Summary

Macroeconomic Focus

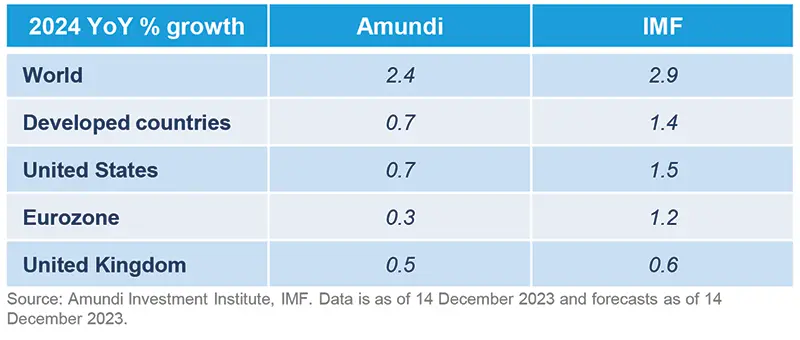

2024 growth outlook: more cautious than the IMF

Following 3.1% growth in 2023, we expect global growth to slow to 2.4% in 2024, well below the IMF’s expectations of 2.9% in 2024 and the historical (2000–19) average of 3.8%. The weaker performance of advanced economies is one of the main reasons for this divergence. Indeed, we expect them to decelerate from 1.5% this year to 0.7% in 2024, while the IMF forecasts advanced economy growth at 1.4% next year. Our pessimistic view is driven by a mild recession in the United States (0.7%) and lacklustre growth in the Euro Area (0.3%). Meanwhile, in 2024 the IMF anticipates a soft-landing scenario in the United States (1.5%) and almost back-to-potential growth for the Euro Area (1.2%). Regarding the UK, we broadly share the IMF’s view, expecting 0.5% in 2024 compared to the IMF’s 0.6%. Our weaker outlook for the United States is also the main reason why we differ from Bloomberg consensus estimates.

We think the US economy may already be weaker than perceived and is already slowing, as suggested by weaker coincident and forward looking indicators. In particular, domestic demand will continue to deteriorate: consumption will progressively slow as tighter credit conditions, depleted excess savings and weaker labour prospects curb spending. Also investment, which has been strongly supported by incentives so far, will significantly slow, as companies, particularly small businesses, face very high borrowing costs, higher economic uncertainty and weaker demand. Regarding Europe, we have significantly lower expectations (+0.3%) compared to the IMF (+1.2%), but we are almost aligned with the consensus (+0.7%). The Eurozone is already slowing in line with a deterioration in financial conditions, demand and business confidence. However, with household balance sheets remaining strong and a recent pickup in savings, we do not expect a deep recession, but we also do not see any strong domestic support for growth in a weakening global growth environment and in a context where fiscal policy will be less supportive. The outlook for investment will also remain subdued given monetary policy is expected to be restrictive for an extended period.

We think the US economy may already be weaker than perceived and already slowing.

Emerging Markets

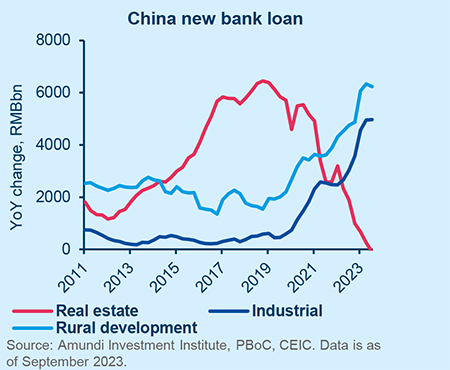

China: Policy adjustment continues

A cyclical upturn in 2024 will be limited.

Market-friendly initiatives have recently stepped into the spotlight. China will allow visa-free entry for citizens from five EU countries and Malaysia, starting from 1 December. Regulators are further supporting property developers and urging banks to fund private-owned entities.

A supplementary budget of 0.8% of GDP, dedicated to infrastructure, has been approved and we expect additional funding for urban renewal and affordable housing. These are responsive defences aimed to soften the blow of ongoing deleveraging. The push to temper the "two excessives“, real estate and Local Government Financing Vehicle (LGFV) sectors, could suppress growth. We hold our below-consensus forecast, believing a cyclical upturn in 2024 will be limited by the secular forces of debt deleveraging.

India: Industrial Production setback in a robust cycle

No fiscal slippage despite more pre-elections measures announced.

The economic cycle remains quite robust although the latest Industrial Production figures are showing a mild softening across sectors. On the one hand, the trends for Capital Goods and Infrastructure/Construction goods remain robust or marginally softer. On the other hand, consumer goods production remains weak, highlighting some dichotomy between investment and consumption. India’s inflation was well-behaved at Headline and Core levels, printing at 4.9% YoY and 4.2% YoY, respectively, in October.

Headline inflation is expected to rise above 5% in November. Important ballots in five states are taking place in the next two months and pre-election initiatives are increasing (e.g. the Free Food Scheme was extended for the next 5 years). While these measures shouldn’t threaten the fiscal deficit target, they could over time divert expenditure from more productive items.

Macroeconomic snapshot

After a strong Q3 performance, we expect the US economy to progressively weaken. In particular, domestic demand will continue to deteriorate, as both consumption and investment gradually slow, due to tighter credit conditions. We expect a mild recession in H1 24. In the meantime, inflation will gradually decelerate thanks to weakening services inflation, which has so far remained sticky.

The weak Q3 print across several Eurozone countries provided evidence that the economy is already slowing, in line with the deterioration of financial conditions, demand and business confidence already reported. Weaker global growth and less supportive fiscal policy will ensure growth remains flat for the next few quarters. Inflation will progressively slow towards target, although this will be faster for headline inflation than for core.

The UK economy is slowing and expected to move towards flatter growth over the next few quarters, with domestic demand slowing as the effect of a quick deterioration in the labour market, weaker capex spending (due to tight monetary policy taking its toll on the real economy), a weak external environment and ongoing elevated inflation. However, inflation is expected to moderate going forward, moving closer to the target around year-end 2024.

The first estimate of Japan's Q3 GDP was weaker than we expected, falling by 0.5% from Q2. This, however, has not changed our view of an ongoing above-trend recovery. Indeed, despite the volatile growth performance, the underlying trend has improved. In particular, exports have surprised on the upside, while business capex is expected to accelerate following record-high corporate earnings, a full capacity utilisation rate and a labour shortage.

The Romanian economy is decelerating but continues to outperform compared to CEE3 and real GDP growth should remain around 3% YoY, supported by a tight labour market and loose fiscal policy. As 2024 is a multi-election year, pension reforms voted by the Parliament are likely to be implemented and are just waiting for the President’s signature. Regarding monetary policy, the NBR will likely remain cautious, especially as the pace of disinflation is slow and uncertain.

The South African Reserve Bank (SARB) remained on hold this month, with rates at 8.25% despite a re-acceleration of inflation. A weak growth environment, lower oil prices and ZAR’s recent recovery are likely the reasons why there were no further hikes. However, due to tight global financial conditions, uncertainty on inflation, fiscal challenges and high volatility among financial markets and assets, the SARB will likely remain cautious. The beginning of the easing cycle will remain data dependant.

Turkey’s central bank raised rates again this month by 500bps to 40%. Additional hikes are probable. However, inflation is still expected to rise, likely peaking in Q2 2024 at around 70/80% YoY. The lira continued to depreciate but at a slower pace. This tightening of monetary policy (+3,150bps since June) will weigh on H2 real GDP growth, but the first half of the year was very solid, thus the impact will be more visible for 2024 figures.

After a very robust 1H, Brazil's economy is finally showing a more pronounced slowdown as tight monetary policy bites hard. Meanwhile, disinflation is progressing nicely and Brazil should be the first LatAm country whose inflation falls into its target range by year-end. The BCB, however, is determined to keep cutting at a gradual pace (50bps) in light of fiscal concerns and to keep pressure on Lula’s administration to respect the fiscal rules as initially proposed.

Central Bank Watch

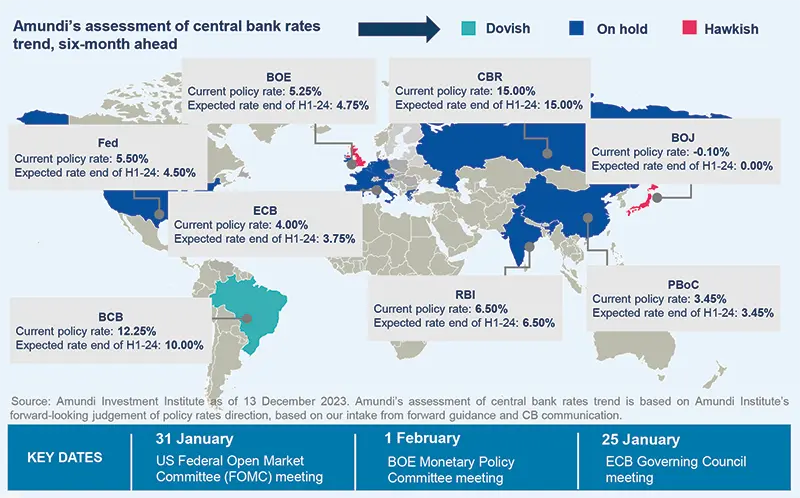

DM and EM Central Banks cautiously turning dovish

Developed markets

The latest ECB committee meeting was dovish. Christine Lagarde acknowledged the recent deterioration of the macroeconomic environment (fewer new jobs are being created) and the further tightening of financing conditions. Monetary policy tightening is affecting the economy more than expected.

During its press conference, a dovish Powell stated that the FOMC might be done with rate hikes. This belief was reinforced by a downside surprise in October CPI. However, given the recent easing of financial conditions, we expect the Fed to maintain a tightening bias for its policy rate and to “proceed carefully” for the time being, with further tightening to remain on the table if needed.

We believe that the BoE terminal rate has been reached at its current level. The tightening bias was maintained, but, barring some majorly unpleasant data surprises between now and the year-end, the rate cycle appears to be over.

Unlike other G4 central banks, the BOJ is not done with rate hikes. We are convinced that strength in domestic inflation will result in YCC being eased further and negative rates being withdrawn in the coming quarters.

Emerging markets

Over the last month, the market narrative has moved from envisaging a “higher for longer” Fed to expectations that US monetary policy will become less hawkish. EM Central Banks have responded by continuing their monetary policy conduct as planned, mainly based on the evolution of their domestic economies. Indeed, in support of policy easing, which has either started or is yet to start, inflation dynamics in October broadly indicated a benign disinflationary trend across EM. Yet a few changes are worth mentioning with respect to our previous expectations. The first one concerns the National Polish Bank (NBP). In September, the NBP boldly started what we call a “mini easing cycle”, but this was abruptly called off at its latest monetary policy meeting. Contrary to our expectations of ongoing gradual easing, the NBP is now likely to pause until the first quarter of 2024. Meanwhile, based on its latest monetary policy meeting minutes, we anticipate a first cut from Mexico’s central bank in Q1 24 rather than Q2 24 and the pace of easing will increase moving forward. The new projection assumes an even more dovish stance, compared to the Federal Reserve which is not expected to start easing until Q2 24.

Geopolitics

Elections in Taiwan – what to expect for geopolitics

Elections in Taiwan will shape China/Taiwan and US/China relations alike.

There will be many elections in 2024. Geopolitically, the most significant ones will be in Taiwan (January) and in the US (November). There are other important elections also on the timetable, taking place in the EU, India, Ukraine, Russia, Mexico, Venezuela, South Africa and the UK. As Taiwan heads for the polls, much will be at stake for China/Taiwan and China/US relations. We expect William Lai from the ruling DPP to win the January vote. There is still a small window of opportunity for the opposition to come together but, at the time of writing, this seems unlikely given growing friction. Should our base case play out and William Lai wins the vote, this will likely have negative implications for China/Taiwan and US/China relations. For example, Lai has nominated the ‘de-facto’ US ambassador Hsiao Bi-khim as his running mate; Beijing sees this ‘independence + independence’ ticket negatively. While we don’t expect tensions between Taiwan and China to escalate, there is more room for error and accidents in the Taiwan Strait. Should the opposition win, relations between China and Taiwan would likely steady, while US/Taiwan relations would begin a new chapter. The US is unlikely to act in any meaningful way should a more Beijing-friendly government seek to gradually improve ties with China.

Policy

Sword of Damocles threatens German green investments

The German coalition's constitutional setbacks will be echoed in the ongoing negotiations on EU fiscal rules.

On 15 November, the German Constitutional Court (GCC) ruled that the off-budget fund set up to finance urgent climate and energy transition measures (CTF) does not comply with Germany’s ‘debt brake’ rule, which limits central government’s net structural borrowing to 0.35% of GDP. In recent years, off-budget entities have become the cornerstone of fiscal policy. According to the Bundesbank, they have scope for deficits amounting to around €400bn (10% of GDP). The result of the GCC ruling was an estimated budget shortfall of €17bn in 2024. On 13 December, the three parties of the coalition announced a compromise, combining spending cuts with sources of additional revenue. On the expenditure side, spending on the CTF will be cut by €12bn in 2024 and will reach a total of €45bn by 2027. Planned subsidies for the solar industry will be reduced, and a bonus for consumers who buy an electric vehicle earlier than planned will be phased out. However, the remaining volume of the CTF is still substantial (€160bn for 2024-27), an amount deemed sufficient by the coalition to finance its projects. On the revenue side, the carbon price on heating and transport fuels will be increased. Nevertheless, the debt brake rule could be suspended next year for two reasons: (i) reconstruction aid for regions hit by flooding in 2021, and (ii) aid to Ukraine. This fiscal consolidation could slow GDP growth by 0.5 % points in 2024. The fiscal problems linked to the debt brake rule will inevitably resurface next year.

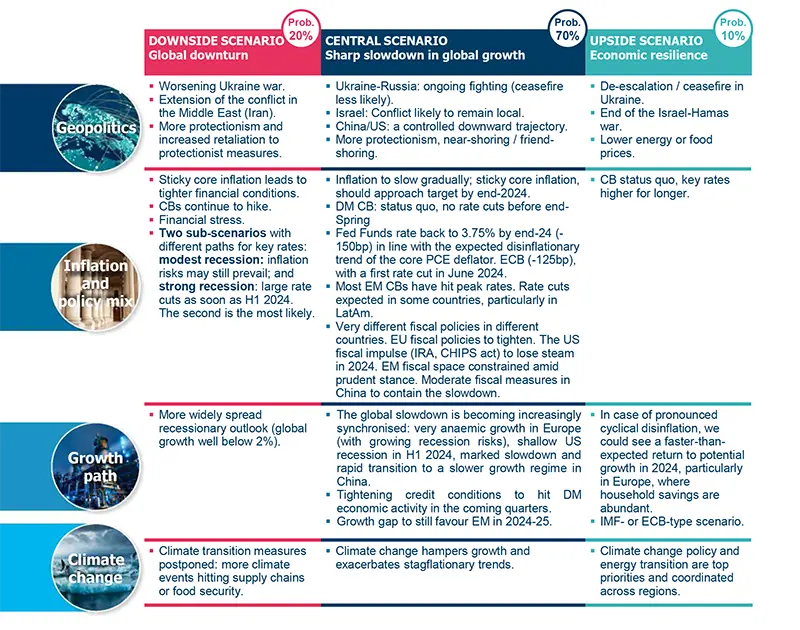

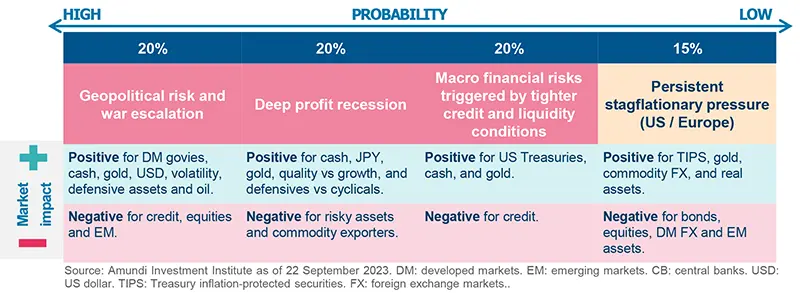

Scenarios and risks

Central and alternative scenarios

Risks to central scenario

Amundi Investment Institute Models

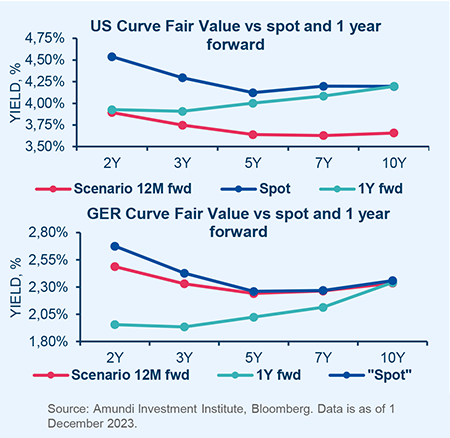

Nelson-Siegel yield curve fair value model update

The long end of the US yield curve is undervalued in the scenario of a mild US recession in H1 24 and Fed rates reaching 4% by the end of 2024.

The 2024 fundamental scenario flags under-valuation across the US curve

- Economy and inflation: 2024 will see a gradual weakening in global growth, with inflation tempering. The US is expected to face a recession in H1 as stringent financial conditions begin to impact consumers and businesses. In the Eurozone, growth should remain low with heterogeneous dynamics across countries, as fiscal policy becomes progressively more restrictive on top of already tight monetary policy.

- Monetary policy: both the Fed and the ECB are expected to have reached their terminal rate and to start delivering cuts at the end of H1 2024. More specifically, the scenario for the US is 1.50% of easing throughout next year (starting in May), while for the European Central Bank the cutting cycle would consist of a 1.25% reduction, taking place at every meeting from June onwards. In terms of balance sheet management, the Fed is expected to continue its Quantitative Tightening into 2024 but at a potentially reduced scale from 2023, bringing the Central Banks’ assets / debt ratio from 23% to 20%. The ECB is expected to continue not reinvesting the maturing assets under its asset purchasing programme with a possible earlier end to the reinvestment of securities bought under the PEPP* programme, resulting in a reduction to its balance sheet / debt ratio from 56% to 46%.

- Market’s long-term inflation expectations: in the context of next year’s very sluggish economy in both the US and the Eurozone, amid the normalisation of inflation towards Central Banks’ targets, 5Y5Y inflation swaps are expected to move to lower levels from the historically elevated ones reached in 2023, in line with more subdued nominal growth.

Fair value yield curves – 2024 scenario

- US fair values flag an undervaluation across the yield curve, particularly at the long end. The main drivers are lower Fed rates for year-end 2024 than the market is currently pricing, as well as Amundi’s 5y5y inflation swap target, which is below current levels.

- The German curve is fairly valued at the long end as current market pricing for ECB rates and long-term inflation expectations have moved closer to Amundi’s scenario for 2024. However, we see a reduction of rate volatility being a catalyst for yields to shift even lower from here.

Infographic - Markets in charts

Equities in charts

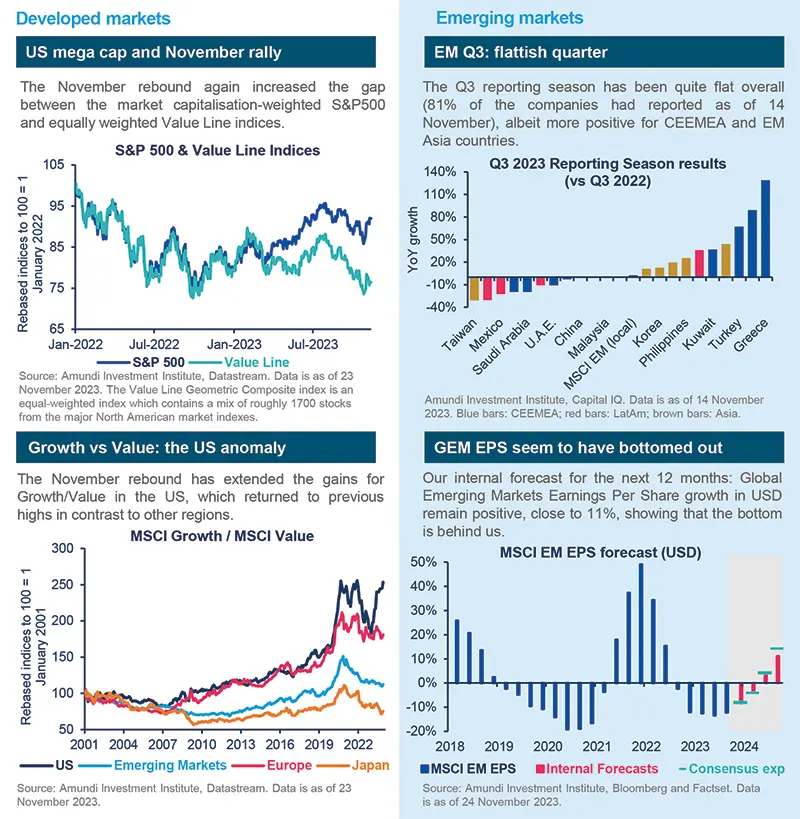

American exceptionalism played out again in November.

GEM’s EPS forecasts for 2024 are positive, showing signs of a rebound.

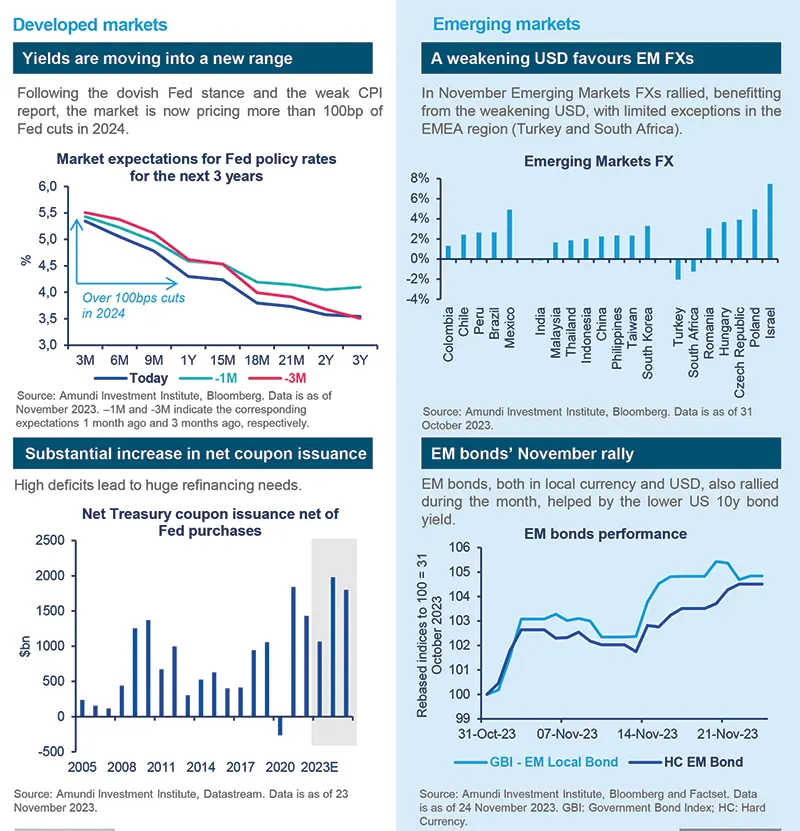

Bonds in charts

We expect the US economy backdrop to deteriorate. It should drive Treasury demand.

November has seen both EM FX and EM bonds rally.

Commodities

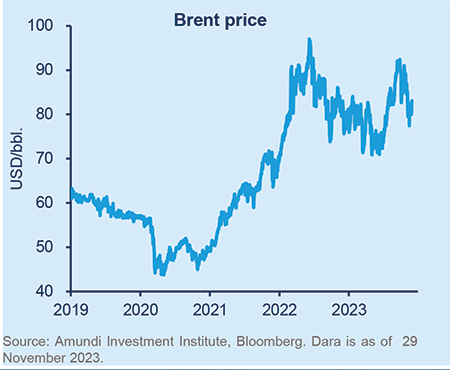

Oil weakness feels like déja vu

The balance of forces keeping prices in a range will be slightly higher than today.

Recent oil price weakness was driven by fading catalysts. Oil prices were boosted this summer by OPEC+ cuts at a time when jet fuel demand was surging. This is now old news particularly as weaker OPEC discipline has become more visible. Oil prices were also boosted by the Middle East crisis, with evidence increasingly suggesting the crisis would remain local. Yet, selling pressure looks excessive once more.

Investors now have light positions, valuations are cheap, stocks are low and demand shows no sign of a material decline. We see OPEC+ as marginally supporting markets at its delayed meeting. Amid fading support from geopolitics and a modest deficit in 2024, oil prices are already caught in our $85/b-$90/b Brent target range for 2024, bounded by a balance of negative and positive forces. This implies a slight upside

Currencies

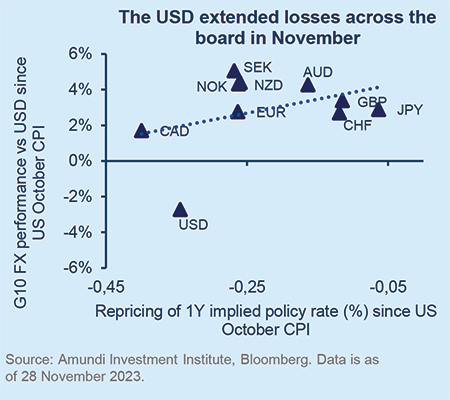

What a month for the USD, but for how long?

We expect the USD to be choppy entering 2024 and not to materially weaken until the first rate cut is delivered.

A battery of weaker-than-expected US economic data was responsible for a violent shift in market behaviour in November. The “higher for longer” narrative abruptly disappeared, the Fed was repriced more than other central banks and the USD sold off across the board, with no exceptions. While we see fundamental reasons for the trend to extend over the course of 2024 (expensive valuation is a headwind once the Fed’s cutting cycle begins), we find it hard to believe the process will be linear.

December may still offer negative seasonality for the USD, yet the easing of financial conditions seems premature given the approaching economic recession. We expect the USD to be choppy entering 2024 and not to materially weaken until the first rate cut is delivered.