Summary

Macroeconomic focus

Red Sea: a new supply chain and inflationary shock in the pipeline?

At this stage, we think the impact is more regional than global, with Europe more impacted than other regions.

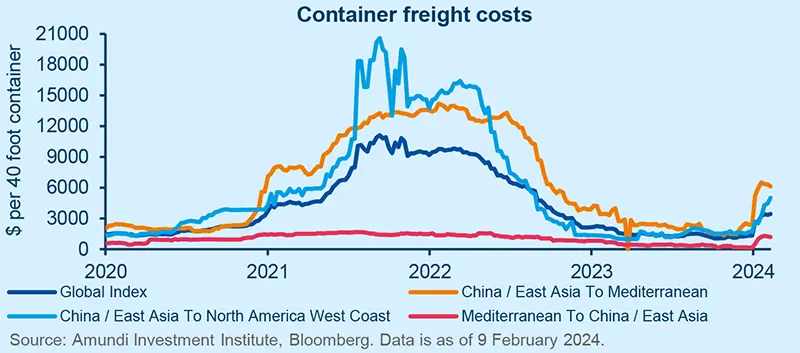

Disruption in the Red Sea is prompting speculation around inflationary shocks just as in the Covid era So, what differs today from the post Covid experience to make the impact more micro than macro and more regional and sector specific than global?

There are three main factors to consider:

- Goods are traded, ports are open and trade flows continue, although it is taking longer and is more expensive;

- The shock is more regional than global, as not all regions are affected equally (the most affected trade route is Southeast Asia to Europe);

- Not all goods are affected in the same way (more sector/industry impacts).

Supply chains and inflation are the shock’s main channels of transmission, while the location of the country, and the breadth and duration of the disruption are the dimensions relevant to sizing the economic impact:

- Supply chain disruptions as of now appear to be more temporary. They may occur for some weeks as rerouting has led to some delays, but trade flows are continuing and there is some excess capacity among shipment companies which could be deployed to restore shipment flows should the difficulties in the Red Sea persist;

- The inflation impact is clearly linked to the duration of the shock and the set of goods involved at this stage, we have not revised our inflation or macro outlooks but, as the geopolitical situation evolves, key factors to watch are the duration of this stress and whether it also spreads to energy goods or remains limited to some specific categories.

As a consequence, at this stage, we think the impact is more regional than global, with Europe more impacted than other regions In the short term, companies may be willing to absorb higher costs with margins and avoid pass through to consumer prices as demand is not particularly strong retailers are still overstocked and goods demand is weakening as consumer demand has already shifted from goods to services If the stress extends in duration there may be higher pass through by companies but, again, we think it will be sector related and not widespread across all goods In the context of a wider disinflationary trend in goods, an increase in a limited subset may not significantly impact the expected overall inflation dynamics.

Emerging markets

China: Lowflation era

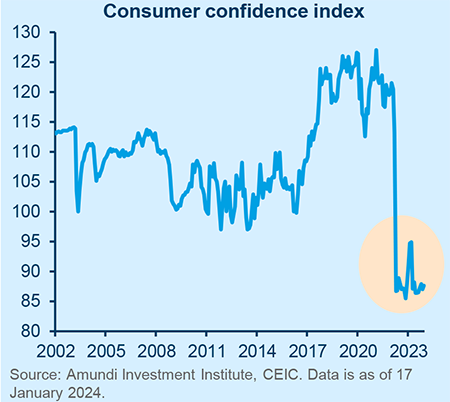

Since 2021, consumer confidence has plummeted, savings increased and spending growth declined.

To truly comprehend China’s economic reality, one indicator cuts through the noise: CPI. December’s CPI dropped for the third straight month by 0.3% YoY, bringing the full-year rate to 0.2%, considerably lower than the expectation of over 2% at the beginning of 2023. We expect low inflation for China to persist, with our CPI forecasts significantly below consensus at 0.2% and 0.4% for 2024 and 2025, respectively. The palpable decline in consumer confidence has led to increased savings and reduced spending growth. The labour market will experience a slow burn, while the average Chinese household faces the dual blows of wealth and income shocks. Specifically, we are likely to see a further decline in housing prices, coupled with persistently low consumer confidence.

India: Union Budget, no compromise

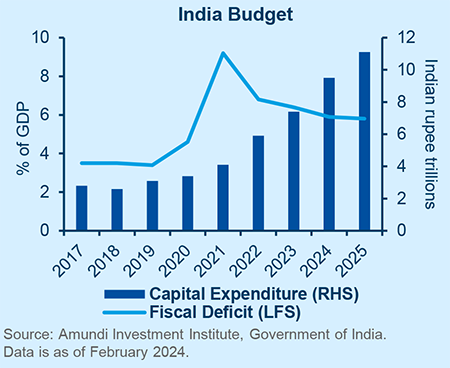

No fiscal slippage despite the announcement of more pre-election measures.

The Finance Minister announced the next Fiscal Year Budget (FY25, April 2024 to March 2025). Key messages were: a continuous capex push to sustain growth and a stronger commitment to fiscal consolidation. On a steep uptrend since 2021, capital expenditure continues to rise (+16.9% budgeted in FY25 compared to FY24): highways, electrification, port traffic and airports.

In line with commitments made in the Budget for FY22 (Fiscal Deficit at 4.5% by FY26), the Ministry of Finance is committing to a large fiscal consolidation in FY25: FD at 5.1% from 5.8%. Between the lines, the FY25 Budget sends another important message: as the General Elections approach (April and May), the incumbent cabinet is showing a certain degree of confidence about remaining in power with few compromises to pre-electoral spending.

Macroeconomic snapshot

With the second half of 2023 remaining resilient and above potential, the US economy has started the year on a stronger footing, but we still see weakness as the year progresses. Several factors that we monitor are pointing in the direction we expect, yet we acknowledge that others – such as financial conditions – have eased, making the picture more blurred. We continue to expect inflation to decelerate thanks to moderating services inflation, although so far it has remained sticky.

After the weak Q3 print, GDP growth in Q4 23 was flat. Tighter monetary policy transmitted relatively quickly into credit growth and is negatively impacting demand and business confidence. Weaker global growth and less supportive fiscal policy will ensure growth remains lacklustre for the next few quarters. Inflation will progressively slow towards target, although this will be faster for headline inflation than for core.

We expect weak growth for the UK in 2024 due to slowing domestic demand, a deteriorating labour market and weak capex spending; tight monetary policy, a weak external environment and ongoing elevated inflation will cap economic momentum. Yet, the fiscal side may provide some modest support. Inflation is expected to moderate going forward, moving closer to target around year-end 2024.

The Turkish central bank raised its interest rate by 250bps to 45% and signalled an end to the tightening cycle as it sees improvement in the macroeconomic backdrop. Indeed, domestic demand is decelerating and the current account is rebalancing. We expect inflation to continue to rise and peak above 70% YoY in May, retrenching thereafter to 40% YoY by the end of 2024. However, risks remain tilted to the upside especially if the Lira depreciates badly.

The National Bank of Hungary (NBH) unexpectedly maintained the pace of its base rate cuts at 75bps, even though recent comments from Deputy Governor Barnabas Virag meant the consensus was expecting 100bps. According to the press release, the global and domestic macroeconomic environment has improved and would have justified a higher cut. Yet, the volatility of the market regarding risk appetite, as well as the uncertainty about EU funds, prompted caution by the NBH. Going forward, both 75 and 100bps cuts will be on the table.

Chile’s economy is slowly picking up after several quarters of contraction and stagnation while inflation is back within the target range and quickly heading towards the middle of it. The central bank (CB), meanwhile, is cutting rates at a fast and furious pace, targeting a neutral stance (of 4%) in H2 24. Clearly, the CB is more concerned about falling behind the inflation curve than about FX. The pension reform has cleared the Lower House in a much-diluted form suggesting President Boric’s agenda will not progress much further.

Weak economic activity in Brazil in H2 23 should inflect higher in early 2024 as another strong harvest, lower rates and some fiscal stimulus (via ‘precatorios’) provide some tailwinds. Headline inflation is already within the target range and continues to head lower. The central bank seems happy with the current easing pace of 50bps/per meeting and is guiding for more of the same as long as fiscal policy remains prudent, with the latter generating some noise recently amid the ambitious and unrealistic 2024 budget proposal.

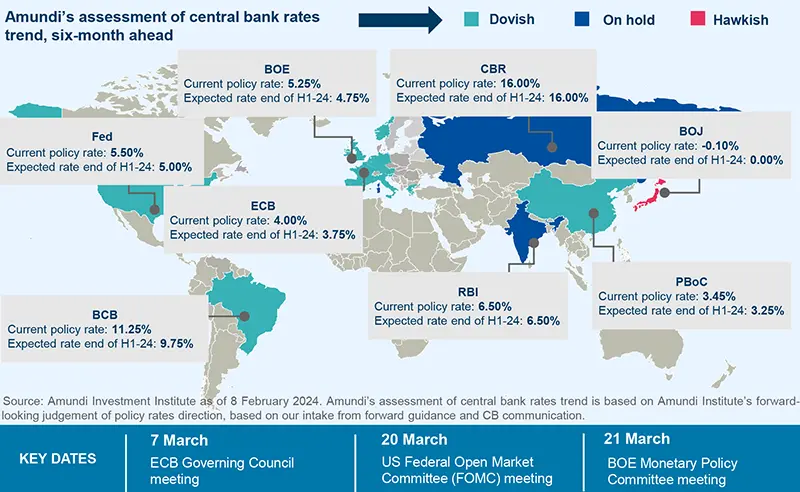

Central Bank Watch

EM and DM Central Banks are being prudent in the short term

Developed markets

There were no big surprises from the latest monetary policy meetings, but the disinflationary process was confirmed. Even so, Central Banks remain cautious about the pace of disinflation, especially in the service sector and will continue to monitor the evolution of the labour market, which has been highly resilient. Geopolitical tensions are also an upside risk to inflation. Our attention is on the risk of overtightening in the Eurozone and the ECB again falling behind the curve. The dichotomy is widening between the US and the Eurozone:

- Monetary policy has a much faster impact on the economy in the Eurozone than in the United States.

- The disinflationary process also appears more rapid in the Eurozone than in the US.

We expect the ECB to adopt a more dovish tone in March/April. March projections will constitute "A Big Set Of Information". Meanwhile, we hold our view that the Bank of Japan will seize this once-in-decades opportunity to normalise its monetary policy, but with a 0% terminal rate, implying no initiation of a rate hike cycle.

Emerging markets

On the back of benign inflation reports at the end of 2023, market expectations – as well as some Central Bank rhetoric – had turned more aggressively dovish implying either lower terminal policy rates and/or a faster easing pace. However, with the March first cut by the Fed now priced out and poor performance for EM FX in January, this excessive optimism has moderated, indicating a return to a more prudent monetary policy conduct. The National Bank of Hungary and the Central Bank of Colombia have cut their policy rates less than the consensus expected (75bps instead of 100bps and 25bps instead of 50bps respectively). Having said that, the easing cycle by EM Central Banks is continuing, still mainly concentrated in LatAm and Eastern Europe, and is well supported by the ongoing disinflationary trend and mindful of softening economic conditions. Central Banks in the main Asia countries, with the exception of China, are still in no rush to ease, with real rates being only slightly positive. Looking at more idiosyncratic stories, the Central Bank of Turkey should have reached the peak of its hiking cycle at 45% and is now assessing the inflation dynamics, which are expected to peak in Q2 2024.

Geopolitics

Ukraine will face a difficult 2024

Trump could offer Putin an offramp – but it is not a given that Putin would stop the war.

Despite difficulties in approving new financing, the West is likely to keep supporting Ukraine with ‘just enough’ to maintain defensive positions in 2024. The geopolitical consequence of Russia making significant gains in Ukraine is not (yet) politically acceptable for Western leaders. Both the EU and the US are likely to announce new financing for Ukraine in the coming weeks and months. Beyond the short term, the (partial) use of Russia’s frozen assets will become more likely with time. Apart from the financing, 2024 could be a difficult year for Ukraine. Since Ukraine managed some territorial gains in 2023, Russia has been able to take a few kilometres back. The fighting will most likely continue throughout 2024, with Ukraine being most likely in a defensive position. It is unlikely that Ukraine will receive the military aid that could make a decisive change given the evolution of Russia’s war strategy. Europe has so far been unsuccessful in ramping up weapons production sufficiently. After the March election, Russia is likely to attempt new territorial gains. Russia will try these territorial gains ahead of a possible ceasefire brokered by Donald Trump, should he be voted into office, because ceasefires are based on the territorial status quo. However, in 2025 things could develop very differently as previous wars have shown.

Policy

European defence at a crossroads

Since the early 1990s, social spending has swallowed up the peace dividend.

Russia's invasion of Ukraine has changed the face of European security. With the possible return of Donald Trump to the White House in 2025, European countries, particularly those in NATO, will have to do more to ensure their own security. Increased defence spending is imperative. But the state of public finances in most countries makes this a daunting task for Europeans. With higher interest rates, debt charges will continue to rise and increase the pressure on public finances. For 7 of the 25 European countries that are members of NATO, the interest burden already exceeds defence spending. It is estimated that European countries as a whole have reaped €1,800 billion since 1990 by reducing their defence spending below NATO's 2% target. Returning to this target requires effort at the very time when European countries need to invest in transforming their economies, while at the same time putting their public finances on a sounder footing. European countries would have to allocate almost 5% of their public spending to defence to achieve the 2% target. On the face of it, this target seems achievable. Indeed, during the Cold War, most European countries devoted at least that proportion of their budget to defence. Since then, however, social spending has grown much faster than GDP and there seems to be no way back. The creation of a European ‘off-budget’ defence fund seems the only conceivable option for meeting Europe's new security challenge. The sooner the better.

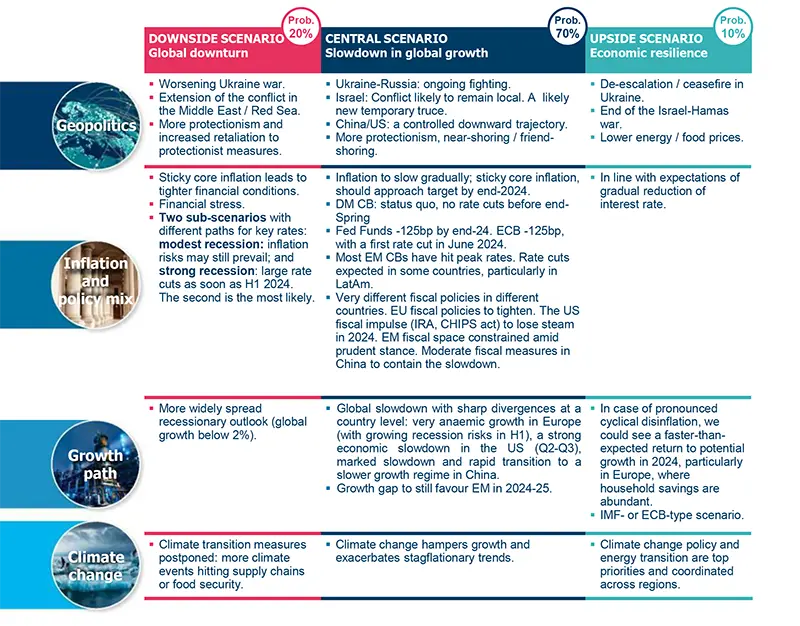

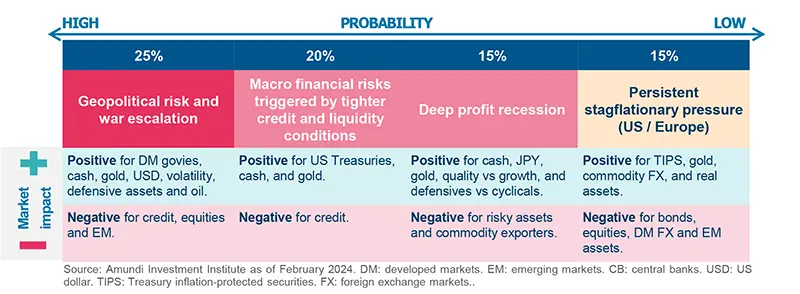

Scenarios and Risks

Central and alternative scenarios

Risks to central scenario

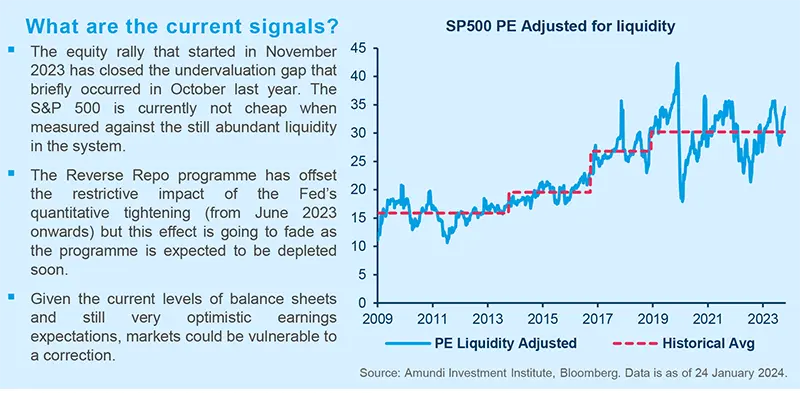

Amundi Investment Institute Models

Liquidity-Adjusted Valuation for S&P500

Liquidity conditions are key in assessing financial market valuations, as unconventional monetary policy remains a key tool for Central Banks.

What is the model about?

- The rationale: Unconventional Monetary Policy and liquidity abundance dramatically changed the way valuations are assessed, not only for bonds but also for risky assets and, in this instance, equity. The expansion of Central Banks’ balance sheets and the recent Reverse Repurchase Agreement (RRP or Reverse Repo) boosted multiples beyond what earnings and rates expectations would have suggested, hence the need to enhance the typical valuation framework with a liquidity factor.

- Model setup: the Liquidity-Adjusted Valuation for the S&P500 is calculated by using the time-weighted average of current and next year’s price-earnings for the index. The liquidity adjustment consists of dividing these valuations by the Fed’s balance sheet corrected by the reverse repo amount. From the resulting historical ratio (solid blue line in the below chart) we can then identify “regimes” that represent dynamic reference values, reflecting the evolution of investors’ risk appetite over time (dotted red line in the below chart). Historically, the main drivers of such regime shifts have been swings in the economic backdrop and/or the monetary policy stance.

- Considered variables: A Reverse Repo Agreement is a liquidity-maintaining method used by Central Banks. In an RRP the Central Bank sells bonds with the agreement of buying them back later at a slightly higher price. Therefore, an increase in the amount of reverse repos (as actioned by the Fed from March 2021 to May 2023) means that the supply of money in the market decreases, while the opposite happens when the amount of RRP agreements diminishes (what has happened on the Fed’s balance sheet since June 2023 onwards).

- Model output: as the Liquidity Adjusted PE drifts away from its reference regime level, the S&P500 index is considered expensive (at a premium) when above such threshold, while cheap (at a discount) when below.

Infographic - Markets in charts

Equity in charts

US mega caps and Japan were back in the driving seat in January.

We expect positive numbers for EPS in Q4 2024 for MSCI EM in USD, yet below consensus.

Bonds in charts

The ECB and Fed are expected to deliver roughly the same amount of easing in 2024.

YTD, Emerging Market bonds have delivered a negative performance.

Commodities

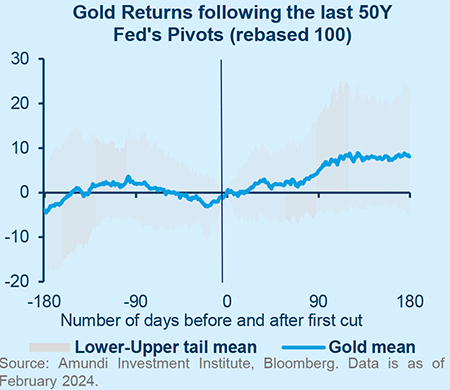

Gold still in the waiting room

Pivots, debasement risk and deficits, and geopolitics are upcoming drivers.

Gold remains range-bound and displays unstable correlations amid fading hopes for an early pivot by central banks, as well as macro crosswinds. Yet, this only delays our view of more gains in Q2, boosted by a combination of drivers. Gold prices usually gain +5/10% when CBs pivot. Debasement risk from profligate deficits could be accentuated by expanding global liquidity and an end to QT.

Geopolitical stress from China and US elections and firming ETF flows, when competition with cash recedes, would also contribute positively.

Yet, we expect any upside to be modest and volatile given gold’s polarised fundamental drivers, stubbornly high bond volatility and bold breakeven expectations. Valuations also already factor in part of the pivot impulse. We maintain our short-term target at $2050/oz and our 12M target at $2100/oz.

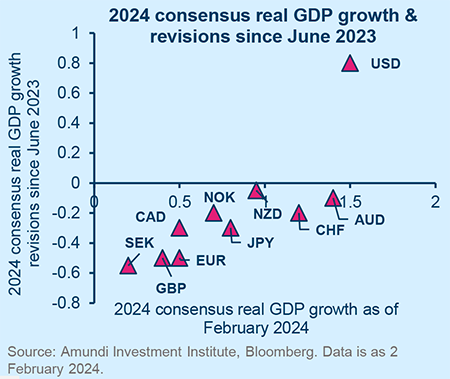

Currencies

A lack of credible alternatives to the USD in H1

Strong US growth is supportive for the USD in the near term.

2024 has just started and it already feels very different from the fourth quarter of 2023. If Goldilocks seems confirmed for now, it is the USD reaction function that has substantially changed. US growth is proving stronger than expected and this is triggering upside revisions for 2024, which now sees a sizable US growth premium compared to most countries in G10. Back in 2021, such diverging trajectories pushed the market to reassess the relative terminal rates in favour of the US, which supported the USD.

Given what is priced now in, we see USD strength extending into H1, but remain reluctant to believe a meaningful trend is on the cards. A difference from 2021 is that inflation has peaked, commodities importers are enjoying positive ToT (Terms of Trade) shocks and the next move for the Fed will be a cut rather than a hike.