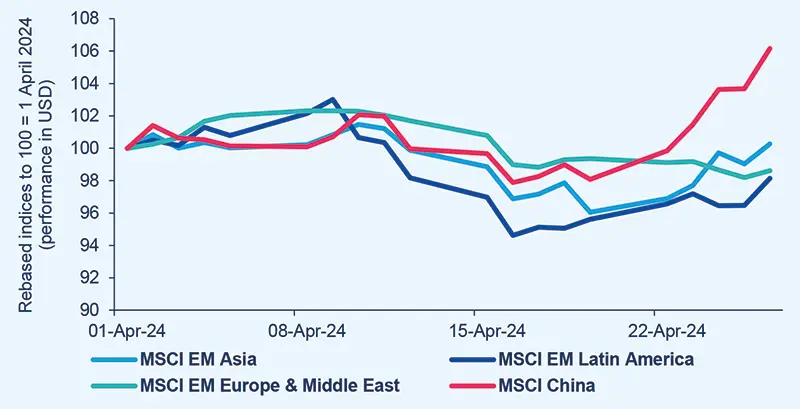

EM: Local policies support China’s momentum

China outperformed the other EM indices in April

Source: Amundi Investment Institute, Factset. Data is as of 26 April 2024.

Investors are still cautious but, overall, China stocks gained momentum in recent weeks thanks to a recovery in property stocks on hopes of more policies aimed at destocking and the restrictive property policy easing in Tier-1 cities.

Bonds in charts

DM: Pricing of Fed and ECB easing for 2024 – a gap is opening up

Pricing of rate cuts for the Fed and the ECB

Source: Amundi Investment Institute, Bloomberg. Data is as of 24 April 2024. SOFR: Secured Overnight Financing Rate.

The Fed is taking a different turn from the other major central banks. Powell says the Fed wants to see 'more good inflation readings' before it can cut rates. On the other hand, the June ECB rate cut remains firmly in play as long as there are ‘no surprises’.

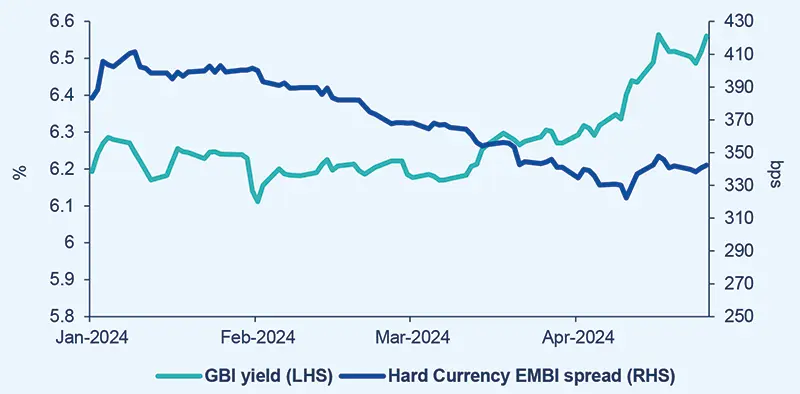

EM: Hard Currency EMBI spread moving laterally

Hard Currency EMBI spread quite resilient

Source: Amundi Investment Institute, Bloomberg. Data is as of 25 April 2024. GBI: JPMorgan

Government Bond Index-Emerging Markets; EMBI: Emerging Markets Bond Index.

The spread between Hard Currency Emerging Markets bonds and US Treasuries has been quite resilient, moving laterally during the recent spike in US Treasury yields and EM Local yields.

Commodities

Appealing Gold and Base Metal medium-term outlook. Oil to hedge inflation and geopolitics.

The latest surge was primarily driven by hedging and momentum flows. With a delayed monetary pivot, a pause is likely. Yet, planets are aligning for the medium term. We target $2,300/oz in 3M and $2,500/oz in 12M.

Oil fundamentals are supportive given stable supply, resilient demand and geopolitical risk. Yet, the upside looks limited given ample spare capacity and prospects for higher non-OPEC supply. In the short term, we would hold position as a hedge and to capture the appealing roll yield.

Copper is surging due to tight mining supply, as China starts hoarding stockpiles and as Russian metals are banned from trading on the LME and CME exchanges. We expect a consolidation in the short term, but see more upside in the long run as supply struggles to match demand.

Currencies

Global and local conditions are still far from what the JPY likes.

Monetary policy divergence between the Fed and the ECB remains a headwind for the EUR, which we expect to stay weak towards Q3. Yet, this mainly reflects a strong USD rather than a weak EUR, which has appreciated relative to most G10 currencies YTD, apart from the USD and GBP.

Higher-than-expected US inflation continues to push forward expectations of Fed rate cuts and to support the USD. The lack of challengers at this stage is notable, but a meaningful trend remains unlikely if the distribution of forward US rates does not skew toward rate hikes once again.

Sticky UK services inflation limits the ability of the BoE to cut in 2024 and in turn supports the currency given its high carry profile within G10. Yet, UK growth remains weak and the evidence of rising stagflation does not bode well for the currency. We keep expecting modest depreciation ahead.

The BoJ failed to introduce any hawkish shifts to support the currency in April; the global backdrop is still far from what the JPY likes (i.e. slowing growth, falling yields and risk appetite) and we doubt FX intervention can translate into long-lasting JPY support with no help from G7. We expect a delayed JPY appreciation.